Options as a Trading Vehicle

With options you get the right to control a stock for a limited period of time. You also gain leverage as you can control the stock with an option for far less money than if you buy the stock. Remember our examples – 100 shares of XYZ stock at $50 a share costs $5,000. We can probably buy an option call on XYZ Strike 55 call with five–month expiration for $1.00. So for the same $5,000 we could buy 50 contracts (I'm ignoring commissions here) or control 5,000 shares for the same money we can buy 100 shares.

That's the principle of leverage. And a small movement in the price of the stock will give us a large percentage increase. Earlier I told you that when a stock is at its strike price, it goes up quite sharply. Even on an out of the money option, the XYZ option will probably go up at least $.25 if the stock goes from $50 to $51 at the beginning of the option. So you will be up 25% if the stock just goes up $1.00.

I may repeat myself at times in this chapter and that's good. I want to hammer home many points about options and repetition is a good way to do that. Please make sure you understand this whole chapter well before you start trading options because as I said earlier – it is riskier than trading stocks or ETF's because of the time expiration factor.

Below I will show you again the great profit potential of options and their great leverage.

Be sure you understand what commissions you will be paying to your broker for options before you begin trading. Also make sure you completely understand how to buy the correct option of the correct stock before you start trading. If you don't understand how to do that from the broker's website, call your broker and have him or her explain how to you. From my experience brokers have made it very easy to identify exactly what option you want to buy. They'll be glad to help you. And in no time at all, you will feel comfortable buying options yourself from the broker's website.

One other thing before we get into the covered call options. The Securities and Exchange Commission is concerned for investors investing in options and they want you to read a pamphlet basically called the risks of options and your broker will want you to sign something saying you have read this pamphlet and do understand that options are risky.

Strategy #1 – Buy Call Options

ABC stock is selling at $26; you buy one call contract option at $30 and pay $.75 per option share or pay $75 for one contract of 100 shares. The commissions are very low so I'm ignoring them in these examples.

The "buy call option" gives you the right but not the obligation to buy ABC at $30 a share for a specific period of time (we will use 5–6 months’ time period for this strategy.)

For example: if you buy the call option in March 2006, you will be buying the call option expiring in August 2006 or September 2006 (remember they expire the third Friday of the month when they expire).

Below is potential for profits of options.

Remember you always want long time periods at least five – six months if you buy a call option, and if you want for longer, maybe even years, then buy LEAPs.

And

A short time if you sell a call option.

You buy the call option at $.75 for one contract. If you lose all of your investment, you lose $75 – so this strategy meets our goal of limited losses. We may decide to buy 2–3 contracts if we really feel bullish about this stock over the next 4–5 months. A couple of months ago Google would've been a good stock to buy call options on – now it seems to be a good stock to buy puts on again this was written 20 years ago so it might not be true today.

Let's say the price is $28 a share three days after we buy our option. The stock owner is ahead 7% on the increase in the stock price. Option owners are now 100% (your option bought for $.75 is now $1.50 per share or $150 per contract. You can sell the contract for the $150 because there is someone else willing to buy your option because he or she feels ABC will continue to go hire – the trend is bullish.

Let's say a week later stock price rises from $28 to $30 – bullish trend continues. Stock prices ahead 15% but option premium has risen from $1.50 per share to $2.50 per share or each contract rose from $150 to $250. You are ahead 233% on your options. Than a month later stock goes to $32. The stock is ahead 23% but the option is ahead 466%! You see the power of options.

I recommend the buy call options (gives you the right to buy a stock at a certain price for a specific period of time) for stocks you are bullish on, stock you feel will go up. Remember that my newsletter is giving you stocks at or near their 52-week lows. The stocks are definite candidates for buying a call. This is a low dollar amount risk that could lead to good profits. I will start identifying stocks I think are possible stocks that you may want to buy an option on.

Again remember that the normal options are usually good for as long as six months or so. But also there are long-term options – LEAPs which will expire in the third Friday in January of whatever particular year they expire in. I will suggest possible option candidates but I don't have the time to determine if all of my choices are even optionable. You can look at any I suggest in my newsletter by going to Yahoo Finance and typing in the symbol and seeing what options are available for that particular stock. You will find a nice example of an option listing I took from an earlier issue of Barron’s but it's just too big and bulky to put in an e-book so again go to your free Adobe Acrobat version to look at this spreadsheet.

