Lesson II Demand Analysis

Reading Objective:

At the end of reading this chapter the reader will understand that demand analysis is an important part of economic analysis. The manufacturers produce and supply goods to meet demand. When the demand and supply is equal the economic conditions of the country is in equilibrium position. This demand and supply are market forces which gives dynamism to the economic conditions of the country. The demand is not always static. The changes in demand or elasticity of demand gives room for the managerial decision making like what to produce, how much to produce, when to produce, and where to distribute the products.

Lesson Outline:

-

Law of demand

-

Determinants of demand

-

Types of demand

-

Exceptional demand curve

-

Elasticity of demand

-

Price elasticity

-

Income elasticity

-

Cross elasticity

-

Demand forecasting

-

Review questions

Introduction:

The concepts of demand and supply are useful for explaining what is happening in the market place. Every market transaction involves an exchange and many exchanges are undertaken in a single day. The circular flow of economic activity explains clearly that every day there are a number of exchanges taking place among the four major sectors mentioned earlier.

A market is a place where we buy and sell goods and services. A buyer demands goods and services from the market and the sellers supply the goods in the market. In economics, demand is “the quantity of goods and services that will be bought for a given price over a period of time”. For example if 10 Lakhs laptops are purchased in India during a year at an average price of Rs.25000/- then we can say that the annual demand for laptops is 10 Lakhs units at the rate of 25,000/-.

This chapter describes demand and supply which is the driving force behind a market economy. This is one of the most important managerial factors because it assists the managers in predicting changes in production and input prices. The manager can take better decisions regarding the kind of product to be produced, the quantity, the cost of the product and its selling price. Let us understand the concept of demand and its importance in decision making.

Demand: Demand means the ability and willingness to buy a specific quantity of a commodity at the prevailing price in a given period of time. Therefore, demand for a commodity implies the desire to acquire it, willingness and the ability to pay for it.

Law of demand: The quantity of a commodity demanded in a given time period increases as its price falls, ceteris paribus. (I.e. other things remaining constant)

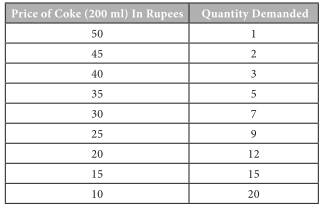

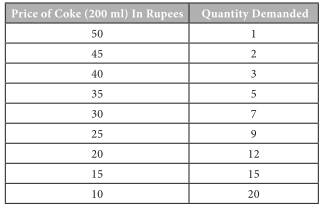

Demand schedule: a table showing the quantities of a good that a consumer is willing and able to buy at the prevailing price in a given time period. (Table – 1) 14

Table – 1: The Demand Schedule For Coke Price of Coke

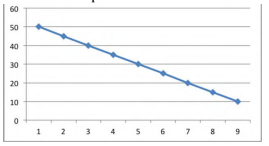

Demand Curve:

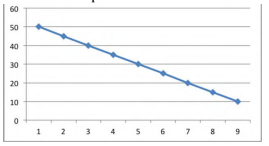

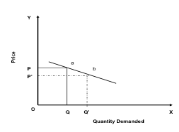

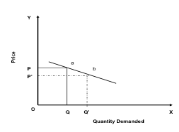

A curve indicating the total quantity of a product that all consumers are willing and able to purchase at the prevailing price level, holding the prices of related goods, income and other variables as constant.

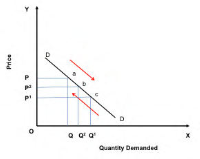

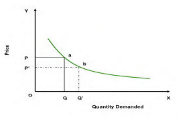

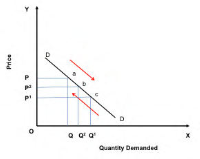

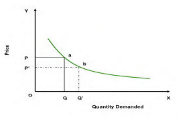

A demand curve is a graphical representation of a demand schedule. The price is quoted in the ‘Y’ axis and the quantity demanded over time at different price levels is quoted in ‘X’ axis. Each point on the curve refers to a specific quantity that will be demanded at a given price. If for example the price of a 200 ml coke is Rs. 10, this curve tells us that the consumer (the students in a class of 50) would purchase 20 units. When the price rises to Rs. 50 there was only one student would buy it. The demand curve, (DD) is downward sloping curve from left to right showing that as price falls, quantity demanded rises. This inverse relationship between price and quantity is called as the law of demand. When price changes, there is said to be a movement along the curve from point A to B.

