Chapter 21

How to Use LEAPs with and without AIM

Now you have read my book and you see how AIM operates. You see that it works best with volatile investments – ones that have good high/low swings so AIM can do its buying and selling. Well, now after many years of searching, I have found the perfect investment for AIM – LEAPs.

LEAPs are long-term options on many of the stocks and ETF's that are household names and many others. About 1,000 stocks on both the New York Stock Exchange and NASDAQ National Stock Market have LEAPs and again many ETF's also have LEAPs.

Here's Jeff's quickie review on LEAPs. LEAPs are derivatives – they "derive" their value from their parent’s stock. LEAPs only have value if the stock has value. And as the stock goes up and down, the LEAP goes up and down. All LEAPs are more than a year away from ending – as of November 4, 2006 the two classes of LEAPs you can buy are either one's expiring in January 2008 or January 2009 – the January 2010 expiring LEAPs will probably come out in early 2007.

You need to understand some basic option knowledge. All options, including LEAPs have basic terminology you need to know. You need to understand this terminology. Don't worry; I won't overwhelm you – just the basics. Here are the four terms you need to know: "in the money" "out of the money", "at the money" and "strike price". I'll go over these terms briefly, you will find them listed and explained in the previous Chapter, Chapter 20.

Regarding Strike Price, you need to understand that each LEAP can have many strike prices – some are "in the money", one could be "at the money" and some could be "out of the money". Below is an example:

Let's say Yahoo is currently selling at $26.16 (it is on November 3, 2006).

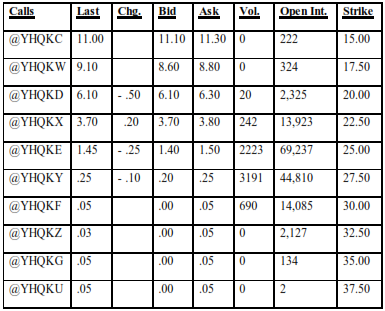

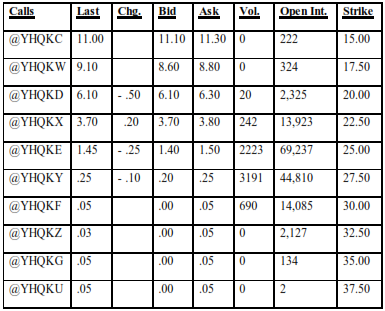

Below are the call LEAPs available with the January 2008 expiration and their current price (note: price below was for one share – LEAPs are sold in 100 share lots called contracts so multiply the price below 100 to get the price of one contract.

Since the price is $26 16, any strike price higher than $26.16 is "in the money” and any strike price lower than $26.16 is "out of the money". And when you look today in 2011 at Yahoo Finance option prices, you will see that the symbols for options have legally changed and are much different than the symbols you see above under the call’s column. Strike price merely means the price you have a "right" to buy the stock at for the term of the LEAP. With call LEAPs, the option will go higher when the stock goes higher.