SUSTAIN INCLUSIVE GROWTH

What is Inclusive Growth?

One of the best definitions I like to use to describe inclusive growth is this: inclusive growth signals a process by which economic growth is generated and distributed in ways that are broadly based, which allows people to form economic growth.

Why does Inclusion Matter?

In my view, inclusion matters in many ways:

- It helps sharply reduce poverty. In Brazil, the Human Developent Index of Municipalities dramatically improved during the last two decades. According to UNDP, in 1991, 99.2 percent of the municipalities had a low/very low Human Development Index (HDI), however, this figure fell to 25.2 percent in 2010. In other words, the number of municipalities with high/very high HDI jumped from around 0 percent in 1991 to 34.7 percent in 2010. In 2012, the Brazilian HDI was 0.730, which is ranked 83rd in the world and considered high.

- Inclusion affects social stability and peace, such as the political instability we see in Egypt, Yemen, Tunisia, and Iraq. The Arab Spring! Arab countries show immense concern for the demands of inclusive growth. To have social stability, governments in Arab countries and their developmental partners have strived to regulate their economic policies and assistance programs for inclusive growth and social justice.

- Inclusion contributes to growth (Korea, Japan in the 20th century).

- Inclusion is essential for big growth to continue. Inclusive growth is also one of the reasons why India ranked third in the GDP PPP rankings in 2016, lifting millions of its citizens out of poverty in the process. The country has attracted billions of dollars in foreign direct investment (FDI) and the world’s most dynamic firms. The country is trying to promote young, middle-class, lower-

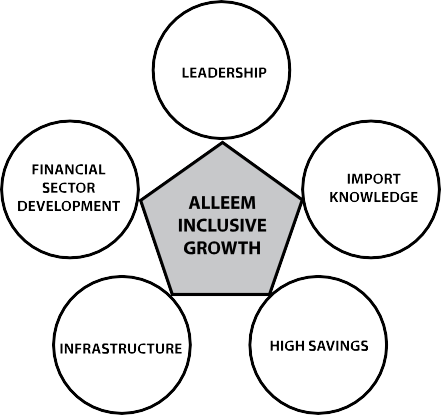

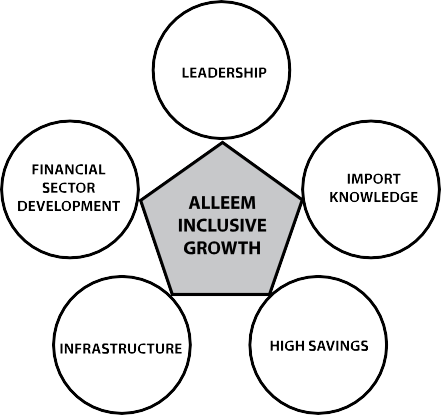

Alleem Inclusive Growth Strategies

The following is my model for inclusive growth. It is based on my experiences from working for so many humanitarian projects and the intensive research conducted by the Alleem R&D Center. The model consists of five pillars: leadership, import knowledge, high savings, infrastructure, and financial sector development. To sustain growth over a long period, a set of conditions need to come together in a very integrated way. The following info graph summarizes the module.

1. LEADERSHIP

As the saying goes, “That government is best which governs least.” This can be seen in smart governments, and I am proud to say that the UAE is one of them. Yes, indeed, leadership is a must if we consider a country’s sustainability and inclusive growth.

CCC

Growth is about more than economics. It also requires commit ted, credible, and capable governments. A country’s policy makers must communicate a credible vision for the future and a strategy for achieving it. Also, we can look at Singapore’s growth, which has served as an organizing principle of the country’s politics for the past 40 years.

2. IMPORT KNOWLEDGE

They say, “It is easier to learn something than it is to invent it.” That is why advanced economies do not grow (and cannot grow) at a rate of 7 percent or more and why lagging economies can catch up.

LEARNING ORGANIZATIONS TO LEARNING COUNTRY

A learning organization is a concept adopted by the most successful organizations and corporations around the world. What is it? A popular definition is this: a learning organization is one that acquires knowledge and innovates fast enough to survive and thrive in a rapidly changing environment by embracing characteristics that encourage, support, and promote participation.

In his book, The Fifth Discipline: The Art and Practice of the Learning Organization, Peter Senge describes five characteristics that embody learning organizations:

- SYSTEMS THINKING. This is the understanding of how everything works together—how all the parts influence one another to compose the whole.

