CHAPTER 2.

USAGE OF FINANCIAL SERVICES

AND DELIVERY CHANNELS

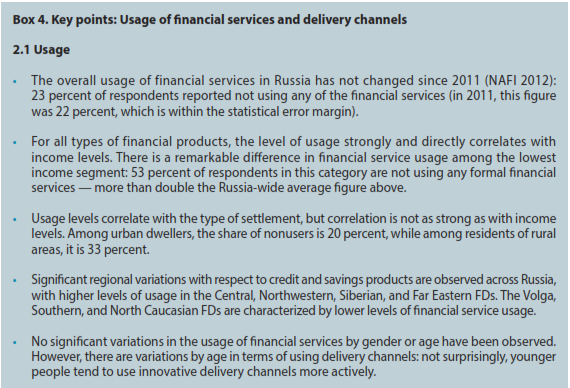

Usage of financial services is the next of the three dimensions of financial inclusion measurement as defined in the G20 Financial Inclusion Indicators. This chapter addresses the usage of various financial services and explores the level of awareness about financial services and people’s intention to use them — as important prerequisites for usage. In addition, statistics on the usage of and awareness about financial service delivery channels are presented.

The chapter is organized as follows:

-

Section 2.1 presents an analysis of the usage of financial services and delivery channels, with separate subsections devoted to ( i) credit, card-based, and savings products; ( ii) insurance products; and ( iii) delivery channels.

-

Section 2.2 explores the awareness about financial products. Similar to the previous section, credit, card-based and savings products are discussed separately from insurance products and delivery channels.

-

Section 2.3 discusses potential demand for credit, card-based, and savings products, as well as insurance products — in terms of people’s intention to use these products.

