-3%

3%

• Zero to Five Percent Basically Flat, but Rising Moderately

• Five Percent Plus Rising, Beating Inflation

• Eight Percent Plus Really Rising

• Twelve Percent Plus Holy Cow, Was That a Rocket That Just Shot Past Me?

• Minus Two Percent Falling

• Minus Five Percent Really Falling

• Minus Ten Percent Good Lord, I’ve Never Seen Something Hit the Ground

So Hard!

• Minus Zero Percent Even, Flat

• Minus Five Percent to Zero Percent Basically Flat, but Falling Moderately

Easy enough for a baby to follow, right?

Now, some of you might wonder, “But isn’t it possible for there to be tons of inventory, and sales prices going sky high, and little to no foreclosures?”

No.

A glass cannot be both full and empty at the same time. You really can’t have your cake and eat it, too. These eight combinations are logical and make economic sense. Don’t believe me; ask an economist.

You might also wonder, what indicates “even” or “flat”? What indicates “up”? Foreclosures, for example, are typically at three percent. That’s the definition of flat. When it creeps below that, they are considered down; when it rises above that, it is considered up. I will give you guidelines for what is considered up or down for all the other indicators as well, as we move forward.

As you read on, you will learn how to chart and track these economic indicators so that you can tell what point in the cycle a real estate market is at. But first, you have to have a thorough understanding of the cycle itself. Here we go…

STAGE ONE

A key to understanding this chart: The cycle is drawn as a circle, so read it clockwise. We talk about a stage just prior to the numeral indicating that stage.

I start the cycle at the worst possible time: right after an unimaginable increase in property values (see data just prior to Stage Eight). The novice investor decides it is a good time to start investing now. Bad move. To invest now would be like buying at the top of the market, which everyone knows is bad. But the reason there are less rich guys in the world than poor guys is insecurity. Poor guys see a peaked market and they want to “jump on the bandwagon” with the rich guys. Insecurity. What they can’t comprehend is that at this stage, the rich guys will be the guys selling off to them so that they can get off that particular bandwagon. They know the party’s over and it’s time to go home, while the poor guys are just entering the club. Supply and demand. At Stage Eight, there were high prices and low inventory. Here at Stage One, inventory has begun to increase.

Low inventory = time to sell. High inventory = time to buy.

Builders will continue to build at this stage to use up the excess land they purchased earlier. Price climb has started to slow, due to the local incomes not being able to keep up with the rising house prices. Suburban areas begin to retract and lose value. As the builders continue to build, they experience increased failed sales due to purchasers not being able to sell their existing homes. This will further increase inventory as the wheel spins ’round.

Despite this, sales will continue somewhat, albeit at a less frenetic pace. Your market stimulants: entertainment, education, transportation, redevelopment and employment aren’t going to completely dry up overnight. They’re still there and will continue to create some sales.

Rents will be down because everyone will have made purchases during the Stage Eight boom and shortly thereafter. When sales are up, there are less and less renters.

STAGE TWO

Foreclosures begin to increase as homeowners experience a tighter market and the inability to cash out of their equity. Despite this, foreclosures will not be easily visible because they take time to surface upon the market. Foreclosures will create a downward force on sales prices for sellers who are forced to move distressed sales, desperation sales. When the guy down the street has to sell at any price in order to avoid a sheriff ’s sale, that affects the asking price for everyone else’s property.

The flat lines you see on the chart are not an indication of no activity whatsoever, but a plateauing of market action. Bear in mind that this plateau is still higher than a downturn. Activity is still occurring. In fact, a flat line (= or = = on our chart) means “moderate” or “average” activity.

If you are already in the market and already own investment properties, this is a good time to evaluate those properties to determine if they will continue to produce income through the years ahead. If they do not, I suggest liquidating those that perform the worst and paying down on the good performers.

