You have to remember just like using AIM with stocks that every time you make a buy or sell you MUST fill out your AIM spreadsheet. You may have to fill out your sheet a couple of times a month. It's no big deal as you know how easy it is to fill out an AIM spreadsheet. It's still simple arithmetic – adding, subtracting, multiplying and division. If I can do it, you certainly can do it.

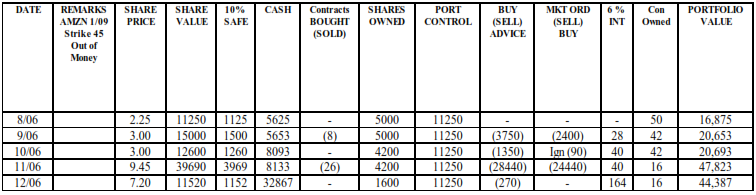

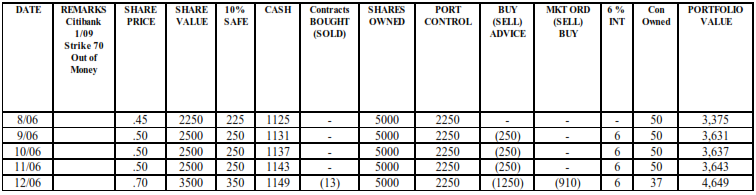

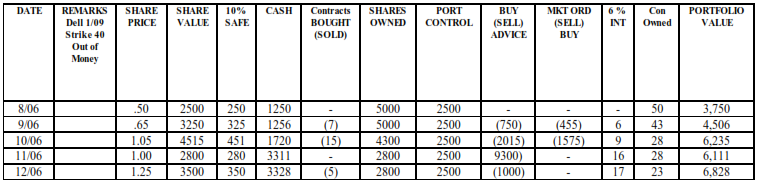

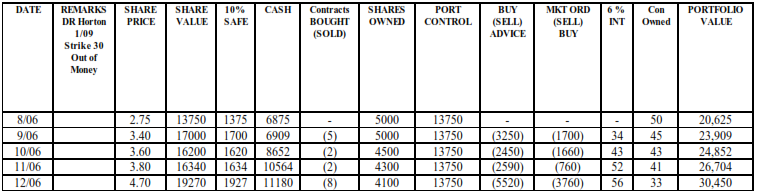

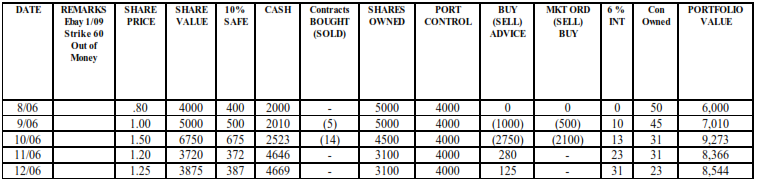

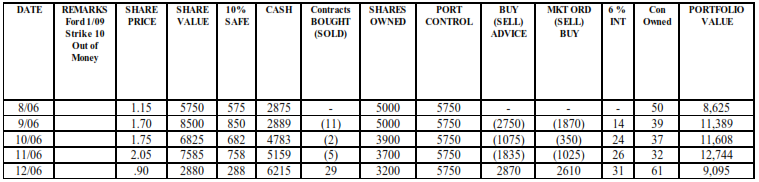

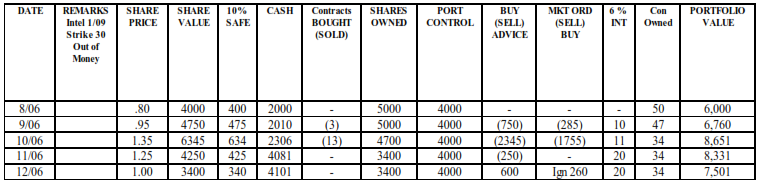

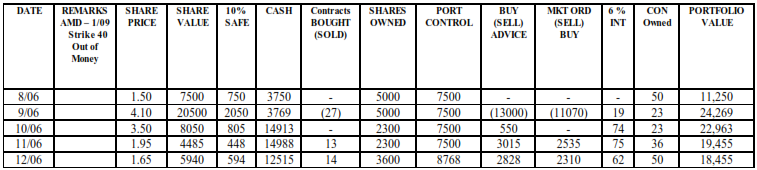