2.1 Usage

Credit, card-based, and savings products

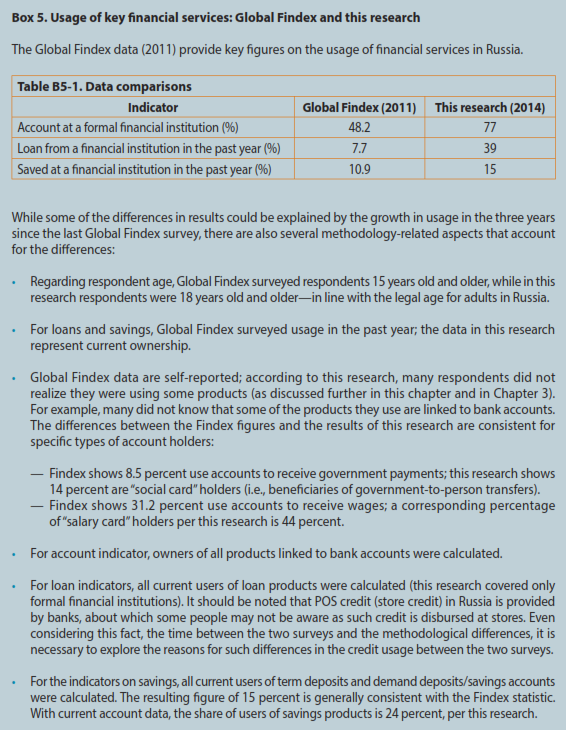

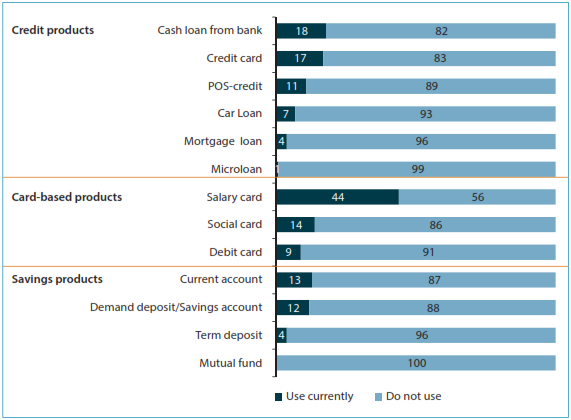

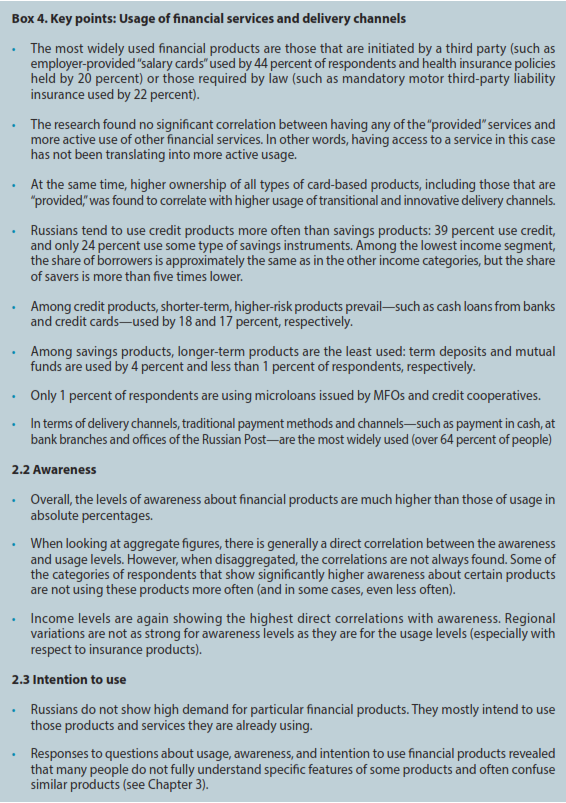

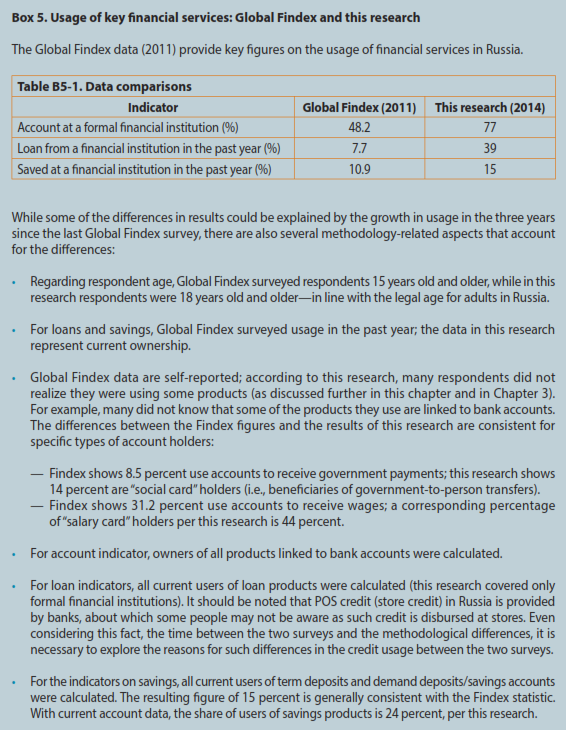

While card-based products in Russia can generally be considered “savings” products (except credit cards that are shown along with statistics on credit products) as they are usually linked to bank accounts that could be topped-up, statistics on their usage are shown separately to reflect specifics of the Russian financial services market — where many of such card-based products are initiated and provided to people by third parties — such as employers (“salary card” used to transfer staff salaries and benefits) and government (“social card” used for various government-to-person transfers to specific categories — see Glossary in Annex 2).

As shown in Figure 4, with the exception of “salary cards,” the share of Russians using credit, savings, or card-based products does not exceed 18 percent for each product. The relatively high percentage of those using “salary cards” (44 percent) is due to the fact that this product is initiated and provided by employers to transfer salaries to their employees. Similarly, 14 percent of “social card” users reflect the number of government support beneficiaries — who were issued the card by the state but have not actively requested this service.

Figure 4. Usage of credit, savings and card-based products

Note: Distribution of answers to the question “What financial products do you currently use?” (percentage of total respondents, n = 2800).

As both salary and social cards are usually regular debit cards linked to bank accounts, this allows their holders to transact and use other services, such as payments, money transfers, and savings. The research has not found significant correlations between the fact of having any of the “provided” services and more active use of other financial services. At the same time, a correlation has been established between having any of the card-based products and higher usage of transitional and innovative delivery channels.

Credit products are used more often than savings products — in total, 39 percent of respondents have some of the credit products, and only 24 percent have used any of the savings products (the latter figure includes 15 percent of those with term deposit/savings account). Among credit products, Russians use shorter-term, higher-risk products more actively — such as short-term cash loans from banks, credit cards, and POS credit. This is not surprising as consumer credit has become more accessible in recent years — for example, in 2013, the volume of consumer lending by banks in Russia grew by some 40 percent, according to the Central Bank.31

At the same time, the volume of natural persons’ deposits has grown by 20 percent in the same year.32 Among the savings products, longer-term instruments are the least used: only 4 percent of people have term deposits, and less than 1 percent have investments with mutual funds.