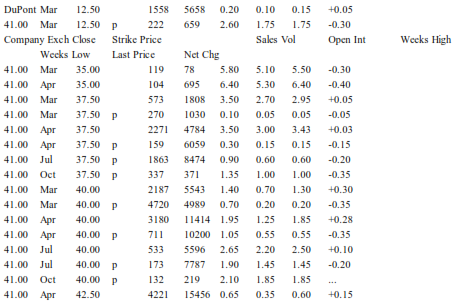

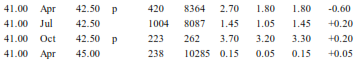

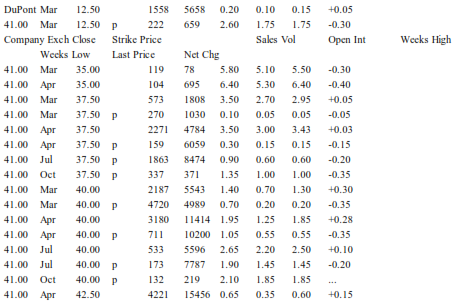

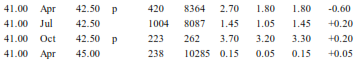

Barron’s Option Listing Example

The above gives an example of how Barron’s list options. The above shows the put and call options available on DuPont. They list weekly option prices after the market closes every Friday. This is a good way to see how your option is doing. Once you own an option you should track it daily as far as I'm concerned. And again time to radically change for the better for investors because now you don’t have to think about looking them up in a paper publication you can easily check the option prices for any stock very easily in Yahoo Finance. Remember the prices are per share so you have to multiply the price you see in Yahoo Finance X 100 to get the value of your contract.

If any stock you buy a call option on hasn't moved in two – three months, you should strongly think of selling your option and only incurring a small loss. Remember that options have the time value. The closer an option gets to its expiration date, the less it is worth. You can't win every battle with options. Cut your losses and try again – you can even sell your option that has only two – three months remaining in likely buy another option on that same stock that doesn't expire for six months and that option will be cheaply priced because of the downward trend.

Normally stocks in the $20 price range have strike prices set $2.50 apart. So on a stock selling for $20, you will find options with strike prices of say $20, $22.50, $25 and maybe even $27.50 or $30. The higher the strike price, the cheaper the call option. I would recommend paying a little more and getting a call option that is only slightly out of the money.

For example, if the stock is selling at $20, I would recommend buying a call option with a strike price of $22.50 or $25 but not higher.

2nd Strategy – Covered Calls

A covered call means you own the stock when you "sell" a call giving the buyer the "right" to buy your stock for a set period of time at the strike price. Use this strategy when you feel your stock is stagnant or bearish in the short term. When you "sell" a call, you ARE OBLIGATED to sell your stock to the buyer at the strike price.

You ask yourself – why am I doing this? You are doing this because you get to keep the premium from the buyer of your call option. Remember that call options are sold as contracts and each contract is for 100 shares – so if you own 325 shares do not sell more than three contracts (300 shares) worth of call options. You do not want to be "naked" when you sell call options (not own the stock that you are selling calls on).

Here's an example of what I propose you do:

Determine your outlook on the stock – you must feel the stock is stagnant, not likely to have a large price increase in the near future. You can look at your AIM spreadsheets and see what the price of the stock has been for say the last five or six months. And again you can always go to Yahoo Finance, type in the symbol of your stock, and then look up the historical prices of your stock on a weekly or monthly basis to see if it has been stagnant, not likely to have large price increases. You can look at your AIM spreadsheets and see what the price of the stock has been for say the last five or six months. And if there is no dramatic news that will boost the stock in the next month, then that is the stock you should sell call options on.

Sell call options against the stock – remember don't sell more call option contracts than you own stock on - see the above example - pick an expiration date – for this strategy we want a short strike price date. Pick the next month’s expiration date. So if this is March 6, 2006, sell call options within April 2006 strike date – one month or so is the right time. You want – you want these options to expire worthless.

Pick strike price "out of the money". Pick the first one that is out of the money. So if your stock is selling at $18 a share, the first strike price out of the money is $20. Thus the stock has to go up to at least $20 before the option has intrinsic value to the buyer

So here's our example:

XYZ stock currently selling at $18 a share – you own 200 shares.

You sell 2 call option contracts (all 200 shares) to the buyer, giving the buyer the right to buy your stock for $20 a share (strike price). Notice the option is out of the money.

For selling the buyer 2 option contracts, the buyer pays you a premium of $1.25 a share on 200 shares X $1.25 = equals $250. THE $250 IS YOURS TO KEEP FOREVER!

Three possible things can happen to your stock – goes up, stays stagnant, or goes down.

Let's say it goes up: say it goes from $18 to$20 – here's how you did:

Goes to $20 (unlikely you even have to fill the order – likely your broker just fills the order since it is at market price). Here's how you did:

- Made $250 from the option buyer

- Made $400 if you had to sell the stock

You made $650 which works out to a rate of return of 18% in one month and your stock only went up 11%!

Let's say the stock stays stagnant (doesn't go up or down very much):

- Stock still at $18

- Keep $250 from call buyer

- Then sell another call option for the following month May 06 for another $250

- Make 7% profit in one month on a stock that didn't move!

Let's say the stock goes down:

– Say stock is selling at $16.75

- You have broken even – the stock is down $250 but you made $250 from selling the 2 options. And your "loss" is a paper loss. AIM might tell you to buy some more shares because AIM feels that long-term the stock will go up. So you really didn't lose any money!

Always use short-term options not – LEAPs (long–term) options for the covered call strategy.

Remember with our strategy you want to sell "out of the money" calls (strike price is higher than stock currently selling for). You use out of the money options because the purpose of this strategy is to generate income from the premium you receive for selling the call.

You do not have to wait until an option expires to close it. You can close it and roll it over with options at a higher strike price.

