Making Money Grow

THE TWO WAYS TO MAKE MONEY

There are basically two ways to make money.

1. You work for money.

Someone pays you to work for them or you have your own business.

2. Your money works for you.

You take your money and you save or invest it.

YOUR MONEY CAN WORK FOR YOU IN TWO WAYS

Your money earns money. When your money goes to work, it may earn a steady paycheck. Someone pays you to use your money for a period of time. When you get your money back, you get it back plus “interest.” Or, if you buy stock in a company that pays “dividends” to shareholders, the company may pay you a portion of its earnings on a regular basis. Your money can make an “income,” just like you. You can make more money when you and your money work.

You buy something with your money that could increase in value. You become an owner of something that you hope increases in value over time. When you need your money back, you sell it, hoping someone else will pay you more for it. For instance, you buy a piece of land thinking it will increase in value as more businesses or people move into your town. You expect to sell the land in five, ten, or twenty years when someone will buy it from you for a lot more money than you paid.

And sometimes, your money can do both at the same time— earn a steady paycheck and increase in value.

THE DIFFERENCES BETWEEN SAVING AND INVESTING

Saving

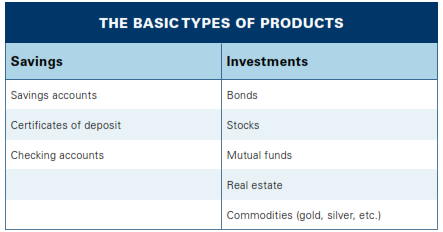

Your “savings” are usually put into the safest places, or products, that allow you access to your money at any time. Savings products include savings accounts, checking accounts, and certificates of deposit. Some deposits in these products may be insured by the Federal Deposit Insurance Corporation or the National Credit Union Administration. But there’s a tradeoff for security and ready availability. Your money is paid a low wage as it works for you.

After paying off credit cards or other high interest debt, most smart investors put enough money in a savings product to cover an emergency, like sudden unemployment. Some make sure they have up to six months of their income in savings so that they know it will absolutely be there for them when they need it.

But how “safe” is a savings account if you leave all of your money there for a long time, and the interest it earns doesn’t keep up with inflation? What if you save a dollar when it can buy a loaf of bread. But years later when you withdraw that dollar plus the interest you earned on it, it can only buy half a loaf? This is why many people put some of their money in savings, but look to investing so they can earn more over long periods of time, say three years or longer.

Investing

When you “invest,” you have a greater chance of losing your money than when you “save.” The money you invest in securities, mutual funds, and other similar investments typically is not federally insured. You could lose your “principal”—the amount you’ve invested. But you also have the opportunity to earn more money.

What about risk?

All investments involve taking on risk. It’s important that you go into any investment in stocks, bonds or mutual funds with a full understanding that you could lose some or all of your money in any one investment. While over the long term the stock market has historically provided around 10% annual returns (closer to 6% or 7% “real” returns when you subtract for the effects of inflation), the long term does sometimes take a rather long, long time to play out. Those who invested all of their money in the stock market at its peak in 1929 (before the stock market crash) would wait over 20 years to see the stock market return to the same level.

However, those that kept adding money to the market throughout that time would have done very well for themselves, as the lower cost of stocks in the 1930’s made for some hefty gains for those who bought and held over the course of the next twenty years or more.

It is often said that the greater the risk, the greater the potential reward in investing, but taking on unnecessary risk is often avoidable. Investors best protect themselves against risk by spreading their money among various investments, hoping that if one investment loses money, the other investments will more than make up for those losses. This strategy, called “ diversification,” can be neatly summed up as, “Don’t put all your eggs in one basket.” Investors also protect themselves from the risk of investing all their money at the wrong time (think 1929) by following a consistent pattern of adding new money to their investments over long periods of time.

