A country's BoP accounts record transactions between a

country and the outside world for a specific time period, where the country

consists of residents including the government, and the outside world consists

of non-residents including foreign governments. They present an aspect of the

national accounts relating to imports, exports and other international

financial transfers. The balance between imports and exports is known as the balance

of trade, and is normally the largest component of the balance of payments.

Monetary value leaves the UK when UK residents purchase foreign

goods, services and assets; when non-residents repatriate returns from UK

assets that they own; when residents exchange money to send abroad (transfers

out); and when the UK government sends aid to foreign countries.

Monetary value enters the country when residents sell UK goods,

services and assets to non-residents; when residents repatriate returns from foreign

assets that they own; and when non-residents exchange money to send to the UK

(transfers in).

What matters is not whether or not things physically enter

or leave the country but whether or not ownership changes between UK residents

and non-residents.

For accounting purposes these transactions are split into

three main accounts, each with many sub-accounts for specifics. They are the Current

Account, the Capital Account, and the Financial Account.

The current account is the trading account and records:

·

trade in goods and services;

·

primary income - income earned by UK residents from non-residents

and vice versa (investment returns, wages, taxes, subsidies etc.);

·

secondary income - provision (or receipt) of economic value by

one party without directly receiving or providing any economic value in return

(money transfers other than for trade purposes between residents and non-residents).

The capital account is a minor account in the BoP and records:

·

the acquisition and disposal of non-produced, non-financial

assets (such as copyrights, patents and trademarks);

·

capital transfers where there is no quid pro quo to offset the

transfer of ownership of fixed assets, or the transfer of funds linked to fixed

assets such as aid to finance capital works, or the forgiveness of debt.

The financial account records UK claims on, and liabilities

to, non-residents.

A very confusing aspect of the BoP is that the financial

account used to be known as the capital account, and is still often referred to

as such. It's a pity the same name has been used for the new minor account

because it causes ambiguity.

The current account holds wealth rather than money, and the

wealth it holds is that received from and given to non-residents. Therefore whenever

wealth is received by residents from non-residents (wealth is imported) it is

given to the current account and is therefore recorded as a debit, and when

wealth is given (wealth is exported) it is taken from the account and therefore

recorded as a credit. It can be confusing because all explanations tell us that

the account records primary and secondary income, so income received would seem

to be a debit, whereas it's the wealth that the income was earned for that the

account holds, not the income itself. For example when a UK resident does work

for a non-resident, and is paid for it, it is the export of work that is

recorded in the current account – wealth is taken from the account - so it is

credited. The same applies for secondary income. When a UK resident receives

money from abroad, perhaps a parent receiving money from a son or daughter

working abroad, then the account holds the putative export - nothing was

exported but for accounting purposes it is considered to be an export, and

again in this case it will be credited. A country that imports more than it

exports suffers a current account deficit, and a negative current account

balance indicates that the totality of imports to date has exceeded the

totality of exports.

The capital account represents non-produced, non-financial

assets and capital transfers received from and given to non-residents as listed

above.

The financial account represents money and financial assets received

from and given to non-residents. It records the opposite end of each

import/export and capital account transaction, so money paid out for an import

or for work done by a non-resident is credited (money is taken from the

account) and money received for an export or for work done by a resident for a

non-resident is debited (money is given to the account). The current and

financial accounts are by far the main players in the BoP.

The sum of these accounts must always be zero, but in practice

in recording all the transactions there are errors and omissions, so a

balancing item with this name is included to make the overall total zero.

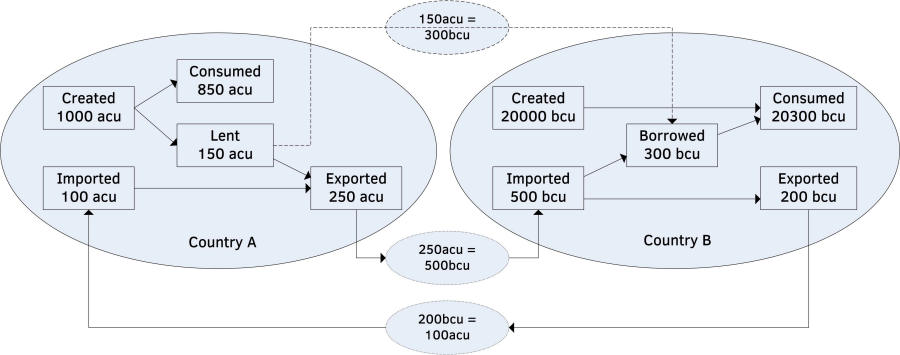

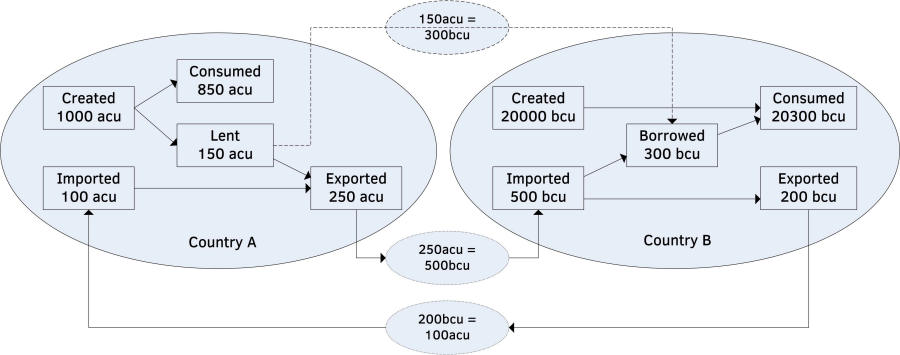

Figure 69.1 International Trade with Different Currencies

Figure 69.1 is a wealth transfer diagram showing how

international trade plays out using a simple world economy consisting of just

two countries, A and B. Each box indicates wealth value in terms of the

country's own currency, where A's currency is worth twice B's - one A currency

unit (acu) can be exchanged for two B currency units (bcu). B creates ten times

the wealth of A, but B consumes more wealth than it creates, whereas A consumes

less wealth than it creates, so it is able to export more to B than it imports

from B, the difference being the value of wealth created less that consumed. The

difference between creating and consuming wealth represents lending if

positive, and borrowing if negative. The dotted line indicates the equivalence

of lending and borrowing, and lending wealth becomes saving money when payment

is made. A is paid an excess of 150acu in money by B after B had exchanged

300bcu for A's currency (B imports 500bcu worth of wealth but only exports

200bcu worth of wealth, so it must pay the difference in money).

Here A's BoP accounts would show a current account surplus

of 150acu (more wealth taken from this account than received by it), and a

financial account deficit of 150acu (more money received by this account than taken

from it). B's BoP accounts would be the reverse of A's but expressed in bcu. If

the residents in A that had savings of 150acu decided to use them to buy B's

government bonds there would be no effect on either country's current account

because no goods or services had been traded, but the financial accounts would

change. A's financial account would replace the money with the bond - money taken

from the account = credit and bond received by the account = debit, the net

effect still being 150acu deficit, but now in the form of a bond rather than

money. B's financial account would replace the money debt with a government

bond debt - money received by the account = debit and bond taken from the

account = credit, the net effect still being 300bcu surplus, but now in the

form of a bond debt rather than a money debt.