You want to roll over your options. You want the income you earn from selling calls to continue month after month. So you want to roll over your calls. So as soon as one of your covered calls expires worthless because the stock did not go high enough for the buyer to exercise the option, you figure out a good strike price for next month and sell to more options against the shares you still own.

This lets you make a steady income from the premiums and let you hold onto your stock while waiting for it to go up. If you choose to have a short call and that call got exercised (very unlikely) then you would make profits both on the premium and on the rise in the stock. You can then either buy another stock that is at or near its 52-week low or rebuy the original stock if you still like it. But if you don't want to have to sell the stock, you can avoid that by rolling over your options for higher strike price options.

For example: you sell a call with a strike price of $25 when your stock is $21. Let's say your stock has risen to $24. You can close out your 25 call option and buy another option with a strike price of $27.50. You can often roll forward and up and gather higher net premiums.

Third Strategy – Aggressive

This is a good strategy for stocks that are stagnant, mildly bullish. We have the same outlook for XYZ stock – we feel the stock is stagnant and unlikely to go up much. XYZ is selling for $18 a share in February 2006.

- Buy the right to buy the stock (the call)

- Buy as close to the money as possible (for $18 stock, buy the $17.50 strike price call – by more time, get a five-month call – expires July 2006, the third Friday of the month. Let's assume the call costs 44 a share. For this example will assume you buy 12 contracts for $4,800 (1,200 shares X $4 a share).

- Then sell 20 call options at same Strike price of $17.50 expiring in March 2006 (you sell for $1,200 (1,200 shares times X $1 share premium = $1,200.

Three Possible Outcomes

Stock goes up:

Say stock goes to $20.

- Keep $1,200 selling premium – obligation to sell ends third Friday in March 2006

- Make $2,400 more – sell call options which are worth $2 each more than you paid, now worth six dollars).

Keep $1,200 premium

Make $2,400 on stock

= $3,600 profit

75% return on stock you never owned.

Stock stays stagnant:

- Keep $1,200 (25% return in one month).

- Still own long term buy option

- Sell another one month sell option (probably bring in $1,150)

Stock goes down:

(Must go down $1.50 a share for you to lose money):

If the stock starts to go down – buy $17.50 put option (gives you the "right" to sell the stock at $17.50 a share no matter how far down it goes. Probably you had to pay a premium of $.90 a share. Buy the same number of contracts you previously had call options on – 12 contracts.

Doing that gives you a profit of 3%. You keep $.10 a share. You make $1 a share on the premium you sold ($1,200) and you paid $1,080 for the 12 put contracts to eliminate your risk on the 12 call contracts you bought earlier.

Recommended Broker

At my class where I learned about options, our instructor strongly recommended using Options Xpress for trading options – visit their website at http://optionsxpress.com

Their rates appear quite reasonable to me. They charge a $1.50 per contract so in the above example 12 contracts would cost you $18. It's easy to place an order according to our instructor – I haven't tried to yet. You don't need to be a computer expert. Their site does have a lot of educational material to help explain options.

Please read all the information you can on options – there are fortunes to be made and you become familiar with all the various options strategies. With the right strategies you can practically eliminate risk. Once you open an account it is very easy to get a current quote. Just type in the stock symbol and Options Xpress will give you all the put and call opens and their current prices for any stock if that stock trades options.

Also, Steve, our instructor, said that Options Xpress will let you "paper trade" as a game with no real money involved. Again, you need to open an account and you can open an account for no money and fund it later. There is a hotlink right at the top of the Options Xpress homepage that you click to paper trade. Again I haven't tried that yet either. I'm too busy typing away so you get this chapter sooner rather than later!!

I would highly recommend that you paper trade for a month or two before doing this for real. But don't be like the guy Steve told us about. This guy told Steve he was making $100,000 a year trading options on paper. Steve asked him: "How long have you been paper trading"? The guy said: "15 years"! Sad, very sad.

Again remember is very easy to find out current quotes on any options by using any of numerous websites including Options Xpress to check on option prices.

Useful Websites for Option Prices

My favorite is again that very useful site Yahoo Finance. Again all you have to do is click on Finance and type the symbol in the box click, enter and when the summary page for the stock appears, just look on the left and click on the options button and you will see all of the various options listed. The option prices always defaults to the most current option or the one that will expire in the shortest period of time. When you look above the prices for that option you will see hot links to other months and even other years as they organize the option prices by the shortest of the longest. So LEAPs which will say for example now include January 12, January 13, January 14, will always be on the far right side at the top of the current option prices at all you have to do is click on either say January 13 or January 14 and you will suddenly see all of the prices for those particular options it is very easy.

Our instructor said roughly 1/3 of all stocks have options. Usually there are options on the better-known, higher volume stocks. There are no options on stocks trading for less than $5 unless originally that stock was trading much higher at the times the options were sold, for example Citibank.

I recommend you scroll through the options listing and get a feel for which stocks trade options and what prices for options are like. And it isn't only stocks that can have options, many ETF's also have options and could prove to be an excellent trading vehicle for options. You will see more about ETF's in a later chapter.