There are significant regional variations in the level of financial service usage:

-

Not surprisingly, in the two main Russian cities — Moscow and St. Petersburg — the share of people who do not use any financial services is much lower than elsewhere — about half of the national average of 23 percent (11 and 12 percent, respectively). Among residents of rural areas, this figure is 10 percent higher than the national average.

-

The overall usage of financial services is higher in the Central, Northwestern, Siberian, and Far Eastern FDs:

— The Central FD has the highest share of residents using current accounts (24 percent versus 13 percent across Russia). In Moscow, 22 percent use debit cards versus 9 percent Russia-wide.

— Both the Central and Northwestern FDs show higher usage of card-based products (especially salary cards), which may be explained by high employment levels in these regions.

— The Siberian and Far Eastern FDs show the highest levels of short-term credit product usage — cash loans from banks (30 percent and 25 percent versus 18 percent average), credit card (24 percent in Siberia versus 17 percent average), and POS credit (24 percent in the Far East versus 11 percent average).

-

The overall lower usage of financial services is typical for the Volga, Southern, and North Caucasian FDs:

— In the Volga FD, credit card usage is only 11 percent — 6 percent lower than the average.

— Residents of the Southern FD hardly use debit cards — only 1 percent mentioned using this product as compared to 9 percent Russia-wide.

— The North Caucasian FD has the lowest level of salary card usage — 23 percent; this is followed by the Volga FD with 37 percent — as compared to 44 percent on average. As mentioned above, this corresponds to employment levels in these regions.

-

Residents of certain regions have shown specific financial behaviors:

— With higher usage figures on credit products, the Siberian FD shows a much lower usage of savings products — only 6 percent use demand deposit/savings account and another 6 percent use current accounts. These are only half of the respective national average figures.

— St. Petersburg (capital of the Northwestern FD, where the usage is higher than average overall) is showing much lower figures of cash loan usage — only 2 percent compared to the average of 18 percent.

— The Urals FD is characterized by higher than average usage of mortgage and car loans — 8 and 9 percent, respectively, as compared to 4 percent and 7 percent Russia-wide. At the same time, only 6 percent of residents of this region use POS credit, as compared to 11 percent Russia-wide.

Another factor accounting for significant differences in the usage of financial services is the level of income:

-

For all types of financial products, the level of usage strongly and directly correlates with income levels.

-

The highest share of people who do not use any financial services — 53 percent — is among the respondents belonging to the lowest income segment (below RUB 3,000 — approximately US$88 monthly per capita). This is more than double the national average of 23 percent. Remarkably, in the next income category — slightly better off (RUB 3,000–5,999) — the share of nonusers in only 26 percent — much closer to the Russia-wide average.

-

Income levels correlate with the use of card-based products — notably the salary card, which is usually offered by larger, higher wage paying employers.

-

Interestingly, with the exception of a cash loan from a bank (8 percent versus 25 percent on average), the lowest income segment is characterized by levels of short-term credit usage similar to other income categories, but much lower levels of savings products usage: only 3 percent of people in this category have a term deposit or savings account versus 15 percent, on average.

The analysis of credit, card-based, and savings products usage has not revealed significant correlations with such sociodemographic factors as gender and age of respondents.

Detailed breakdowns of the survey results on the usage of credit, card-based, and savings products are presented in Annex 3.

