How to plan your cash flow for

holidays and long breaks

Paddy Donnelly

Hiking through the Amazon jungle. Climbing to the top of a volcano in Chile. Standing in the middle of the world’s largest salt flat in Bolivia. These are the things that spring to mind when I think of my three-month trip around South America. What I don’t think about is how much money it cost me to miss so much work as a freelancer. Why? Because I planned the finances well in advance, so while I was away I was able to focus on having an amazing experience.

How to plan for a long break

As a freelancer, taking time off work is a big deal - if you’re not working, you’re not earning. Nobody tells you that you have X days of vacation to take this year. You’re in charge of your time off, so you need to plan it well. I’ve taken breaks from work before, but my three-month trip around South America was by far the longest I’ve had.

I learned a lot planning this trip, and I’m going to walk you through the various steps you should consider if you’re planning a long break.

Review your annual revenue for the past few years

First, you need to know how much money you earn each year. To find this, look in your profit and loss report for the past few years - it will be called either “Sales” or “Revenue”. Based on those figures and what you know about your business, you can work out a number that you’ll need for the upcoming year.

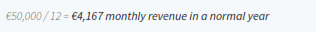

For this example, let’s say that your annual revenue is on average €50,000, and that’s what you’re working towards again this year.

Recalculate the required revenue for the months you’ll be away

Now that you have the annual revenue target, you can divide it out by the normal 12 months that you would normally work, so:

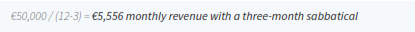

But if you need to remove three working months from that year, your calculation would become:

Now you have a starting point. So far, you need to earn €1,389 extra every month to cover the cost of your sabbatical. But this is just the start - there are a few other things to consider.

Build in buffers

When taking a long sabbatical from your work, you need to build in a buffer before and after your break. The buffer before you actually leave on your break lets you deal with last- minute requests from clients squeezing in more work, to deal with unexpected delays, and of course to plan for your trip!

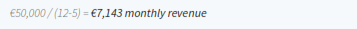

This will allow you to wrap up your work stress-free for both you and your clients. So, let’s say that’s another month off to add into the equation:

It’s also a good idea to plan for a buffer after your return. You can’t expect to return from a long break and immediately start back to work - it takes a while to get back into the swing of things, and if you’ve been away for a long time, it may also take some time to build back up your list of potential clients.

In my case, I took another month off before I started client work again. I used this month to work on our Wee Taps’ apps, ease myself back into designing and find some new client projects. So, in reality there were five months in the year where I wasn’t bringing in any money instead of just three. The length of time you’re actually not earning is very easy to overlook. Adding both buffers into the equation gives us:

Add in the cost of living while on the break

This will depend on what you’re doing in your sabbatical. If you’re spending three months working on a pet project at home, then your living costs will be built into this equation already. But if you’re travelling around the world then your living costs may be significantly higher when it comes to flights, accommodation, tours, visas etc. Let’s estimate that you’ll need an extra €2,000 a month to cover the cost of living in the three months you’re on your trip:

Consider any other financial implications

One thing I had to take into account while I was off travelling was that the world didn’t stop for anyone else, especially for my clients and their projects. I had a pool of regular clients who provided me with steady work, however as I was jetting off for three months they would need a designer to replace me, so I had to face the fact that I would most likely lose these clients for good.

Keeping in mind that my regular income wouldn’t be at the same level once I returned, I accepted that I would need to grow my pool of regular clients again. This would take time, so I had to plan that my revenue would also take a hit initially when I returned. If we estimate that my revenue would be cut in half for the first two months after returning, then we can take another month off our equation:

The result, and how to earn it

Based on the calculation you’re going to

Page 1 Page 2 Page 3 Page 4 Page 5 Page 6 Page 7 Page 8 Page 9 Page 10 Page 11 Page 12 Page 13 Page 14 Page 15 Page 16 Page 17