Graph – Demand Curve

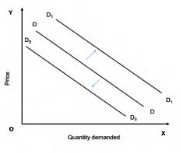

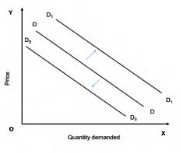

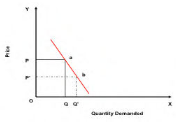

Shifts in Demand:

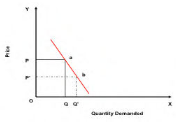

Shift of the demand curve occurs when the determinants of demand change. When tastes and preferences and incomes are altered, the basic relationship between price and quantity demanded changes (shifts). This shifts the entire demand curve upward (rightward) and is called as increase in demand because more of that commodity is demanded at that price. The downward shift (leftward) is called as decrease in demand. The new demand curves D 1 D 1 and D 0 D 0 can be seen in the Graph below.

Graph – Shift In Demand Curve

Therefore we understand that a shift in a demand curve may happen due to the changes in the variables other than price. The movement along a demand curve takes place (extension or contraction) due to price rise or fall.

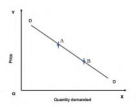

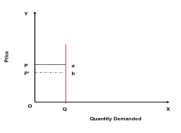

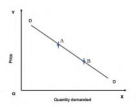

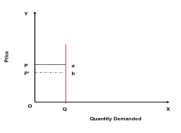

Extension And Contraction Of Demand Curve:

When with a fall in price, more of a commodity is bought , then there is an extension of the demand curve. When lesser quantity is demanded with a rise in price, there is a contraction of demand.

Graph –Extension And Contraction In Demand Curve

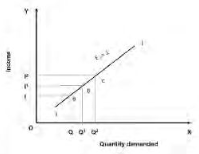

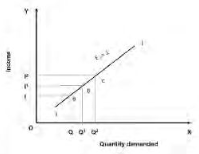

From the above graph we can understand that an increase in prices result in the contraction of demand. If the price increases from P2 to P then the demand for the commodity fall from OQ2 to OQ. Therefore the demand curve DD contracts from ‘b’ to ‘a’ on the other hand when there is a fall in price, it results in the extension of demand. Let us assume that the price falls from P2 to P1 then the quantity demanded OQ2 increases to OQ1 and the demand curve extends from point ‘b’ to ‘c’

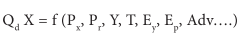

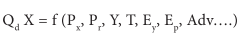

Demand function is a function that describe how much of a commodity will be purchased at the prevailing prices of that commodity and related commodities, alternative income levels, and alternative values of other variables affecting demand.

Price is not the only factor which determines the level of demand for a good. Other important factor is income. The rise in income will lead to an increase in demand for a normal commodity. A few goods are named as inferior goods for which the demand will fall, when income rises. Another important factor which influences the demand for a good is the price of other goods. Other factors which affect the demand for a good apart from the above mentioned factors are:

Changes in Population

Changes in Fashion

Changes in Taste

Changes in Advertising

A change in demand occurs when one or more of the determinants of demand change and it is expressed in the following equation.

Where,

The above mentioned demand function expresses the relationship between the demand and other factors. The quantity demanded of commodity X varies according to the price of commodity (P x), income (Y), the price of a related commodity (P r), taste and preference of the consumers (T), expected income (E y) and advertisement cost(Adv) spent by the organization.

Determinants Of Demand:

There are various factors affecting the demand for a commodity.

They are:

-

Price of the good: The price of a commodity is an important determinant of demand. Price and demand are inversely related. Higher the price less is the demand and vice versa.