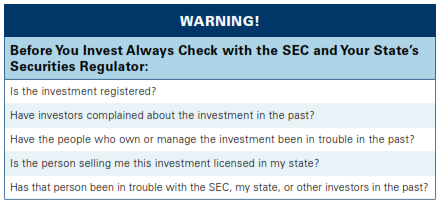

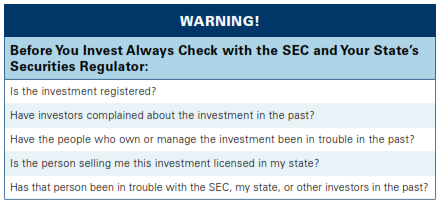

Once you’ve saved money for investing, consider carefully all your options and think about what diversification strategy makes sense for you. While the SEC cannot recommend any particular investment product, you should know that a vast array of investment products exists—including stocks and stock mutual funds, corporate and municipal bonds, bond mutual funds, certificates of deposit, money market funds, and U.S. Treasury securities.

Diversification can’t guarantee that your investments won’t suffer if the market drops. But it can improve the chances that you won’t lose money, or that if you do, it won’t be as much as if you weren’t diversified.

What are the best investments for me?

The answer depends on when you will need the money, your goals, and if you will be able to sleep at night if you purchase a risky investment where you could lose your principal.

For instance, if you are saving for retirement, and you have 35 years before you retire, you may want to consider riskier investment products, knowing that if you stick to only the “savings” products or to less risky investment products, your money will grow too slowly—or, given inflation and taxes, you may lose the purchasing power of your money. A frequent mistake people make is putting money they will not need for a very long time in investments that pay a low amount of interest.

On the other hand, if you are saving for a short-term goal, five years or less, you don’t want to choose risky investments, because when it’s time to sell, you may have to take a loss. Since investments often move up and down in value rapidly, you want to make sure that you can wait and sell at the best possible time.

What are investments all about?

When you make an investment, you are giving your money to a company or enterprise, hoping that it will be successful and pay you back with even more money.

Stocks and Bonds

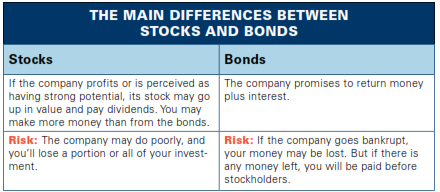

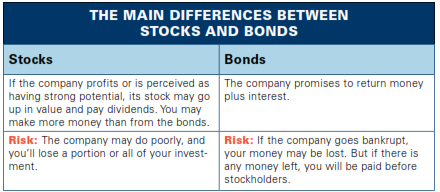

Many companies offer investors the opportunity to buy either stocks or bonds. The example below shows you how stocks and bonds differ.

Let’s say you believe that a company that makes automobiles may be a good investment. Everyone you know is buying one of its cars, and your friends report that the company’s cars rarely break down and run well for years. You either have an investment professional investigate the company and read as much as possible about it, or you do it yourself.

After your research, you’re convinced it’s a solid company that will sell many more cars in the years ahead.

The automobile company offers both stocks and bonds. With the bonds, the company agrees to pay you back your initial investment in ten years, plus pay you interest twice a year at the rate of 8% a year.

If you buy the stock, you take on the risk of potentially losing a portion or all of your initial investment if the company does poorly or the stock market drops in value. But you also may see the stock increase in value beyond what you could earn from the bonds. If you buy the stock, you become an “owner” of the company.

You wrestle with the decision. If you buy the bonds, you will get your money back plus the 8% interest a year. And you think the company will be able to honor its promise to you on the bonds because it has been in business for many years and doesn’t look like it could go bankrupt. The company has a long history of making cars and you know that its stock has gone up in price by an average of 9% a year, plus it has typically paid stockholders a dividend of 3% from its profits each year.

You take your time and make a careful decision. Only time will tell if you made the right choice. You’ll keep a close eye on the company and keep the stock as long as the company keeps selling a quality car that consumers want to drive, and it can make an acceptable profit from its sales.

WHY SOME INVESTMENTS MAKE MONEY

AND OTHERS DON’T

You can potentially make money in an investment if:

-

The company performs better than its competitors.

-

Other investors recognize it’s a good company, so that when it comes time to sell your investment, others want to buy it.

-

The company makes profits, meaning they make enough money to pay you interest for your bond, or maybe dividends on your stock.

You can lose money if:

-

The company’s competitors are better than it is.

-

Consumers don’t want to buy the company’s products or services.

-

The company’s officers fail at managing the business well, they spend too much money, and their expenses are larger than their profits.

-

Other investors that you would need to sell to think the company’s stock is too expensive given its performance and future outlook.

