silver pricing ratio.

There can be no doubt that the price potential appreciation is there for silver. This is true whether you look towards its all time high, inflation adjusted high, or

historical gold to silver price ratio. Now that you see why you have to invest in silver today, you need to understand the various vehicles for doing this. They all have their own advantages and disadvantages, as you will read about in the rest of the chapter.

But first, you will read about why there is another ten years left to the incredible silver bull market run left.

The Twenty Year Cycle and Silver

With these incredible percentage appreciation possibilities for silver presently ranging from 117 percent, to 390 percent, to 615 percent, depending on the way

that you figure the fair price for silver in today’s dollars, you may wonder how long a period this might take to transpire. The answer to your question has

everything to do with the length of commodity cycles.

As you have read earlier in the book, commodity cycles typically run a good 20

years. There has never been one that lasted for under 15 years. Since commodity

cycles have averaged at twenty-year periods fairly consistently, this means that you have to know when a bull market cycle began in order to properly understand how

much time is left in this commodities bull market cycle.

50 - Chapter 5 - How You Can Make a Fortune Investing in Silver

The Silver Fortune Formula - How to Make Extraordinary Profits from the Silver Bull Market

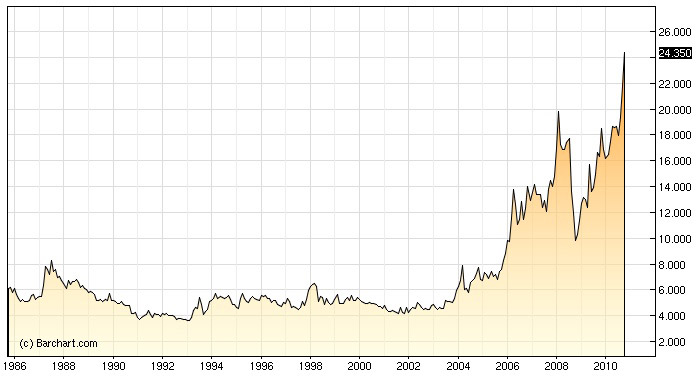

Above chart shows the Silver trend from 1986 - 2010

Prices for silver actually bottomed out back in the year 2001. The cumulative

monthly average for silver hit its low in November of 2001 at an incredibly low

$4.12 per ounce average for the month. Silver prices ended 2001 at $4.52 per

ounce.

From that point and year on, silver prices have been steadily increasing, having seen a closing price of $4.66 per ounce in 2002, a closing price of $5.96 in 2003, and a closing price of $6.81 in 2004.

These represented gains of three percent in 2002. Percentage wise, the bull market in silver really took off in the year 2003, as silver managed an impressive almost 28 percent gain that one year alone. 2004 proved to be strong too, with silver

running up more than 14 percent.

51 - Chapter 5 - How You Can Make a Fortune Investing in Silver

The Silver Fortune Formula - How to Make Extraordinary Profits from the Silver Bull Market

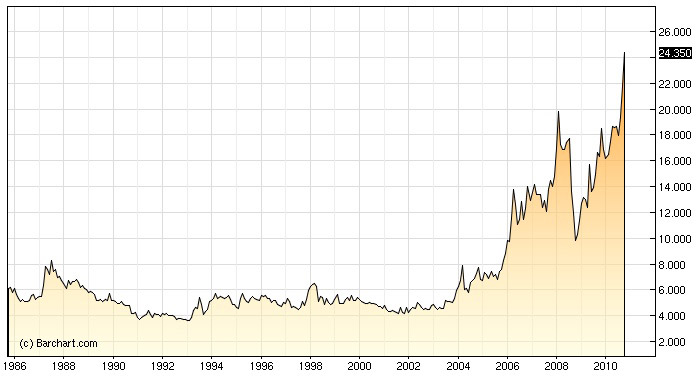

Above chart shows the Silver trend from 2004 - 2010

Silver closed at $8.83 per ounce in 2005, again closed substantially higher at

$12.90 per ounce in 2006, and reached another solid high in the bull run of $14.76

per ounce in 2007. These represented annual gains of nearly 30 percent for the year in 2005. In 2006, the gains weighted in at a staggering 46 percent increase. For 2007, the year’s percentage gains proved to be less torrid at a still decent 14.5

percent.

To bring silver current, you should know that in ended the year of the financial panic of 2008 at $10.79 per ounce, while finishing off 2009 at $16.99 per ounce.

For 2010 as of the first week of October, silver is at over $23 per ounce. It suffered its first bull market run decline in 2008, having dropped nearly 27 percent with the world economy.

By the end of 2009, silver was back up to a new bull run high, tacking on gains of 57 percent for the year, or 15 percent since 2007.

So far in 2010, silver has made another banner year, with gains through the first

week of October tallying over 35 percent.

52 - Chapter 5 - How You Can Make a Fortune Investing in Silver

The Silver Fortune Formula - How to Make Extraordinary Profits from the Silver Bull Market

Above chart shows the Silver trend from January 2009 - December 2009

Since the bull market run began at the end of 2001, silver has gained from $4.52 to $23 plus per ounce. In ten years, this is an increase of $18.48 per ounce.

It represents a decade long gain of nearly 410 percent. Averaged over the period,

this comes out to nearly 41 percent per year for ten years.

This is an impressive run for silver, but it is only for ten years. The average bull market runs 20 years, and the shortest commodities bull market has lasted 15 years.

Either way, you can count on between five and ten more years of the bull market

continuing in silver.

Getting back to the question asked earlier in this section about how long it would take silver to run the remaining from 117 percent, to 390 percent, to 615 percent amounts that potentially remain in site for silver based on constant dollar, gold to silver ratio dollar, and inflation adjusted dollar highs, the answer becomes simple.

53 - Chapter 5 - How You Can Make a Fortune Investing in Silver

The Silver Fortune Formula - How to Make Extraordinary Profits from the Silver Bull Market

Silver should achieve somewhere in this range of gains over the next five to ten