This is a bad time to reinvest in more properties, even though you may have to pay some capital gains taxes as you cash out of the market. Your taxes on capital gains are less and far less risky than the loss in value and the hold cost through this recession, or to reinvest into an area that is cycling against you. On the other hand, once you have mastered this system, you will have already identified a completely different real estate market somewhere else, one that is perfect to jump into right now.

STAGE THREE

The foreclosed homes begin to hit the resale market. (It takes six to nine months to foreclose.)

At this stage, sales are low compared to the large amount of inventory. Rents begin to rise due to the inability of displaced people to re-buy after a foreclosure or bankruptcy, forcing them to become renters. Builders begin offering outrageous incentives to get buyers to purchase. Sales aren’t really horrible, but these guys are still on that “high” from Stage Eight. Anything less than sales going through the roof seems like a disaster to them. It’s easy to get drunk on success. Loan fraud begins to run rampant due to builders and sellers feeling the pressure of the down markets.

STAGE FOUR

Foreclosed homes seem to be everywhere. Rents are beginning to rise! The demand for rental housing is out-pacing the demand for ownership. Foreclosures are continuing to keep pressure on prices, driving them noticeably downward. Inventory is over-supplied, and builders have retracted plans for future projects. People are beginning to feel there is no hope to the market. (But we are just getting ready!)

STAGE FIVE

NOW! Rents have hit our guidelines. Due to rents increasing and prices falling, sales falling, and foreclosures rising, rents have hit or exceeded one percent of sales prices. This is a mathematical analysis you will soon be learning as we continue. But as we study a typical real estate market cycle, this is the time when you have the best chance to succeed in “Buy and Hold Investing.”

Buy and Hold is the simplest and most generic term to describe the cornerstone of my system. It is not about real estate speculation per se. It is about understanding real estate cycles, learning the indicators, and then going in, making investment purchases, renting out those properties, and getting cash flows while your properties rise in price and value. This is what other books on Buy and Hold strategies fail to teach you!

This strategy should give you a solid base of income to withstand the ups and downs of being a landlord.nSee, this system is only dummy-proof if you’ve made a commitment to not being a dummy! You do not need a Ph.D. to succeed with this program, but you do need a work ethic. You do need to be willing to do your homework. I will teach you how.

STAGE SIX

This is the Honeymoon stage. Your rents are increasing, and values continue to pace upward at five to eight percent. It is cheaper to purchase than to rent. Renters are seeing the value of purchasing again. There is a large supply of good rentable homes for purchase due to the lag time in the foreclosure process. You should continue to purchase wisely.

Note that last statement. It is not always possible or even feasible to make all your investment purchases at the exact same time. If each of these stages represents about eighteen months, perhaps you’ll make one purchase at Stage Three, another at Stage Four, go crazy and buy three of them at Stage Five our very best market position then one more at Stage Six. Stage Six is one of our last really good times to enter the market for Buy and Hold.

STAGE SEVEN

Values are rising eight to ten percent per year in your specific sub market. Speculative investing starts heating up. Fix and Flips (and Fix and Flops) are abundant.

If you still want to risk getting into the market (and at this stage, it is a risk), your best bet is to find high-demand new construction. Everybody likes “new.” Think babies and puppies.

Inventory is low. Rents are hitting resistance, forcing renters to purchase, which further reduces housing inventory.

It is increasingly difficult to find properties to meet our one percent strategy and you will learn that that strategy is sacrosanct. What kind of person buys property that rents for less than what it costs to carry the mortgage, taxes, insurance, and expenses? A speculator, that’s who.

I give very limited endorsement to pure real estate speculation. Speculation only gives you one way to make money the property value must rise and rise significantly enough to not only give you a profit, but a large enough profit to cover all the money you lost carrying that property while waiting for it to appreciate in value. Buy and Hold gives you cash flow and someone else to carry the expenses while you wait for that property value to rise.

But if speculation is your game, this is the time to get in. See, since it is you who will be carrying that property, not a tenant (or not completely a tenant. If you can find someone to rent for a little less than what it takes to fully cover expenses, that is better than an empty house), speculation must be a short-term thing. You want to try to sell that sucker in two years or less.

