Chapter five

So how do you go about building credit in the company’s name without putting your personal credit on the line? For starters, if you operate as a sole proprietorship you’ll need to incorporate your business and obtain a Federal Tax Identification number.

As a corporation your company is treated as a separate being with its own tax registration with the IRS and state agencies. It files its own tax returns and it can also create its own credit files completely separate from that of its owners.

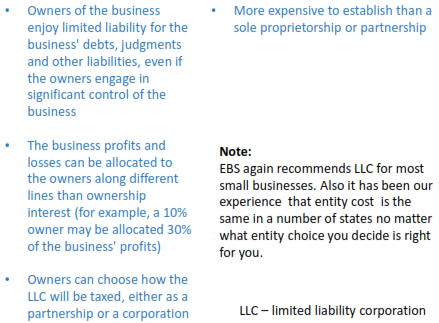

Note: I suggest a LLC for most small businesses this entity has the best flexibility for tax purposes.

Your company’s Tax ID Number or Employer Identification Number is the number that you will use to get registered with the business credit bureaus like Dun and Bradstreet.

You will also be required to furnish this number on corporate credit applications because lenders use this information to conduct a business credit check on your company.

Before you start to apply for credit make sure your corporate records, state filings and required business licenses are all up to date. In addition, get your company’s phone number listed in the 411 directory so a supplier or lender can complete every aspect of its verification during the underwriting process.

After you meet these requirements you will be ready to apply for credit and the best place to start is with suppliers. Many types of suppliers, including major brands, extend lines of credit to businesses like yours giving you the opportunity to finance purchases and conserve your company’s cash.

You can obtain products like office supplies, computers and marketing materials with payment terms ranging from net 30 to net 60 days.

Note: In the beginning you may not want some of the credit you apply for, but stay focus. We will cover this in a up coming chapter.

As a startup I know it can be tempting for you to decide on operating your business as a sole proprietorship and using your personal credit to fund your business simply because it’s one of the easiest structures to create and you already have the cards on hand.

By building business credit for your start up, you can improve your company’s image, protect your personal credit, limit your liability and increase your credit capacity since businesses can obtain 10 to 100 times greater financing then an individual.

Note: it is impossible to build/establish business credit as a sole proprietorship (you are simply doing business as yourself).

Build Business Credit With Bad Personal Credit

If you have bad personal credit and starting the process of building business you will have to make a few small adjustments then follow this guide as usual.

Secured Business Credit Card - An additional form of credit is revolving credit via a business credit card. However, with bad credit you would certainly need to start with a secured business credit card which requires a security deposit of $300 - $500.

Trade Financing – Throughout the preliminary phases of the business credit building process, one type of credit a business owner with personal credit issues can obtain is business-to- business credit, also known as trade financing. While trade credit is a form of short-term financing with usually net 15 to net 30 day terms, it allows a business to establish a positive payment record with suppliers while conserving cash flow.

Build Business Credit With Bad Personal Credit

Fleet Cards – A secured fleet card is another form of credit you can acquire with bad personal credit and generally requires a very small security deposit of $300.

Revenue based financing – There are additional financing programs such as revenue based financing where credit scores in the 550 range can even enable a business to secure financing. This type of financing is based more upon business bank deposits rather than credit scores.

It’s crucial to bear in mind; the trick to developing a creditworthy company is in utilizing a correct mix of credit kinds such as short-term funding, revolving credit, installment loans, leasing, etc.

Note: after completing one are all of these steps then continue to follow guide. For revenue base financing call us at 888-591-4988

Step1

So lets recap on the first steps in the process on building business credit.

- Create a entity

- EIN number

- Business bank account

- Have a business address

- A business phone number (that’s listed)

- Required business licenses are all up to date.

