Chapter 3

The 3 Forex Markets

One of the distinctive benefits of trading in the FX market is that you can continue your transactions all through the day and night, since one or the other financial markets will be open when you want to trade.

However, what should be clearly understood is that not all trading times are made equal.

Although there is always liquidity in the market for the majors, there are times when the volatility is muted and others when it is most pronounced. In fact, varying currency pairs will display different activity depending on the time of the session. In this chapter, we will take a look at the operational periods of the three FX markets and how the varying currency pairs react during these trading sessions and at their overlap.

The 24 hour market that can be too much to handle!

Undeniably, there are several benefits to a trading in a market that stays open 24 hours of the day, but to expect somebody to spend that much time in front of the computer, hawkishly ogling at the screen, would be unrealistic.

However, even when you are sleeping, the market is moving at full pace, which means that you could end up missing out on some very lucrative chances if you are not around. Then, there is the possibility that a jump in the volatility of the market may make the prices move in the opposite direction to your position, which would equate to serious losses.

To minimize the risks and the loss of money making opportunities, a trader needs to be aware of the market behavior at various points through the day. Also, it helps to know the typical trends seen in the different FX markets at different times. This helps the trader to decide on the perfect trading time to suit his investment style and strategy.

Segmented for simplification!

The currency market is divided into three sessions based on the opening of the major financial centers across the globe. During these sessions a flurry of activity is noticed in the prices of various currencies, particularly those that are in some way linked to that geographical region.

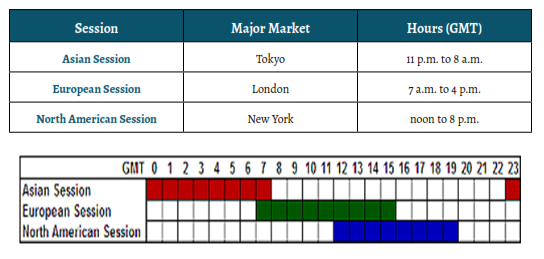

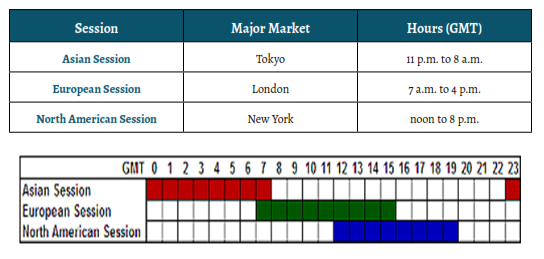

The 3 FX sessions are the Asian, the European and the North American; there are also known as Tokyo, London and New York sessions. The names are used interchangeably since these cities represent a major financial center for the region they are in. These markets/sessions open on the heels of one and other. Although currencies are traded even after they close, most active trading is done while these markets are in session.

The Asian or Tokyo Session: The Asian session is the first to open in the world with the Tokyo capital markets starting after the weekend. This session of the FX market opens at 11 pm GMT and closes at 8 am GMT, and many countries start their trading in this period, including China, Russia, Australia and New Zealand. In fact, given the large geographical area covered by these countries, it is understandable why the Asian session is stretched well beyond the standard hours of operations of the Japanese financial markets.

Because the Tokyo Market is the first to open, many traders use the activity in the Asian session to understand price dynamics and develop strategies. About 6% of all currency transactions are conducted during the Asian session.

The European or the London Session: This is midway between the Asian and the North American Sessions in terms of timing. As the Tokyo Market closes, the one in London goes live, keeping currency trades active. This is an exceptionally dense time zone in terms of transactions since it includes several major financial centers in the region.

Officially, business hours start at 7:30 am GMT and go on to till 3:30 pm but given the inclusion of Germany, France and the other EU nations, trading hours are increased well beyond the standard London business timing. Typically, the European session runs from 7 am to 4 pm. GMT. This is a particularly active session of the currency market with almost 34% of the world’s trade being effected in this market. In fact, given the presence of the large players in this market, the European session is inevitably more volatile than the other two.

The North American or New York Session: This is the last of three official currency market sessions. By the time trade starts in NY, the Asian Markets have already closed down, but the European Session is just midway through its day. The North American Session is dominated by activity in the US and Canadian markets as well as South American countries.

The NY market handles about 16% of all FX activity and it operates from 12 pm to 8 pm GMT. After this point, there will be a lull in the transactions till the Asian Market reopens. As you will see in the table below, a large part of the European and the North American sessions overlap and the majority of the transactions in both markets take place during this period.

Towards the half day mark in the NY Market activity slows down as the liquidity dries up in the European session and traders begin to exit the market. In fact, the drop in activity by mid day is measured at nearly 50%. This is one of the prime reasons why very little attention is paid to market developments in the afternoon during the North American Session.

Market overlap

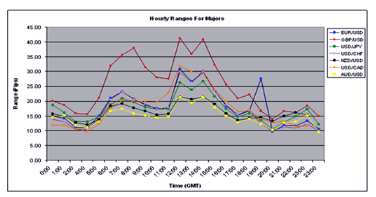

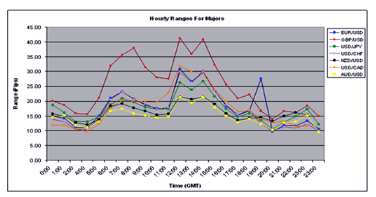

In the graph below, notice how the activity of GBP/USD and EUR/USD peaks at the open of the European Session at 7 am GMT. However, the most significant volatility, indicating an increase in trading is seen at 12 pm as the North American Market opens. You can see that the maximum transaction activity takes place during the European Session.

Also, the graph above shows that when you are trading with a pair that includes a currency from the Asian region and the other from the European region such as GBP/JPY or EUR/JPY, the greatest activity in these pairs will be seen when the operating hours of the Asian and the European markets coincide while the price action will be less dramatic during the overlap of the European and the NY sessions.

The three GOLDEN rules of timing the FX markets

1. The European session is the busiest of the three currency markets, hence it is perfect for beginner as well as more advanced traders.

2. The busiest trading hours are during the overlap of the European and the North American sessions.

3. Tuesday through Thursday are the best days of the week to trade as they record maximum trade activity.