Look at our inventory indicator. At this stage, builders are having buyers wait in line to buy a property.

STAGE EIGHT

Values are increasing fifteen percent or greater per year. ( Prior to 2007 this stage would produce thirty to fifty percent per year appreciation, due to the ability for virtually anyone to be a speculative investor. Inventory is scarce and prices are unreal. It makes no sense to buy now and hold, due to rents being so low compared to prices.

This is also the final stage of purely speculative investing. Move forward with caution. If you still have that speculation itch that needs scratching, do not close unless you have checked and double checked prices and Days on Market. This is where greed kills. You must sell speculative properties before the market slows, or you may be left with a cash drain.

Some people at my seminars ask why I number the stages as I do. “Why not make Stage One the stage where I should get in and start buying investment properties?” The reason is this: When you are taught something, it still takes a period of using it “hands on” before you truly master it. Therefore, even though you will finish this book knowing all about economic indicators, how to find them and how to interpret them, I start the cycle with the easiest one to identify: The Boom. Stage Eight is the boom. Stage Eight is everyone going crazy the whole real estate world going crazy in some locale. Anyone can identify this sort of thing. The recent boom and bust in the economy, mortgage industry, and real estate market is a great example of a national cycle reaching Stage Eight then restarting.

Stage Eight is the peak of the market. What follows the peak is Stage One. All the craziness of Stage Eight is what gets your attention. Now that you’re focused, you must begin watching for the slowdown—Stage One. Once the slowdown begins, you’re in Stage One.

What’s also good about marking our cycles this way is that once your attention has been drawn by Stage Eight and you begin watching for the slowdown, the first thing I want you to do is…nothing. That’s right; nothing. When a baby is born, you don’t ask it to sprint across the delivery room floor. You let it lie in Mommy’s arms a while, getting used to seeing the lights and colors of the world. The poor thing isn’t even ready to walk yet, let alone run. Neither are you.

What I also want you to notice as you read through the cycle is the difference between what the consumers are doing and what the builders are doing. These are two separate players with two separate agendas. They each operate on a different rhythm. Builders buy land when it is cheapest. This is rarely when it is the best time for the consumer to buy a home for investment or otherwise. And just because a builder buys land does not mean that there are homes on it yet. That takes time. Builders will often be ahead of the curve, not only in their land purchasing, but also with their building schedule. It is not unusual for a builder to start selling units to a new development even though there appears not yet to be a market need. You and I would probably think that the best time to build housing was when there was a demand for it. What if I told you that most successful builders do not think this way? Builders build when it is most affordable to do so. They figure that the buyers will eventually come and they are right more often than they are wrong. Again, the builder knows what he is doing. He’s positioning himself for when the need appears. Two great examples of this is Shea Homes and Richmond American Homes, Shea uses it’s enormous wealth to speculate on land sometimes fifteen years prior to development plans. While Richmond American Homes saw Stage Eight quit purchasing large parcels of land knowing that there was cheaper land coming in the future.

One of the things that makes these developers rich is that a lot of consumers see that new construction and figure, “Hey, I bet these guys know about some new big employer coming into the area. I better buy up a few of those units and watch my investment grow.” Well, what if I told you that the guy the developer was waiting for was YOU? The developer only has to sell the property once, and at a reasonable profit. Once he’s sold it to you, the investor, he’s gone and now you’re the one looking for a way of reselling the property or finding a tenant. Being a developer is a big money venture, and the guys who last are geniuses at what they do. We, as consumers, will often watch them and pick up market signals from them. The genius on our end, though, is knowing what to do with what we see.

Bear in mind, though, while I will teach you to be on the lookout for new construction (the activity of the builders), this is not the only thing that affects Inventory. Inventory is the total number of properties on the market at any one time. It is possible, though rare for there to be a large housing inventory somewhere at sometime without any significant amounts of new construction. This sort of thing might be caused by a major employer or employers leaving the area, and its employees leaving the area with it. This would dump an awful lot of homes onto the market all at the same time. Never forget the Ripple Effect and the Market Stimulants. There are negative ripples and negative stimulants, too.