Entity Choices: When building business credit

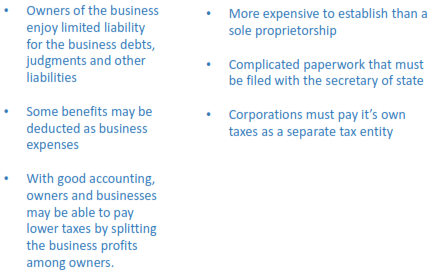

- C - Corporation

- S – Corporation

- LLC

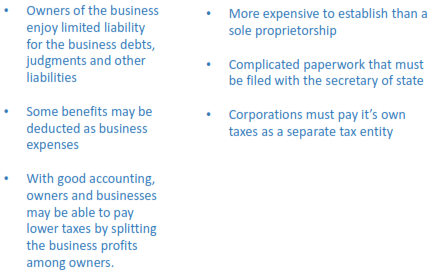

Business Entities, Benefits and Drawbacks C- Corp

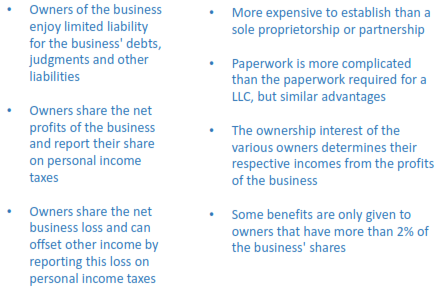

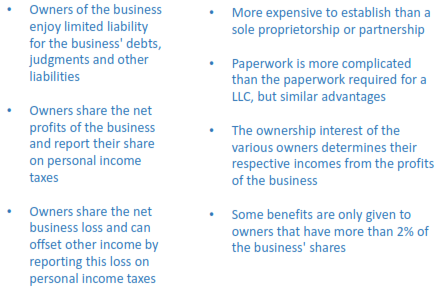

Business Entities, Benefits and Drawbacks S Corp

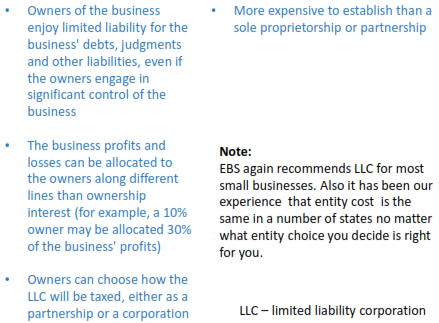

Business Entities, Benefits and Drawbacks LLC

Step 2

Obtain a Federal Tax ID Number

After choosing how you will operate and filing the necessary paperwork, you should obtain a Federal Tax ID Number (Known as an EIN). You will need this number even if you don’t establish a business credit profile so it’s a necessary part of doing business. You can get your EIN number in about 5-10 minutes.

Every business is required to have a business license in order to operate. Be sure to check with your local city hall to find out the steps that’s needed in order to obtain a business license.

You can apply for an EIN online at: www.irs.gov.

If you would like EBS to help with any or all of the process please reach out to us.

Step 3

Open a bank account in the business name

A business bank account reference is a part of the credit granting process for a lot of creditors. Basically, they want to ensure that you are actually in business. With the highly competitive nature of the current banking industry, it shouldn’t be hard to find a bank where you can open a business account for as little as $50.00.

Set-Up a Commercial Office

In order to maximize your chances of obtaining business credit, you need to establish a commercial business presence. A commercial business presence includes:

- A business telephone number listed in the local telephone directory in the name of the business.

- An office address in a commercial office location is the preferred preference, however with the growth of home based businesses you can use a home address as long as the business license is set up correctly.

Step 4

Now it’s time to register your new or existing business with the business credit bureaus.

I believe in dotting I’s and crossing T’s , make sure you register your business with the following major credit bureaus.

Dun & Bradstreet

Dun & Bradstreet

- Experian Business

- Equifax Business

Note: Web addresses to register or listed in chapter 2

Step 5

Now it’s time to apply:

Let’s start this step with you keeping this in mind

1. With business credit, it’s not mandatory that creditors report your payment history to the credit bureaus.

- Remembering that you are building true business credit (not just getting cards/credit lines in your business name).

If you keep these two things in mind you will be successful in building true business credit separate from your personal credit.

Note: Always verify that the creditor will report to business credit bureaus

Now it’s time to apply:

When applying for credit/filling out credit applications your employee status should be at least 5 or more instead of a one or two person establishment. It may not be viewed as being a stable enough company for some creditors. And unlike personal credit, with business credit the higher credit ratings are reserved for the largest companies Not all creditors offer true business credit, in fact most creditors would like to keep you personally connected to your business accounts this is why it is important for you to verify with the creditor that they with only report on the business side and you are not personally guarantying the account.

Next page is a list of creditors that provide true business credit and will report on the business side only.

Now it’s time to apply:

I want you to know in advance that in the beginning you will be apply for credit that you may not necessarily want or need. But stay focused and remember this is a starting point for building true business credit with creditors that report to bureaus.

In the next chapter I will teach you how to manage your credit so you can build it in the fasted possible time frame.

Creditor list (buy)

Reliable: www.officedepot.com

Nebs: www.nebs.com

Staples: www.staples.com

Uline www.uline.com

Interstate Battery www.ibsa.com

Note: Find a product to buy, something cheap. Make one or two payments wait 30 -60 days then move to the creditor list. Your profile should be created by then.

Now it’s time to apply:

Creditor list

Once you have received your Paydex score you can now apply to the companies listed below.

Gas Cards are great to apply for

Our data base has over forty thousand potential creditors so let’s stop here.

This is building business credit, in our next and last chapter I will share with you some very important information such as managing your business credit for faster build and statistics on the percentages of people who start this process and actually complete it.

You now know the steps to building business credit. Enhanced Business Solutions wishes you continued success.

Note: Please read the next chapter for more insight.