JULY 1994

Now how to use the system in the real world. On July 1 or thereabouts, you pick up your newspaper or look on your website. You look under the New York Stock Exchange and find Claire’s Stores. From now on I'm just going to say you look on your website because when I wrote this, newspapers were a lot greater source of stock market information than they are today. Today everything you want is either on a website or your iPhone on your iPad etc. so now on we would just say we look it up on the web. My new iPhone has this great little feature; all I have to do is press the stock market app on the very opening screen and I can find out all the information on stock prices you ever dreamed of. Once you type the symbol in, you can always find any symbol by going to Yahoo Finance. At http://www.barrons.com and going down to the bottom and opening up either the New York or NASDAQ stock exchange going to the first letter of the stocks name scrolling down and you will see the symbol right next to the name of the stock.

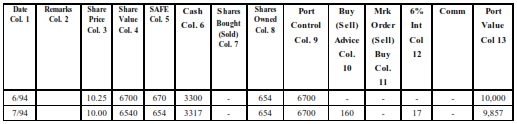

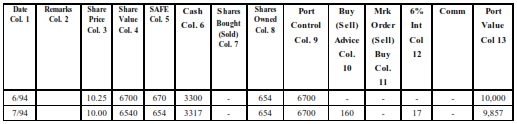

We find Claire’s Stores and see that the price on July 1 is $10 which we write in column 3. Did you remember to put July, 94, - 7/94, in the date column? Now go to column 8 for July 94. Look above in column 8 and you will see you owned 654 shares in June and you didn't buy or sell any in column 7. This is why you leave column 7 blank in the first month. You still own 654 shares. Write 654 in column 8 for July 94. Also your PORTFOLIO CONTROL amount is still the same (you didn't buy anything in addition to the opening buy in the first month, when you opened your account) so write 6,700 in column 9. Now multiply the number of shares owned (654) by the share price ($10) and you have your SHARE VALUE for column 4. Now CASH, you'll notice, has grown from $3,300 to $3,317. This is because you earned $17 interest which you write in column 12. If you had bought or sold stocks the preceding month, this would have also affected cash this month.

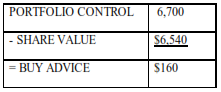

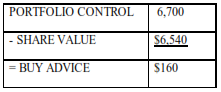

Now you take your two key amounts – SHARE VALUE and PORTFOLIO CONTROL and look at them. Which is higher? PORTFOLIO CONTROL is higher (6,700) than SHARE VALUE (6,540). Since PORTFOLIO CONTROL is higher, put PORTFOLIO CONTROL on top. You'll be seeing this chart every month. Once you start doing this, you won't need the chart, but it's a good way to learn.

You now have a potential buy for $160 but it's only potential. Now look at the SAFE amount in column 5 and you find that it is 654 which is higher than your buyer advice in column 10. So you put zero in column 11, MARKET ORDER BUY because your signal isn’t strong enough to give you a market order yet. Put a – in column 7 since you won’t be buying or selling any stock this month. Be patient the system doesn't want you to sell or buy too soon. You'll get plenty of chances. Now all you have to do is figure column 13, PORTFOLIO VALUE. You remember, add column 4, SHARE VALUE and column 6, CASH and you have the current value of your investment. This month it's $6,540 + $3,317 = $9,857. If the stock goes up in price, you'll have a potential sell and if it goes down, a potential buy.