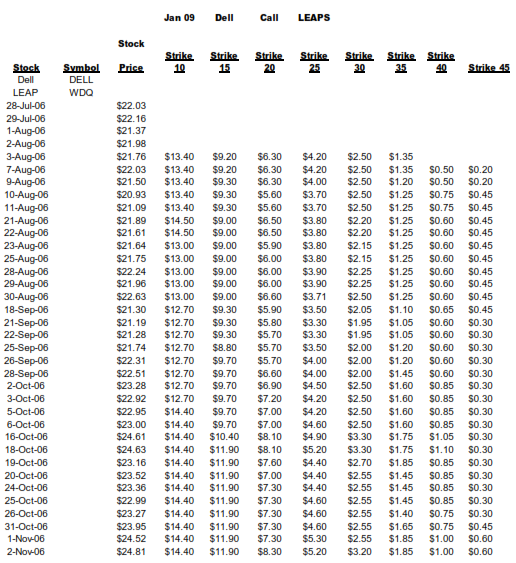

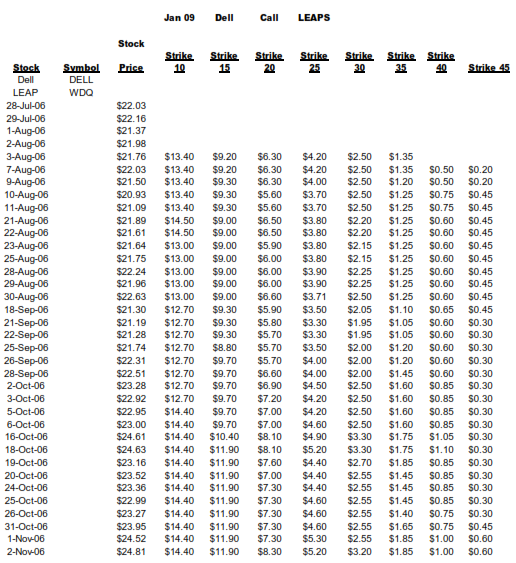

You can see that LEAPs become cheaper in price the higher the Strike price is out of the money. But realize that the stock doesn't even have to go higher than the Strike price for you to make profits. If other investors think the stock could possibly go up, then the price of the LEAP will go up. I'll show you that when you see how price movements have gone on several LEAPs I have been tracking have done in the last several months. You will see "deep out of the money" LEAPs that have at least doubled in price even though the stock price is nowhere near the strike price.

All you need is the possibility that another investor thinks the stock could go way up. That's all it takes. All you need is to be smarter than the other investors and have a plan and a strategy is up as I am giving you and you will make very high profits. Again look in your free Adobe Acrobat version of my investing book and you will see a nice spreadsheet showing how prices on a LEAP for Dell computers did over a period of several months.

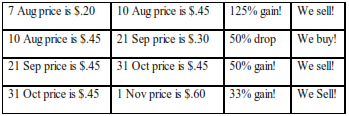

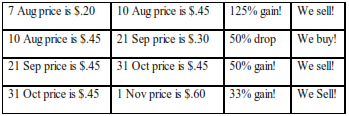

Looking at the spreadsheet I just told you about that you can easily see in the Adobe Acrobat version of my book you can see that even the Strike 45 LEAP doubled in price from October 26, 2006 to November 1, 2006 even though the stock only went up in price from $23.27 to $24.81. You see the power of LEAPs as investing vehicles! Also you can see why I am suggesting an AIM strategy for LEAPs. Looking over the Strike 45 LEAP over the short period shown above (August 7, 2006 two November 2, 2006) here's the price swings you see:

Below you will see how just checking the LEAPs price once a month – not even following the above price swings still has major tremendous profits. I will be showing you several ways to play LEAPs so you can pick the method that is best for you.

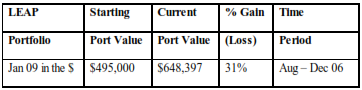

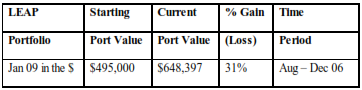

Below I will show you how one LEAP model portfolio has done:

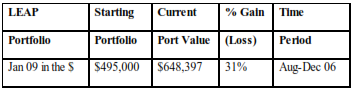

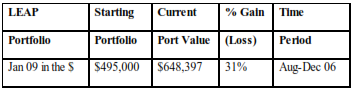

Yearly Gains (Losses) for Jan 09 In the Money LEAPs

I still keep track of this model portfolio so if you wanna see how it is currently doing just go to my website http://www.jjjinvesting.com and near the top of the page click on the hot link to how model LEAP portfolios are doing. Every month in my newsletter that you will be getting for free, you will see the latest up-to-date detailed information on the two model LEAP portfolios and two other model portfolios – one showing how bear ETF's are doing, and one showing how the most conservative of blue-chip stocks are doing under the AIM system.