When you are working the system perfectly, you are buying at around Stage Four, selling and getting out at Stage Eight, and sitting out Stages One, Two, and Three. Another question I get asked a lot is, “How high is up? How low is low?” It’s the classic gambler’s query. Yes, it does become a little challenging figuring out if your cycle is at Stage Seven or Stage Eight or even Stage One when you’re looking to cash out. But that’s greed talking. If you bought at Four, Five, or Six, you will make money selling at Seven, Eight, or One. Yes, you will make the most money at Stage Eight, but if you get out at Seven, don’t kick yourself. You made money; I guarantee it. What you really don’t want to do (and this is a greed-driven thing) is get drunk on property appreciation and start buying a lot of properties at Stage Seven, hoping to quickly get out at Stage Eight. That’s like day-trading. It’s risky. It’s called “chasing a trend.” You’re the tail and the trend is the dog. That’s not where you want to be.

If you buy too early if you buy at Stage Two or Three when you should have waited for Stage Five, you may have some expenses in your first few years of ownership. You may have some sleepless nights. But you will survive if you hold on.

An even better answer to the “how low is low?” question is…

it doesn’t matter!

What matters is that rents must exceed costs. Again, what is unique about this system is that rents are the most important factor. If you can purchase a property that you can rent for $1,000 a month and your costs (mortgage, taxes, and expenses) are $900 per month you win. If you later discover that you could have waited to buy that property and had only $800 per month in total costs and still have gotten that $1,000 a month rent, don’t beat yourself up. The system will still work out for you. Your only concern should be that the rents sustain at a level above your costs. Once that turns sour on you, get out, get out, get out. But waiting for lower-than-low prices, despite the existence of rents that will create a nice cash flow as is, is foolish greed. The key word is opportunity. If the opportunity is there to purchase cashflowing properties, grab it. Those properties may not be there tomorrow. Someone like me may buy them out from under you if you don’t move quickly enough.

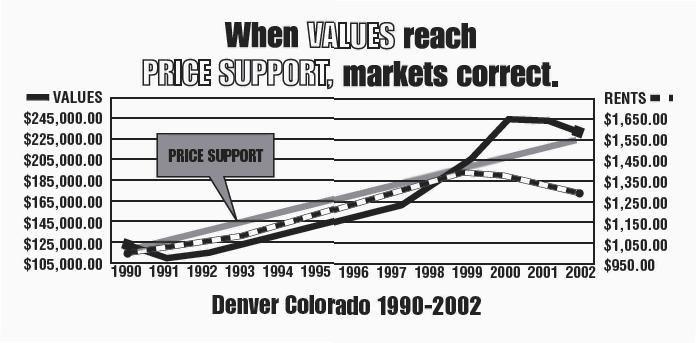

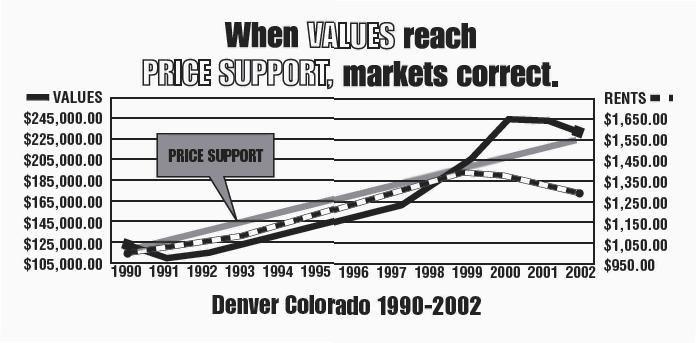

See, looking at the chart, we demonstrate that were we to

have purchased a rental property in 1991, ’92, ’93, ’94, all the way through ’97, we would have had our costs supported by the rental market. That’s our goal; that’s what we are looking for.

