Scenario 4 LAY first, then BACK for Guaranteed Profit Target

To PROFIT from this method you MUST be able to pick a horse which you think will have its BACK ODDS increase compared to the LAY ODDS at which you take your LAY BET. After that you won’t care who wins or who loses.

Let’s work through an example. (I shall be overwriting a lot of the figures on the Betfair screenshots with hypothetical figures to demonstrate the principles involved. Some of the figures may be exaggerated to show a point).

The LAY BET is placed early in the day to give the BACK ODDS time to move in my favour. (This is my preference~ you may decide to start trading at a different time).

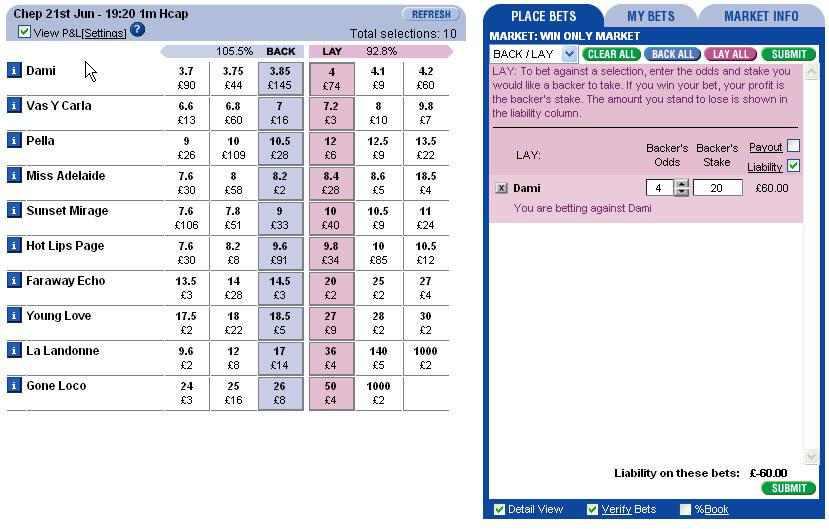

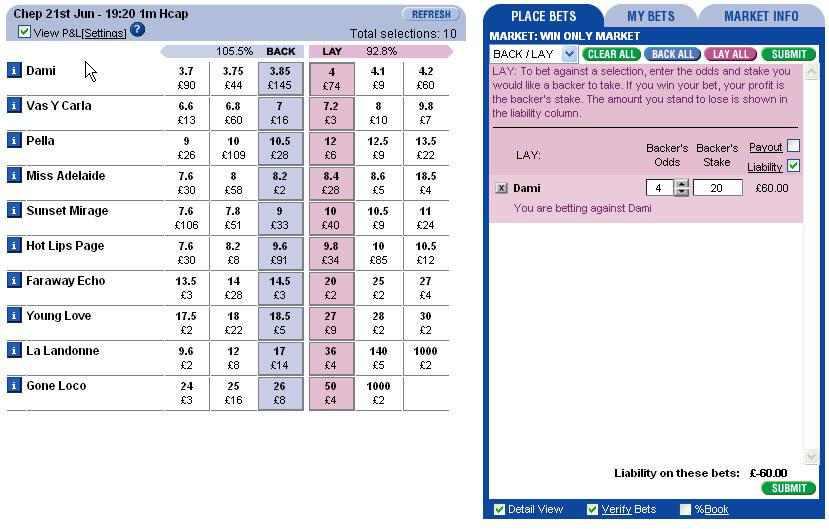

The Odds are reasonable at this time, and I think the BACK ODDS will move in my favour, so I’m going to LAY to LOSE using the displayed Odds, but I’m only going to take £20 of the £40 on offer. I SUBMIT and CONFIRM my bet and the bet is matched.

Sunset Mirage 10 £180

You are betting against Sunset Mirage

Sunset Mirage 10 £180

You are betting against Sunset Mirage

Amount will change to £20

once my bet is matched and

provided noone is posting at

the same time as me.

(Original £40 less Backer’s

Stake of £20)

£180 £180

As things stand, I am left with one of the following possibilities:

·

Sunset Mirage LOSES the race and I keep the Backer’s Stake of £20 as PROFIT. ·

Sunset Mirage WINS the race and I have to pay the Backer £180 (the Backer keeps his

Stake Money) A loss to me of £180

What I am looking for now is for the BACK ODDS against Sunset Mirage to increase (goout) so that I can BACK the increased Odds to produce a “Guaranteed Profit Target” situation no matter what the result of the race turns out to be. Obviously, the BACK ODDS will have to increase to a level which will generate my required profit. Once I know what the BACK ODDS and Stake need to be, I can ask for them and wait to see if they are matched. Closer to the event I will check to see if anyone has matched my BACK BET, and if there have not been any takers, I may decide to lower my Profit Target.

There may be times when it is impossible to place a BACK BET to produce a profit because the BACK ODDS have not moved in your favour. This may result in having to leave the original LAY BET to ride its course, hoping that the horse will LOSE. Alternatively, if there is no sign of the BACK ODDS increasing above the original LAY ODDS, as the start of the event draws closer, but the difference is not too great, you may decide to tradeout of your LAY BET by placing a BACK BET at current odds, and take a small loss.

It is also possible to monitor the odds as the race is in progress (inrunning). They change very quickly, and the odds and stake you require may appear.

What do the BACK ODDS and Stake need to be to produce a “Guaranteed Profit Target” situation?

Take a look at the table below:

The table has been filled in with known facts. I have a LAY BET which is currently active and I now wish to place a BACK BET to trade myself into a “Guaranteed Profit Target” situation. I know that if I leave things as they are and Sunset Mirage LOSES I will make a profit of £20. On the other hand, if Sunset Mirage WINS, I will have to payout £180. Therefore, to trade myself into a “Guaranteed Profit Target ” position I need to establish what the BACK ODDS and Stake need to be to produce my Profit Target.

Odds Stake Potential Potential Profit Payout £ £ £

CURRENT BET LAY 10.00 20.00 20.00 180.00

PROPOSED BET BACK NIL

I’m going to set my Profit Target at £10. I cannot set my Profit Target any higher than LAY BET Stake.

After setting my Profit Target at £10.00, I now know that my Back Stake has to be £10.00 (Potential Profit from LAY BET of £20.00 less Profit Target of £10.00) I can enter this £10.00 into my table in the Stake for BACKING. After setting my Profit Target at £10.00 I know that any Potential Profit from my BACK BET needs to be £190.00 (LAY BET Poten tial Payout of £180.00 plus £10.00 Profit Target).

I can enter this £190.00 into my table in the Potential Profit for BACKING.

CURRENT BET LAY Odds Stake Potential Potential Profit Payout £ £ £ 10.00 20.00 20.00 180.00

PROPOSED BET BACK 20.00 10.00 190.00 NIL

The only thing left to do now, is to calculate the LAY ODDS I will be asking for.

This is simply a matter of dividing the Potential Profit by the Stake, and adding one.

(Don’t forget European Decimal Odds include the Stake)

(£190÷10) +1 = 20.00

RACE RESULT

Sunset Mirage WINS

Winnings from