-

Price of related goods: The price of related goods like substitutes and complementary goods also affect the demand. In the case of substitutes, rise in price of one commodity lead to increase in demand for its substitute. In the case of complementary goods, fall in the price of one commodity lead to rise in demand for both the goods.

-

Consumer’s Income: This is directly related to demand. A change in the income of the consumer significantly influences his demand for most commodities. If the disposable income increases, demand will be more.

-

Taste, preference, fashions and habits: These are very effective factors affecting demand for a commodity. When there is a change in taste, habits or preferences of the consumer, his demand will change. Fashions and customs in society determine many of our demands.

-

Population: If the size of the population is more, demand for goods will be more . The market demand for a commodity substantially changes when there is change in the total population.

-

Money Circulation: More the money in circulation, higher the demand and vice versa.

-

Value of money: The value of money determines the demand for a commodity in the market. When there is a rise or fall in the value of money there may be changes in the relative prices of different goods and their demand.

-

Weather Condition: Weather is also an important factor that determines the demand for certain goods.

-

Advertisement and Salesmanship: If the advertisement is very attractive for a commodity, demand will be more. Similarly if the salesmanship and publicity is effective then the demand for the commodity will be more.

-

Consumer’s future price expectation: If the consumers expect that there will be a rise in prices in future, he may buy more at the present price and so his demand increases.

-

Government policy (taxation): High taxes will increase the price and reduce demand, while low taxes will reduce the price and extend the demand.

-

Credit facilities: Depending on the availability of credit facilities the demand for commodities will change. More the facilities higher the demand.

-

Multiplicity of uses of goods: if the commodity has multiple uses then the demand will be more than if the commodity is used for a single purpose.

Demand Distinctions: Types Of Demand

Demand may be defined as the quantity of goods or services desired by an individual, backed by the ability and willingness to pay.

Types Of Demand:

-

Direct and indirect demand: (or) Producers’ goods and consumers’ goods: demand for goods that are directly used for consumption by the ultimate consumer is known as direct demand (example: Demand for T shirts). On the other hand demand for goods that are used by producers for producing goods and services. (example: Demand for cotton by a textile mill)

-

Derived demand and autonomous demand: when a produce derives its usage from the use of some primary product it is known as derived demand. (example: demand for tyres derived from demand for car) Autonomous demand is the demand for a product that can be independently used. (example: demand for a washing machine)

-

Durable and non durable goods demand: durable goods are those that can be used more than once, over a period of time (example: Microwave oven) Non durable goods can be used only once (example: Band-aid)

-

Firm and industry demand: firm demand is the demand for the product of a particular firm. (example: Dove soap) The demand for the product of a particular industry is industry demand (example: demand for steel in India )

-

Total market and market segment demand: a particular segment of the markets demand is called as segment demand (example: demand for laptops by engineering students) the sum total of the demand for laptops by various segments in India is the total market demand. (example: demand for laptops in India)

-

Short run and long run demand: short run demand refers to demand with its immediate reaction to price changes and income fluctuations. Long run demand is that which will ultimately exist as a result of the changes in pricing, promotion or product improvement after market adjustment with sufficient time.

-

Joint demand and Composite demand: when two goods are demanded in conjunction with one another at the same time to satisfy a single want, it is called as joint or complementary demand. (example: demand for petrol and two wheelers) A composite demand is one in which a good is wanted for several different uses. ( example: demand for iron rods for various purposes)

-

Price demand, income demand and cross demand: demand for commodities by the consumers at alternative prices are called as price demand. Quantity demanded by the consumers at alternative levels of income is income demand. Cross demand refers to the quantity demanded of commodity ‘X’ at a price of a related commodity ‘Y’ which may be a substitute or complementary to X.

Price Demand: The ability and willingness to buy specific quantities of a good at the prevailing price in a given time period.

Income Demand: The ability and willingness to buy a commodity at the available income in a given period of time.

