CHAPTER 8: FINANCIAL ANALYSIS

A tax debtors resolution options are almost entirely based on financial analysis. In short, it is a way to provide a statement of your financial status, including information about your assets, the businesses monthly income and monthly expenses.

Because the financial analysis largely makes up what resolution options are available to you, we are going to explore this topic in detail.

After completion of a financial analysis of your business, the IRS will use the information to figure out your ability to pay your balance in full, the amount you’ll need to make as part of an installment agreement situation, or if you are eligible for an offer in compromise.

For quick reference purposes, here are likely outcomes based on what the financial analysis shows that a business has:

- Assets (or access to equity) – then you will likely have to tap into these sources of cash to pay the debt in full.

- No Assets, but Disposable Income – then you will likely fall into an installment agreement where extra income outside of ordinary and reasonable expenses will go to the IRS on a payment plan.

- No Assets, No Disposable Income – Likely a currently non-collectible (CNC) situation.

- Offer in Compromise – Not many qualify, but if you do it is all about the math.

Again, this topic is extensive, and I am going to go through a few specific sections in the Internal Revenue Manual with you to point out some of the key concepts when representing yourself.

The Internal Revenue Manual is the IRS’ playbook on what their procedures are supposed to be. If you know the playbook, I believe you can put up a better defense against whatever the IRS is going to throw your way and will lead to a better resolution outcome.

Unlike the 1040-individual tax resolution side of things, the financial analysis on the business side is much more intricate. When an individual has a tax liability, the financial analysis comes along with set collection standards (housing, food, clothing allowances and the like).

Well, there are no set collection standards for businesses. Instead, there is much more grey area. IRS Agents predominately spend their time looking at assets, and specifically if an asset is essential “for the production of income”. Because of the grey area revolving around business expenses, the financial analysis package takes a lot more time and is much more complex. That is one of the reasons why practitioners charge more for 941 representation than 1040-individual resolution.

Let us first dive into a few concepts within the Internal Revenue Manual (IRM) and then we will go through Form 433-B together and you’ll be well on your way to understanding how to put the financial analysis together for your business.

IRM 5.15

General Concepts & Ideas

In this section, I want to review a few general concepts and ideas. These will help you start thinking through your business the way that the IRS will think through it, and will ultimately lead to a better resolution outcome for you:

1. Necessary and Ordinary

The first concept is likely the most important. The IRM dictates that business expenses must be “necessary for the operation of the business”. IRM 5.15.1.15(3) takes it a step further by saying, “allowable business expenses are the cost of carrying on a business or trade”. Thus, the necessary and ordinary business expense rule comes about.

Well, what is considered a necessary and ordinary expense? As you can tell, it is a much greyer area than you might think initially.

You need to be critical in this area. Business expenses that do not directly impact business income may be examined more thoroughly and ultimately not be allowed in the final analysis. When you start down the resolution path, you need to be willing to make some business adjustments and that first starts with this concept.

2. Audit Technique Guides

Audit Technique Guides (ATGs) were developed by the IRS to help IRS personnel complete examinations of businesses within a specific industry. In other words, it puts forth what a Revenue Officer should look for when analyzing a business within an industry sub-category. These ATG’s walk the IRS personnel through common scams, common assets that people attempt to hide in that industry, pretty much all the bad things. It also talks about common business expense items.

Luckily, there is a construction industry specific ATG. You can find that here:

https://www.irs.gov/pub/irs-utl/Construction_ATG.pdf

This ATG is exhaustive. In fact, it has 258 pages to it! But if you really want to represent yourself before the IRS, then you need to read this ATG. Afterall, the Revenue Officer who is examining your business has read it and you need to know what they are going to look for before they are there looking.

The entire thing is a healthy read, but I would specifically target chapters 3, 6, 8, 9 and then Appendix 1, 3, and 6.

3. Scrutiny

Another concept we should review. In short, the IRS does not trust you.

Is that mean and uncalled for?

Potentially, but in their eyes, you are the one in tax debt and that means they can justify having a lack of trust.

Because of this lack of trust, you need to expect scrutiny in all matters with the IRS: reviewing of bank statements, tax returns, verification of assets, and other records with line items. If records show that you have the cash to full pay, the buck will stop there! If records show that you cannot pay the debt, they will force you to provide ample evidence to prove that.

