ANNEXES

Annex 1. Research methodology

The research methodology included one quantitative survey and two qualitative studies as described here.

1. National representative quantitative survey: Individual, standardized face-to-face interviews at respondents’ place of residence — 2800 interviews. The survey was conducted in accordance with the following criteria:

-

National multi-stage stratified geographical probability sampling

-

Respondents were 18 years old and older

-

Quota sampling by gender, age, and education

-

Statistical error with 95 percent confidence level not exceeding 1.85 percent

-

Coverage of at least 52 territorial entities of the country; at least 150 settlements with at least five respondents per settlement

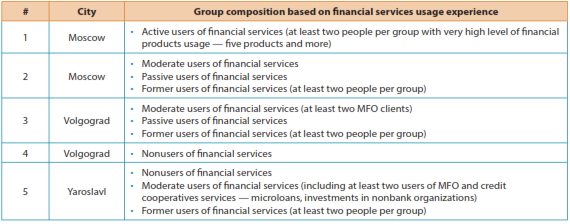

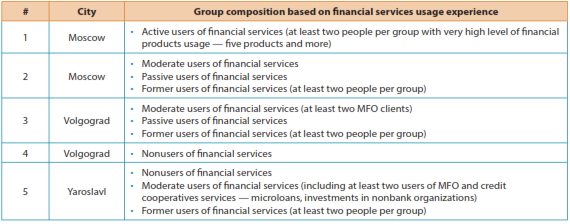

2. Focus group discussions: Group discussions with representatives of the following segments — active, moderate, and nonusers of financial services — five focus groups. In addition, the composition of the focus groups was designed in accordance with the following criteria:

-

Gender: equal number of men and women in each group

-

Age: 18 to 60, equally distributed; at least two people of age 60+ for focus groups 3 and 4 (see Table A1-1)

-

Education: at least secondary school

-

Respondents must be articulate and be able to speak clearly

Table A1-1: Survey Design

Description of segments

-

Active users of financial services have at least three financial products besides salary or social cards, and actively use them (make payments with cards, top up deposit accounts).

-

Moderate users of financial services have at least one, but not more than two financial products, (loan, deposit, insurance, etc.), including salary or social cards, voluntary health insurance policies issued by employer or mandatory MTPL insurance, and actively use them (make payments with cards, top up deposit accounts).

-

Passive users of financial services have one or two financial products, do not use them (do not make payments with cards, use salary card only for cash withdrawal, do not top up deposit accounts).

-

Former users of financial services have one or two financial products, may or may not use them currently, but must have experience of giving up any of financial products.

-

Nonusers of financial services do not use any financial products (except payments).

3. In-depth interviews with financial service providers: Qualitative in-depth interviews with representatives of financial institutions responsible for the development of a market strategy (top managers, managers of strategic and other relevant departments) — 40 interviews.

Tentatively, the provider market has been divided into the following segments covering the main financial services (credit, savings, insurance and payments):

-

Banks: The sample included eight federal and five regional banks; 13 interviews.

-

Microfinance organizations and credit cooperatives: Seven interviews.

-

Insurance companies: The sample included five federal and two regional companies; seven interviews.

-

Payment services providers: Eight interviews.

-

Mobile operators: Three interviews.

-

The Russian Post: Two interviews.