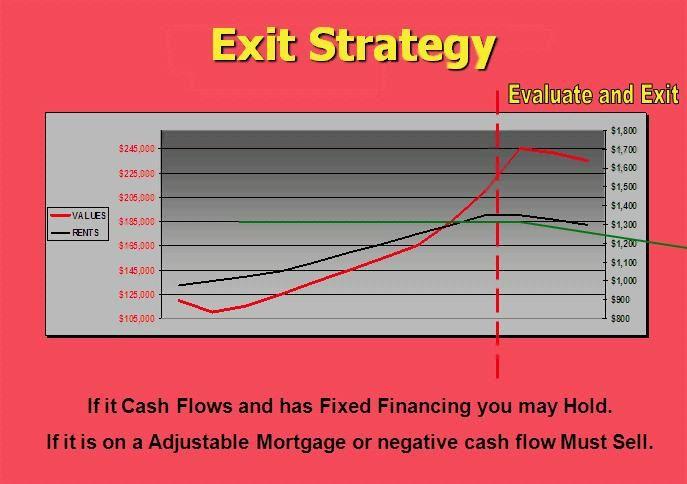

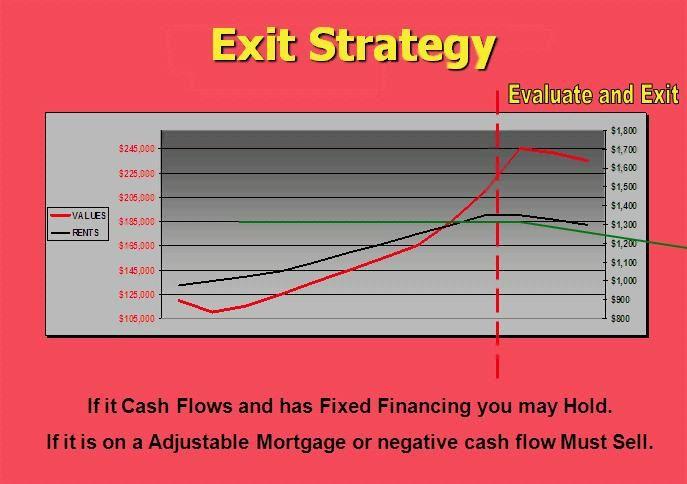

Exit Strategy

Okay, there is one more important talent for you to master before you put it all

together and make this program sound like a fully-integrated symphony of personal profit: How to get out.

Yes, as we discuss cycles one must realize that there is a time when it is most prudent to get the heck out, cash in and take some profits—or reinvest elsewhere, which we will also discuss.

You might be thinking, What is so challenging about getting out of a market? Isn’t it as easy as putting up a ‘For Sale’ sign? Well, yes and no. It is knowing when to get out, knowing why you are getting out, knowing what you are getting rid of and what you are keeping, and yes, knowing how to get out, which is more complicated that one might at first imagine.

Exit Strategy: When?

We have studied the cycles and we should have an idea from what we have learned in order to know when the time to start unloading properties is. On the other hand, sometimes it is challenging to know exactly where we are in the cycle at all times. Sure, if I lay it out for you in nice bright colors on a graph, anyone can figure it out. But real life isn’t like that. We see some things, we hear other things, and the media tells us conflicting information from time to time.

I’ve found that the single best way to know that it’s a good time to sell properties is when people are banging down your door offering to buy your property. This is a “dummies” method for judging when you are in a “buyer’s” market versus a “seller’s” market. When this begins to occur, you may start to feel that it is too early, that there is more money to be made if you wait a bit longer, maybe a lot longer. In fact, when I give seminars, I tell my audiences that this is the single toughest thing to do because it truly runs contrary to human nature. When people are banging down your door to buy your property is when all the media will be telling you that the real estate market is turning cartwheels and money is being made hand over fist. Why on earth would a sane person sell at a time like that? Easy. No run lasts forever. Make money when there is money to be made. Don’t get greedy. That’s the toughest lesson—we are all greedy by nature, whether we like to admit it or not.

