Chapter - 13

INTERNATIONAL ECONOMICS

(Ohlin , Meade, R.Mundell and Krugman)

Inter National Trade is one of the oldest branches of Economics. Leaving aside the exact dating of its origin, let us start with the Theory of Comparative Cost in the early 19-century. The gist of the theory is that where two Countries specialize in producing goods in which they have a Comparative advantage, both Countries gain from trade.

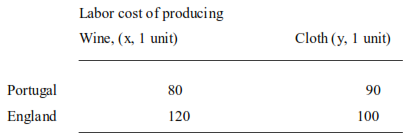

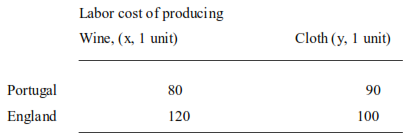

According to Ricardo, Labor Cost determines domestic value of any commodity. In International Trade however, the labor cost principle does not govern value in exchange. It is determined by Comparative advantage arising out of differences in labor productivity. Ricardo assumes the following figures for labor costs of production for wine and cloth in Portugal and England.

Costs of producing both commodities are lower in Portugal. In spite of that, it will pay Portugal to specialize in the production of wine and exchange it for Cloth made in England. For by doing so, Portugal would procure Cloth for an outlay of 80 days of Labor (man-years) what would cost her 90 days to produce. Both would gain from the exchange. This theory lends support to free trade argument.

If labor were the only factor of production as the Ricardian model assumes, comparative advantage could arise only because of international difference in labor productivity. In the real world, however, while trade is partly explained by difference in labor productivity, it also reflects difference in countries resources. Heckscher and his students Ohlin have developed a theory which states that international trade takes place largely due to difference in countries resources. This theory is often referred to as Heckscher – Ohlin theory (H - O theory). This H-O model says, in Ohlin’s words.

“Commodities requiring for their production much of abundant factors of production and little of scarce factors are exported in exchange for goods that call for factors in the opposite proportions.”

Further, H-O theory implies the Factor price Equalization Theorem, which states that exports result in the decrease of some factors of production and imports increase certain other factors. The newly created export industry will raise the relative prices of the domestically abundant cheap factor required in its production; imports will reduce the returns to the domestically relatively scarce and expensive factor previously utilized in its home production. Under certain restrictive assumptions, this results in the international equalization of factor prices.

Ricardo’s example of Trade between Portugal and England reflects inter-industry trade. But, much of the International Trade takes the form of intra-industry trade. In the intra-industry trade countries will export as well as import differentiated manufactured goods, if manufactures is a monopolistically competitive industry. For example Germany exports and imports cars from France. Intra-industry trade is driven largely by economies of scale. By producing fewer varieties of goods a country can produce each at a large scale, with higher productivity and lower costs. International trade thus leads to reduced prices and a wider choice of goods to the consumers. Krugman, winner of the 2008 Nobel Prize, explained the causes and patterns of International trade by focusing attention on economies of scale and the economics of imperfect competition. His analysis reveals that similarly placed countries in capital labor ratios, skill levels etc., such as EEC countries should trade, as opposed to countries that are different. Most trade occurred between countries with similar factor endowments and often involved different varieties of products from within the same industry.

International trade and capital flows gives rise to problems of surpluses and deficits, causing Balance of Payments (B.P) dis-equilibrium. Meade’s book Balance of Payments is a classic on the subject. The B.P is a comprehensive record of economic transaction of residents of a country in question (say India) who have received external currency (purchasing power) and how it is used. Since the payments side of the account enumerates all the uses which are made of the total foreign currency (purchasing power) acquired by India in a given period, and since the receipts side of the B.P account enumerate all the sources from which foreign currency is acquired by India in the same period , two sides must balance.

Balance of Payments Accounts are divided into Current account and Capital Account. Also the Current Ac.(CA) is equal to the difference between National Income and Domestic Residents spending which is known as Domestic absorption.(C+I+G).Further in a closed economy Saving is equal to Investment. In an open economy S= I + CA where CA is Current Account balance. Developing Countries can borrow from foreign nations for investment purpose and make good the Current Ac. Deficit. That is why the C.A surplus (Or deficit) is referred as Net foreign investment.

The current and capital accounts together make-up the overall Balance of Payments. If BP is in deficit, the Central Bank loses Foreign Reserves and if BP is in surplus the Central Bank gains Foreign Reserves. The BP always balances because the statement of BP includes the monetary movements and other balance items.