Here are the stocks that I picked LEAPs on for the above model LEAP portfolio:

AMD Strike 20, Amazon Strike 25, Citibank Strike 40 (only real bomb I picked for the model portfolio), Dell Strike 20, DR Horton Strike 20, Ford Strike 5, eBay Strike 25, Intel Strike 15, Symantec Strike 15 and Yahoo Strike 25. You will see when you look at the modern portfolio as of November 2011, that the stocks have changed. Again you are not married to either stocks or LEAPs and can always sell an old one and replace it with a new one if you like the new one better and I will help you decide when you will want to get a better new one.

This portfolio is up 31% in just two months and all I did was look at the price for each of the 10 LEAPs listed above and make buy and sell decisions just like I would with AIM stocks – 31% in 4 months just by checking the LEAPs once a month is pretty impressive to me. Only takes about one hour a month to manage this way and you still make very impressive profits.

The other way that would take more time but would result in more profits is to monitor your LEAP prices at least once a day and on any day you see a large rise or fall in your LEAP price, you use AIM and make either a buy or sell. You would probably be trading 5 – 10 days a month but would be rewarded with even higher profits. I'll do the above price switches on the example above to show you. I'll assume we started with 50 contracts as is used in the above 31% gain example. You'll see that just by making the few trades are listed in the in the example you accomplish two important things:

- First you made big profits – went from $1,500 to $3,211 – a 114% gain in less than three months which works out to an annual gain of 456% – not too bad!

- Second you reduce your risk – we went from owning 5,000 shares or 50 contracts to owning 2,000 shares or 20 contracts.

Strategies for LEAPs

I am going to give you some strategies for playing LEAPs. You know your situation – the amount of money you want to invest, your risk level. I will let you know if the strategy I suggest is risky, conservative or somewhere in the middle.

First of all, while LEAPs are volatile, overall I don't consider them risky... Unless you let your emotions rule your investing. If you can't handle LEAPs going up and down 50% in short periods of time, then LEAPs are not for you. Because they're going to do that. (My investor’s Jan 13 Strike 5 LEAP on Bank of America went from $3.70 a share to $1.75 a share and so we made our first buy (following my rule – don’t any more LEAP contracts until a LEAP has dropped 50%!) But if you understand the complete strategy and where you will be way down the road investing in LEAPs, then you will not worry and be quite happy because you're going to make huge profits.

First, what are the best stocks to buy call LEAPs on? Well, I apply the same rules I employed with what are the best stocks to invest in – namely ones that are at or near their 52-week low. I have started focusing on stocks at or near their lows in my monthly newsletter - this will give you a starting point for good stocks I feel that will go up. And if the stock goes up, the LEAP really goes up. Since I originally wrote this I have added a new feature to my monthly newsletter and you will find that I list whether or not the stock has LEAPs for all the stocks and ETF's I recommended in my newsletter.

Now the stocks are a little more risky. If you want to be conservative and still use LEAPs then do LEAPs with conservative stocks, with Dow Jones stocks. Every month I bring you the Dow Jones stocks and you see they have done very well over the last 13 years as I wrote this probably longer today. And they will keep doing well over the long term. So if you want to be conservative, stick with them. If you wish to see if a stock has LEAPs, then go to http://www.cboe.com, click on Products at the top and then click on LEAPs, then click on Equity and you will get an A to Z list of stocks with LEAPs.

And if you're really obsessive-compulsive like I am, you can download the file of all of their LEAP options to an Excel spreadsheet, then you can laboriously go through that list and delete all the options that do not have LEAPs. Then you could put break page breaks at the end of each letter of the alphabet so each new letter starts at the top of a new page, then you can print out the entire list of LEAPs from A to Z and put them in a spiral binder with letter tabs to identify each letter of the alphabet. That's what I've done and it makes it much easier every month to check the stocks I am recommending in my newsletter and find out whether they have LEAPs or not.

Strategy #1

Strategy #1 is for investors to have larger sums of money and are risk takers and willing to make large profits. Here's what the strategy entails: you have 10 LEAPs, each LEAP has anywhere from 10 to 50 contracts, and you make buys and sells as AIM tells you either monthly or setting stops and limits. The only difference between selling stocks and LEAPs is that when you sell LEAPs you have to sell contracts not shares. So basically when AIM gives you a buy or sell signal you check the amount of money to buy or sell and divide by the price of a contract to see how many contracts to buy or sell. For example if AIM gives you a MARKET ORDER (SELL) for $1,800 and a contract is worth $600, then you would sell three contracts.

