The Energy Needs of United States

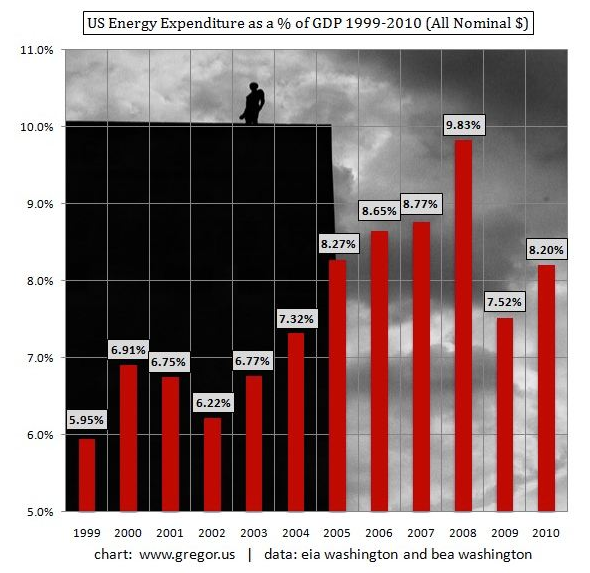

The following map from the Business Insider shows the energy expenditure of the United States as a percentage of the American GDP (Gross Domestic Product). See “Here's What Happens When US Energy Spending Passes 9% Of GDP”, June 2011.

Picture 1

http://www.businessinsider.com/the-energy-limit-model-2011-6

By “energy expenditure” the article refers to all forms of energy i.e. oil, natural gas, nuclear energy, coal etc. The Gross Domestic Product (GDP) refers to the total added value produced by a country.

Think about GDP in the following way. Man A cut a tree and sells it to man B for 10 dollars. Man B makes a table with this tree and sells it for 30 dollars to man C. Assume that this is the only economic activity in the country during the year. Therefore the total added value produced in the economy was the 10 dollars that man A made by cutting the tree, and the 20 dollars that man B made by converting this tree to a table and selling it for 30 dollars.

Therefore the GDP can be seen as the profit of man A (10) and the profit of man B (20), or the total profit of the economy. That’s not the definition of GDP, and the calculation of the GDP is a very complicated procedure in a real and complex economy, but the above example with the tree and the table is all you need to know to understand what the GDP is about.

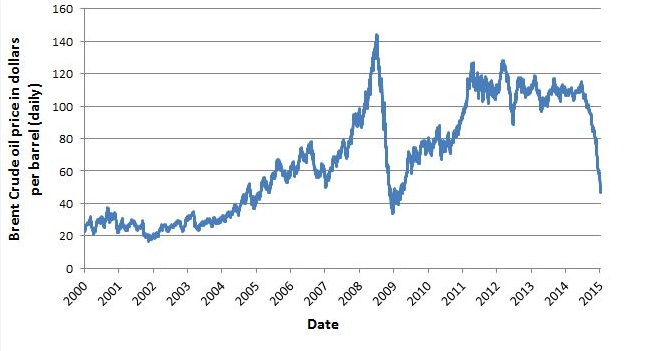

From picture 1 you can see that the energy expenditure of the United States was approximately 10% of the GDP in 2008, and 7.5% in 2009. I guess that the main reason for the large percentage of 2008 was the very high oil prices of that year, as you can see at the following table from the London School of Economics. Actually I am only guessing here, but there must be a relationship between the two, since the American economy is addicted to oil.

Picture 2

http://blogs.lse.ac.uk/europpblog/2015/01/21/falling-oil-prices-should-help-europes-ailing-economies-but-the-wider-implications-of-the-price-drop-remain-to-be-seen/

If we take the American GDP to be approximately 17 trillion, a 10% energy expenditure amounts to 1.7 trillion dollars per year. Therefore we can assume that in 2008 the American public, the American citizens and the American companies paid approximately 1.7 trillion dollars for oil, natural gas, coal, nuclear energy etc. That’s a huge amount.

