CH 14: Gaussian Copula: $ Implications

It is hard not to be aware, whether you are 8 or 88, that in recent times this great country of ours has suffered some degree of an economic hiccup. Furthermore, like so many things in modern society, the issues surrounding this financial collapse are complicated ones, making it more difficult to hone in on its root cause. According to a lot of people though, we needn't look further than the Gaussian Copula Function for answers.

The copula is a way to measure the behavior of more than two variables and this function was intended to measure complex risks in the financial markets. This function allowed banks to attach a correlation number to many different types of securities. This number can be thought of as a sort of risk barometer. This led to banks taking risks they would simply not normally take. The Gaussian Copula function convinced banks, bond traders, insurance companies, hedge funds and other Wall Street big wigs to assess risk in an altogether risky way. It gave people with tremendous power in the financial world the ability to create correlations between seemingly unrelated events when in fact there was very little of a relationship to be found. This led to credit rating agencies becoming convinced that toxic mortgages were in fact AAA rated. This fuzzy math ignored common sense and the realities of innate instabilities that are present in the financial markets.

Perhaps an important lesson to take away from this economic collapse is that when we foster a society that elevates, appreciates and demands math fluency, we make it harder for this kind of problem to arise in the first place.

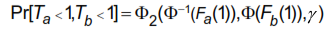

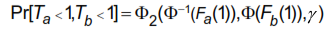

Do you know what

really means?

Neither did most of Wall Street.