When they ultimately verify assets, expect scrutiny. They will scrutinize all sources of revenue, all liquid assets, any equity in assets and available sources of credit.

This all leads to me telling you to get your crap in order, because the IRS will poke and prod their way to the truth through the eyes of scrutiny!

4. Adjust Immediate Expenses

You should know right up front that the IRS will expect to receive any and all money in excess of ordinary and necessary business expenses.

What this means is that when you start putting your financial analysis together, you need to know that whatever amount you have left over after reasonable expenses, the IRS is keeping. But the trick is “whatever amount you have after reasonable expenses”.

There are likely reasonable expenses that you do not currently pay for that could enhance your company and keep money out of the IRS’ hands. Yet, there are other expenses that the IRS will not let stand in this computation.

But by taking advantage of legal and ethical additions to the reasonable expense category, you can ultimately absorb more of the amount that should have gone to the IRS and lower your long-term required payment amount regardless of installments or one-time cash payment.

A few general ideas to consider that would seem reasonable and ordinary right from the get-go:

- Legal, payroll, and accounting fees

- Increasing reasonable compensation to Employee-Shareholders. In fact, I would recommend going above and beyond (within reason) given that you are:

o Working 80 hours a week

o The added stress of being an owner

o Extra time and skills in the industry

o Etc.

- Safety compliance training for staff members (you are in construction after all!)

- Business, Errors & Omissions Insurance and premiums for health insurance for employees

- Marketing and advertising to get additional business

- Mileage and auto expenses getting employees to and from the job site.

- Federal Tax Deposits (yes, start paying your deposits right away)

As you can see, many of these are traditional business expenses that you may not be capitalizing on currently. If you pick apart each of these, for the most part, you can make a reasonable claim that they ultimately lead to an increase in revenue:

- i.e. - Legal, payroll, and accounting fees – better contracts and accounting lead to increased accounts receivables

- i.e. - Safety compliance training for staff members – keeping people safe lowers injuries on the job and therefore lower workers compensation insurance and increased efficiency for employees

- i.e. – Health insurance premiums for employees – better employee retention, leading to happier employees and therefore more efficient employees

- i.e. - Marketing and advertising to get additional business – no example needed!

Hopefully, you get the picture. By adjusting immediate expenses, you will have less in excess going to the IRS when you reach resolution. At the end of the day, the Revenue Officer assigned to your case is going to really be looking for the excess profits to swoop up and pay off your debt. Lower that profit (reasonably, ethically, legally) and you will pay less.

5. Bookkeeping & Documentation

I think it goes without saying but I am going to say it anyways. Bookkeeping, accounting, and documentation are incredibly important while putting your financial analysis situation in place.

The 433-B dictates that 6 months of income and expenses be provided. Cases that are less than $25,000 and are in IBTF-E do not need to submit financials; however, expect the enforcement of the 6-month rule with those who have tax debts above this number.

*Special Note - I would never fill out the income/expense portion of the 433-B. In full transparency, I never do that for clients. The IRM allows for a business P&L and balance sheet in lieu of the income/expense section of 433-B. The reason I recommend this is that it creates a sense of organization with the Revenue Officer. It will look like you have (or are putting) your crap together. You will have a better resolution experience, I promise.

*Special Note - If something indicates to the Revenue Officer that a major change in your finances has occurred, they will request a new 433-B.

IRM 5.15.1.3: Verifying Financial Information

Like I mentioned before, the IRS does not trust you. They will be reviewing your case with scrutiny. As such, they are going to verify a lot of information, both from a business operation perspective as well as a financial one. Here are some common questions you will see and some expectations you should have throughout the process:

1. Questions to Verify Information

These are questions that the IRS will likely ask you to verify information about the business and how it operates:

- How does your business make money?

- Who are your customers?

- Tell me about your inventories.

- Who are your suppliers and vendors? How much do you owe them?

- Do you have foreign assets or income?

2. Site Visit Expectations

With liabilities over $25,000, it is mandatory that a Revenue Officer in the field show up in person to verify assets. Revenue Officers will typically request this early in the process. Just do it ASAP and get it over with. A few special notes here though:

- Do not be surprised if they sketch out a floor plan of your location or facility.

- They will count the number of employees and make notes about what they do.

- They will take notes about equipment, computers, inventory, etc.