The other thing we must look for are the rents. These are things we have at our fingertips—we see them with immediacy because they are right in front of us. Our property manager—if we have one—can tell us if the market appears to dictate that we can increase our rents or that we must decrease them, depending upon what they are seeing with other properties. Property managers are a great resource for current information because even if we do not have a vacancy or a lease coming up for renewal, a busy property manager probably has some other property that very month that is going through a changeover. Keep up a good relationship with your property manager so that you can constantly pick his or her brain for this sort of data. Bear in mind that population charts and employment statistics are very often way behind the times. Things change quickly and an upswing in population that is not reported until twenty-four months after it has occurred may be masking a population decrease that is occurring right now.

So theoretically here we are in what one might refer to as a real estate “bull market.” We will imagine that properties are increasing in value by ten, twenty or maybe even thirty percent per year. As for rents, for as much as people are lining up to buy our properties, our rents may actually be going down. These things will almost always go hand in hand, as we have illustrated in past chapters. Thus, if no one is actually knocking on your door to buy your property—because people don’t necessarily tend to do that with properties that are not, in fact, on the market—we can certainly track rents. Once we see that it is getting harder and harder to rent our properties, we should check with local real estate agents to see how sales are going. Look for comparables that have sold very recently. By doing so, we may suddenly see that properties like ours are going for a greatly appreciated price.

There is also the issue of “quality” of tenants. This is not meant to besmirch the reputations of specific individuals who wish to move into your properties, but the more renters there are, the more people line up for any one rental slot. You, as the landlord, get your choice of tenants. I have previously said that your best long-term tenants are often families. When the rental market begins to dry up because your past renters became home owners again, those families are no longer filling out rental applications. If we are running credit checks, our potential tenants are now more likely to have long term abysmal credit profiles. If and when we call previous landlords to check how they feel about these people as prior tenants, they are more likely to tell us that they would not rent to them again if given the chance. These things should be like red flashing lights, telling us that it might to be time to begin selling properties.

At the point at which you begin to notice these red warning lights, there are eighteen to twenty-four months left in the “good” part of the market. That’s how much time you have to get out. Stay in longer and you will have stayed in too long and you may begin to lose money. Get out too soon and…you’ll be fine. Again, this is the toughest thing for me to convey to people. If you sell now, you will make a profit. If you wait, you may make an even larger profit, but your risk goes up. I say, take a nice-sized profit and live to fight another day. Win small time after time, rather than always looking for the home run. Don’t kick yourself when your neighbor sells twelve months after you and makes twice the profit that you did. Never look back; always look forward.

Also, understand how these markets work. We know all about market stimuli. When real estate values skyrocket, lower-wage workers will start to get locked out of the market. They, in turn, will complain to employers for higher wages, citing the inability to be able to live in this market area. You cannot work for $2,500 per month if housing alone runs in the vicinity of $2,000 per month; you wouldn’t be able to drive a car or eat. If wages go up in order to match housing costs, large employers will begin to look around for areas in which to relocate in order to get cheaper labor. Workers will then be forced to either move to these new “boom” areas or…things will get very bad for them. This defines a recessionary scenario. You must get out before a recession hits. Remember— we buy as an area is coming out of a recession, not going into one. You must sell many or maybe even all of your properties before you, too, become a victim of this sort of market shift.

As bad as some of these signs sound, what will be deceiving is that speculators will sometimes still be flooding the market because real estate sales will still be increasing. A speculator only tracks real estate sales. They do not care about other market issues such as rents or employment. If a four-bedroom, three-bath colonial went for $400,000 last year and goes for $500,000 this year, that’s all they care about. Many of them are buying blindly—getting this kind of narrow data from charts and reacting like a financial SWAT team. Great for them, but potentially confusing for you. In order to keep your eye on the ball, simply keep apprised of what I’ve taught you: Are the number of renters drying up and are real estate sales appreciating? Once that occurs, put properties on the market.

But Which Properties Do I Keep (Buy and Hold)?

