Chapter four

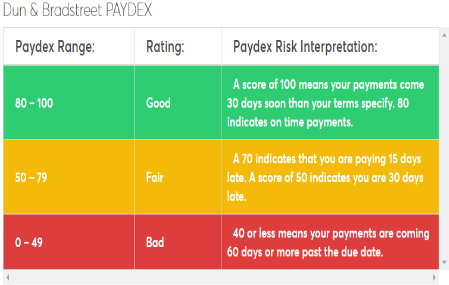

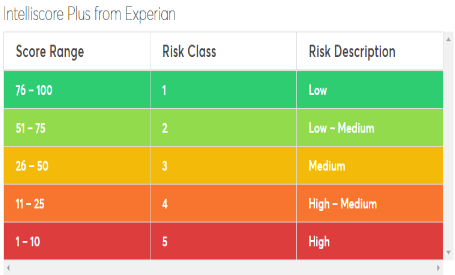

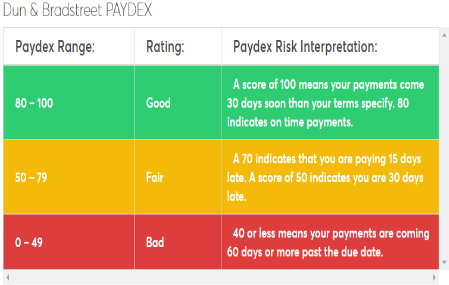

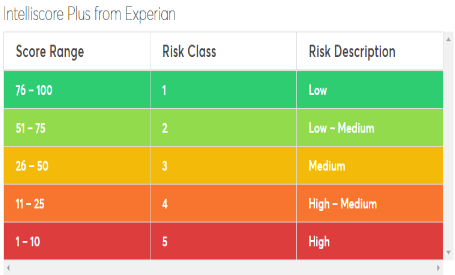

While scales may vary, many popular credit reporting companies, like Experian’s Intelliscore Plus and D&B’s PAYDEX Score, use scoring algorithms that rank scores from 1 to 100. Ranking systems like these typically associate a higher score with good business credit.

For example, a D&B PAYDEX Score of 80 or higher would mean you make on time or early payments. Still, other companies like Equifax’s Small Business Credit risk Score for Financial Services, which uses a rating system that ranks scores from 101 to 992, ascribe to alternative rating scales.

The takeaway? To find out the exact scores needed for good business credit, it’s important to familiarize yourself with the reporting entities that valuable vendors, suppliers, manufacturers and lenders use.

Here’s what the business credit scoring system looks like for D&B.

Here’s what the business credit scoring system looks like Experian.

FICO SBSS scores range from 0 to 300. Like the other business credit indexes, the higher the score the better. If you are seeking financing, the magic FICO SBSS number to remember is 140. If you have a FICO SBSS score of 140 or above, you can pre-qualify for an SBA 7(a) loan. Most banks have a higher standard and will only prequalify you with a score of 160 or above.

SBSS scores can be used for term loans and lines of credit for amounts up to $1 million. If you're applying for $1 million or less, chances are your lender will use SBSS to help make its decision.

Fair Isaac Corporation (FICO) Small Business Scoring Service (SBSS)

Achieving & Maintaining Good Credit

Similar to the way rating scales vary from company to company, evaluative methods can also vary depending on the firm or bureau that is reviewing your credit profile.

Essentially, the impact of different types of activities (late payments, available credit, credit utilization, etc.) can change from company to company. For that reason, it’s also important to research the logic that goes into a company’s credit score rating structure.

However, there is good news! While there may be different methods of evaluation, there are still some simple guidelines that can help you reap the benefits of good business credit.

1. Pay On Time — or early — Every Time

- Utilize Credit