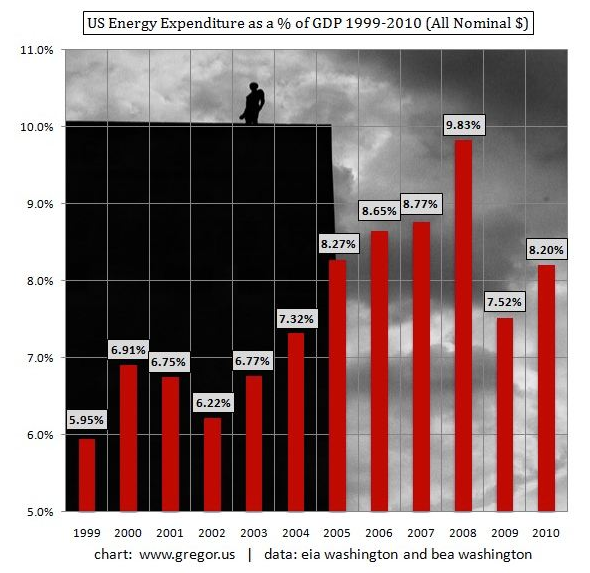

The following map from Wikipedia shows the various sectors of the American economy as a percentage of the American GDP (2011).

Picture 3

https://en.wikipedia.org/wiki/Economy_of_the_United_States

You can see that retail sales in the US accounted for 6% of the American GDP. That means that the valued added produced by the process of retail sales was less than the energy expenditure of the United States. What I am trying to show energy’s great importance for the large industrial economies i.e. USA, China, Japan and Germany, which are the four largest economies in the world. Think about the United States as a company with an annual profit of 17 trillion dollars. This company has to pay 1.7 trillion dollars every year for energy i.e. electricity, oil, natural gas, gasoline etc, in order to heat its buildings, to move its vehicles, to produce its goods etc. That’s a huge amount, and you can imagine what would mean for this company (country) if oil prices were to increse from 20 to 140 dollars, as was the case for the period 2000-2008.

The higher the energy prices the more a company has to charge for its products, and the less competitive the economy becomes. If a country can get lower energy prices than a competing country, she will have a lower production cost and a more competitive economy (ceteris paribus). That’s a great problem for a country, and it can lead to wars on its own. But there is a more important problem i.e. the issue of national security. All countries want to make sure that in case of war they will have access to energy sources.

Finally the energy sources are not unlimited. For example for the last decades the French state-owned Areva, which is a major producer of nuclear energy, has been counting on Niger’s uranium reserves. Now that the Chinese and the Iranians are giving France a hard time in Niger, because they need Niger’s uranium for their own nuclear programs, France might lose some of Niger’s uranium fields. But even if France does not lose this uranium fields, she might have to pay higher prices to Niger due to more competition and higher demand. That would mean higher energy prices and higher production costs for France, and a lower competitiveness in the international markets for the French products.

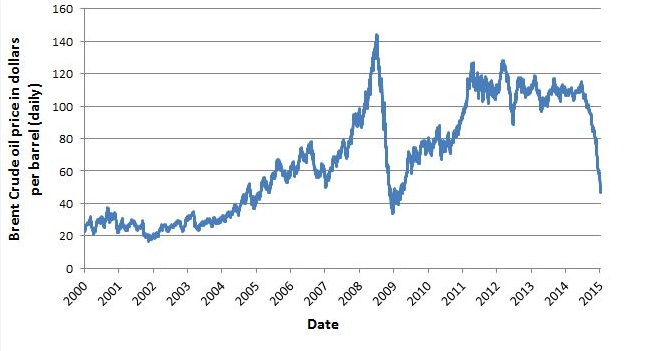

Finally I have to say that more than 2/3 of the oil and natural gas reserves of the planet are located in the zone Persian Gulf- Caspian Sea – West Siberia. See following map.

Picture 4

For the Business Insider article see:

“Here's What Happens When US Energy Spending Passes 9% Of GDP”, June 2011

http://www.businessinsider.com/the-energy-limit-model-2011-6