Chapter 15

The System for Large Investors

It's time to take the system and see it in the real world. I'm going to show you how commissions affect the system and show you real world judgments used to improve profits. We’re always trying to maximize profits and you'll find that a few simple decisions will greatly increase profits. This chapter is for larger investors ($10,000 per stock) and will show large investors a gain of 568% after commissions for seven years. Your portfolio rose from $101,200 to $676,023, an average gain of 80% a year.

At the end of four years I evaluated the portfolio – remember I told you you're not married to your stocks. I had held all 10 stocks for four years. I only evaluated the stocks I owned once in four years for three reasons:

1) by doing it once I could keep the example as simple as possible

2) when I first wrote the book I didn't think to do it

3) by doing it once you see the dramatic effect – an increase of 76% in the fifth year versus only 16% the year before

In real life I recommend you evaluate your portfolio at least once a year. The best time to sell all remaining shares is when they are at or near the 52-week high for the year. This is the opposite criteria of what we want when we want to make our initial buy. Of course when we sell all our remaining shares, we immediately put all the proceeds into a new stock that meets our requirements.

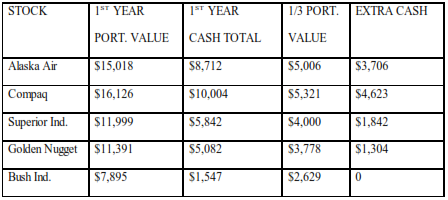

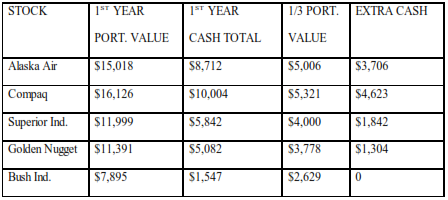

Look in the next chapter for the reasons I sold the five stocks and the reasons I bought new stocks. Also look in the next chapter for how to buy and sell so you buy and sell 100% of what the system tells you. The two chapters are almost identical except for the amount of money invested. Another thing we did to boost profits was to buy additional shares. After one year the CASH amount had grown larger than 1/3 of the PORTFOLIO TOTAL. We took this extra cash and bought additional shares of the same stock. Remember we make our profits buying and selling stocks, not collecting interest on large cash balances. Below is an example of what we did in the first year (same thing done every year):

Checking for extra cash is also something you should do at least every year. When you find some, buy more stock and remember to increase PORTFOLIO CONTROL by 100% of the amount of additional stock bought.

For the 5 stocks that I took the cash over 1/3 of PORTFOLIO TOTAL to buy additional shares, I made the discovery why PORTFOLIO CONTROL should be increased 100% of the amount used to buy additional shares. This is because if you only increase PORTFOLIO CONTROL by 50%, you get an immediate sell at the same price you paid for the new shares. This defeats additional gains from the purchases of new shares.

Remember the only times you increase PORTFOLIO CONTROL 100% of the buy amount are:

1) - when you initially buy stock;

2) – when you take cash over 1/3 of PORTFOLIO VALUE and buy additional shares;

3) – when you add extra money to an existing stock.

All other buys increase PORTFOLIO CONTROL by 50%. Read this chapter and the next chapter carefully and really understand the reasons for doing what they say. All reasons are based on the incredibly simple premise of doing things to make the highest profits with the least risk. You can read why we sold the five stocks in the next chapter.

Selling the five stocks gained us $86,433 (I subtracted $9,144 from the fourth-year total of $95,577 because our cash was minus $9,144 at the end of the fourth year) which we used to buy five new stocks in the fifth year. Thus each of the five stocks started life with $17,287. We kept the stocks for the next three years (years 5-6-7). After the fifth year we sold our remaining original five stocks because they had matured, were a little high-priced, and we had been doing our homework and found five new stocks we wanted to own. Our last five stocks started with $38,744 each.

Our portfolio grew from $101,200 to $676,023, a 576% increase or a compound growth rate of 30% the year for seven years. A reviewer of our CASH account will show ups and downs. I omitted the first three years of the CASH account because the total wasn't negative. For the next three years, your CASH portfolio only showed a negative balance in four months. In the seventh year your CASH account went negative for three months, hitting a low of - $24,424, however, look at your PORTFOLIO VALUE – at the end of the sixth year, your portfolio was worth $328,350 and at the end of the seventh year $676,023, a gain of over $347,000. I figure after doing the system for six years and being ahead over $200,000, you could come up with an extra $25,000 – it was worth it. At the end of the seventh year, your cash balances over $235,000.

Finally I'm sure a few errors crept into this chapter. I'm writing this book related night after working all day and my family breaks my concentration. Remember this is an art not a science and any discrepancies are very minor – anyway you look at this you made a pile of money – the system works! In December 1992 I fixed most of the errors.

Also I kept these examples as simple as possible and didn't use the system to the max. I only adjusted CASH once a year and always bought more shares of the same stock whatever the price. You can take the extra money and buy shares of another stock or one you already own that is at or near its 52-week low. Also I held onto stocks that if I owned for real I would've sold. For example, I would've sold all my Wang B in April 1991 when it hit $4.37 and the PORTFOLIO TOTAL was $66,128. Also you can adjust your CASH balance more than once a year.

I think you see how you can use the system for your maximum profit. You may think of some good ideas on your own. If you do, please share them with me and I'll put them in the next edition.

Again for simplicity sake, I omitted all the remaining spreadsheets for stocks used in this chapter. Again they can be found on my website: http://www.jjjinvesting.com – click on Books by Chapters hotlink and click Chapter 15. Again you will find some useful spreadsheets at the end of Chapter 15 in your free Adobe Acrobat version of my book.