-

The people running the company are dishonest. They use your money to buy homes, clothes, and vacations, instead of using your money on the business.

-

They lie about any aspect of the business: claim past or future profits that do not exist, claim it has contracts to sell its products when it doesn’t, or make up fake numbers on their finances to dupe investors.

-

The brokers who sell the company’s stock manipulate the price so that it doesn’t reflect the true value of the company. After they pump up the price, these brokers dump the stock, the price falls, and investors lose their money.

-

For whatever reason, you have to sell your investment when the market is down.

MUTUAL FUNDS

Because it is sometimes hard for investors to become experts on various businesses—for example, what are the best steel, automobile, or telephone companies—investors often depend on professionals who are trained to investigate companies and recommend companies that are likely to succeed. Since it takes work to pick the stocks or bonds of the companies that have the best chance to do well in the future, many investors choose to invest in mutual funds.

What is a mutual fund?

A mutual fund is a pool of money run by a professional or group of professionals called the “investment adviser.” In a managed mutual fund, after investigating the prospects of many companies, the fund’s investment adviser will pick the stocks or bonds of companies and put them into a fund.

Investors can buy shares of the fund, and their shares rise or fall in value as the values of the stocks and bonds in the fund rise and fall. Investors may typically pay a fee when they buy or sell their shares in the fund, and those fees in part pay the salaries and expenses of the professionals who manage the fund.

Even small fees can and do add up and eat into a significant chunk of the returns a mutual fund is likely to produce, so you need to look carefully at how much a fund costs and think about how much it will cost you over the amount of time you plan to own its shares. If two funds are similar in every way except that one charges a higher fee than the other, you’ll make more money by choosing the fund with the lower annual costs.

For more information about mutual fund fees and expenses, be sure to read our brochure entitled “Invest Wisely: An Introduction to Mutual Funds”—which you can read online at www.investor.gov or order for free by calling the Federal Citizen Information Center at (888) 878-3256.

MUTUAL FUNDS WITHOUT ACTIVE MANAGEMENT

One way that investors can obtain for themselves nearly the full returns of the market is to invest in an “index fund.” This is a mutual fund that does not attempt to pick and choose stocks of individual companies based upon the research of the mutual fund managers or to try to time the market’s movements. An index fund seeks to equal the returns of a major stock index, such as the Standard & Poor’s 500, the Wilshire 5000, or the Russell 3000.

Through computer programmed buying and selling, an index fund tracks the holdings of a chosen index, and so shows the same returns as an index minus, of course, the annual fees involved in running the fund. The fees for index mutual funds generally are much lower than the fees for managed mutual funds.

Historical data shows that index funds have, primarily because of their lower fees, enjoyed higher returns than the average managed mutual fund. But, like any investment, index funds involve risk.

WATCH “TURNOVER” TO AVOID PAYING EXCESS TAXES

To maximize your mutual fund returns, or any investment returns, know the effect that taxes can have on what actually ends up in your pocket. Mutual funds that trade quickly in and out of stocks will have what is known as “high turnover.”

While selling a stock that has moved up in price does lock in a profit for the fund, this is a profit for which taxes have to be paid. Turnover in a fund creates taxable capital gains, which are paid by the mutual fund shareholders. All mutual funds are now mandated by the SEC to show both their before-and after-tax returns. The differences between what a fund is reportedly earning, and what a fund is earning after taxes are paid on the dividends and capital gains, can be quite striking. If you plan to hold mutual funds in a taxable account, be sure to check out these historical returns in the mutual fund prospectus to see what kind of taxes you might be likely to incur.

Do I Need an Investment Professional?

Are you the type of person who will read as much as possible about potential investments and ask questions about them? If so, maybe you don’t need investment advice. But if you’re busy with your job, your children, or other responsibilities, or feel you don’t know enough about investing on your own, then you may need professional investment advice.

Investment professionals offer a variety of services at a variety of prices. It pays to comparison shop. You can get investment advice from most financial institutions that sell investments, including brokerages, banks, mutual funds, and insurance companies. You can also hire a broker, an investment adviser, an accountant, a financial planner, or other professional to help you make investment decisions.