As you will see when we put this whole plan together and as I have inferred in the Buy and Hold chapter, there will be some properties that we will keep forever—or what passes for forever. In other words, in some cases we would like to position ourselves to own some properties long enough to pay off their mortgages and then make much larger monthly incomes from them since we no longer have mortgages to pay. So how do you decide which is a “sell off ” property and which is a keeper? First off, don’t feel the need to keep any property that does not merit keeping. Even when, in the next chapter, I am telling you to buy five, say, and then after a time sell off three, if you cannot find any that are truly worth keeping, sell them all off, take your profits, and ask for a new deck of cards. Ever play draw poker? The rules state you can only draw a maximum of three cards unless you have one ace and then you can draw four. Well, in real estate, you can draw all five if that is what is most financially prudent. I would rather you pay attention to the rules of this chapter so

that you can never be saddled with a property or properties that will break you and ruin everything for you. Take profits!

When population decreases, rents will come down. When market stimuli leaves, so do people and so do rental dollars. When the rental market gets worse, the renters get worse. The higher your rents, the worse your tenants will be; you will only get people who may have money, but they are otherwise completely undesirable—I’m talking property trashers, partiers, criminals, etc. If you lower your rent, you may be able to improve the quality of your renters (strange concept, but true), but you must still be able to make a profit. Once things gets really bad, even at a lower rent all you will get are terrible renters. And so you drop your rents again. Eventually, there may come a time when your rents dip below your break-even point—even to get a bad renter. When that happens, you really have to dump that property; in fact, you probably should have dumped that property a long time ago.

BUT…(big but) not every property will drop that badly at any point in the cycle. Yes, some properties will make you have to drop your rents, but they might never drop so low that you are not able to pay your mortgage. If so, that is a property you hang on to. Even if at its lowest point it simply breaks even for you; that’s a good thing. What you don’t want are losses.

The problem is that most of these losses are what we call “slow bleed” losses. Maybe your rents are exactly even with your monthly expenses. But what about property maintenance? The toilet breaks and you have to invest money into it. Now you’re operating at a loss. We know from the outset that things will break; we know that eventually major repairs will be required such as new roofs and new siding. Things do not last forever. But the real slow bleed is when you are losing $50 or $100 per month, every month. You mentally write it off because it really doesn’t amount to a whole lot, but you must still look at your overall financial picture. How badly is that one property dragging you down? Does it appear that it will turn around within some reasonable amount of time? Can your other properties carry it for a while? You must still look at all of your market indicators to make these judgments. But remember—look with your head, not with your heart. Don’t fall in love with a dog property.

Here is the best property to keep: Your break-even point—your monthly overhead —is, say, $800 per month. Perhaps you initially were only able to get $900 per month in rent. As you held and the cycle turned ’round, you eventually and gradually increased your rent to a high of, say, $1,400 per month. This is good.

Now the cycle continues to turn and your rents drop. But they do not happen to drop to or below $800—they only go to a low of, say, $1,000. Now, this is a major drop, both in dollar amount as well as percentage, but if even at your lowest point you are still cash-flowing, THIS is the property you Buy and Hold. You will probably live to see those rents go back up to $1,400, maybe even beyond. Furthermore, your property will be appreciating in value from what you bought it at and as you pay down your mortgage as well, you will get more and more equity— the definition of wealth.

And what makes all of this happen? Buying the right property at the right time in the first place! And so the decision of what property to keep is almost like a fate that has been sealed from the moment you bought the place. If you bought a property that once went for $300,000 but has now dropped to a wholesale price of $100,000, as it goes up and down and up and down throughout market cycles, you will still probably always cash-flow. If, on the other hand, you bought a property that once went for $300,000 and you got it for $265,000.—So what? This property will probably go through fluctuations where it will hit points where it will not cash-flow. You bought wholesale rather than retail, but not by a large enough margin.

A formula I like to run is to see if I can cash-flow if my rents were to drop by twenty percent. If so, I am probably good to Hold. It is usually rather unlikely that rents will go lower than twenty percent. If it looks like that will happen and if it looks like you can dump the property and not lose money, then dump, dump, dump. But figure that a twenty percent drop is usually the worst that you will have to sustain. If, when you run this formula, you see that twenty percent will take you below a point where you will cash-flow, then look at this property from the start as one you will most likely not hang on to for a long time. Watch for its appreciation and then sell when the time is right.

