3.5 Barriers to financial inclusion: Customer versus provider perspectives

This section compares the results of a qualitative study of customer and provider perspectives on barriers to financial inclusion in Russia.

Customer perspective

In addition to the quantitative survey questions on reasons for using or not using financial services and delivery channels, barriers to financial inclusion were discussed with focus group participants (active, moderate, and nonusers of financial services). During a structured discussion, respondents were asked to talk about their experiences with using various financial services and barriers preventing them and their family members from using financial services. In addition, they were asked to name up to five main factors affecting their choice of financial services providers, as well as up to five main factors that they would be willing to forgo or put up with — provided that the main factors are in place. Due to the nature of the study, the results cannot be generalized for a broader customer group; rather, they provide insights into customer thinking on the issues (although some of the findings can be confirmed with results of the quantitative survey — see Sections 3.2 and 3.3).

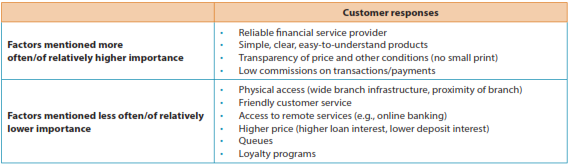

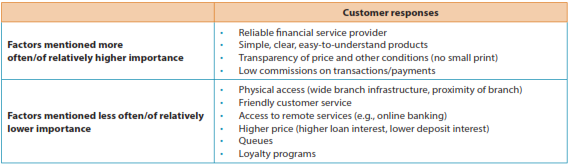

Customer responses are grouped in two broad categories: factors mentioned more often and considered relatively more important, and factors mentioned less often/of relatively lower importance. A summary of customer responses is presented in Table 4. Factors listed in each of the two broad categories are not ranked but rather presented in the order of how frequently they were mentioned.

Table 4. Summary of customer responses on key factors affecting their choice of providers and decision to use financial services

Responses have been generally consistent across all groups of respondents — active, moderate, and nonusers of financial services. They all mentioned the following factors that are of key importance for them both for choosing a financial service provider and for using financial services:

-

Transparency of providers. Respondents feel that complicated procedures and documents add to the complexity of financial products.

-

Price is important, but to a higher extent in terms of commissions on transactions and payments, as well as regular service fees (e.g., for debit cards). Respondents would be willing to put up with reasonably higher prices (e.g., higher loan interest and lower deposit rates) if providers offered clearer, more understandable products. This finding is consistent with another qualitative study finding when some respondents chose higher-price microloans because the product presentation was much easier to understand with the help of an online credit calculator and the presentation of interest as an absolute value (Section 3.4).

Factors of relatively lower importance, in respondents’ view, included the following:

-

Physical access. Respondents admitted it is an issue, especially for rural areas. At the same time many said they would be ready to put up with the need to travel further if a provider were reliable and transparent.

-

Quality of customer service, including friendly and supportive staff and absence of long queues was mentioned as an important factor, but just as physical access, much less important than provider reliability and product complexity. It should be noted that respondents often mentioned low qualification of provider staff and their inability to explain products to customers — which relates again to their need to have more clear information on products.

-

Access to remote services was more important for active users (it should be noted that for this very reason physical proximity was less important for them). For moderate and nonusers it was not as essential.

-

Loyalty programs were generally referred to by respondents as “nice to have, but not a must.”

Provider perspective

During the research, in-depth interviews with the key types of financial service providers were conducted: federal and regional banks, MFOs and credit cooperatives, insurance companies, and NBCOs providing payment and e-money services. The purpose of the interviews was to understand provider perspectives on the issue of financial inclusion in Russia. Specifically, they were asked to talk about barriers for financial inclusion. As there was only a general interview guide, providers were free to focus on those topics they considered most important.