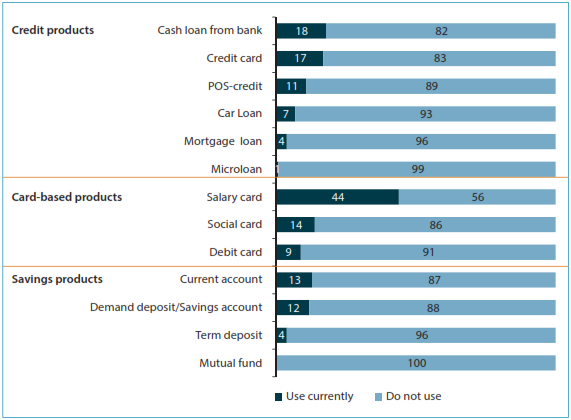

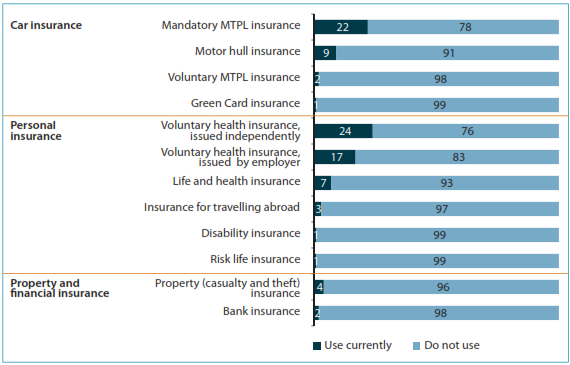

Insurance products

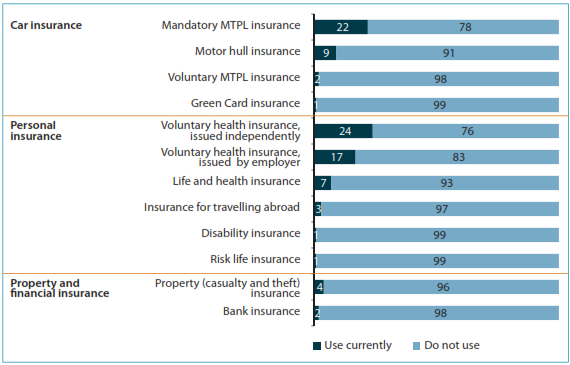

Similar to the financial products discussed above, among the insurance products used most frequently are mandatory products — such as mandatory motor third-party liability (MTPL) insurance for car owners (22 percent) and products initiated by third parties — such as employer-provided voluntary health insurance (17 percent) (Figure 5).

The research revealed an unusually high level of the voluntary health insurance usage — 24 percent. During the qualitative research, and also with support from data from prior NAfiresearch, it became apparent that many respondents confused this product with the free universal public medical care program (which is called “mandatory medical insurance”). Since in 2012 the share of those using this product was about 5 percent (NAfi2013), it is most likely that it is currently at a similar level.

Figure 5. Usage of insurance services

Note: The data on voluntary health insurance usage presents perceived usage; the actual usage is about 5 percent. Distribution of answers to the question “What insurance products do you currently use?” (percentage of total respondents, n = 2800).

Note that the figures for bank insurance usage (2 percent) do not correlate with the statistics on credit product usage (ranging between 4 percent and 18 percent for various credit products) — although most banks require insurance as one of the conditions for loan disbursement — especially for larger and longer-term loans (mortgage and car loans). While legally banks cannot make any loan insurance mandatory, they usually offer better conditions on loans with such insurance, or sometimes just sell “packaged” products where insurance is already included. As a result, respondents have not identified themselves as users of insurance products, and the actual usage level may be higher.

The research has revealed some regional differences in the usage of insurance products, but they are not as significant compared to credit, card-based, and savings products discussed earlier:

-

Moscow and St. Petersburg have the lowest levels of respondents not using any insurance products — 27 percent and 29 percent, respectively.

-

Not surprisingly, car insurance usage is higher in regions and cities with higher car ownership levels. This includes higher use of motor hull insurance in Moscow (21 percent versus 9 percent on average) and mandatory MTPL insurance in St. Petersburg (36 percent versus 22 percent). In the Southern FD, the level of mandatory MTPL and motor hull insurance is also higher than average (27 percent and 18 percent, versus 22 percent and 9 percent on average, respectively).

-

As is the case with other financial products, the North Caucasian FD shows the lowest level of insurance products usage among the Russian regions (only 44 percent currently use insurance products in this region versus 57 percent Russia-wide).

In terms of income levels, only 42 percent of the lowest-income category currently use insurance products versus 61–66 percent of those in higher-income categories.

Detailed breakdowns of the survey results on the usage of insurance products are presented in Annex 3.

Delivery channels

Delivery of financial services outside of bank branches presents significant opportunities for the expansion of access to finance. Due to much lower delivery costs compared to traditional banking, branchless banking can reach many more customers and allow for smaller-value transactions at lower costs.33 One of the objectives of this research was to see how many people are using various delivery channels. Unfortunately, there is no time series data available on the use of the channels,34 which makes it impossible to compare how the usage has been changing with time. As such, the data presented here can be used as a baseline for further research.