Properties that are not performing need to be sold off as soon as they can be sold off at a profit. Properties bought during the speculative period need to be watched extra carefully because we knew going in that these would be quick hit and run deals. When it appears that they have appreciated enough that we can get out with a nice profit—get out.

As you analyze the market cycle, you will probably come to find that the first properties that you bought—the ones you purchased right at the bottom of the market when the rents were the highest and the purchase prices were the lowest—those will probably be the only properties you keep. They will be your Buy and Holds. Almost everything past that little window you will most likely sell at a profit and forge ahead into new and different properties. The idea is that you will buy low and sell high and then take that money and do it again. When it works right, you will be buying one property, watching it appreciate while it cash-flows for you, then you will sell it and perhaps make enough to buy two other properties from what you made from that one property. The idea is to grow your real estate empire—you want to get bigger and bigger and bigger, giving yourself lots of equity and personal wealth—and this system will help you to make that happen.

Benefits of Nearby Properties

I’ve been preaching that you should be comfortable buying outside of your locality. But when it comes to deciding what to Buy and Hold and what to sell at the height of the market, properties close to where you live or work have a certain advantage. For one thing, you can save money and make them cash-flow better by managing them yourself. You can’t do that with a property three states away. For that reason, I tend to advise investors to think “Buy and Hold” more with nearby properties than with properties farther away.

Remember the Tides

Remember what we said about how real estate constantly pushes out from an urban or employment center, mimicking high tide and low tide. What we’ve also discovered is that the properties closer to the “bull’s eye”—that center—will be our best Buy and Hold properties. They will not likely appreciate as greatly as those newer properties out on the perimeter, but they will be less likely to lose their value below a certain point. Their swings during the best of times and the worst of times will be narrower and thus easier to prepare for and deal with.

There are an awful lot of ways in this world to make money. The most basic is to go out and get a job. But what most of us do not comprehend is that someone else woke up one morning and created that place of employment where other people got their jobs. Someone did not think to “get a job,” because if everyone did that, who would hire these people? Someone instead woke up and decided to create a job.

Some people also march to their own drummer by making what I like to call “passive income,” a term I’ve used throughout this book. These are people with jobs— jobs they themselves created or where they work for someone else—but they also have this “side business.” It can be something as slow to grow as a bank savings account, or it can be something as aggressive as what I’ve taught you about in this book—investing in real estate. There are also a million other things in between— playing the stock market, selling things on eBay, whatever.

The thing is, nearly every single one of these other forms of passive income involve taking money and using it to hopefully grow more money. It reminds me of an old saying: “Do you know the easiest way to make a million dollars? Start with a million dollars.” The point is, once you have a million, there are a lot of simple, fairly conservative ways of eventually doubling that money and making a second million. But doubling nothing equals…nothing. The concept is predicated on you first having a million dollars. Is that you? Perhaps not.

You can get all the stock tips in the world, but if you have no money with which to buy stock, the information is useless. Literally every other way to make passive income involves investing money in order to try and grow that money. If you don’t have money to invest, you are left forever on the sidelines of life…except for real estate investment.

Despite that, the world is full of financial advisors and stockbrokers. God bless them, they serve a very important need. But what about advisors for real estate investors? They hardly exist.

Real estate agents, brokers or Realtors? By and large, this is not within their job description. In some states, they are actually warned that they can get into a lot of legal and ethical trouble by even discussing property investment and property appreciation. They are supposed to present properties, help you make bids on properties, help you list properties for sale, and advise you on how to get the best price for your property when you go to sell it. Very little of this has anything to do with my program. I believe that in the future there will be real estate investment advisors the same way that there are stockbrokers. Have you ever gotten a call from a stockbroker touting a hot stock? I believe that in the future, your real estate investment advisor will call you up and say, “Tony, you really ought to look at these properties I found in Oklahoma City. The market there is perfect right now. Today is the best time to get in.”

