2.2 Awareness

Credit, card-based, and savings products

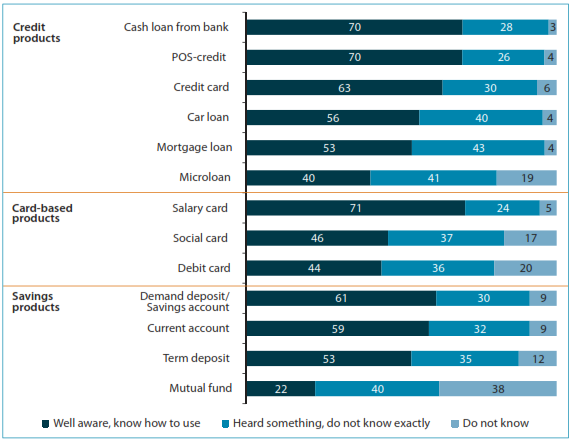

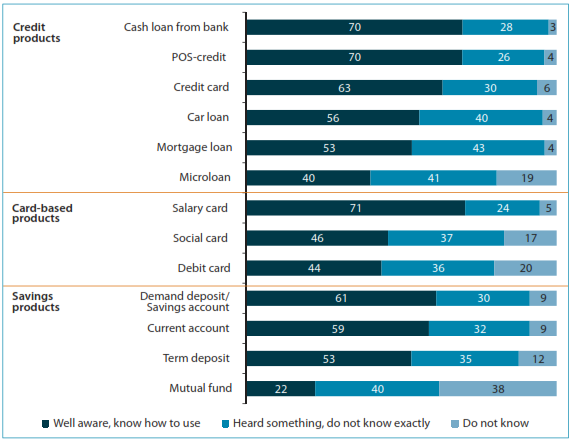

One of the objectives of this research was to establish how awareness levels about financial products correlate with usage levels. Figure 9 presents an overview of awareness levels with respect to credit, card-based, and savings products.

Figure 9. Awareness about credit, card-based and savings products

Note: Distribution of answers to the question “Which of the financial products (services) do you know?” (percentage of total respondents, n = 2800).

Overall, the levels of awareness are much higher than those of usage in absolute percentages. With a few exceptions discussed below, a vast majority of respondents believe they are either well aware and know how to use the products, or at least they have heard something about most of the products. This indicates that low usage levels are not due to the fact that people do not know about the existence of certain products, but there are other factors affecting their decision not to use them. In particular, the research revealed that many people thought they know and understand some product, but actually they confused it with a similar one. This and other factors preventing people from making the most use of financial services is discussed in more detail in Chapter 3.

Respondents showed the lowest awareness levels about mutual funds and microloans. This can be explained by the relatively short history of these products in Russia: the first mutual funds were established in Russia about 15 years ago, and the first official microfinance institutions

(MFIs) started providing services in January 2011 (see Chapter 1).

As is the case with usage, there are regional differences in awareness levels — generally corresponding with usage patterns, but with a few exceptions:

-

Regions with more affordable real estate prices and lower income levels demonstrate higher awareness about mortgage and car loans: respondents in the Northwestern, Urals, and Siberian FDs show 8–12 percent higher awareness levels than the average with respect to these products. Residents of these regions show higher awareness about other credit and savings products — which corresponds with higher usage levels.

-

The lower-usage regions — the Volga, Southern, and North Caucasian FDs — also show 5–10 percent lower awareness levels for almost all of the products. At the same time, these regions show the highest awareness about microloans — as MFIs are more active in these regions.

Other sociodemographic characteristics that influence awareness levels about credit, card-based, and savings products include the following:

-

Income levels. As is the case with usage, awareness levels directly correlate with respondents’ income levels for all types of products. In the lower-income groups, the share of respondents believing that they are well aware and know how to use the products is 10–20 percent lower than the average.

-

Age. Awareness levels about most of the credit and card-based products are higher among people of working age as compared to respondents of retirement age. On average, among younger respondents the awareness levels are 13–19 percent higher that among people 60 and older.