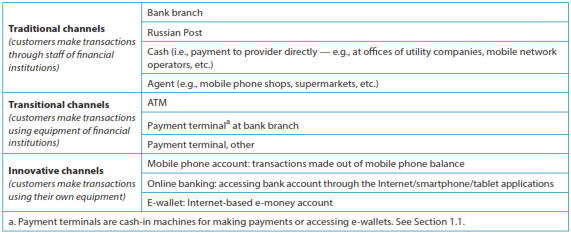

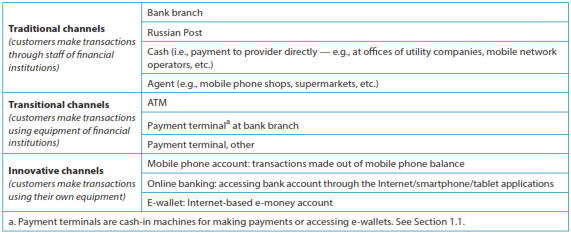

For the purposes of the research, financial service delivery channels are organized into three broad categories as presented in Table 2: traditional, transitional, and innovative channels. This classification reflects customer perspective rather than provider perspective. The channels are grouped based on the types of customer interactions (with staff , provider equipment, own devices) rather than the type of provider (bank or nonbank).

Table 2. Financial services delivery channels

As shown in Figure 6, Russians tend to use traditional channels the most. Not surprisingly, innovative channels are the least frequently used. As mentioned earlier, it was found that owners of any card-based products, both “provided” and independently obtained, tend to use transitional and innovative delivery channels more often than those who do not use these products.

Figure 6. Usage of financial services delivery channels in the past 12 months

Note: Distribution of answers to the question “Which of the delivery channels have you used in the last 12 months?” (percentage of total respondents, n = 2800).

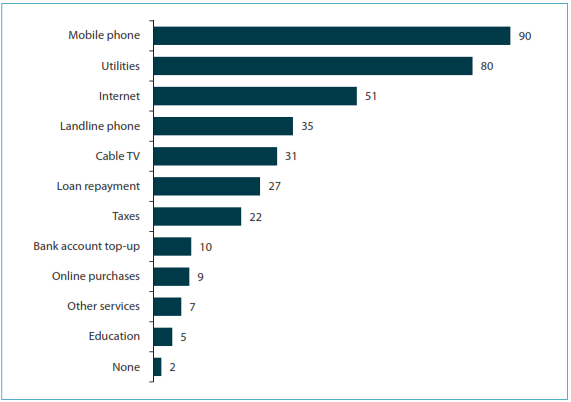

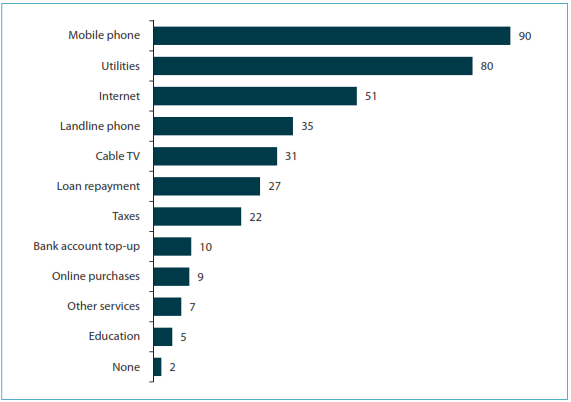

Statistics on using payment agents in the past 12 months turned out higher than for other traditional channels. This is likely because payment agents are mostly used for the most popular and frequently used type of payment — the mobile phone, for which payments are made by 90 percent of respondents, 65 percent of whom pay several times a month (see Figures 6 and 7).

As is the case with financial services, usage of delivery channels varies by regions:

-

In Moscow and St. Petersburg, respondents use transitional channels 5–10 percent more often than Russia-wide; however, these cities also show the highest usage rates of traditional channels (except the Russian Post offices, which tend to be more popular in rural areas), which correlates with the higher-than-average usage of financial services.

-

Interestingly, the highest level of innovative channel usage is observed in the Far Eastern FD: payments from mobile phone accounts are used by 19 percent versus 14 percent, on average, and online banking — 30 percent versus 18 percent. This may be due to the low availability of other channels — for example, the usage of agents in this region is the lowest in Russia — only 66 percent versus 76 percent Russia-wide. Another factor affecting this may be the proximity of the Asian countries where mobile phone payments are widely used.

-

The North Caucasian FD has the lowest level of bank branch usage — 49 percent as compared to 64 percent on average. This is consistent with the data on physical access (see Chapter 1).

The usage of delivery channels also varies by income levels and age of respondents:

-

Representatives of higher-income segments tend to use transitional channels more often: 80 percent use ATMs versus 60 percent Russia-wide; 63 percent use payment terminals versus 40 percent on average; and 49 percent use terminals at bank branches versus 34 percent. Respondents in this category are also more active users of innovative channels: for example, the usage of payments from mobile phone accounts is 12 percentage points higher than the average.