Market Demand: The total quantity of a good or service that people are willing and able to buy at prevailing prices in a given time period. It is the sum of individual demands.

Cross Demand: The ability and willingness to buy a commodity or service at the prevailing price of the related commodity i.e. substitutes or complementary products. For example, people buy more of wheat when the price of rice increases.

Exceptional demand curve: The demand curve slopes from left to right upward if despite the increase in price of the commodity, people tend to buy more due to reasons like fear of shortages or it may be an absolutely essential good.

The law of demand does not apply in every case and situation. The circumstances when the law of demand becomes ineffective are known as exceptions of the law. Some of these important exceptions are as under.

1. Giffen Goods:

Some special varieties of inferior goods are termed as Giffen goods. Cheaper varieties millets like bajra, cheaper vegetables like potato etc come under this category. Sir Robert Giffen of Ireland first observed that people used to spend more of their income on inferior goods like potato and less of their income on meat. After purchasing potato the staple food, they did not have staple food potato surplus to buy meat. So the rise in price of potato compelled people to buy more potato and thus raised the demand for potato. This is against the law of demand. This is also known as Giffen paradox.

2. Conspicuous Consumption / Veblen Effect:

This exception to the law of demand is associated with the doctrine propounded by Thorsten Veblen. A few goods like diamonds etc are purchased by the rich and wealthy sections of society. The prices of these goods are so high that they are beyond the reach of the common man. The higher the price of the diamond, the higher its prestige value. So when price of these goods falls, the consumers think that the prestige value of these goods comes down. So quantity demanded of these goods falls with fall in their price. So the law of demand does not hold good here.

3. Conspicuous Necessities:

Certain things become the necessities of modern life. So we have to purchase them despite their high price. The demand for T.V. sets, automobiles and refrigerators etc. has not gone down in spite of the increase in their price. These things have become the symbol of status. So they are purchased despite their rising price.

4. Ignorance:

A consumer’s ignorance is another factor that at times induces him to purchase more of the commodity at a higher price. This is especially true, when the consumer believes that a high-priced and branded commodity is better in quality than a low-priced one.

5. Emergencies:

During emergencies like war, famine etc, households behave in an abnormal way. Households accentuate scarcities and induce further price rise by making increased purchases even at higher prices because of the apprehension that they may not be available. . On the other hand during depression, , fall in prices is not a sufficient condition for consumers to demand more if they are needed.

6. Future Changes In Prices:

Households also act as speculators. When the prices are rising households tend to purchase large quantities of the commodity out of the apprehension that prices may still go up. When prices are expected to fall further, they wait to buy goods in future at still lower prices. So quantity demanded falls when prices are falling.

7. Change In Fashion:

A change in fashion and tastes affects the market for a commodity. When a digital camera replaces a normal manual camera, no amount of reduction in the price of the latter is sufficient to clear the stocks. Digital cameras on the other hand, will have more customers even though its price may be going up. The law of demand becomes ineffective.

8. Demonstration Effect:

It refers to a tendency of low income groups to imitate the consumption pattern of high income groups. They will buy a commodity to imitate the consumption of their neighbors even if they do not have the purchasing power.

9. Snob Effect:

Some buyers have a desire to own unusual or unique products to show that they are different from others. In this situation even when the price rises the demand for the commodity will be more.

10. Speculative Goods/ Outdated Goods/ Seasonal Goods:

Speculative goods such as shares do not follow the law of demand. Whenever the prices rise, the traders expect the prices to rise further so they buy more.

Goods that go out of use due to advancement in the underlying technology are called outdated goods. The demand for such goods does not rise even with fall in prices

11. Seasonal Goods:

Goods which are not used during the off-season (seasonal goods) will also be subject to similar demand behaviour.

12. Goods In Short Supply:

Goods that are available in limited quantity or whose future availability is uncertain also violate the law of demand.

Elasticity Of Demand

In economics, the term elasticity means a proportionate (percentage) change in one variable relative to a proportionate (percentage) change in another variable. The quantity demanded of a good is affected by changes in the price of the good, changes in price of other goods, changes in income and changes in other factors. Elasticity is a measure of just how much of the quantity demanded will be affected due to a change in price or income.