-

Gender, with respect to certain products. Car loans are better known to men than women (61 percent versus 52 percent, respectively), most likely due to higher car ownership among men. Men also show slightly higher awareness about term deposit, salary card, and microloan products.

Detailed breakdowns of the survey results on the awareness about credit, card-based, and savings products are presented in Annex 3.

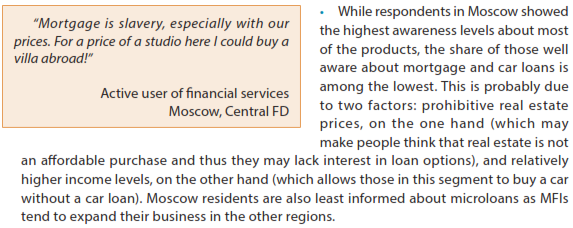

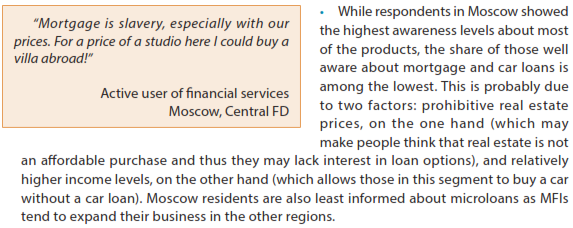

Insurance products

The overall level of awareness about insurance products is generally lower than that about credit, card-based, and savings products: the awareness about the most popular products does not exceed 58 percent (Figure 10). As discussed, Russians are most aware of those products that are either required by law (e.g., mandatory MTPL insurance) or provided to them by a third party (e.g., employer-issued voluntary health insurance). The latter is best known to residents of large cities where large corporate employers operate.

Figure 10. Awareness about insurance products

Note: Distribution of answers to the question “What insurance products do you know?” (percentage of total respondents, n = 2800).

The products people are the least aware of include Green Card insurance and insurance for traveling abroad: both are issued only to those who travel abroad by car or to certain countries (e.g., Schengen), respectively, and it seems not many Russians do so (e.g., according to a recent national poll only 6 percent of Russians plan to travel abroad in 2014).36

This part of the research revealed the highest degree of confusion with various insurance products among respondents: for example, many of them were not sure about the differences among health insurance products (and the public medical care program as discussed above), or among mandatory and voluntary products (e.g., mandatory and voluntary MTPL insurance and motor hull insurance).

In contrast with credit, card-based, and savings products, there are no significant regional variations in awareness levels with respect to insurance products. Awareness about car insurance is slightly higher in Southern FD, which corresponds with the higher usage rates of these products in this region. In North Caucasian FD, certain types of personal insurance (such as disability and risk life insurance) are better known to respondents due to higher personal security risks as a result of military conflicts in this area in the late 1990s and early 2000s; however, this does not translate into higher usage rates for these products.

The factors influencing awareness levels about insurance products include the following:

-

Income levels. Among higher-income groups, awareness levels about all insurance products are generally higher than average by 10–15 percent, including the least known products — Green Card insurance and insurance for traveling abroad (as the share of those who can afford traveling abroad should be higher in these categories).

-

Type of settlement. Residents of smaller towns and rural areas are better aware of personal insurance (such as life, health, and disability) and property insurance. This is most likely due to the fact that smaller towns are home to many factories with high injury risks, as well as higher impact of natural phenomena on rural housing. Better awareness in this case does not translate into higher usage.

-

Level of the Internet usage. Active Internet users are better aware about all insurance products: their awareness levels are 5–7 percent higher than average for all insurance products, and 13–19 percent higher than the awareness of those who do not use the Internet.

-

Gender (with respect to car insurance only). Men are better informed about car insurance products, showing awareness levels 11 percent higher than that of women both about mandatory MTPL insurance and motor hull insurance.

Detailed breakdowns of the survey results on the awareness about insurance products are presented in Annex 3.

