STEP 4

Emergency Savings

Emergency savings is like insurance: painstaking and boring, but outright necessary. Can you imagine driving without car insurance?

No isn’t it?

Likewise; you should not try to live life without emergency savings.

An Emergency fund is a certain amount of money available at a short notice to meet the unexpected expenses like;

- Loss of job

- Medical Emergencies to parents or relatives back home

- Emergency travel / Unexpected Travel

- Medical or Dental emergency if you do not have an insurance

- Breakdown of Car, electronics or appliances at home

Emergency savings should be earmarked separately and kept in a savings account or an esaver account, accessible at short notice.

For this purpose money; in your current account kept aside for your rent cheque, school fees or for any other purpose does not count.

A part of your emergency funds can be invested in National Bonds, although it does not offer a good return, the money invested is safe and can be liquidated within 24 hours.

It is highly recommended to have 3 6 months of income as emergency savings, and more if you have small children in your family.

If you are finding more month at the end of money regularly, saving for an emergency might seem as a challenge; trust me, it can be achieved with a little effort and by following the 5 steps listed below;

Step One: Start Small It is certainly desirable to have atleast 3 months of income as emergency savings, but having some is definitely better than having none!!!

Set a small goal of AED 5000 or AED 10,000 depending on your income. Take action today, start an E saver account with your current bank, you can do it online in less than 5 minutes.

Transfer a minimum of AED 100 or more if you can afford immediately into your esaver account.

Step Two: Set a Date Once you have set the desired emergency savings; set a target date to achieve it. Depending on your cashflows, expenses and income it can be between 3 6 months, and not more.

Step Three: Sacrifice Till you achieve your emergency savings goal, reduce or if possible avoid expenses which you can live without, like eating out, or coffee at Costa or Starbucks.

If you smoke reduce or stop smoking it is not only helps you save money, it is also good for your health.

Do not buy any gadgets, appliances or any luxury on cash or on credit card till your desired emergency savings is achieved.

Identify the one big expense you can avoid in the next three months, which can help you reach closer to your goal and avoid it.

For Eg : If you are planning for a vacation or travel within the next 3 months, revisit the decision to understand if you really need to travel and if you can postpone it to save money for your emergency.

If yes then divert the funds you were planning to spend for the travel towards emergency funds.

I know that this is difficult, but one has to make small sacrifices to achieve greater things in life.

Step Four: Save As indicated earlier , open a Savings Account or E-saver account, or you can also save with national bonds regularly with fixed monthly payments, Mashreq Millionaire Certificates or any other bond you can liquidate at short notice.

Setup standing instructions from your current account to the savings, Esaver account, and also you can set up standing instructions with National Bonds for saving a fixed regular amount ever month.

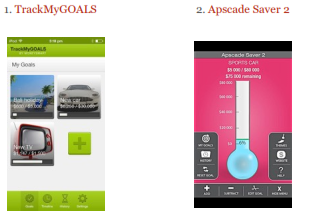

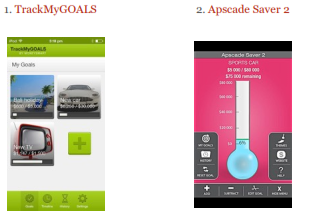

Step Five: Monitor Mere setting an emergency fund goal may not always suffice, ii would certainly help if a course of action and a facility to track progress is setup.

You can use some good Smart phone applications like;

These applications help you visualize your emergency savings making it more interesting to pursue and achieve it.

When you see savings grow, you are motivated to do more, hence you will achieve your goal faster.