Chapter one

Understanding your business credit score is an important first step in successfully running and growing your business. This section is intended to help you understand your business credit score and business credit report.

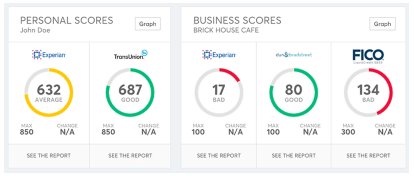

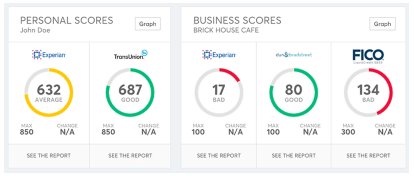

Experian®, an industry leader in business credit reporting and scoring, offers insight to more than 27 million credit-active public and private U.S. companies. Like personal credit scores, business credit scores provide a quick view of risk potential based on where the score falls on the scale — the higher the score, the lower the risk. However, business credit scores use a scale that ranges from 0 to 100.

You can proactively manage your business credit score, ensure your vendors are reporting your payment history, and monitor your business credit report regularly.

As an entrepreneur, you have a unique opportunity to build, maintain and acquire credit both individually and as a business owner? That's good news if you're trying to build and grow a company because you won't have to rely solely on your personal credit to do that.

Fewer then 10 percent of all entrepreneurs know about or truly understand how business credit is established and tracked-and how it affects their lives and businesses.

So let's first take a look at how personal credit differs from business credit. Then we'll discuss some steps you can take to build your business credit.

Personal Vs. Business Credit

At the point an individual with a social security number accepts their first job or applies for their first credit card, a credit profile is started with the personal credit reporting agencies. This profile, otherwise known as a credit report, is added to with every credit inquiry, credit application submitted, change of address and job change. The information is typically reported to the credit bureaus by those who are issuing credit. Eventually, the credit report becomes a statement of an individual's ability to pay back a debt.

In some cases, the same is true for businesses. When a business issues another business credit, it's referred to as trade credit. Trade, or business, credit is the single largest source of lending in the world.

Information about trade credit transactions is gathered by the business credit bureaus to create your business credit report using your business name, address and federal tax identification number (FIN), also known as an employer identification number (EIN), which you get from the IRS. The business credit bureaus use this compiled data to generate a report about your company's business credit transactions. In many cases, those issuing credit to you will rely on your business credit report to determine if they want to grant you credit and how much credit they'll give.

Foreign Identification Number (FIN) Employer Identification Number (EIN)