In an Open economy, sustainable B.P position over time is an important objective to go along with economic growth, low unemployment and as low inflation. The effects of policy instrument in achieving the objectives depend on the exchange rate system; the system may be a fixed exchange rate system; a floating exchange rate system and a managed exchange rate system.

Now let us consider the effect of Monetary and Fiscal instruments on the internal and external objectives of a country. Mundell extended the Keynesian IS*- LM framework, referred to in chapter 2, by incorporating a Balance Payments Schedule. While Keynesian aggregative demand approach focuses entirely upon Current account, Mundell’s model (and also of Fleming) takes into account Capital flows as well. The overall BP, is the Current account plus Capital account. The Current account gets worse as National Income (Y) rises, just as in Keynesian system. Thus, if BP equilibrium is to be maintained (at Zero) as national Income rises, the domestic rate of interest must also rise so that improved Capital account compensates for current account deficit. The schedule of External Balance Curve (EB) or BP Curve is a locus of zero overall BP positions. Add the EB curve to IS – LM curves, we get the Mundell model.

Visualize a graph showing interest rate on the vertical axis and income level on the horizontal axis; the IS curve downward sloping and LM curve upward sloping. Assume perfect capital mobility so that domestic and foreign interest rates tend to be equal. At that point only, a country can have external balance of Zero. Add, a horizontal BP (EB) Line at the point of intersection of IS-LM curves.

Fixed Exchange Rates:

Let us assume that a country cannot influence world interest rates and the economy is having external balance but not full-employment level of income. The Government attempts to eradicate unemployment through expansionary Fiscal policy. Fiscal expansion shifts IS curve up and to the right tending to increase both the interest rate and the level of output. The rise in domestic interest rates sets off a capital inflow from abroad. This would lead to the domestic currency to appreciate. But under Fixed Exchange rates this cannot happen. To maintain exchange rate, the Central Bank buys Foreign Currency (sells domestic currency). Hence, money supply in the economy increases causing LM curve to shift down and to the right, thereby causing output to increase a little more. Adding both the output expansions, we get a large increase in output. To conclude, Fiscal expansion under fixed exchange rates with perfect capital mobility is effective in increasing output.

In the case of Monetary expansion, the LM curve shifts to the right and this would result in reduced interest and capital flight. It results in BP deficit and hence, pressure for the exchange rate to depreciate. To maintain fixed exchange rate, the Central Bank must intervene, selling foreign currency and receiving domestic currency in exchange. This causes decline in the supply of domestic currency in the economy. As a result LM curve shifts back up and to the left. The process continues until the initial equilibrium point is reached. Hence, output do not expand.

Flexible exchange rates and Perfect Capital mobility

The situation is different under Flexible exchange rates. Market determines the exchange rate and there is no need for a Central Bank to intervene in the market. Without any such intervention, any deficit in the Current account of BP, must be financed by private Capital inflows, and in the case of Surplus in Current account it should be balanced by Capital outflows. As for perfect Capital mobility, any slight rise in domestic interest rate above the World interest rates leads to massive inflow of Capital from abroad making EB(BP) schedule horizontal at World interest rate. Assuming price stability domestically, let us consider the effect of expansionary Fiscal and Monetary policy instruments under flexible exchange rates. The effects of contractionary policies are similar but reverse.

A tax cut or an increase in Government spending would lead to an expansion of demand for domestic goods. This shifts the IS curve to the right. Fiscal expansion leads to increased Government borrowing and thus leads to a rise of domestic interest rates. This results in inflow of foreign capital which in turn leads to exchange rates appreciation. Consequently, domestic exports will decrease and imports will increase. Balance of Trade worsens. IS curve shifts back to the original position. But LM curve remains the same, as supply of money under flexible exchange rate is exogenous. There is no obligation for the Central Bank to intervene in foreign exchange market. The unchanging LM curve and the shifted back IS curve to the original position interact at the old equilibrium position. Hence, output do not change due to Fiscal expansion under flexible exchange rates.

Monetary expansion under Flexible Exchange rates results in increased real stock of money. This results in reduced domestic interest rates which in turn results in capital out flows to foreign countries. This leads to exchange rate depreciation, increased exports and reduced imports. The I.S. curve shifts to the right and output will increase.

To summarize the effects of policy instruments Monetary policy has no impact on output under fixed exchange rates, while fiscal policy has no effect on output under flexible exchange rates. On the other hand, fiscal policy has a strong effect on output under fixed exchange rates, while monetary policy has a strong effect on output under flexible exchange rates.” If the assumptions and parameters change then the effects of policies on output and employment will also alter.

