5. STRATEGY

Strategy Analytics

Agents: System analysts, business analysts, technology management consultants;

Strategic moves :

Call deep analytics ‘7-S’ model; explore how to ensure a perfect fit among 7- S elements : scope, system, structure, security, strategy, staff-resources, skill- style-support;

Call deep analytics ‘7-S’ model; explore how to ensure a perfect fit among 7- S elements : scope, system, structure, security, strategy, staff-resources, skill- style-support;

Define a set of financial security goals and emerging technologies accordingly.

Define a set of financial security goals and emerging technologies accordingly.

Do SWOT analysis: strength, weakness, opportunities and threats of financial security technologies.

Do SWOT analysis: strength, weakness, opportunities and threats of financial security technologies.

Fair and rational business model innovation

Fair and rational business model innovation

- Who are the customers?

- What should be the offering of products and services?

- What do the customers value?

- What is the rational revenue stream?

- How to deliver values to the customers at rational cost?

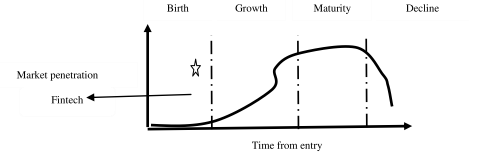

Do technology life-cycle analysis on ‘S’ curve : presently at emergence phase of ‘S’ curve.

Do technology life-cycle analysis on ‘S’ curve : presently at emergence phase of ‘S’ curve.

Explore technology innovation-adoption-diffusion strategy.

Explore technology innovation-adoption-diffusion strategy.

Explore innovation model and knowledge management system for creation, storage, sharing and application of knowledge.

Explore innovation model and knowledge management system for creation, storage, sharing and application of knowledge.

Adopt ‘4E’ approach for the implementation of financial security globally : Envision, Explore, Exercise and Extend.

Adopt ‘4E’ approach for the implementation of financial security globally : Envision, Explore, Exercise and Extend.

Dr. Ramaswamy is analyzing the strategy for the innovation, adoption and diffusion of financial security technologies. This element can be analyzed from different dimensions such as R&D policy, learning curve, SWOT analysis, technology life- cycle analysis and knowledge management strategy. It is essential to analyze strength, weakness, opportunities, threats, technological trajectories, technology diffusion and dominant design of top innovations related to financial security today. In the first decade of the 21 Century, financial security technologies were applicable to banking and trading services. Today, the scope of the same has been getting explored in miscellaneous emerging financial services such as financial literacy and education, retail banking, investment to crypto-currencies. In 2008, global investment into Fintech sector was around $900 million and was $27 billion in 2017. Fintech is a flourishing market due to various factors :

(a) Internet and mobile revolution : smartphone penetration surge from 53% in 2014 to 64% in 2018; the number of internet users has been rising from 481 million in December’2017 to 500 million in June’2018; the number of cheap and affordable smartphone users have been rising from 199 million in 2015 to 378 million in 2018.

(b) almostt 40% of the population do not have bank account and over 80% of money transactions are made in cash.

(c) Fintech funding was 21.47% of total startup funding rounds across every market during the first quarter of 2018 and raised over $251 million of funding. Fintech is a startup trend is upsetting the structured format of traditional financial companies such as banks, mobile payments, money transfers and asset management. The worth of Fintech market is expected to double in 2020.

SWOT Analysis : It is rational to evaluate strength, weakness, opportunities and threats of this innovation. There may be major and minor strengths and weaknesses. Strength indicates positive aspects, benefits and advantages of a strategic option. Weakness indicates negative aspects, limitations and disadvantages of that option. Opportunities indicate the areas of growth of market and industries from the perspective of profit. Threats are the risks or challenges posed by an unfavorable trend causing deterioration of profit or revenue and losses. Financial technologies touche technology, business, and government. Financial technologies have been evolving over the past several decades, there are various types of technological challenges such as risk of cyber attacks, money laundering, information security and privacy and trust in digital currency. Government should play the role of regulator protecting markets and consumers and promoting the innovation, adoption and diffusion of financial technologies globally.

Figure 8.1 : SWOT Analysis

Figure 8.2 : Technology life–cycle analysis of Financial security technologies

Financial security technology life-cycle analysis: Deep analytics evaluate and explores top technological innovations in terms of technology life-cycle, technology trajectory, S-curve, technology diffusion and dominant design. No element in this universe exists eternally. Similarly, each technology emerges, grows to some level of maturity and then declines and eventually expires, At present, most of financial security innovations exists at emerging or birth phase of S-curve as per perception; some are growing at fast pace.