-

Respondents of retirement age use delivery channels less frequently overall, except the Russian Post — of which they are the most active users (52 percent versus 46 percent on average) as the Post administers pension disbursements and thus can cross-sell other services to this category.

-

The youngest respondents (18–24 years old) are the most active users of payment terminals (52 percent versus 41 percent Russia-wide). Among this age group, there are 8 percent less users of the Russian Post and 5 percent less users of bank branches.

-

Respondents ages 25–34 use bank terminals and ATMs more often than average Russians — by 5 percent and 7 percent, respectively. They are also the most active users of online banking — 26 percent versus 18 percent Russia-wide.

Finally, more active users of innovative channels are those who use the Internet more actively: among those using the Internet daily, 66 percent of respondents use innovative channels versus 26 percent Russia-wide.

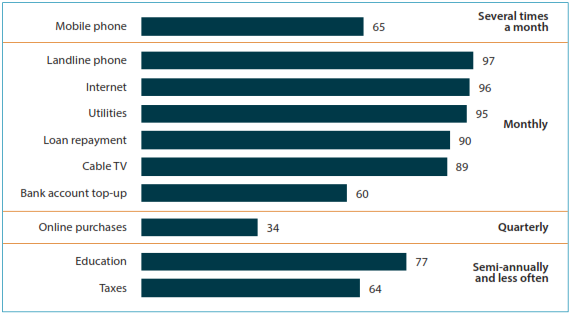

Figure 7 shows the most popular types of payments made through financial service delivery channels.35

Figure 7. Types of payments

Note: Distribution of answers to the question “What payments do you regularly make?” (percentage of total respondents, n = 2800).

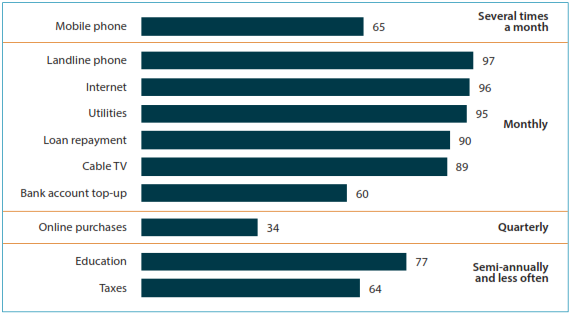

About 90 percent of respondents make various payments at least monthly. Figure 8 summarizes the types of payments, percentage of users, and payment frequency. Together with information on customer perceptions about the channels in terms of their reliability and safety (see Chapter 3) , and information on preferred delivery channels for different types of payments (which were explored through qualitative methods only during this research), this can provide useful information for financial service providers about the potential for using the channels to expand financial service offerings. Thus, the focus groups revealed that customers prefer to pay for mobile phones mostly through payment agents (which explains the high usage rates of this channel as mentioned above) and payment terminals. Additional research is needed to obtain detailed statistics on this.

Figure 8. Frequency of payments

Note: Distribution of answers to the question “How frequently do you pay for…?” (percentage of total respondents, n = 2800).

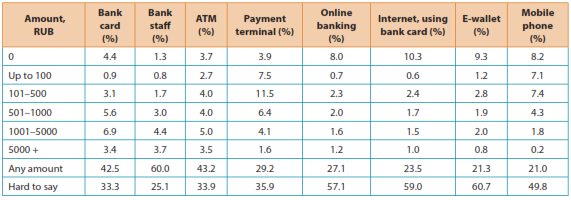

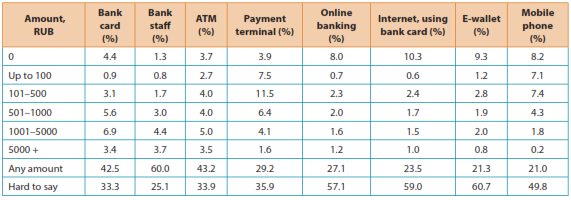

Another factor that could shed light on the potential for expanding the use of transitional and innovative channels for services other than payments is customer sensitivity to amounts that they are ready to pay through available channels. Research by the Central Bank of the Russian Federation (2014) (Table 3) suggests that customers tend to prefer paying higher amounts through banks and bank-operated infrastructure and channels, which correlates with a higher level of trust in banks (see Chapter 3).

Table 3. Distribution of answers to the question “What amount will you be ready to pay through each of the following channels?” (percentage of total respondents, n = 3209)

Detailed breakdowns of the survey results on the usage of financial service delivery channels are presented in Annex 3.