Some financial planners and investment advisers offer a complete financial plan, assessing every aspect of your financial life and developing a detailed strategy for meeting your financial goals. They may charge you a fee for the plan, a percentage of your assets that they manage, or receive commissions from the companies whose products you buy, or a combination of these. You should know exactly what services you are getting and how much they will cost.

Remember, there is no such thing as a free lunch. Professional financial advisers do not perform their services as an act of charity. If they are working for you, they are getting paid for their efforts. Some of their fees are easier to see immediately than are others. But, in all cases, you should always feel free to ask questions about how and how much your adviser is being paid. And if the fee is quoted to you as a percentage, make sure that you understand what that translates to in dollars.

In contrast to investment advisers, brokers make recommendations about specific investments like stocks, bonds, or mutual funds. While taking into account your overall financial goals, brokers generally do not give you a detailed financial plan.

Brokers are generally paid commissions when you buy or sell securities through them. If they sell you mutual funds make sure to ask questions about what fees are included in the mutual fund purchase.

Brokerages vary widely in the quantity and quality of the services they provide for customers. Some have large research staffs, large national operations, and are prepared to service almost any kind of financial transaction you may need. Others are small and may specialize in promoting investments in unproven and very risky companies. And there’s everything else in between.

A discount brokerage charges lower fees and commissions for its services than what you’d pay at a full-service brokerage.

But generally you have to research and choose investments by yourself. A full-service brokerage costs more, but the higher fees and commissions pay for a broker’s investment advice based on that firm’s research.

The best way to choose an investment professional is to start by asking your friends and colleagues who they recommend.

Try to get several recommendations, and then meet with potential advisers face-to-face. Make sure you get along. Make sure you understand each other. After all, it’s your money.

OPENING A BROKERAGE ACCOUNT

When you open a brokerage account, whether in person or online, you will typically be asked to sign a new account agreement.

You should carefully review all the information in this agreement because it determines your legal rights regarding your account.

Do not sign the new account agreement unless you thoroughly understand it and agree with the terms and conditions it imposes on you. Do not rely on statements about your account that are not in this agreement. Ask for a copy of any account documentation prepared for you by your broker.

The broker should ask you about your investment goals and personal financial situation, including your income, net worth, investment experience, and how much risk you are willing to take on. Be honest. The broker relies on this information to determine which investments will best meet your investment goals and tolerance for risk. If a broker tries to sell you an investment before asking you these questions, that’s a very bad sign. It signals that the broker has a greater interest in earning a commission than recommending an investment to you that meets your needs. The new account agreement requires that you make three critical decisions:

1. Who will make the final decisions about what you buy and sell in your account?

You will have the final say on investment decisions unless you give “discretionary authority” to your broker. Discretionary authority allows your broker to invest your money without con-sulting you about the price, the type of security, the amount, and when to buy or sell. Do not give discretionary authority to your broker without seriously considering the risks involved in turning control over your money to another person.

2. How will you pay for your investments?

Most investors maintain a “cash” account that requires payment in full for each security purchase. But if you open a “margin” account, you can buy securities by borrowing money from your broker for a portion of the purchase price. Be aware of the risks involved with buying stocks on margin. Beginning investors generally should not get started with a margin account. Make sure you understand how a margin account works, and what happens in the worst case scenario before you agree to buy on margin. Unlike other loans, like for a car or a home, that allow you to pay back a fixed amount every month, when you buy stocks on margin you can be faced with paying back the entire margin loan all at once if the price of the stock drops suddenly and dramatically. The firm has the authority to immediately sell any security in your account, without notice to you, to cover any shortfall resulting from a decline in the value of your securities. You may owe a substantial amount of money even after your securities are sold. The margin account agreement generally provides that the securities in your margin account may be lent out by the brokerage firm at any time without notice or compensation to you.

3. How much risk should you assume?

In a new account agreement, you must specify your overall investment objective in terms of risk. Categories of risk may have labels such as “income,” “growth,” or “aggressive growth.”

Be certain that you fully understand the distinctions among these terms, and be certain that the risk level you choose accurately reflects your age, experience and investment goals. Be sure that the investment products recommended to you reflect the category of risk you have selected.

When opening a new account, the brokerage firm may ask you to sign a legally binding contract to use the arbitration process to settle any future dispute between you and the firm or your sales representative. Signing this agreement means that you give up the right to sue your sales representative and firm in court.