As I showed earlier, the best way to manage a portfolio like this is to check prices daily or leave limit orders for both buys and sells and again any limit orders would be "good till closed”. For example, if your LEAP is selling at $.50 – then you could have a sell at $.75 and a buy at $.25. When either of these occurs, then you set up new buy and sell limits.

You won't have to do this a lot. If you look at the above example, we had 4 buys and sells over a three month period. And you can do this with two basic types of portfolios – "in the money" and "out of the money". I think but cannot prove yet which one will do better. The main difference is that LEAPs are much cheaper when they are out of the money so that portfolio would have a lot more contracts than a portfolio of LEAPs in the money. I think both would do well and you can see both are doing well when you check my webpage and see the up-to-date information on the model LEAP portfolios. I will show you how the two January 2008 in the money and out of the money portfolios are doing and how the two January 09 in the money and out of the money portfolios are doing.

The advantage of the out of the money portfolios is that it is much cheaper. Look at starting dollar amount of that in the money and out of the money portfolios below and you will see that out of the money is substantially cheaper. Also the portfolios below started with 50 contracts each. I think you could do this with a minimum of 10 contracts each (though I feel more contracts is better). Look at these portfolios and again all I did was arbitrarily make buy and sell decisions once a month. You would've made even more money by checking prices daily or setting stops and limits and leaving standing by in sell orders with your broker. Look below at the model portfolios for January 2008 and January 2009.

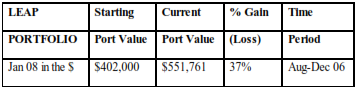

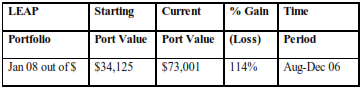

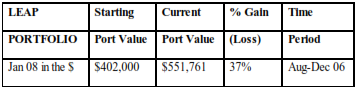

Yearly Gains (Losses) for Jan 2008 In the Money LEAPs

The January 2008 in the money portfolio consists of: AMD Strike 17.50, Amazon Strike 25, Citibank Strike 45, Dell Strike 20, (and actually I'm dictating/typing this book revision on a Dell) Inspiron 530 desktop computer!), DR Horton Strike 20, eBay Strike 22.50, Ford Strike 5, Intel Strike 17.50, Symantec Strike 15, and Yahoo Strike 25.

$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$

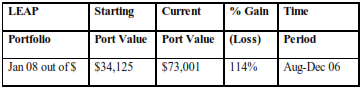

Yearly Gains (Losses) for Jan 08 Deep Out of the Money LEAPs

The January 08 Deep Out of the Money portfolio consists of: AMD Strike 50, Amazon Strike 55, Citibank Strike 70, Dell Strike 40, DR Horton Strike 45, eBay Strike 50, Ford Strike 15, Intel strike 30, Symantec Strike 30, and Yahoo Strike 50.

$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$

Yearly Gains (Losses for Jan 09 In the Money LEAPs

The Jan 09 In the Money portfolio consists of: AMD Strike 20, Amazon Strike 25, Citibank Strike 40, Dell Strike 20, DR Horton Strike 20, Ford Strike 5, eBay Strike 25, Intel Strike 15, Symantec Strike 15, and Yahoo Strike 25.

$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$

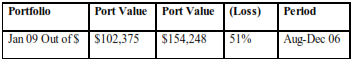

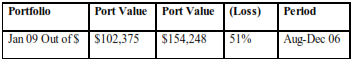

Yearly Gains (Losses) for Deep Out of the Money LEAPs

The Jan 09 Deep Out of the Money portfolio consists of: AMD Strike 40, Amazon Strike 45, Citibank Strike 70, Dell Strike 40, DR Horton Strike 30, eBay Strike 60, Ford Strike 10, Intel Strike 30, Symantec strike 30, and Yahoo Strike 40.

$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$

The above gains in only two months are impressive – if you project them out for the whole year you have an annual rate of return of around 150%. Would you be happy averaging 150% a year for many years? I sure would! And again this is only spending an hour a month checking that once prices and then making buys and sells. I will post some spreadsheets showing what LEAP spreadsheet looks like – it's just slightly different than a stock spreadsheet. And again all these spreadsheets will be found in your free Adobe Acrobat version of my book. The only difference is on a couple of the headings to identify contracts and not shares are traded. And I like adding a column showing how many contracts are owned.

Below I'm going to show you the spreadsheets for the January 09 "out of the money" portfolio. Then I will show you how strategy #1 will work. Remember you can either just check the prices once a month or you can set limits and stops and then you will always have buys or sells said when the price of the LEAP makes a move. Overall if you have the time and want higher profits, you should check daily.