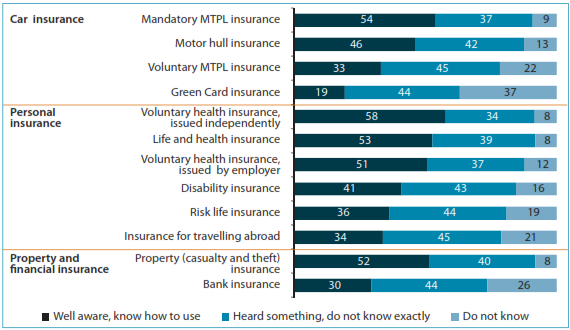

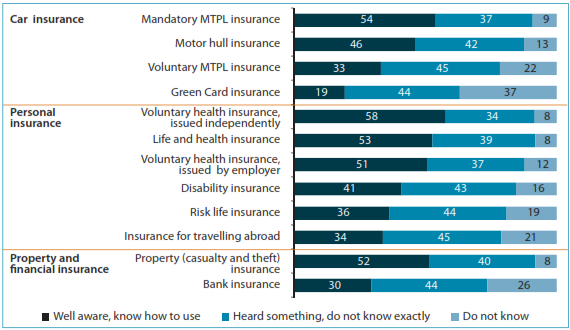

Delivery channels

As could be expected based on usage patterns, Russians are the most familiar with traditional channels (81–91 percent of respondents are well informed), and the least familiar with innovative channels (33–43 percent believe they are well informed). Lower awareness and usage levels of innovative delivery channels may have to do, inter alia, with high prevalence of cash transactions: only 16 percent of Russians regularly use noncash transactions, and 50 percent use cash transactions exclusively (Central Bank of the Russian Federation 2014). Figure 11 provides a summary of the awareness levels on the various channels.

Figure 11. Awareness about delivery channels

Note: Distribution of answers to the question “What financial service delivery channels do you know?” (percentage of total respondents, n = 2800).

There are no significant variations in awareness levels in terms of regions or types of settlement, though Moscow, as is the case with most financial products, again shows the highest average awareness levels about all channels (54 percent versus 42 percent Russia-wide). Among a few notable exceptions are the following:

-

Lower awareness levels about such channels as bank branches and agents in the Far Eastern FD (13–15 percent lower than average). This is consistent with the finding on the higher usage of innovative channels and lower usage of payment agents in this region.

-

The North Caucasian FD — a region among those with the lowest financial service usage — shows higher awareness levels about payments from mobile phone accounts (54 percent versus 43 percent Russia-wide) and e-wallets (42 percent versus 33 percent). This is most likely due to the higher share of young people in this region (as awareness about delivery channels correlates with age, as discussed further). However, this does not correlate with higher usage of these channels in this region.

-

Extremely low awareness about payment terminals in St. Petersburg — 55 percent versus 67 percent Russia-wide (which correlates with much lower usage — 32 percent versus 48 percent, on average). This may have to do with regional specifics of the city and its suburbs, which consist of many densely populated residential areas with underdeveloped retail infrastructure (payment terminals are often installed at retail grocery chains, etc.). However, this finding may need additional research to better understand the reasons for this phenomenon.

The factors influencing awareness levels about delivery channels include the following:

-

Income levels. Again, higher income levels directly and strongly correlate with awareness about delivery channels (as is the case with financial products awareness and usage). This is especially evident with respect to innovative channels on which awareness levels among higher-income segments are 14–19 percent higher than average, as well as with respect to payment terminals outside of bank branches, on which awareness is 20 percent higher than average.

-

Age. Younger respondents are better aware about innovative channels than older ones; for example, the share of those who know about e-wallet is between 44 and 48 percent among respondents in the 18–34 age group, and between 20 and 26 percent among respondents 45 and older. Similar trends are observed with respect to online banking. This also correlates with more active usage of innovative delivery channels among younger respondents.

-

Level of the Internet usage. Active users of the Internet are better aware about all delivery channels. Nonusers of the Internet show generally lower awareness levels even about traditional channels.

Detailed breakdowns of the survey results on awareness about financial service delivery channels are presented in Annex 3.