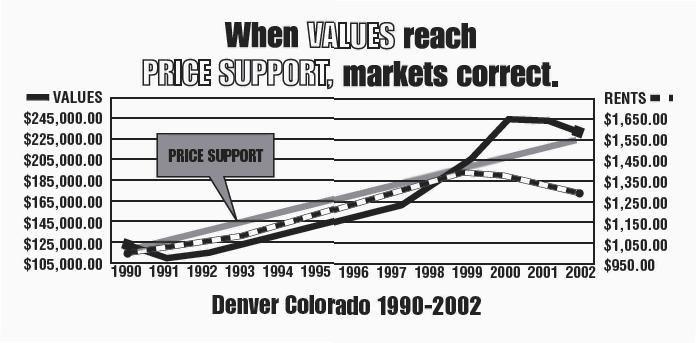

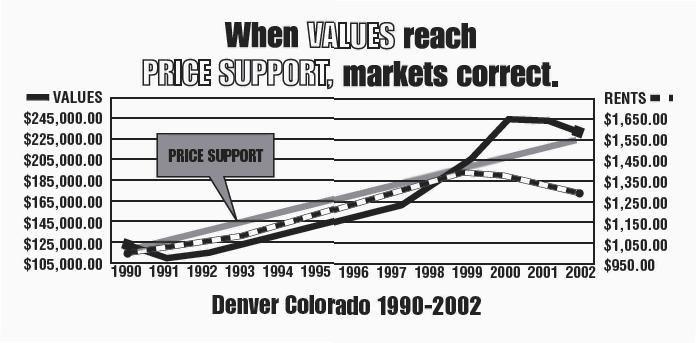

Price Support

Markets Correct When Values Reach Price Support

When people who don’t normally invest in real estate enter the rental market, the market eventually begins to correct itself. In other words, there is a window of opportunity when things are too good to be true.

Say you are your basic individual. You don’t normally invest in real estate, unlike some of the big guys. Suddenly, whether you figured it out by reading this book or whether it was just that you’re an intelligent person with your ear to the ground, you can’t help but notice that you can buy a property that will cost you $1,000 per month in debt service and other expenses (taxes, maintenance, etc.), but you can rent it for $1,400 per month. You’d be crazy not to jump at that investment opportunity.

Now, the beauty of this is in its simplicity. You can make this particular investment decision without concern for property appreciation, for example. All you have

to know is that you will make money today. Believe it or not, this is considered a far more conservative investment strategy. Banking on the future appreciation of a property is speculation. In this instance, you’re not speculating at all.

There are only two times in the Market Cycle that “common people” will buy more than one property. One obviously is when the appreciation is greater than ten percent. The income a property and each month the value is going up $2000.00 anyone who has that ability will consider purchasing another property. Even if they lose a few hundred a month! This created the “Housing Bubble.” The reverse of that is also true. Even if values are flat or declining, if rents are stable and increasing and a property will pay you $200.00 a month after all its expenses are paid the “common person” will consider purchasing additional properties. This is what causes the correction in values and is known as “Price Support.”

Once a property proves that it can consistently throw off a high rent, its perceived value will increase. If you are already in possession of that property, this is great for you. Why? Because, obviously, people will likely be willing to offer you more money for the property than what you paid for it. The positive cash flow from your tenant or tenants is proof of a greater value.

Now, suppose you buy a property for $90,000 and can rent it for $1,400 per month. This is great! But after a while, comparable properties in the area lower in value even more to, say, $70,000. Should you kick yourself? No! Sure, it would be a great world if you could precisely predict just how low a market will go before you buy into it. But that’s a dream. All you need to know is that you picked the right point in the cycle and that you are cash-flowing today. Because those rents provide a price support, even if that property drops to $70,000, we know it will soon climb up to $140,000 to $150,000. Don’t get greedy!

Have you ever met Kenny Can’t-pull-the-trigger? He’s the fellow who always says, “The price is dropping; I’ll wait a little longer.” No matter how low the price gets on anything, he never pulls the trigger because “it might get even lower; then I’ll have a really great deal.” Poor Kenny talks like a big shot. No matter what you’ve paid for something, he tells you that you overpaid. The problem is, Kenny has nothing because Kenny never makes a deal. Don’t listen to him!

Our only concern, even if a property is cash-flowing today, is that you’ve checked out your economic factors so that you can feel secure that the rent will not decrease, or

at least that it will not decrease enough so that you are not cash-flowing. (Rents decrease due to oversupply of rental housing from increasing unemployment and population loss). That brings

us back to our market stimulants and how we have to keep our eye on them. Every part of this program leans on every other part. I will never ask you to do something simply as a form of exercise. This is about making money.

You are not buying a house—you are buying a market!