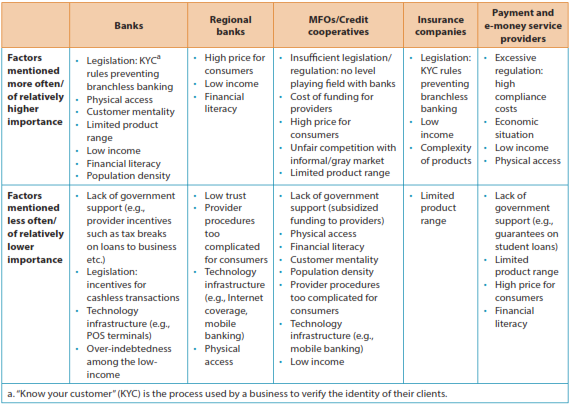

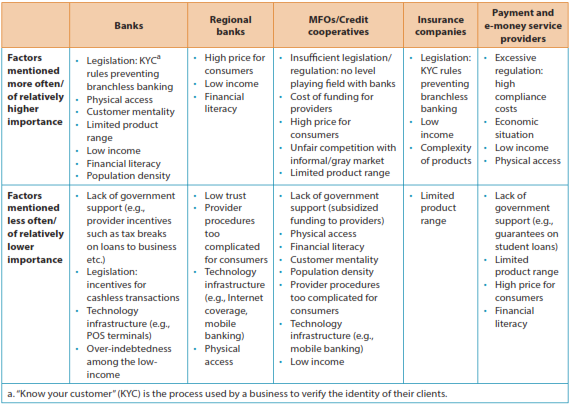

To allow for comparison between provider and customer perspectives, provider responses are grouped in the same two broad categories as customer responses: factors mentioned more often and considered relatively more important, and factors mentioned less often/of relatively lower importance. Provider responses are summarized in Table 5. As in the case with the customer study above, the results cannot be generalized for all providers; they provide insights into provider thinking on the issues. Factors listed in each of the two broad categories are not ranked.

Table 5. Summary of provider responses on barriers to financial inclusion

As can be seen, providers generally mention the same factors affecting financial inclusion as customers do, except those that are provider-specific (such as those related to legislation and regulation). At the same time, providers tend to see many issues in a somewhat different light, and their views on the importance of some factors differ from customer views:

-

Provider procedures. Related to the financial literacy factor, providers mentioned that it is difficult for many customers to collect all necessary documents and understand the forms they need to fill in to get financial products. This factor also has to do with certain regulatory requirements (such as collateral requirements, etc.), as well as provider bureaucracy. With respect to customer desire for clarity and simplicity, the complexity of procedures appears to increase the complexity of products in the eyes of consumers.

-

Customer mentality. Providers mentioned customer conservatism resulting in sticking to the same usage (or nonusage) patterns; MFOs also mentioned lack of responsibility in terms of customers assessing their own repayment capacity.

-

Physical access. The issue of lower level of physical infrastructure development in remote, rural, and less densely populated areas is recognized by all providers. Many mentioned the development of branchless solutions, such as online and mobile banking, payment terminal networks, etc., as key for expanding access to financial services. The importance of the physical access factor is higher in the eyes of providers than in the opinion of customers.

-

Limited product range. Insufficient product range is often viewed by providers as preventing people from using financial services, and providers felt it was their responsibility to develop and market more new products. Consumers, on the other hand, felt that the product range is generally sufficient, but products should be presented in a much clearer manner and specific product features should be better suited to their needs.

-

High price of products and services/low income levels. Many of the providers interviewed felt that low income levels prevent people from using financial services: high price of products makes them unaffordable for low-income people. At the same time, the qualitative study of customers showed that, in terms of price, customers believed it matters more for commissions on transactions and payments than for credit and deposit products.

In addition, while this research established strong direct correlations between income levels and the usage of financial services, price factors tend to matter more for the higher-income segments (see Section 3.2). In addition, as discussed in Chapter 2, the low-income segments tend to use more expensive credit products (such as short-term credit), and about five times less often use savings products. Thus, the issue may not be so much in the income level as such, but rather in the types of products offered for the low-income segment — specifically, an insufficient offer of lower-price products for this category and more active promotion of higher-risk products among them. It should be noted that among the providers interviewed, federal banks mentioned the issue of over-indebtedness among the low-income as a barrier for financial inclusion.

Providers mentioned the following provider-specific factors, which, in their view, affect access to financial services:

-

Legislation affecting branchless banking. Current anti-money laundering/combatting the financing of terrorism rules do not allow for remote account opening for customers and limit the provision of certain products and the use of innovative delivery channels.

-

Excessive regulation that increases compliance costs for providers and adversely affects the business case for the provision of certain services. It should be noted that the cost factor as a barrier for expanding the offer of financial services was mainly mentioned by providers in connection with excessive regulation prescribing minimum requirements for branches and payment agents, which affects the business case.

-

Insufficient regulation for some providers — e.g., MFOs felt that regulation should be more uniform and consistent across all financial market players, to ensure a level-playing field and eliminate unfair competition on the part of the informal market.

-

Insufficient technology infrastructure, such as low Internet coverage and a shallow POS terminal network was mentioned as an important factor preventing providers from expanding their service offer.

-

Cost of funding for some providers — again, MFOs and credit cooperatives felt they have insufficient access to reasonably priced funding sources.41

-

Role of government was frequently mentioned — most providers believe that the government should play a much more active role in expanding financial inclusion in Russia. In their view, in addition to amending burdensome legislation and regulation, the government should provide incentives to providers serving specific segments or offering specific products (e.g., small business loans, student loans, etc.); promote cashless transactions by providing incentives to retailers; develop and promote financial literacy programs for consumers; and provide subsidized funding (the latter was voiced by MFOs and credit cooperatives).

Details on the qualitative research methodology are presented in Annex 1.