Budgeting

Budgeting can be considered a controversial topic. This is mainly because of how people feel about the topic. Over the years I have noticed people wincing and/or cringing when I mentioned budgeting. If I asked, “Do you have a budget?”, sometimes the response was, “No, and I don’t want one. I don’t want to be restricted and feel like I can’t spend anything.” I have used “Spending Plan” in place of “Budget” to make people feel better about the topic.

A budget is a very important tool in Money Management. It is like a road map or GPS to help you to reach your goals. Goals help you to identify what you want to do and a budget helps you to see how you are going to reach your goals. Also, a budget helps you to see where your money is going by identifying your income (the money coming in) and your expenses (the money going out). I have talked to several people who have good incomes but do not know where their money is going. Once you identify your income and expenses, you can determine whether you have a surplus (more income than expenses) or a deficit (more expenses than income) at the end of the month. This information can help you make wise decisions about your Money Management.

Let’s look at the different parts of a budget. First there is income. Income can be your wages or salary, business income, earnings from investments, or bonuses or gifts. Next, we look at expenses. This list is more extensive than income because there are so many things you can spend your money on. Here are some examples: Charitable giving; mortgage, rent, and utilities; car payment and fuel; clothing, personal care and grooming; groceries, dining out, entertainment and vacations; insurance, etc.

If you do not have enough income to meet your expenses or you want to save more of your income, then you may want to review your expenses to see where you can cut back. Some expenses are fixed such as mortgage/rent, car payment, and insurance. Other expenses are variable and can change such as groceries, dining out, and entertainment. You may want to start with your variable expenses to see if you can decrease them to free up some money for savings and goals. During this exercise, you may find yourself looking at your needs vs. your wants. This can help you to decrease some of your expenses. You may decide that having cable is a need but then realize that having all of the extra channels that you do not even watch is not only a want but is costing you more than $60 extra per month. See what you can do to decrease your expenses to free up extra money. You many surprise yourself. Also, you can consider increasing your income so you can have extra money for savings and your goals. If you choose this option, please use the extra money to make up a deficit, to save more money, or to go toward your goals. Many times when people make more money they just spend it. It disappears before they realize they have it. Hopefully, a budget can help you to avoid that disappearing act.

Sometimes when you are making a budget it will be important to track your variable expenses for a week or so. This can be useful because a lot of people have no idea how much money they spend on eating out, including buying coffee and/or snacks. Write down the date, each item purchased that day, and the amount of each item. Total the amount of the items at the end of each day or at the end of the week. This has proven to be an eye opening exercise for many people. They did not realize how much they spent on unnecessary items (wants). They actually “found” money for savings and their goals.

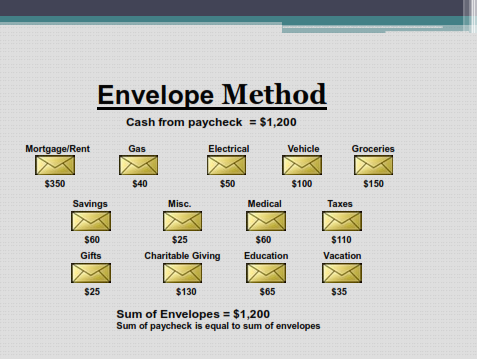

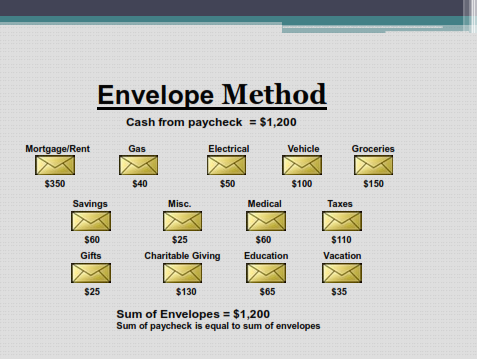

There is a popular way to budget that has been very successful for many people. It is called the Envelope Method. It is illustrated below. People have found that using cash has been very effective for them. After you get paid, you withdraw cash from your bank account and put it into envelopes that are marked with your expenses. When the bills are due or the money is needed for the allocated expense, you take it out of the envelope and pay the bill or pay for the expense. When the envelope is empty, then you cannot use money for that expense until you get paid again. You cannot borrow money from another envelope. If the money is not spent, then it can accumulate for your goals and/or go into your savings account. There is also software available to allow you to do this electronically.

Action Plan:

Use the Weekly Spending Tracker on the next page to track your spending for the next two weeks. Track everything you spend including your bills, meals, giving, gas, snacks, entertainment, etc. Whether you pay cash, pay online, withdraw money from an ATM, or swipe your Debit Card to make a purchase make sure you record it on the Weekly Spending Tracker to get an idea of where your money is going.