Elasticity of Demand is a technical term used by economists to describe the degree of responsiveness of the demand for a commodity due to a fall in its price. A fall in price leads to an increase in quantity demanded and vice versa.

The elasticity of demand may be as follows:

-

Price Elasticity

-

Income Elasticity and

-

Cross Elasticity

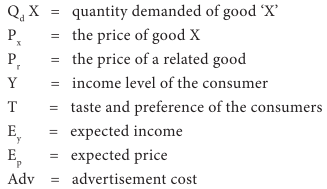

Price Elasticity

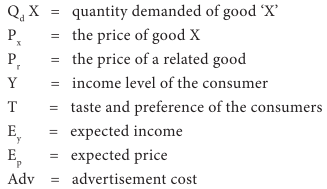

The response of the consumers to a change in the price of a commodity is measured by the price elasticity of the commodity demand. The responsiveness of changes in quantity demanded due to changes in price is referred to as price elasticity of demand. The price elasticity of demand is measured by dividing the percentage change in quantity demanded by the percentage change in price.

For example:

Quantity demanded is 20 units at a price of Rs.500. When there is a fall in price to Rs. 400 it results in a rise in demand to 32 units. Therefore the change in quantity demanded is12 units resulting from the change in price of Rs.100.

The Price Elasticity of Demand is = 500 / 20 x 12/100 = 3

The Determinants Of Price Elasticity Of Demand

The exact value of price elasticity for a commodity is determined by a wide variety of factors. The two factors considered by economists are the availability of substitutes and time. The better the substitutes for a product, the higher the price elasticity of demand.. The longer the period of time, the more the price elasticity of demand for that product. The price elasticity of necessary goods will have lower elasticity than luxuries.

The elasticity of demand depends on the following factors:

-

Nature of the commodity: The demand for necessities is inelastic because the demand does not change much with a change in price. But the demand for luxuries is elastic in nature.

-

Extent of use: A commodity having a variety of uses has a comparatively elastic demand.

-

Range of substitutes: The commodity which has more number of substitutes has relatively elastic demand. A commodity with fewer substitutes has relatively inelastic demand.

-

Income level: People with high incomes are less affected by price changes than people with low incomes.

-

Proportion of income spent on the commodity: When a small part of income is spent on the commodity, the price change does not affect the demand therefore the demand is inelastic in nature.

-

Urgency of demand / postponement of purchase: The demand for certain commodities are highly inelastic because you cannot postpone its purchase. For example medicines for any sickness should be purchased and consumed immediately.

-

Durability of a commodity: If the commodity is durable then it is used it for a long period. Therefore elasticity of demand is high. Price changes highly influences the demand for durables in the market.

-

Purchase frequency of a product/ recurrence of demand: The demand for frequently purchased goods are highly elastic than rarely purchased goods.

-

Time: In the short run demand will be less elastic but in the long run the demand for commodities are more elastic.

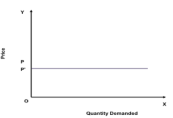

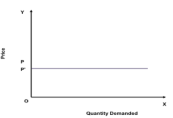

The following are the possible combination of changes in Price and Quantity demanded. The slope of each combination is depicted in the following graphs.

1.Relatively Elastic Demand (E d >1) a small percentage change in price leading to a larger change in Quantity demanded.

2.Perfectly Elastic Demand (E d = ∞) a small change in price will change the quantity demanded by an infinite amount.

3.Relatively Inelastic Demand (E d < 1) a change in price leads to a smaller percentage change in quantity demanded.

4.Perfectly Inelastic Demand (E d = 0) the quantity demanded does not change regardless of the percentage change in price.

5.Unit Elasticity of Demand (E d =1) the percentage change in quantity demanded is the same as the percentage change in price that caused it.

