Chapter 14

How to Handle Taxes from Your Profits

The new tax law makes the short-term buying and selling happening under the system, the same tax-wise as long-term trading. No longer is there a tax break on long-term capital gains – this was true when I wrote this in the 80s; you'd have to check on the current status of how short-term capital gains on long-term capital gains are taxed as probably a change again this year as Congress wrestles with the debt problem.

The spreadsheets that you are keeping on all your stocks will also help you to figure your basis (cost of the stock) that you will need to figure out the amount of taxes on your profits. There are several ways to figure basis, all high falooting accounting terms like LIFO and FIFO. LIFO stands for Last In First Out. FIFO stands for First In First Out, I recommend FIFO. It will work out to be simpler. In the system you are going to be buying $5 shares of stock that will be sold as $10 shares of stock to greatly simplify the examples in this Chapter.

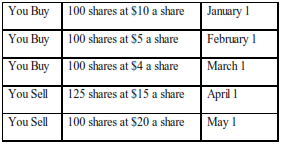

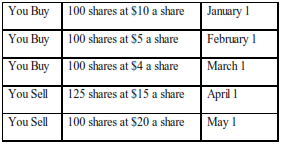

I’ll give a simple example of how this works:

This is hypothetical but greatly hoped for.

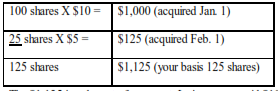

How would you figure taxes? I'll include commissions, phone calls and other deductible costs. Under FIFO, you use the cost of the stock you first bought (the oldest shares of the same stock you're selling). So the cost (basis) of the first 125 shares in the example above would be:

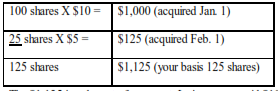

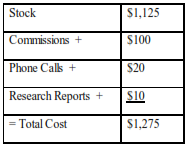

The $1,125 is only part of your cost. Let's say you paid $100 in commissions to buy the stock, had $20 in phone calls, and bought $10 in research reports. Here's your total basis:

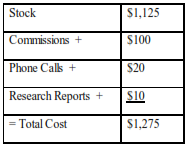

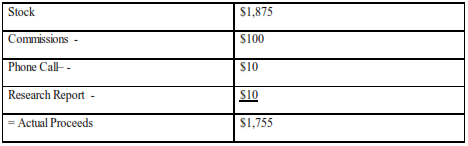

Now how much profit did you get? You sold 125 shares at $15 each for a total of $1,875. But did you actually get $1,875? Let's say you paid $100 in commissions to sell the stock, had a $10 phone call, and bought one research report for $10. Here's your total profit:

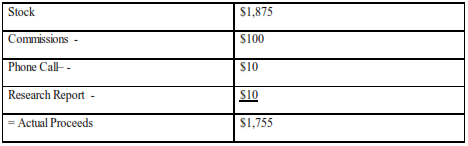

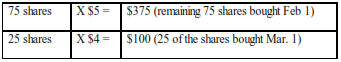

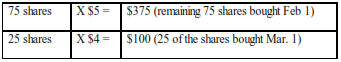

Next month you sell 100 shares. Your cost for these 100 shares would be:

Thus basis is $475 plus any commissions, phone calls, research reports directly related to this stock. Your actual proceeds are 100 shares X $20 = $2,000 minus commissions, phone call, and any other directly related costs. The government subsidizes some of your costs.

This is one reason you need to save all the statements that your broker sends you every time you buy or sell. Again in the high-tech world of today this is very easy because you can easily look up all of your buy and sell prices right on the broker's website.

On your scheduled D Capital Gains and Losses Form (see at end of chapter in the printed version), again you will find the Schedule D in your free Adobe Acrobat investing book. All you have to put on the form are the dates you bought and sold and the actual proceeds from the sale and the total cost. Then subtract the cost from the proceeds and the difference write in the proper place. Basis goes in column E and sales proceeds go in column D. Then add all your profits and subtract any losses (if you lost money from another investment).

You can take up to $3,000 and losses in one year. If you had more than $3,000 in losses, you have to carry it forward and use it in the following year. All your short–term capital gains are taxed at your rates for adjusted gross income. Long-term capital rates change often so consult the current year’s tax form. In reality for small investors, any differences between short and long-term would be so slight it is more worth worrying about. After you summarize your profits, the total amount goes on your 1040 on line 14 of the return – summary of Schedule D.

I don't claim to be a tax expert so if you have any questions in your mind see an expert. This will be your year-end look at how you did with the system. The bottom line is profits and you will see them and they will grow year-to-year. Good luck and may you be free from the chains of having to work at something you don't want to as soon as possible.

I've enclosed a copy of my 1987 schedule D that shows how I figured my taxes on my stocks. My basis was my cost per share from the original purchase on 7/25/86. It's easy to figure: all I had to do to figure the sale price was to subtract the commissions’ Blueprint charged. The forms Merrill Lynch Blueprint sends the gross (before charges) and net sales price (money you get). You report the net sales price. You only pay taxes on your actual profits.