There is a conflict among the three policies of full capital mobility, fixed exchange rate and monetary policy independence; termed as ‘impossible trinity’. This is a direct implication of the Mundell-Fleming (IS –LM-BP) framework wherein capital in fully mobile and the domestic interest rate is tied to the foreign interest rate. However, these three policies, taken in pairs, are feasible and practicable.

I.M.F. and IBRD

During the inter-war years, the great Depression took place leading to widespread unemployment and world wide recession. The 1930’s were marked by major trade in balances which in turn led to widespread Protectionism, the adoption of deflationary policies, competitive devaluations and abandonment of Gold-exchange Standard.

In this context representatives of 44 Countries met in July 1944 at Brettenwoods, new Hampshire and decided to set up Inter-National Monetary Fund (IMF) and International Bank for Reconstruction and Development (IBRD). The IMF agreement tries to provide sufficient flexibility in exchange rates to allow Countries to attain external balance in an orderly fashion, with out sacrificing internal objectives of fixed exchange rates.

The articles of agreement agreed by the member countries provided for the creation of a pool of international reserves that countries with temporary payments imbalances could draw upon. In the case of fundamental disequilibrium in B.P. Position IMF permits the country to change the exchange rates.

It is believed that both IMF and World bank followed a policy of ‘Liberalisation, minimal State and toughness in Monetary and Fiscal matters”. This came to be known as Washington consensus. In his WIDER Lecture Stiglitz has attacked total regulation of Financial markets and supported their intelligent regulations. He suggested better focussing of Government action on fundamentals of economic policies: basic education, health and sustainable development and equitable and democratic government. He criticized the policy of market fundamentalism of IMF. To a large extent Stiglitz is responsible for the transition from the Washington to post-Washington consensus.

Both the IMF and IBRD came into being in an era of fixed exchange rates and stable Capital flows. IMF was designed to meet temporary Current account deficit of member Countries by providing access to its Credit facility. These Brettonwood institutions now find themselves ill-equipped to deal with the problems of instability and volatility in exchange rates and capital flows.

The IMF making efforts to build-up its revenues and strengthen its finances. It is serving as a platform for the deliberations of G.20 countries. It is restructuring itself to make it more representative by giving more say to developing countries in the conduct of its affairs.

Trade Policies

Governments adopt several policies towards International Trade such as Tariffs, Quotas and Subsidies.

One of the basic arguments in favor of direct controls over Inter-National Trade in the ‘Second-best argument’. It is argued that we should not remove one particular Tariffs or Trade control so long as some other Tariff or Trade control or domestic duty or other divergences between marginal values and costs remain in operation. It is argued that maintenance of one particular divergence between marginal values and costs may help to offset the evil effects of another divergence. As a precept for practical policy, Meade does not find this argument very compelling. The only type of practical Inter-National welfare policy is to remove barriers to Trade, argues Meade. Meade wants re-building of liberal inter-National economic order.

Global Trade negotiations take place periodically under the aegis of GATT, now called World Trade Organization. The last Trade negotiations were held at Doha.

Joseph Stiglitz, coauthored with Andrew Carlton, a book titled ‘Fair Trade for All’. In that book Stiglitz argues for establishing a global trade regime which represents fair trade for all – both developed and developing countries. The authors argue that if there is to be widespread support for the continuing agenda for trade reform and liberalization, the developed world must make a stronger commitment than it has in the past to give assistance to the developing world. The developed countries should reduce their tariffs and subsidies on the goods of interest to the developing countries.

Mundell has pioneered the theory of Optimal Currency Area and was influential in shaping the European Union (E.U). The birth of European Monetary Union (EMU) in 1999 resulted in a single currency, Euro for all its 16 members. By joining the EMU, countries have achieved Exchange Rate stability, foregoing independence of monetary policies. Countries like England wishing to retain monetary flexibility preferred to stay out of the European Monetary Union.

In recent years, several bilateral Free Trade Agreement have been concluded in Asia. Several countries including China and Japan have signed trade deals with the Association of South East Asian Nations (ASEAN).

Paul Krugman’s excellent text book (coauthored with Obstfeld) titled, International Economics deals exhaustively with the theory of economics of scale, the political aspects of free trade and the geographical aspects of economic development and many other policy issues of International Trade.