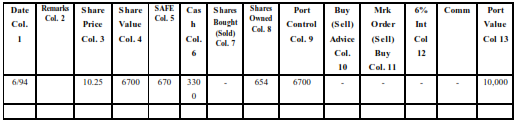

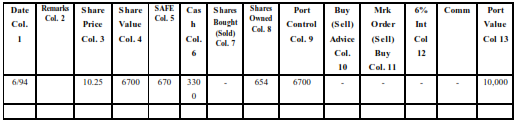

The first month is Jun. 94 (6/94), write that in your date column. Then we are going to imagine that we have $10,000 to invest. Having a calculator will make your figuring easier.

JUNE 1994

We start with $10,000 to invest. First we look at the price of the stock in the newspaper or on the website. A great website to look up stock prices is Yahoo Finance on you have to do is type in the symbol and you'll see exactly what the current price of any stock or other investment is. When you actually buy your stock or other investment, you'll have to wait to get your statement to see what the actual price was. Stock prices move quickly so you may have put in an online order to say buy Claire’s Stores and Yahoo told you the price was $10.25. You might find when you actually buy it maybe you bought the stock at $10.20 or $10.30 so that is the price you would want to put down when you find that your actual buy price. Our stock was selling for $10.25. Write that in column 3. Our first share value will be 2/3 of our $10,000 or $6,700 rounded off. Write $6,700 in column 4. In this example you see I used the liberal idea of two thirds stock and one third cash. Based on the investment you are in; I may recommend that you go 50% cash and 50% stock. It all depends on the volatility of the investment.

Then in column 5, $670 because SAFE is always 10% of the SHARE VALUE in column 4. Then right $3,300 in column 6 because you always start with two thirds of your money in stock and one third in cash on a conservative investment. In column 8 you write the number of shares you own. This is figured by dividing SHARE VALUE in column 4 by the SHARE PRICE – in column 3 - $10.25 equals 654 shares. Always round off, if you get 653.9, then 654 shares, if 653.3, then 653 shares. Then in column 9 PORTFOLIO CONTROL, put in the same number as you had in column 4, SHARE VALUE, 6,700.

Column 10 doesn't come into play yet, and column 11 doesn't either. You haven't earned any interest yet, so column 12 is blank also. Now add up the value of the stock you bought in column 4 and the amount of cash in column 6 and you have your total for PORTFOLIO VALUE. Put $6,700 + $3,300 equals $10,000. Now let me show you how simple and profitable the system will be for you. Remember to reinvest all dividends into your money market account. Just tell your broker when you open your account that you always want any dividends placed into your money market account and you do not want to buy additional shares or fractions of shares with any dividends you receive.