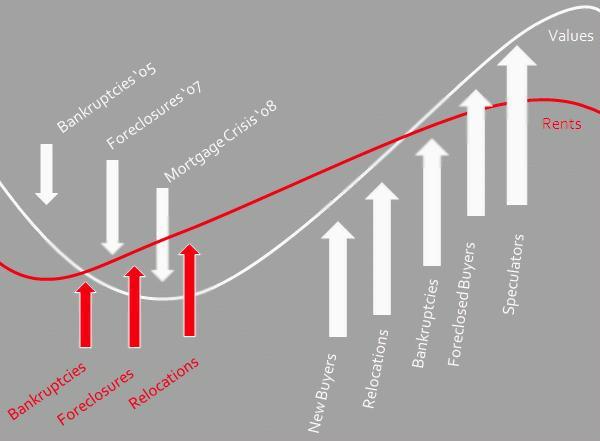

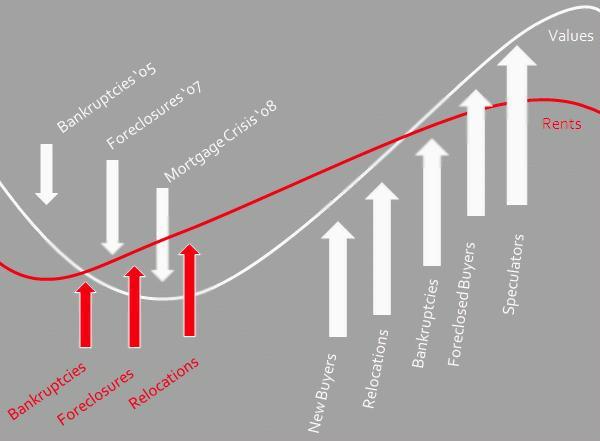

Following “Down” Markets

Recession : a significant decline in economic activity spread across the economy, lasting more than a few months. A recession may involve simultaneous declines in overall economic activity such as employment, investment and corporate profits.

My system is about buying

post-recession properties. When rents start increasing, population starts increasing, employment starts increasing,

then we buy.

Buying During Despair

The perception of the real estate market during recessionary times is “don’t buy.” This is contrary thinking. We want to buy low, but we want to know that we are coming out of the recession, not just going into it.

During a recession, high-end housing will continue to appreciate, just at a lesser rate maybe two or three percent per year. But that’s still an upward movement. But again, these are not the properties we will be concentrating on. And even if a $5 million mansion has to drop its price to $4 million in order to sell, there’s no way we’re going to buy that thing and figure we can find someone to rent it to an itinerant rock star or pro athlete, perhaps. That’s WAY too much risk.

I use the word “despair” as both an emotional as well as an economic term. When everyone in the local barbershop is talking about how much the housing market stinks that’s despair. And THAT is when you want to buy. Why? Because that’s when the deals are out there!

Despair is a self-perpetuating condition. Talk of despair creates more despair. And this will continue and continue until something, some big thing, happens that turns things around some market stimulant. And so, these things are easier to spot than you might have previously thought. When people at the barbershop or the beauty salon or the local tavern or diner are saying how bad the housing market is, that’s the time to buy. When they say that things may be looking up because there’s a new super highway coming in, that’s the wake-up call that the market will soon begin to rise. Despair and optimism. They may be emotions, but they’re economic states as well.

Bad Times Mean High Rents (what did he just say???)

The core of my program is to buy properties and rent them then eventually sell them. Buying for the purpose of renting requires you adopt a completely different mindset than what you’ve ever experienced before. Prior to this, perhaps you were simply buying a house to live in. Fine. That’s another book entirely. Or maybe you’re a renter residential or commercial. That’s another completely different book. Now you are buying to rent.

People who have just lost their home due to foreclosure or bankruptcy are often shocked to find that rents in their area are far higher than they expected. Why? Good old supply and demand.

If a person loses his home and it is an isolated incident, anything can happen— he may find high rents, low rents, no rentals, or lots of rentals. It all depends on the market.

But if a person is part of a regional or localized trend—think of, perhaps, a large employer going belly up and leaving hundreds of workers standing in the unemployment line—then the incident is not isolated; it is broad. It means lots and lots of people who once had homes will no longer have homes. That means that they all become renters at the same time. And when that happens, landlords can raise their rents, since people will be trying to outbid one another in order to find a roof for over their heads.

