CHAPTER 5

CONCLUSION AND RECOMENDATION

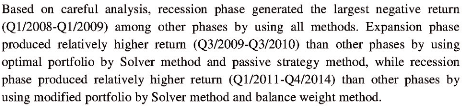

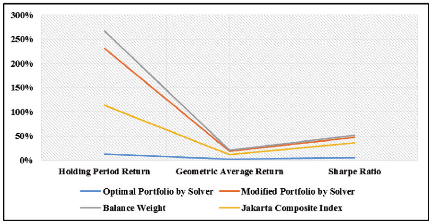

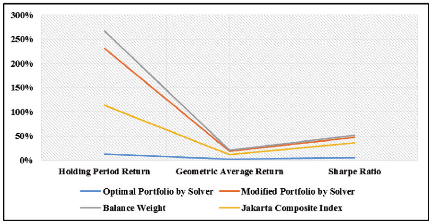

For measuring the effectiveness of strategy implementation to investment portfolio, the author use Sharpe ratio and additional indicators such as holding period return and geometric average return. By assuming some research limitations, sector rotation strategy with balance weight method has the best result in comparison with other strategies. Nevertheless, optimal portfolio by Solver which gives the lowest result than the others indicates insufficient historical data cannot forecast the future performance precisely although the result is still positive and not too bad for being counted.

In summarized, it was proved that sector rotation strategy based on modified portfolio as give superior return in comparison with passive strategy. The author also conclude that sector rotation strategy is possible to be implemented into the real investment world.

5.2. Recommendation

The author recommended for the investors to consider using sector rotation investment strategy in optimizing their investment portfolio. Balance weight method is preferred than modified portfolio by Solver method because it generates higher ending investment and risk adjusted return. Nonetheless, investors should rethink about all assumptions in this research to be implemented in the real investment world such as sufficient historical market price, positive annual growth expectation, transaction fee, lot size, and so forth. The investors should also make careful decision in analyzing business cycle phase, sector choice, stock selection, and investment portfolio construction by keep updating the information regularly. For further research, the author recommended to keep using sector rotation investment strategy in future period and assess its performance whether the strategy will be still effective and feasible to apply or not.