- PERSONAL MASTERY. Individuals must learn for organizations to learn. Personal mastery of skills and knowledge is a journey with no final destination. It is more than just building skills and competencies; it involves a hunger for knowledge and continual improvement.

- MENTAL MODELS. Senge defines this as “deeply ingrained assumptions, generalizations, or even pictures and images that influence how we understand the world and how we take action.”

- BUILDING SHARED VISION. Vision is more than a statement, it is a shared future. When all your staff believe and see the vision, it can become a reality. A shared vision creates excitement and synergies to work toward common goals.

- TEAM LEARNING. Team learning begins when individual assumptions are abandoned and an organization’s members begin to think together. This requires a culture of understanding and openness. Hoarders of information and knowledge have no place in learning organizations. The idea is for everyone to share what they know and build on the sum knowledge of the entire team.

FOREIGN DIRECT INVESTMENT (FDI)

One of the UAE’s strategies in importing knowledge is creating free zones throughout the nation. The UAE has attracted multinationals to its 47 free zones, where they enjoy tax holidays and other privileges.

Historically, Japan and Korea were much less open to FDI, though they did import and improve on technology from outside. For example, Japan’s Sony surpassed America’s RCA in the small radio market using the technology it had licensed from the American company itself!

3. HIGH SAVINGS

The Abu Dhabi Investment Authority (ADIA) is the world’s largest sovereign wealth fund owned by the Emirate of Abu Dhabi in the UAE. It was founded in 1976 by His Highness the late Sheikh Zayed bin Sultan Al Nahyan, the founding president of the United Arab Emirates and leader of Abu Dhabi. He created the Abu Dhabi Investment Authority and separated it from the government as an armslength organization with an independent management. Its goal is to invest the Abu Dhabi government’s surpluses across various asset classes, with low risk. It manages the emirate’s excess oil reserves, estimated to be as much as $500 billion. Its portfolio grows at an annual rate of about 10 percent compounded. The fund is a member of the International Forum of Sovereign Wealth Funds and is therefore signed up to the Santiago Principles. The Santiago Principles are designed as a common global set of 24 voluntary guidelines that assign best practices for the operations of sovereign wealth funds (SWFs). Although ADIA has never published how much it has in assets, estimates have been between US$800 billion to approximately US$875 billion. The Sovereign Wealth Fund Institute puts the figure at US$773 billion.

EIA

After the success of ADIA, the UAE government created a similar sovereign wealth fund. In similar ways, the Emirates Investment Authority (EIA), which was formed in November 2007, is an investment institution setup with a mandate to manage the sovereign wealth of the United Arab Emirates’ federal government.

CHINA’S NATIONAL SAVINGS

While reading the IZA (Institute of Labor Economics) Discussion Paper of January 2011, I got to know that China has saved more than a third of its national income every year for the past 25 years. You could just imagine the financial vision of China and how much wealth the nation has for its future generations.

The statistics that China associates with in the past three decades are quite remarkable: the gross national savings as a percentage of gross domestic product (GDP) hovered just a little above 35 percent in the 1980s, and the average yearly rate climbed to 41 percent in the 1990s. Since China’s entry into the World Trade Organization (WTO), its growth in aggregate savings accelerated, surging from just below 38 percent in 2000 to an unprecedented 53 percent in 2007. China’s national savings rates since 2000 have been one of the highest in the world.

We can say that China’s high savings rate could be the result of the country’s faster economic growth relative to the rest of the world, which boosts its income, as well as the government’s tax receipts.

According to the National Bureau of Economic Research’s 2011 report by Dennis Tao Yang, Junsen Zhang, and Shaojie Zhou, the corporate, household, and government sectors have all contributed significantly to the upsurge in national savings in the past decade. The key causes also include accession to the WTO, rising corporate profits, changes in life cycle earnings, pension system, other provisions of social services, and demographic transition.

4. INFRASTRUCTURE

There is a point to be clarified whenever we talk about infrastructure. For the majority of the people, whenever they hear the word infrastructure, they think of buildings only, such as roads, airports, high-rises, and other types of building, which is wrong. Infrastructure includes more than buildings. Social and financial institutions are infrastructure too. I like to call the two infrastructure types as hard and soft infrastructure. Infrastructure is also an important factor for sustaining long-term growth. The following is a summary of my thoughts:

HARD INFRASTRUCTURE:

- Transportation (roads, airports, seaports)

- Energy (power, natural gas, petroleum)

- Water management (drinking water, sewage, etc.)