Yes, I know this all sounds cruel. You’ve probably never thought in terms of capitalizing off of someone else’s misery before. But like they said in The Godfather, “It isn’t personal; it’s business.” When a home must be sold because it is in foreclosure, someone has to buy it. The person or entity who owns it wants someone to buy it. No one wants it to just sit there vacant forever.

These are the sorts of properties we will be looking to buy. Furthermore, the person who used to live there quite possibly will be staying in the area and will now need a rental property in which to live. Would you believe, it is quite common for people to buy a house that is in a “distressed sale” situation—due to bankruptcy, foreclosure, or simply needing to be preemptively sold in order to raise cash so as not to have to go into foreclosure or bankruptcy—and then turn around and rent the darn thing back to the old owners? It happens all the time. Frankly, it’s a win-win. The person with money problems gets out of debt; then you, the buyer, come along, get to buy it at a “discounted price” (a motivated seller is a buyer’s best friend) and there’s a built-in renter looking for a place to live.

The Chickens Come Home To Roost

Every era has its fads—and I’m not talking about fashion or music. In real estate, there is always some “new cool thing” that everybody wants to jump on board. In the ’80s, it was assumable mortgages. In the ’90s it was “mortgage wraps”—where you’d take one mortgage that was at a low rate, combine it with one at a high rate, and “blend” the rates together to give you one middle rate that you thought you could afford.

This decade, we had one hundred percent financing (no money down), negative amortization loans (you can begin with payments that don’t even satisfy the monthly interest, thus raising, rather than lowering, your principal each month) and interest-only loans.

The problem with these fads is that all the wrong people purchase them. It’s the person who looks at life like a big scratch-off lottery ticket who thinks he’ll “hit it big” and be able to afford that big ol’ mansion who gets that interest-only loan. That kind of loan product attracts the person with no patience. That person wants that big house NOW. The fact he cannot afford it means nothing, not if some lender has some crazy “designer mortgage” deal that can get him inside his dream house anyway.

But then the chickens come home to roost. Today, as I write this, is just such a time. These whacky, unconventional mortgage products do not let you go on forever paying interest-only or less than interest-only. That part of the deal is usually only for a short, finite period of time—maybe three years at most. What happens then? The piper must be paid. And what happens then to our eternal optimists who thought judgment day would never come? They’re out selling their houses at fire-sale prices—or else! And if they can’t move them quickly enough, they lose them through foreclosure or bankruptcy. In any of these three possibilities, the end result is the same—a house getting on the market, being sold for less than it should, and another renter coming onto the market as well. Terrible as it may sound, this is what we are looking for.

Increased Inventory

So let’s keep focusing upon this recessionary market phenomenon. A local or regional economy is in the pits. Unemployment is on the rise. Lots of homes are on the market, many because their owners have to put them on the market. The worse the

economy, the more recessionary the times are, the more housing inventory you can expect to see. The more inventory there is on the market, the more it becomes a buyer’s market. Gone are the days of people trying to outbid each other for a home. Instead, the homes sit on the market longer and longer, and eventually they have to lower their prices in order to attract buyers. This is when you buy!Wean yourself away from the “hot, hot, hot” market. That market is overpriced. Look for the “make me an offer…please!” market.

Higher Rents

When recession hits an area, the number of renters increases. Furthermore, when that market of renters increases due to foreclosures, bankruptcies and distressed sales, these new renters entering the market are probably only looking to go down a few levels, so to speak, on their monthly expenses.

Here’s what I mean: Someone is in a big McMansion paying his interest-only mortgage for three years, when the time runs out and he must make larger payments that he can ill afford. Perhaps, his interest-only payments were $1,800 per month. Now the mortgage company wants to increase that to $2,200 per month and he can’t afford that. So he sells his house at less than market value, just to get out of debt. That guy no longer has enough for a down payment and his credit has been beaten up as well, so he’s looking to rent.

Well, we already know he paid $1,800 a month for the last three years. And maybe he could barely afford that. So where is he now, financially? No, this guy is probably not looking to live in a $250 a month outhouse. Most likely, he’s doing a bit better than that. His number is maybe in the $1,400 per month range. That’s a decent rental rate, if you’re a landlord. In fact, if there are a lot of renters out on the market looking to spend that kind of money, two things happen. One, you can take a rental property that should normally go for $1,400 per month and get $1,500 per month for it. It’s called bidding. If your phone is ringing off the hook with lots of people all willing to meet your $1,400 a month price, see if any of them will go higher. They probably will.

