STEP 7

Eliminate Debt

Debt is like cancer eating away your hard earned money and keeping you away from financial goals.

If you have played the cashflow 101 game recommended in the earlier chapter you would have by now realized the importance of living a debt free life.

In reality almost all of us want to be debt free and we also make resolutions to eliminate debt as early as possible, but our consumerism prevails over common sense and keeps us chained to debt.

Step One Emergency Funds

The first step towards debt elimination is to have sufficient emergency funds, without which it will be impossible to clear off debt.

In chapter 5; we discussed in detail about the importance of emergency funds. If you do not have reserve funds the first step would be to set a goal of saving atleast AED 10,000 toward emergency.

You may be thinking that I am crazy to encourage you to save instead of paying of debt. The reason why I am recommending to save first for the emergency is because it will keep you from borrowing further in an emergency situation.

Please bear in mind that attractive hotel, flight and room offers or DSF sale is not emergency and you should not spend your emergency savings on such things.

It is better to keep the emergency savings in a e-saver account, savings account or invested in National bonds.

Once you have saved atleast AED 10,000 for emergency, then you should look at clearing debt. There are 2 major methods of debt clearance and we will discuss about the benefits of each.

Step 2 Stop Further Borrowing

If you keep spending on the card after making the monthly payment, you can never pay it off. It is very important that you start using cash or debit cards for all your purchases and bills. Leave the credit card at home and do not avail a new personal loan or top up your personal loan. Try and resist the temptation, even when you receive a call from a bank for a new loan or top-up of your existing loan.

Step 3 Select a Debt repayment method

The following 2 are the widely used debt elimination methods, you can select the one which you feel is easy to apply and most applicable to your personal situation.

Snowball Method

The snowball method of debt elimination is highly prescribed by Dave Ramsey, the famous personal finance guru. It works on the basis of amount of outstanding balance on each loan.

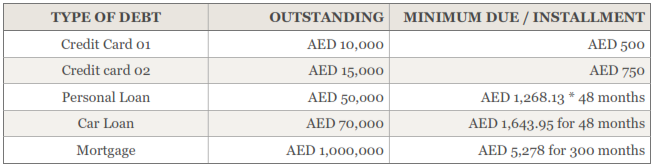

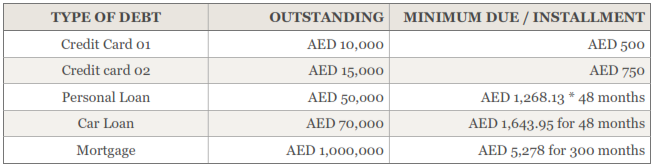

For Example if the outstanding balance on various debts is as follows;

The idea is to start with the lowest amount of Debt. In this case it will be credit card with AED10,000 o/s. The minimum due for all loans / cards except Credit card 01. For this card pay whatever more possible over and above the minimum due.

Even if it is AED 100 it will help. In 23 months you will be able to Pay Off the credit card 01 by not using it further and paying AED 100 more than the minimum due.

When card 01 is closed, then add the AED 600 to the monthly payments of card 02, and now make a monthly payment of AED 1,350/-, and it will take 14 months to pay off the 2nd card.

By this time the outstanding on the personal loan would be AED13,276/-.Banks in UAE do not allow part repayment of personal loans hence you will have to keep aside the excess cashflow of AED 1,350 in a e-saver or savings account for 5 months.

After 5 months the outstanding balance on the personal loan would be AED 7,391/-. AED1,350 * 5 months is AED 6,750. At this point you can pay off the personal loan by paying only AED 641 extra.

By using the same strategy for the car loan; clear it in the next 2 months, ie at the end of month 44. When your car loan is cleared, talk to your mortgage provider to reschedule the term of the mortgage to suit a monthly repayment of AED 9,540/-(600 + 750+1,268 + 1644+5278) .

At the end of month 44 your mortgage outstanding would be AED 905,737/-, with 21 years and 4 months still left to pay.

When you reschedule your mortgage with a monthly repayment of AED 9,540, you can pay it off in 116 months or a little less than 10 years. Saving more than 10 years of installment payments, amounting to AED 754,754/-

This model replicates the rolling of a snow ball from a hill top, at the beginning it starts as a small ball of snow, but as it rolls down it keeps collecting snow from the hill; growing larger and gathering further momentum as it rolls further down.

By the time it reaches the foot of the hill it would have become enormous in size... Click here to use an online snowball debt pay off calculator.

You can also use the following iPhone or android applications to simulate debt pay off using snowball method of debt elimination.

Highest Interest Rate Method

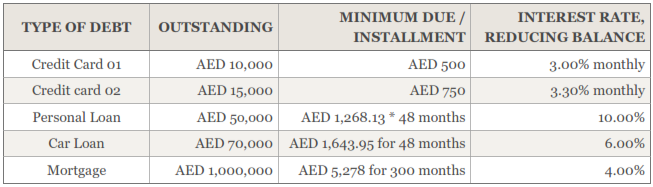

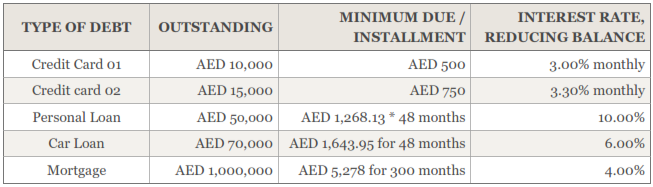

In this method the priority is given to a debt with highest interest rate. Using the same example with a small difference we will try and understand this method.

In this case we will apply the extra payment of AED 100 towards credit card 02, to pay it off completely while making minimum payments on other card and loans.

Once card 02 is paid off, then the excess cashflow to allocated for the repayment of the card with the highest interest rate.

Using the same strategy you can pay off all your liabilities till you are debt free.