SECTION 4

Home and Contents Insurance is easy to understand, easy to avail and is very affordable.

Inspite of which most of us comfortably ignored it, until the recent Fire in Torch Tower in Dubai Marina and in Tamweel towers, and the very recent file accident at Address hotel on the new year’s eve.

Every body would talk about it for 2 to 3 days and slowly it would be forgotten, assuming that nothing will happen to us or that the possessions we have are not significant enough to be insured.

Many people believe that Home and contents insurance is only for the rich, who have big assets and they also believe that it costs a lot to insure their home and contents…

Contrary to the popular belief, Home and Contents Insurance is useful for every individual, whether a home owner, tenant or a landlord. You will be surprised to know that it is very affordable, in-fact contents insurance may cost you less than One Dirham a day…

What is Home and Contents Insurance?

For most people in UAE, their home is their biggest asset, not to mention all the valuable items inside. Home and Contents insurance covers a loss or damage to your home and or all the valuable items within your home including Furniture, Fittings, Electronics, Electricals, Art, Jewellery, wardrobe and other priceless valuables.

What does it Cover?

Building: Accidental Damage to the Building due to Fire, explosion, earthquake, smoke, storm, theft, damage by domestic animals, riot and so on.

Also including domestic garages, swimming pools, terraces, patios, drives, footpaths, wall fences, gates, permanent fixtures and fittings.

Home owners liability towards third party like tenant, building association etc… Alternative accommodation or loss of rent.

Contents: Accidental loss or damage to contents due to fire, water leakage, theft etc.…

Also covers improvements to the property made by the tenant. Tenant Liability towards landlord Third Party Liability

Personal Belongings: World wide Coverage to personal belongings like Jewelry, Watches, Laptop and other valuable items against following risks;

- Accidental contents damage

- Malicious damage

- Theft or attempted theft

- Accidental breakage

- Accidental loss

Before you buy Contents and Personal Belongings Insurance, take an inventory of your belongings.

An easy way to conduct a home inventory is to walk through your house or apartment with a video camera, while giving a brief description of the things that are the most valuable—like your big-screen TV, computer, antique furniture, major appliances and other pricey belongings.

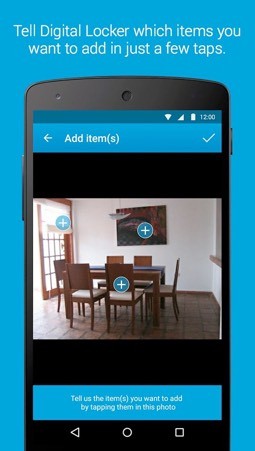

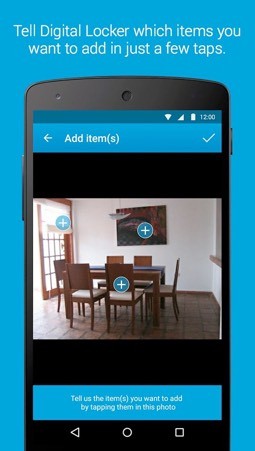

You can also use the Allstate Digital Locker Smart Phone or Web application, to catalog the items you own. Once you have the list, it will be a lot easier for you to figure out how much coverage you need. And, it may help if you ever need to file a claim.

The next step is to decide, how much you would want each content to be insured for?

You can either calculate the Actual Cash Value of the asset (Current Value) or the replacement cost of the asset.

For eg : If you bought a flat screen TV, 2 years back for AED 5000/and the current cash value of that TV may be around AED 2,000 or less, while the cost of replacing with a similar TV might still be around AED 5,000..

It is up to you to decide which value you would want to choose for insuring your assets and arrive at a total value of the assets to be insured.

Contact your financial advisor, to help you decide and avail the most suitable solution for you.

With Home and Contents Insurance you can afford to relax, knowing that you are covered in the event of loss or damage to your home, contents and or personal belongings.

What about you?

Do you have Home and Contents Insurance? if not have you thought what will happen if your home was destroyed in a fire?