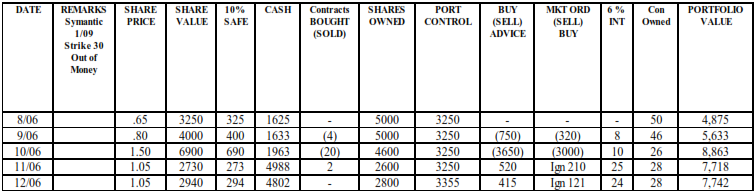

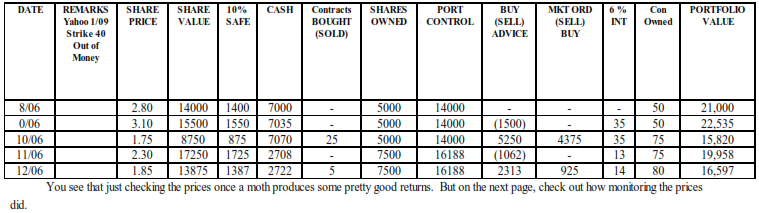

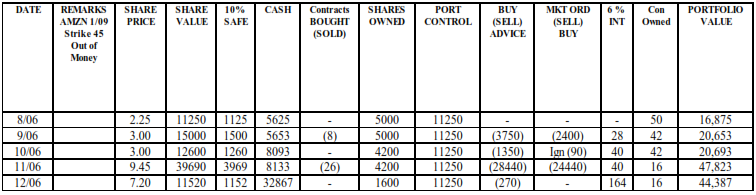

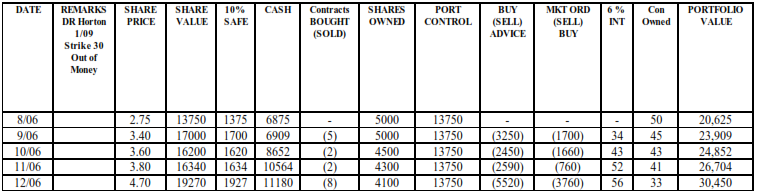

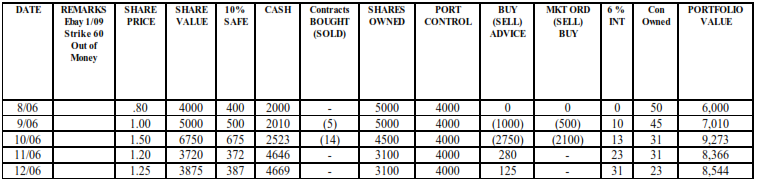

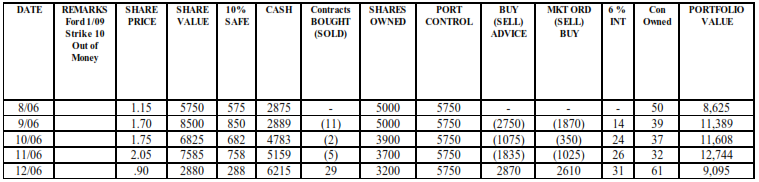

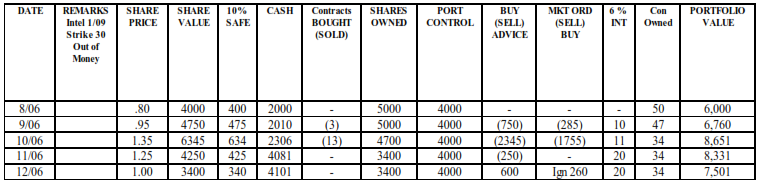

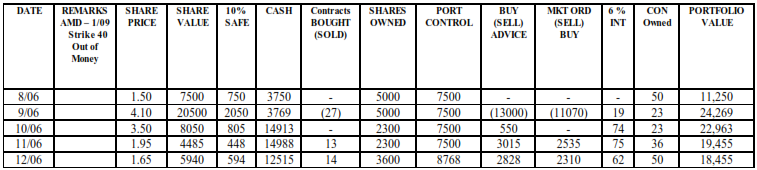

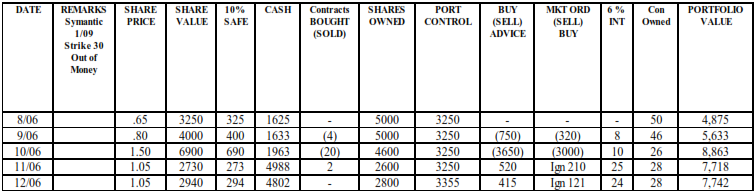

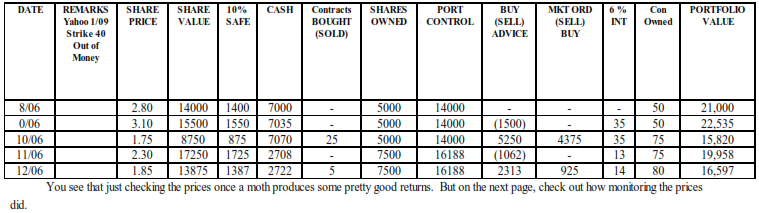

You will quickly see the power of AIM when you see the spreadsheets. Since I am new at this, I plan to be conservative. So when you see big cash amounts on the sheets, know I am leaving the cash there and NOT going to get back quickly to 1/3 CASH and 2/3 LEAP. I will be conservative until my research tells me not to be and shows me that I should be putting the cash back into LEAPs. And I will have no problem supplying the Chapter 2A bear strategy to LEAPs if I need to either.

I haven't figured out when I should get out of the JAN 08 LEAPs. Remember they will expire worthless on the third Friday of Jan 08. I plan to be out of them long before that. Right now I think my idea is to sell all the Jan 08 LEAPs and buy the Jan 10 LEAPs when they come out – not sure when that is, probably early in 2007. Please check out the spreadsheets after only three months and you will see what a great match AIM and LEAPs are. Again you will find lots of spreadsheets showing exactly what the LEAPs did in the free Adobe Acrobat investing book.