But again, remember the baby analogy. When you put down this book, you will have learned a lot of things you didn’t know before. Once you start putting it into practice, your knowledge will grow even more. Pretty soon, understanding the difference between Stage Seven and Stage Eight will seem like child’s play to you.

I know I started the chapter with this, but let’s talk for a moment about why a real estate life cycle is approximately twelve years and why markets need to cycle at all.

For one thing, look at stocks. Consider two companies: Chrysler and Apple. Both hit the skids at one point in the not so recent past. But both took that time period to reinvest in Research and Development and retool. Stock prices dropped as this reinvestment was taking place.

Finally, when things looked gloomiest, both companies rolled out their new products: First, Chrysler came out with the sporty, funky PT Cruiser, going after the youth market along with some wild and crazy baby boomers. Then they rolled out the Bentley-like Three Hundred, which cross-appealed to urbanites as well as the older crowd. Chrysler was back in the game.

Apple? The iPod brought them back from the dead. Now the iPhone is putting them through the roof. The approximate length of time of the cycle from beginning to end? About twelve years.

Cities and towns go through the same thing. Areas fall out of favor; businesses move out. The towns themselves come under political pressure to find employers to reenergize the local work force. They shake down the state and the fed for a reinvestment of funds in order to create new highways or other destination projects. This is identical to the R&D cycle that corporations go through. This is a fortuitous time for the private sector, because they will accept a variety of monetary incentives to come into an area. They also figure they can get cheaper labor and they are right. High unemployment is good for a new employer coming into a market.

Then the “new product” is introduced and things start to happen. In this case,

the new product is that new super highway, that new hospital, that new multi-use development, or more likely something from the recent stimulus plan like a small town in the mid west that didn’t have high speed connectivity. Now a start-up tech company has opportunity to grow in a new low cost environment. Finally, success starts to breed success and there’s a boom happening.

It does not always take exactly fourteen years, but fourteen years is quite common. What I will repeat and repeat and repeat again throughout this book is, cycles must be watched. If you make a mistake and buy a stock when it is at its peak, what’s the worst that can happen? You’ll have tied your money up and missed better opportunities. You may have to keep that money tied up for a long, long time before the stock price gets to that level again. But if you buy real estate at the wrong time, it costs you month after month after month. If you buy a share of Disney stock at $200 and it drops to $40, Mickey Mouse isn’t going to show up at your door once a month for a handout. But if it’s real estate, your mortgage banker will. You can hold on to that Disney stock for as long as it takes until, eventually, the stock goes to $210 a share and you can get out with your big $10 profit. But if the same thing happens to you in real estate, you would have to wait and have an infinite amount of money in order to hold on until your property rose five hundred, six hundred, seven hundred percent in value so as to make up for the money you lost during all those bad months. And frankly, it may never happen. If you follow the lessons in this book, this will never happen to you.

Furthermore, don’t downplay the “missed opportunity” position. You are tying up real money, real credit. If some property is bleeding money from you every month, no bank is going to lend you more to make up for it in some other market. You will have missed that rocket to the stars while you’re on a one-way train to Loserville.

Acknowledging the existence of cycles is also important insofar as understanding real estate investment itself. You cannot buy in your own local market each and every year. There is almost no way that such a program could be financially profitable. Accepting the concept of cycles helps you to understand this. It also triggers us to move outside our local comfort zone. Sure, you could track only your own locale. That might mean you would finish this book, do some calculations, and realize it would be a bad idea to invest in your local market for another five or six years. Now, I am assuming that since you have this book in your hands today, you want to start making money today not five or six years from now (of course, you’ll want to make money then, too, but…). It would be frustrating as heck to have to wait for years to start putting this program into motion. Remember what I said about cycles and markets: Somewhere, today, there is a perfect market in which to invest. I’ll teach you to find it; I’ll teach you how to buy into it; the “doing” will be up to you.