Daily Pivot Trading Strategy

Pivot Trading aims to gain a profit from the currency’s daily volatility. In its basic sense the pivot point is defined as a turning point. It is considered a technical indicator derived by calculating the numerical average of the high, low and closing prices of currency pairs.

In mid-1990s a professional trader and analyst Thomas Aspray published weekly and daily pivot levels for the cash forex markets to his institutional clients. As he mentions, at that time the pivot weekly levels were not available in technical analysis programs and the formula was not widely used either.

But in 2004 the book by John Person, “Complete Guide to Technical Trading Tactics: How to Profit Using Pivot Points, Candlesticks & Other Indicators” revealed that pivot points had been in use for over 20 years till that time. In the last years it was even more surprising for Thomas to discover the secret of quarterly pivot point analysis, again due to John Person.

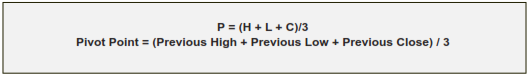

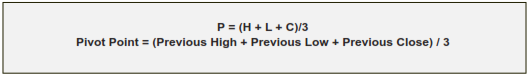

Currently the basic formulae of calculating pivot points are available and are widely used by traders. Moreover, pivot points calculator can be easily found on the Internet. For the current trading session the pivot point is calculated as:

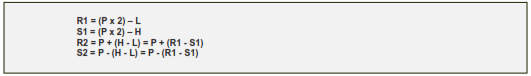

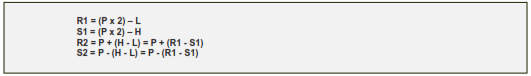

The basis of daily pivots is to determine the support and resistance levels on the chart and identify the entry and exit points. This can be done by the following formulae:

where:

P - Pivot Point

L - Previous Low

H - Previous High

R1 - Resistance Level 1

S1 - Support Level 1

R2 - Resistance Level 2

S2 - Support Level 2