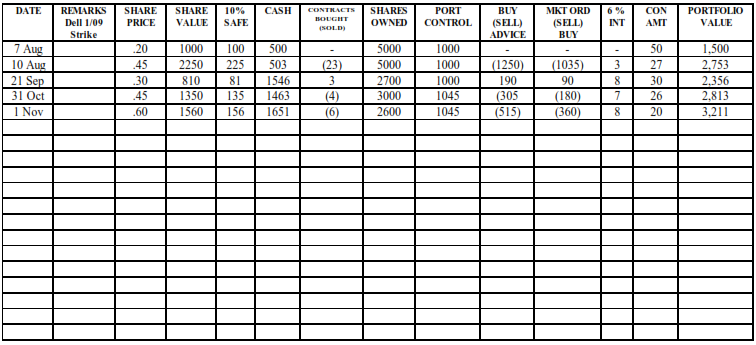

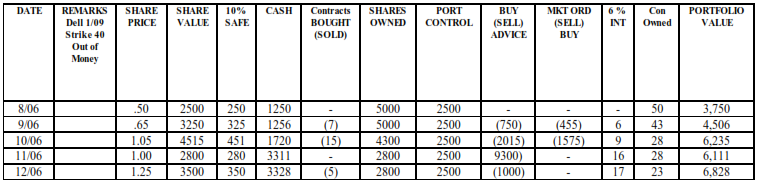

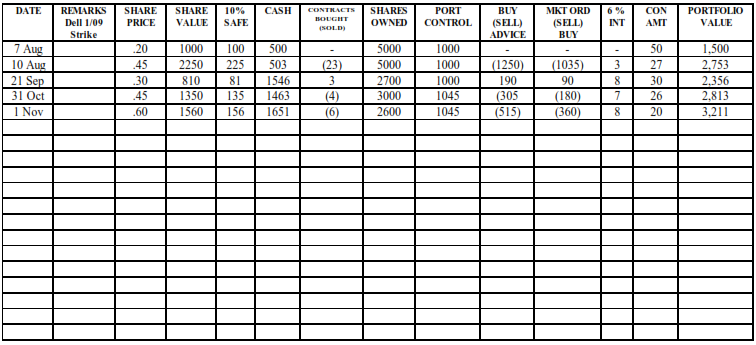

Check the Dell Strike 45 LEAP in this chapter and you will see that the price went from $.20 to $.60 so if you had just bought and held (our infamous lump-sum investor, you would have to "paper" value of $4,500 and would be higher the $3,211 you see above. But (1) you would still own 50 contracts – above we have reduced our risk and now only own 20 contracts. (2) When do the "lump sum" investors sell? He or she doesn't know – maybe too late! Since the above LEAP as easily more than doubled in three months, that's plenty of "real" profits – real profits are always better than "paper" profits.

Strategy #2

Let's say you like the idea of LEAPs but think having a portfolio entirely of LEAPs is a bit extreme. That's a perfectly valid viewpoint also; everybody has a different level of risk and different investing objectives. Different strokes for different folks. Well, then why not have 8 stocks and 2 LEAPs or 7 stocks and3 LEAPs? You can sleep at night because you are comfortable with that risk level. I just want to encourage you to have at least 1 or 2 LEAPs in your portfolio because as you see they do so well.

Strategy #3

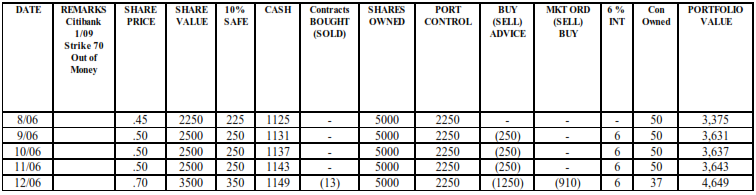

Remember how I told you every once in a while you have to break the rules? Well, for some friends of mine I am doing a different strategy. They wanted to invest $500 each for their two daughters. So I helped them by recommending 3 different LEAPs they could buy for their $500. Since they wanted to invest $500, I concentrated on "out of the money" LEAPs which are cheaper. I came up with the following:

- Yahoo – Jan 08 – buy 3 LEAP contracts at Strike Price 45 = $45 times X 3 = $135

- Citibank – Jan 09 – buy 1 LEAP contract at Strike Price $170

- Dell – Jan 09 – buy 2 LEAP contracts at Strike Price $60 X 2 = $120

That’s a great way to invest $500. I gave them a rule of thumb to sell any of the contracts when they double in price. Then take the principle of profits and invest in more LEAPs. You can see the power of compounding with LEAPs.

I am no options or LEAP expert. But just by applying simple AIM investing techniques, you can make substantial profits with LEAPs – much higher profits then you could make just by using stocks alone. I feel very comfortable using LEAPs because they overcome one of the problems with options – they exist for very long periods of time. Heck, under AIM, you should be selling many of your stocks when they hit their highest in less than two years and replacing them with other stocks selling at or near their lows.

Bottom line, I hope I've convinced you that LEAPs are great way to use AIM to its maximum potential. Again I am willing to manage portfolios for people who want to buy LEAPs.

Again I always wish you happy investing and rising profits!