STEP 8

Financial Independence

Achieving Financial Independence is the last step and the most rewarding phase.

It is the stage when you have achieved or have enough money saved and invested to achieve your short and long term financial goals.

Most importantly it is when your assets are working for you to supply a regular and dependable stream of passive income.

Now let us see the different sources of passive income.

Rent

Rental income can be derived from a number of sources including:

the letting of property, e.g. houses, flats, apartments, offices and farmland,

the letting of property, e.g. houses, flats, apartments, offices and farmland,

Rent or lease from letting out advertising signs, communication transmitters

Rent or lease from letting out advertising signs, communication transmitters

the granting of sporting rights and royalty

the granting of sporting rights and royalty

Dividend

Income from employment or business has been the major source of income for most people. This is okay to begin with, but over a period of time, you may want to build another source of income, supporting your salary or profits

If all of your income comes from a single source, and if that source gets shut off, then what happens?

You will be happy to learn that you can build an alternate source of income via dividends by owning equity of financially strong and profitable organizations.

Dividend income isn’t just for retirees, although it does work wonders in retirement.

By diligently putting away an extra grand or so each month in good dividend stocks you can create a portfolio of dividend yielding stocks.

Interest / Coupon

Interest can be earned from short term or long term deposits with banks. Banks in UAE do not offer a good rate, but UAE residents can invest in Sukuks, offering yields as high as 6.00%, offered by leading government and private entities.

Annuity / Pension

An Annuity or Pension is a plan offered by an Insurance company that pays out a regular income. Annuities are a popular choice for investors who want to receive a steady income stream in retirement.

How to invest in an Annuity / Pension Plan?

You can invest in an Annuity / Pension plan with a life insurance company either by contributing a regular monthly premium or via a lump sum investment.

Your premiums are determined by your age and desired annuity and the number of year you want to receive pension payments

You can choose to receive payments for the rest of your life, or for a set number of years.

Talk to your financial adviser to understand the most suitable or a combination of asset classes which can fetch you a regular and dependable stream of passive income.

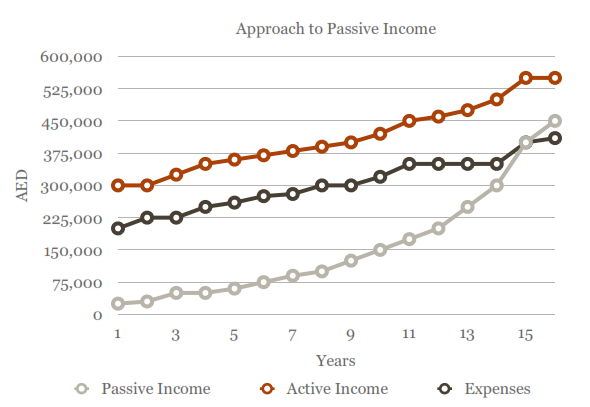

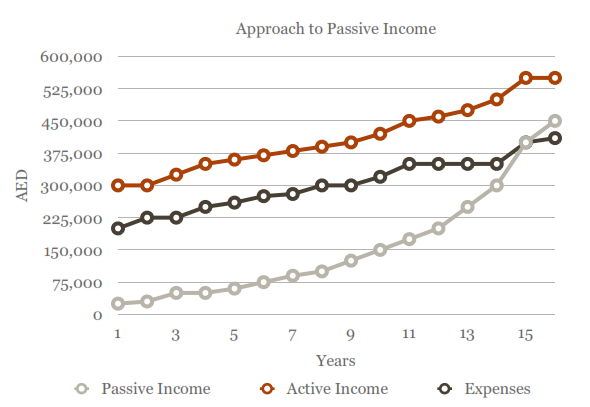

When your passive income from various sources exceeds your expenses, you become financially INDEPENDENT.

Once you have achieved financial independence; active work can be optional giving you more choices to live life the way you want...

Congratulations and Thank you for completing this journey of 8 steps to Financial Independence with me.

I hope and pray that you achieve all your goals to live a happy and fulfilled life.

Best regards,

Damodhar Mata