The second thing that can happen is you can take a property that is more decrepit and should only be worth $1,200 a month and get $1,400 a month for it. Supply and demand; supply and demand. You can get away with spending less in rehabbing and general upkeep on your rental property. If your tenant complains, there’s a line of people behind him willing to put up with the condition your property is in. I’ve seen this happen all the time. When there’re not a lot of renters and lots of rentals, the landlord has to slap down a new paint job, install new carpeting, put in new windows, etc. When there is a down market with lots of renters and not enough rentals for them, you can leave that paint and carpeting alone. If the tenant wants upgrades, he can do it himself or pay you more per month. Either way, you win.

But You Said FOLLOWING “Down” Markets

Yes, indeed, I did. So as not to contradict anything I’ve taught you thus far in this book, there are recessionary times, and there are areas that are simply going to keep bottoming and bottoming and bottoming for many more years. When that happens, eventually your rents will have to start dropping as well. So, too, eventually there will be less and less renters. I mean, if there are no jobs (the quintessential recession), who the heck is going to still be living there? No one! Thus, everything I’ve said before about cycles and market stimulants remains true. You want to buy after a “down” market (recessed market), but before the market gets hot. Once it’s hot, it’s too late.

You will be tracking the recessionary indicators in a market, such as foreclosures and bankruptcies. But you will also be looking at those market stimulants to see if they are gathering to help bring the area out of that recession. You want unemployment (it pains me to say that), but you want jobs on their way, like a white knight on his steed.

Another major thing that brings lots of renters to the marketplace is new employment. Think about this: Say you lived in St. Louis and got a great job offer in Orlando, Florida. While you might take that big deep breath and move down to Florida, would you also immediately BUY a home there? Most folks don’t. First, they want to make sure the job is a good fit. For that reason, a lot of people don’t even sell their old home back in St. Louis or wherever. Secondly, they don’t know the local market yet. It takes a while to become familiar with a place in order to decide what community is best for your needs. For some, schools may be the biggest priority. For others, it might be the shortest commute. Heck, I know guys whose only concern is the nearness of a great public golf course! But any way you slice it (golf pun), you still have a lot of people for whom renting—at least for a while—might be the most prudent choice. THIS is a great market for you, the owner of rental property.

But bear in mind—one of those market stimulants is “entertainment,” in which I included things like geographic amenities in an area. A major port city may recess, but will almost always come back; it’s just a matter of time. If an area has certain physical amenities like that, I will teach you how to run the numbers to see if buying rental property is economically viable even if the end of the recession is nowhere in sight.

There are some areas that are going to hold population despite recessionary economic times. In such cases, properties will continue to flood the market, the prices for them will keep going down, and the pool of renters will continue to rise. Such areas are very, very interesting. You may have to hold on to your property a lot longer before selling, but you will be able to “cash flow” it—make money off of it as a landlord—for a nice long time, all the while building equity, and eventually, selling off the property at a profit.

Foreclosures

There is a lot of misinformation around regarding foreclosures. It is not my mission to school you in a lawyerly way about them, but I want you to be aware of how they affect my program and positively affect you as a real estate investor.

When a bank forecloses on a property, they do NOT necessarily have to recoup all of their money. I repeat: they do NOT have to get back all of their money. They would LIKE to, but I wanted a motorized car for my fifth birthday and I didn’t get that, either.

In other words, picture a bank holding a property that has a $180,000 outstanding mortgage on it. In a perfect world, they sell it for $180,000 or more. But what if they don’t or can’t?

If they can only get $140,000 for it, they will usually chase the old borrower for the balance. But that guy has probably already declared bankruptcy. If they get the money, great. But there’s a high likelihood they won’t.

So they “write it off.” This is no different than if you or I had business gains and business losses during a fiscal year. We add them together—the positive numbers and the negative numbers—and we finish the year with the sum total. Banks do that, too. So no, banks do not always sell foreclosed properties for what is owed. They sell them for what they can get. And most importantly—MOST BANKS WANT TO GET RID OF FORECLOSED PROPERTIES AS QUICKLY AS POSSIBLE. They don’t want to keep that property on their ledger sheets forever. For one thing, who’s going to take care of it? They’re certainly not going to spend more money to have someone fix and repair it. They will also not pay someone to sit around in it night and day. Do you know what happens to abandoned houses? They get wrecked. And what happens when they get wrecked? Their market value decreases even more! So go back to my tip in capital letters—banks want to dump foreclosed properties a.s.a.p. And what does that mean to you? FIRE SALE!