- Communication (TV, radio, phone, postal)

SOFT INFRASTRUCTURE:

- Social (education, health care, social welfare)

- Industrial (free zones, manufacturing units, industrial areas, etc.)

- Institutional (financial system, IT, governance)

In China, Thailand, and Vietnam, their total infrastructure investment exceeds 7 percent of the GDP. India doubled its investments in infrastructure to $1 trillion during the 11th Five-Year Plan, which began in 2012, with half of it expected from the private sector.

PPP

Public-private partnerships (PPP) have been extremely successful in a wide variety of infrastructure areas, including telecommunications, roads, power generation, and port management. But there have been numerous failures as well. Lessons should be learnt from both.

5. FINANCIAL SECTOR DEVELOPMENT

Careful regulation and supervision are required to prevent banks from expanding credit too far (2007–2008 credit crunch). One way to speed up financial sector development is to invite foreign financial firms (FFF) to invest in the sector. Just as FDI brings expertise to a domestic industry, so could the entry of foreign banks raise the game of domestic ones, thereby making them more robust.

The term foreign financial firm can be defined as when a company or individual from one nation invests in the assets or ownership stakes of a company based in another nation. Foreign investment denotes that foreigners have an active role in management as part of their investment. Because of increased globalization in business, it has become very common for big companies to branch out and invest money in companies in other countries. Its benefit is that it attracts cheaper labor, production, and less tax by opening new manufacturing plants in another country.

Another reason to branch out and make a foreign investment in another firm in another country is that the firm being purchased has a specific technology, products, or access to additional customers that the purchasing firm wants. Overall, foreign investment is a good sign as it often leads to economic stability, job growth, more income to a country and creates good understanding between countries.

PARTICIPATION IS NEEDED IN STRATEGIES FOR SUSTAINED GROWTH

To ensure the success of the inclusive growth model and to guarantee sustained growth, the following four actors’ roles are important: government sector, private sector, civil society, and individuals. Different sectors follow their own strategies for a growth-oriented output.

- The government sector is rights driven; it provides information, stability, and legitimacy.

- The private sector is profit-driven; it is inventive, single-minded, and fast.

- Civil society is value-driven; it is responsive, inclusive, and imaginative.

- Individuals are driven by many agendas (e.g., personal, community, country).

I preached and presented this model for so many years now, and I am happy to see the acceptance and the positive feedback I have been receiving and the changes it has made in so many societies around the world.

I am proud and honored to mention that on February 15, 2017, during my visit to India, the Alleem R&D Center was recognized at the Global CSR Excellence and Leadership Awards for developing sustainable strategies. It was truly an overwhelming moment for me as it was the first international recognition for the center. The Global CSR is Asia’s most prestigious recognition awards program for corporate social responsibility. The program recognizes and honors companies for their outstanding, innovative, and world-class products, services, projects, and programs implemented, whether past or present. These projects should demonstrate the company’s leadership, sincerity, and ongoing commitment to incorporate ethical values, compliance with legal requirements, and respect for individuals, communities, and the environment in the way they do business.

To excel and be deserving of this recognition, I must keep the challenge on and do my best to earn the trust people have placed in me and to meet the requirements of the needy.

GRAMEEN BANK

I had the pleasure of being invited by Abu Dhabi Islamic Bank back in February 2015, to be a keynote speaker in one of their events, and it so happened that Dr. Muhammad Yunus, a civil society leader who was awarded the Nobel Peace Prize for founding the Grameen Bank and for pioneering the concepts of microcredit and microfinance, was also a guest. I delivered my speech right after he did. During the break, I gave him a copy of my book Sustainability: The Fourth Wave of Economy, which he appreciated a lot, especially when he read my book dedication, which reads, “To Almost One Billion People Who Sleep with Hunger and Pain Every Night.” Then he talked about his Grameen Bank. I was impressed with its humble beginnings and what the bank has achieved so far. It gives me pleasure to write about the bank’s profile and its global achievements in the following paragraphs.

The Grameen Bank is a Nobel Peace Prize–winning microfinance organization and community development bank founded in Bangladesh in 1976, by Professor Muhammad Yunus. It operates based on the principle that loans are better than charity to alleviate poverty. They offer people an opportunity to take initiatives in business or agriculture, which provide earnings and enable them to pay off their debt.

The bank is founded on the belief that people have endless potential, and unleashing their creativity and initiative can help end poverty. Grameen offers credit to the poor, women, those who are illiterate, and the unemployed. Access to credit is based on reasonable terms, such as the grou