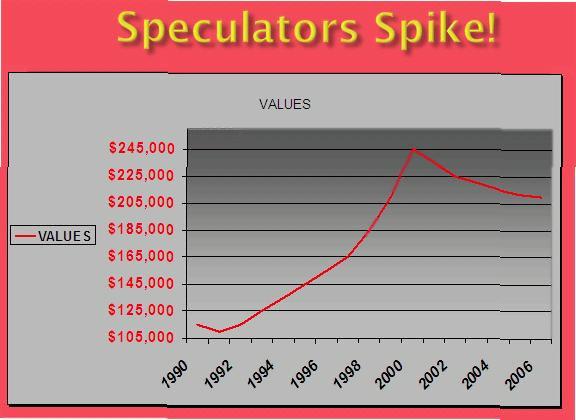

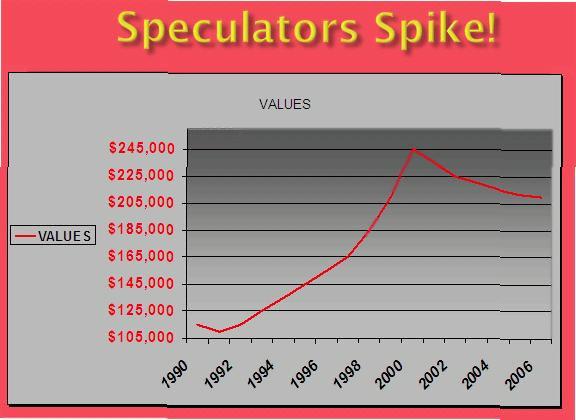

Speculator’s Spike

During Stage Seven and Eight large amount of Speculation cause a peak in the market called The Speculator’s Spike. The Spike occurs from the last minute increase in volume into a market usually caused by inexperienced as well as some experienced investors purchasing multiple properties. As you can see in the diagram at the beginning of this chapter, the last few years appreciate rapidly due to the increase in volume, multiple bids, and wait-lists. When logic is removed from investing, a feeding frenzy often occurs, thus overpaying is commonplace. Then when the market corrects due to falling rent and the inability for employment to keep up with the rising cost of housing, the overpaid prices punish the late arrivals. You will lose fifteen percent to twenty percent of what I call “fluff ” after the Speculator Spike. Fluff is just what it sounds like; it is fantasy—unreal numbers where people are chasing after imaginary fiscal ghosts. Imagine two crazy people at an auction, bidding up and bidding up some worthless piece of crap. Is the thing they are bidding on really of that high a value? On one hand, yes, because these two yahoos are willing to pay that much for it. But the reality is that outside of those two guys, no one else accepts that what they are willing to pay is the true value of the object in question. When the same thing happens in real estate— and it does all of the time—you get a Speculator’s Spike.

An example of pure speculation is when you buy a property in an area that is

appreciating enough that the negative cash flow from rents does not really hurt you. Example: I bought a home in Grand Junction, Colorado, for $173,000. It only rents for $1,300 because the median income there is $42,000 per year, so I am negative about $200 per month on it—I cannot rent it so that it cash-flows, and so I am reaching into my own pocket each month for about $200—but it has been appreciating fifteen percent per year. I will track the trends and plan on being out of that market ASAP. At that time, I will be taking a small profit, but I won’t be in long enough to lose money. Remember, don’t be greedy; be conservative. The idea here is that losing $200 per month translates into losing $2,400 per year. That’s not a lot of money. If that property is appreciating ten percent per year, depending upon what I originally paid for it and how long that appreciation goes on, I could be cashing out with, say, a $25,000 profit. Wouldn’t you give away $2,400 in order to make $25,000? Of course you would. But only if you knew what was going on and knew that your $2,400 would turn into $25,000! That’s why you have to learn this stuff before you go off half-cocked.

The Speculator’s Spike is fool’s gold. It is an insane market that will cause you to sail your financial ship into the hull-ripping reefs of reality (don’t you just love my metaphors?). Properties that go up twenty percent or thirty percent in a matter of months are not the product of marketplace reality. It is artificial; you must always remind yourself of this. If you get caught up in it, keep your head, take profits, and get out; get out today instead of tomorrow. It is the fools who will stay in the market and keep buying and buying, thinking the markets will never correct. But markets always correct.

When markets get so crazy that there is a Speculator’s Spike, you should be a seller, not a buyer. The people getting into a market and driving the prices sky high are amateurs. It is Joe Blow who never invested in real estate before. He sees properties going up, up and up, so he thinks he can grab one and make big bucks. Don’t be that guy; sell to that guy. He’s what is causing the Spike. Take his money from him and run.

Where Does Speculation Fit In?

So when it is all said and done, Speculation is the putter in our golf bag; the smallest club that we only pull out at the point of the End Game. As the cycle goes ’round, right before the cycle goes completely bad there is the opportunity for Speculation, and, if you are feeling frisky, you can get in on it. The key here is to understand that you really are at the end of the good part of the cycle and that you must get out quickly, taking some profit with you. If you can cash-flow a speculative property for a short time, that’s great. But there is something seductive about having a tenant carrying your load for you. You can start to believe that tenant will always be there for you. You get complacent. The problem is, a tenant can pick up and go at almost any time. When cycles get bad, it may be because employment is drying up. Your tenant may lose his job or relocate and he will disappear on you while you are thinking that everything is hunky-dory. Then, exposed to the elements of the real marketplace, you suddenly see that your tenant was shielding you from the fact that you should have dumped that property months ago; maybe even years ago. Now that he’s gone, you not only can’t get a new tenant at almost any price, you also can’t sell your property unless you drop your asking price down into the gutter where you will lose your shirt.

Speculation is a high wire act and you must, must, must know when you are in the speculative point in the cycle so that you are already planning your exit strategy almost from the moment you close on the property. Speculation is a quick hit and run. Greed and complacency are your enemies. Greed will also make you hang on too long, thinking that if you wait just three or four more months, you will make another $10,000. Hey, if you can get out with, say, $60,000 in profit today, don’t kick yourself if you find later that you might have been able to get $70,000 had you waited a little longer, because right around the bend from that $70,000 profit might very well be a situation where you’d be on the market for eight or ten months and then selling at a loss. Always study the cycle and if you know you’ve bought during the speculative time at the end of the good times, take that profit when you see it and run with it. Get out while you still can and cash that check before it bounces.