By now you have finished reading this book—unless you just skipped it all and started reading from the back forward. You’ve learned an awful lot. The thing is, I know a lot of people who invest heavily in the stock market and who also have a lot of things going with their financial advisor—things like IRAs, 401ks, mutual funds, treasury bills, municipal bonds, etc. Some of these people are doing better than others.

The ones who are doing the best are the ones who made a point of learning everything they could about the kinds of investments they entered into. Sure, they may have left the day-to-day charting to the guys who do nothing but chart things all day long, but that doesn’t mean that they gave up all control and responsibility to someone else. If they got a hot stock tip, they probably put the guy on hold and then went to their computer and checked things out for themselves. That’s a good thing to do, but only if you know where to look and know what you are looking at. Thus, these smart guys have also picked up a few books along the way so that they can fact-check and double-check what they are being advised so that they don’t make a bad move.

The reason I bring this up is that I envision a day when people give this sort of advice in the area of real estate investment, perhaps even creating “one-stop shopping” for real estate agents, property managers and so on. Imagine that real estate advisor actually being the person you call when there is a repair problem at one of your properties in Oklahoma City, instead of the actual property manager. Some property managers are notoriously hard to get a hold of. If you’re working for a living, you can’t keep calling and calling this property manager all day long; it will distract you from your job. But your real estate advisor could take care of all of this for you. The same goes for finding a real estate agent a few states away and so on.

BUT…you should still read this book. A professional advisor can lighten your load quite a bit, but nobody loves you like you love you.

I was chatting with a guy the other day. He told me that he knows how to change a tire, but since he belongs to AAA, he rarely ever does change a tire if he gets a flat. “Sure, if I’m stuck in the middle of nowhere late at night and my cell phone has no bars I can change it myself, but otherwise, it’s a quick call to AAA and I let them do it for me.” I believe the future may be something like that. AAA exists because of people like my friend. In America, there are people who make a living doing every single thing that someone else might not want to do for themselves. Don’t want to walk your own dog? Hire a dog walker. Don’t want to go to the store for yourself? Hire a personal shopper.

Time is precious, but I believe that every minute you spent reading this book has been invaluable to you. Now you know how to become a millionaire in five years. Your only anxiety might be the time involved in all of the research and fact checking that I’ve suggested. That is why I believe that people will start springing up to fill this niche, which is something that I have already done. Check out my Website at: www.awsre.com. In the future, I also believe that the Internet will continue to change all of our lives. Right now, buying real estate outside of our home locale is still something that gives potential investors anxiety; I know, because I hear it every day. I think the ’net will begin to accommodate those anxieties and assuage them. More and more real estate listings are being made available via video file. The next step from there— which is already underway—is a full-fledged narrated video where a real estate investment counselor walks you through the property and not only points out the benefits and issues of the property ala a regular real estate agent, but also discusses the investment numbers and takes the camera around, showing you the neighborhood and the centers of employment. In short, I envision full-fledged infomercials

for individual investment properties, touting all of the information needed for an investor to make an educated decision about investment property purchases.

Further on down the line, I see a time when real estate is traded online similar to how stocks and commodities are traded on e-trade. I believe that investors and speculators will be as aggressive and informed as all other kinds of investors. With the exception of big commercial properties, real estate investment has for very long been a “mom and pop” venture, where a person gathered together some money and bought one house that they rented out—Buy and Hold. The concept of Buy and Hold, I believe, will continue on forever, but the “mom and pop” aspect of it will be replaced with greater sophistication and education, with investors such as yourself doing it in much higher volume. And again, I see the Internet Age making the world grow smaller and smaller, as the idea of living in San Francisco and buying property in Wisconsin becomes less and less strange and unmanageable.

Education, such as what you have learned in this book, will be the key to success in this new age, as will professional facilitators such as myself who will help take some of the grunt work off of investors’ shoulders.

In conclusion, there is simply no better investment than real estate. Only real estate enables you to invest without already having large amounts of money, yet through prudent investing be able to make a million dollars in your first five years. I hope you have enjoyed this book and that it has inspired you to roll up your sleeves and begin grabbing your piece of the American dream. Best of luck.