How Can I Protect Myself?

ASK QUESTIONS!

You can never ask a dumb question about your investments and the people who help you choose them, especially when it comes to how much you will be paying for any investment, both in upfront costs and ongoing management fees.

Here are some questions you should ask when choosing an investment professional or someone to help you:

-

What training and experience do you have? How long have you been in business?

-

What is your investment philosophy? Do you take a lot of risks or are you more concerned about the safety of my money?

-

Describe your typical client. Can you provide me with references, the names of people who have invested with you for a long time?

-

How do you get paid? By commission? Based on a percentage of assets you manage? Another method? Do you get paid more for selling your own firm’s products?

-

How much will it cost me in total to do business with you?

Your investment professional should understand your investment goals, whether you’re saving to buy a home, paying for your children’s education, or enjoying a comfortable retirement.

Your investment professional should also understand your tolerance for risk. That is, how much money can you afford to lose if the value of one of your investments declines? An investment professional has a duty to make sure that he or she only recommends investments that are suitable for you.

That is, that the investment makes sense for you based on your other securities holdings, your financial situation, your means, and any other information that your investment professional thinks is important. The best investment professional is one who fully understands your objectives and matches investment recommendations to your goals. You’ll want someone you can understand, because your investment professional should teach you about investing and the investment products.

How Should I Monitor My Investments?

Investing makes it possible for your money to work for you.

In a sense, your money has become your employee, and that makes you the boss. You’ll want to keep a close watch on how your employee, your money, is doing.

Some people like to look at the stock quotations every day to see how their investments have done. That’s probably too often. You may get too caught up in the ups and downs of the “trading” value of your investment, and sell when its value goes down temporarily—even though the performance of the company is still stellar. Remember, you’re in for the long haul.

Some people prefer to see how they’re doing once a year.

That’s probably not often enough. What’s best for you will most likely be somewhere in between, based on your goals and your investments.

But it’s not enough to simply check an investment’s performance. You should compare that performance against an index of similar investments over the same period of time to see if you are getting the proper returns for the amount of risk that you are assuming. You should also compare the fees and commissions that you’re paying to what other investment professionals charge.

While you should monitor performance regularly, you should pay close attention every time you send your money somewhere else to work.

Every time you buy or sell an investment you will receive a confirmation slip from your broker. Make sure each trade was completed according to your instructions. Make sure the buying or selling price was what your broker quoted. And make sure the commissions or fees are what your broker said they would be.

Watch out for unauthorized trades in your account. If you get a confirmation slip for a transaction that you didn’t approve beforehand, call your broker. It may have been a mistake. If your broker refuses to correct it, put your complaint in writing and send it to the firm’s compliance officer. Serious complaints should always be made in writing.

Remember, too, that if you rely on your investment professional for advice, he or she has an obligation to recommend investments that match your investment goals and tolerance for risk. Your investment professional should not be recommending trades simply to generate commissions. That’s called “churning,” and it’s illegal.

How Can I Avoid Problems?

Choosing someone to help you with your investments is one of the most important investment decisions you will ever make.

While most investment professionals are honest and hardworking, you must watch out for those few unscrupulous individuals. They can make your life’s savings disappear in an instant.

Securities regulators and law enforcement officials can and do catch these criminals. But putting them in jail doesn’t always get your money back. Too often, the money is gone. The good news is you can avoid potential problems by protecting yourself.

Let’s say you’ve already met with several investment professionals based on recommendations from friends and others you trust, and you’ve found someone who clearly understands your investment objectives. Before you hire this person, you still have more homework.

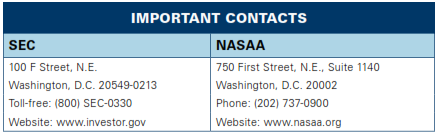

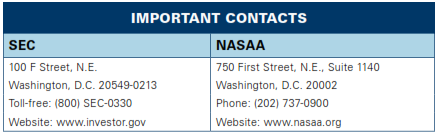

Make sure the investment professional and her firm are registered with the SEC and licensed to do business in your state.

And find out from your state’s securities regulator whether the investment professional or her firm have ever been disciplined, or whether they have any complaints against them.

You’ll find contact information for securities regulators in the U.S. by visiting the website of the North American Securities Administrators Association (NASAA) at www.nasaa.org or by calling (202) 737-0900.

You should also find out as much as you can about any investments that your investment professional recommends.

First, make sure the investments are registered. Keep in mind, however, the mere fact that a company has registered and files reports with the SEC doesn’t guarantee that the company will be a good investment.

Likewise, the fact that a company hasn’t registered and doesn’t file reports with the SEC doesn’t mean the company is a fraud. Still, you may be asking for serious losses if, for instance, you invest in a small, thinly traded company that isn’t widely known solely on the basis of what you may have read online. One simple phone call to your state regulator could prevent you from squandering your money on a scam.

Be wary of promises of quick profits, offers to share “inside information,” and pressure to invest before you have an opportunity to investigate. These are all warning signs of fraud. Ask your investment professional for written materials and prospectuses, and read them before you invest. If you have questions, now is the time to ask.

-

How will the investment make money?

-

How is this investment consistent with my investment goals?

-

What must happen for the investment to increase in value?

-

What are the risks?

-

Where can I get more information?

Finally, it’s always a good idea to write down everything your investment professional tells you. Accurate notes will come in handy if ever there’s a problem.

Some investments make money. Others lose money. That’s natural, and that’s why you need a diversified portfolio to minimize your risk. But if you lose money because you’ve been cheated, that’s not natural, that’s a problem.

Sometimes all it takes is a simple phone call to your investment professional to resolve a problem. Maybe there was an honest mistake that can be corrected. If talking to the investment professional doesn’t resolve the problem, talk to the firm’s manager, and write a letter to confirm your conversation. If that doesn’t lead to a resolution, you may have to initiate private legal action. You may need to take action quickly because legal time limits for doing so vary. Your local bar association can provide referrals for attorneys who specialize in securities law.

At the same time, call or write to us and let us know what the problem was. Investor complaints are very important to the SEC. You may think you’re the only one experiencing a problem, but typically, you’re not alone. Sometimes it takes only one investor’s complaint to trigger an investigation that exposes a bad broker or an illegal scheme. Complaints can be filed online with us by going to www.sec.gov/complaint.shtml.