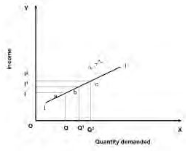

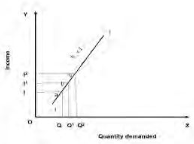

Income Elasticity

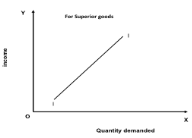

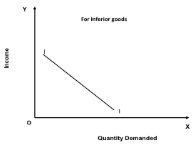

Income elasticity of demand measures the responsiveness of quantity demanded to a change in income. It is measured by dividing the percentage change in quantity demanded by the percentage change in income. If the demand for a commodity increases by 20% when income increases by 10% then the income elasticity of that commodity is said to be positive and relatively high. If the demand for food were unchanged when income increases, the income elasticity would be zero. A fall in demand for a commodity when income rises results in a negative income elasticity of demand.

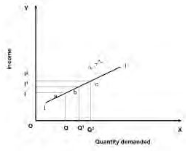

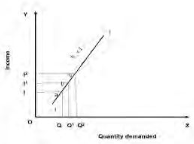

The following are the various types of income elasticity:

Zero Income Elasticity: The increase in income of the individual does not make any difference in the demand for that commodity. ( Ei = 0)

Negative Income Elasticity: The increase in the income of consumers leads to less purchase of those goods. ( Ei < 0).

Unitary Income Elasticity: The change in income leads to the same percentage of change in the demand for the good. ( Ei = 1).

Income Elasticity is Greater than 1: The change in income increases the demand for that commodity more than the change in the income. ( Ei > 1).

Income Elasticity is Less than 1: The change in income increases the demand for the commodity but at a lesser percentage than the change in the Income. ( Ei < 1).

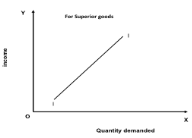

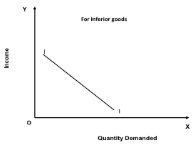

The positive income elasticity of demand can be classified as unity, more than unity and less than unity. We can understand from the above graphs that the product which is highly elastic in nature will grow faster when the economy is expanding. The performance of firms having low income elasticity on the other hand will be less affected by the economic changes of the country.

With a rise in consumer’s income, the demand increases for superior goods and decreases for inferior goods and vice versa. The income elasticity of demand is positive for superior goods or normal goods and negative for inferior goods since a person may shift from inferior to superior goods with a rise in income.

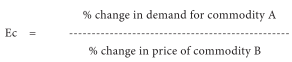

Cross Elasticiy

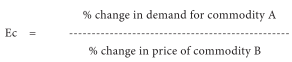

The quantity demanded of a particular commodity varies according to the price of other commodities. Cross elasticity measures the responsiveness of the quantity demanded of a commodity due to changes in the price of another commodity. For example the demand for tea increases when the price of coffee goes up. Here the cross elasticity of demand for tea is high. If two goods are substitutes then they will have a positive cross elasticity of demand. In other words if two goods are complementary to each other then negative income elasticity may arise.

The responsiveness of the quantity of one commodity demanded to a change in the price of another good is calculated with the following formula.

If two commodities are unrelated goods, the increase in the price of one good does not result in any change in the demand for the other goods. For example the price fall in Tata salt does not make any change in the demand for Tata Nano.

Significance Of Elasticity Of Demand:

The concept of elasticity is useful for the managers for the following decision making activities

-

In production i.e. in deciding the quantity of goods to be produced

-

Price fixation i.e. in fixing the prices not only on the cost basis but also on the basis of prices of related goods.

-

In distribution i.e. to decide as to where, when, and how much etc.

-

In international trade i.e. what to export, where to export

-

In foreign exchange

-

For nationalizing an industry

-

In public finance

Demand Forecasting

All organizations operate in an atmosphere of uncertainty but decisions must be made today that affect the future of the organization. There are various ways of making forecasts that rely on logical methods of manipulating the data that have been generated by historical events. A forecast is a prediction or estimation of a future situation, under given conditions. Demand forecast will help the manager to take the following decisions effectively.