NOVEMBER 1995

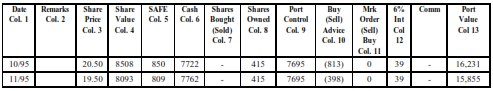

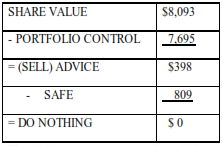

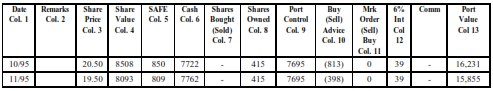

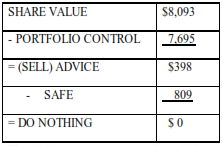

Onto November 95. SHARE VALUE has dropped to $19.50 share. Go to columns 8 and 9. SHARES OWNED and PORTFOLIO CONTROL stayed the same since you didn't buy any stock last month. Write it in. Now multiply 415 X $19.50 equals $8,093. SAFE is 809. Last month’s CASH was $7,723+ $39 INTEREST = this month's CASH total of $7,761. Now the usual, compare SHARE VALUE and PORTFOLIO CONTROL.

The higher the stock goes, the more profits you can make. Later I'll tell you how to pick the best type of stocks, Closed-end funds, ETF's, and LEAPs (long-term options). The types of investments I would recommend depends on the level of risk you're willing to handle.

Now for those calculations. You see SHARE VALUE is higher than PORTFOLIO CONTROL as you thought. So...

The AIM system wants you to sell your high-priced stock, put the money into CASH and sit back and wait for the price to drop. Then you use your cash to buy cheap stock, wait for it to go up and then sell it again; the extreme opposite of a vicious circle. Last thing you have to do for the month this figure PORTFOLIO VALUE which is $8,093 + $7,762 = $15,855.