Now, some people think foreclosures are a great way to buy a home. Note the subtle difference in the words I just used. A “home” is something YOU live in. A “house” is something you buy, rent, and eventually sell. Buying a “home” at a foreclosure sale, you can be assured that you will have to dump a ton of money into it in order to make it feel like, well, “home.” This begins to seriously negate the great deal you got by buying a foreclosed property in the first place.

On the other hand, buying a foreclosure for the purpose of investment, i.e., renting to others is a whole different story. They are the biggest, most desirable fish in the ocean. We always want to buy something for less than it is worth, and nothing is more prone to such things as some form of “distressed sale.” “Distressed” may, in this case, also refer partly to the property’s condition, but what we’re really talking about is a highly motivated seller who will take any reasonable offer. Note my use of the word “reasonable.” A lot of guys with infomercials on TV make it seem like the world is teeming with foreclosures that are “literally free!” Not really.

But if I can buy a property for $80,000 that normally sells for $135,000, I just got a great deal. Furthermore, my ability to have purchased this property at $80,000 versus $135,000 might be the difference between owning something that I can rent with a safe cash flow or not.

Bankruptcy

Bankruptcies often follow foreclosures. Why? Picture this: You have a home with a $180,000 mortgage. The bank tries to sell it, but the highest bid is only $140,000. They take it and “write off ” the $40,000 balance. But you’ve already walked away from that house, so what do you care?

Start to care.

I mentioned before that the mortgage lender will try to collect from you, somehow, someway. So if you do have something, anything, that they can attach or grab, you might be advised (correctly) to declare bankruptcy in order to hold on to something, anything, that you own.

The other possibility is even more insidious. When a bank “writes off ” a loss, it will tell the IRS that this is “income” for you. Think this through—you owe the bank $40,000. You don’t have $40,000. The bank realizes it cannot get $40,000 from you anytime soon. So the bank tells the IRS that it has “written off”—“forgiven” this debt. That means that you once owed someone $40,000, but now you don’t. In the eyes of the IRS, that means that you just “received” $40,000! And the IRS expects you to pay taxes on this imaginary windfall! And THAT, my friends, could be the thing that drives you into declaring bankruptcy!

Now, if you have a foreclosure on your credit records, you cannot get a “conforming loan” mortgage for three years. A conforming loan is one that can be re-sold on the secondary mortgage market. If you can’t get one of those, your best move is just to wait out the process, because your other mortgage alternatives are so cost prohibitive that they’ll only send you into another foreclosure and so on. You’ll just be throwing bad money after even worse money.

But what does this all mean to you, the guy with good credit who wants to buy and hold investment properties? It means that when foreclosures or bankruptcies occur, that’s another renter on the market—another customer. And quite often, these are not super low-income, homeless (well, they kind of are homeless, but…), jobless people. They may be engineers, teachers, policemen, you name it. These people are rarely druggies or criminals. They just have trouble managing their money, or were simply poor at planning for when bad things happen. They make good renters because they are less likely to turn your property into a meth lab or throw furniture out of windows during wild parties. They’re family people who will take care of the property as if it were their own because they want to keep up the façade to their friends that they are still doing well and simply “got a new, smaller house.”

Want to know what else is funny about post-foreclosure and post-bankrupt people? Most of them think they can’t get another mortgage for seven years! That puts a lot of people, people with jobs and families, out into the rental market for a long, long time. Get a nice, stable tenant like that for seven years and you’ll be a very successful investor.

Now, here’s another quirk to all this foreclosure and bankruptcy talk. Remember, we are looking to FOLLOW “down” markets. What happens once these people get out of foreclosure and out of bankruptcy? What happens two, three, or seven years later? A lot of them will re-enter the housing market. They will be looking to buy homes and get mortgages again. And what will this do for you? That’s when you sell off your appreciated property!! Buy when they want to give you their house and sell when they are begging you for it!

It’s a beautiful thing.

Recession is Your Friend

What also tends to happen after a bad recession is that politically, the electorate wants a “kinder, gentler government” that will take care of those who suffered the most from that recession. And government, if it wants to retain power, tends to respond, or else is replaced by a government that does respond. And what do we mean by governmental response? Housing programs get created or more fully funded. Money becomes allocated for low-income housing and rental subsidies. What does this mean to you, the landlord? Good times! The low-income get subsidized housing, often via existing housing stock (such as your building!). The unemployed get employment, making it easier for them to pay fair-market rents. It’s a win-win-win.

And when the upswing in the market comes back, when good times are back again? Government cuts back the funding for housing programs. When this happens, you sell! And at a nice profit, after having gotten some cash flow and your overhead paid by renters for x number of years.

I’m telling you, this is a thing of beauty.