3. Common Requests for Verification

Throughout their process, they will likely request lots of documents for verification. A few of those items might be:

- Accounts receivable summaries

- Bank statements

- Merchant account statements

- Leases

- Receipts

- Contracts

- Canceled checks

- Bank signature cards

- Name, address, phone number for all creditors

4. Co-mingling of Business and Personal Expenses

This is a big no-no with the IRS, and quite frankly its justified. If you are currently co-mingling between business and personal expenses, then shame on you. It is not a healthy practice, and the IRS is going to have a field day with you. At the very least, you will be a prime candidate for a Trust Fund Recovery Penalty assessment, but they likely will just make your life hell.

Do not do it in the first place, but certainly get it corrected and moving forward as two separate groups of money!

If you do have comingling, call the IRS or Revenue Officer assigned to your case and ask for a Stay of Enforcement in order to give you time to get everything cleaned up. Try to get at least one month with clean books to show you have put forth effort to correct the situation.

5. They Will Go deep!

The IRS will go extremely deep to verify the information that you provide them. Hint, hint… be honest and transparent. They will use every agency, vendor, institution, etc. that is legally available to them to verify that you are telling the truth. They will look at:

- Summons records from financial institutions

- Contact customers and vendors

- Request information from other federal, state, and local government agencies

- Ask for substantiation of business expenses

Case and point disclose everything! If you are not truthful, and they find out, you will have a much worse resolution outcome at the end of the process. Revenue Officers are trained on what to look at and how to “sniff out” sources of revenue and assets that are being hidden, so just don’t have anything to “sniff out”.

6. Additional Analysis

And just when you think they are done, they are not! They will look through how you valued assets, your depreciation claims, payment owed to you, and:

- Ensuring that deprecation is not being claimed as a cash expense

- Comparison of book value vs Fair Market Value (FMV)

- Non-payment of accounts receivable

- Careful analysis of at least 3 months (more likely 6 months) of bank statements to look for weird patterns

- Will verify sporadic revenue from prior years

For an extensive look through common questions that Revenue Officers may use during an examination, take a look at the ATG for the construction industry, Appendix 6:

https://www.irs.gov/pub/irs-utl/Construction_ATG.pdf

IRM 5.15.1.5: Internal Sources/Online Research

There are also things that the IRS will do internally to verify information. For example, they will look at:

- 1120, 1120S, 1065 income – looking for odd revenue patterns

- Location of depreciable assets (are they in other counties or states that you are hiding?)

- Review FBARs and pull other data from FINCEN

- YK1 Abusive Tax Shelter tool (to find links between different individuals and business entities)

They will also look at things online:

- DMV records (to identify vehicles not declared)

- Vehicles in the name of the business

- Using PACER – looking for court actions

- Local county recorder, looking for documents in the business name

- Business credit reports to cross check creditors, liens, balances, etc.

- Online detective/skip tracer tool to check for other addresses, vehicles, business interest, etc.

- Look at our website, social media profiles, name searches on local news sites, etc.

IRM 5.15.1.15: Business Cash Flow Analysis

You can submit business financial statements in lieu of the income/expense section. The IRS may go so far as to request pro-forma cash flow projections to review your collection potential. This may result in temporary suspension of collection action or a periodical increase in payment based on certain situations.

For example, currently I reside in Arizona. From the months of October to April, Arizona becomes one of the biggest areas for snowbirds to reside, because the weather is amazing (and the golf too!) With the massive increase in population here during those six months, I know some subcontractors that are doing a lot of their yearly residential work during these booming months. They are then much slower during the summer. For others, it is the exact the opposite (i.e. HVAC professionals).

For these subcontractors here in Phoenix, the IRS will take that into consideration regarding when and how much you are paying each month if you land inside an installment agreement.

IRM 5.15.1.18: Business Expenses

Keep in mind that cash expenses are the only type of expenses that are allowed. You will need to remove any non-cash expenses from your analysis.

Most expenses are often tied to assets. Be prepared for a conversation about some of these items.

IRM 5.15.1.20 & 5.15.1.21: Business Assets and Equity in Assets

Speaking of assets, you will need to locate each asset that needs to be included in the analysis, as well as the amount of debt owed on the asset (if any), the date the debt was acquired and the date the debt will be satisfied. Again, the Revenue Officer will be showing up to verify this information, so be truthful. They will also observe the condition of the assets to verify value.

They also want to know the amount of equity you have in specific assets. The IRS requires that you value assets based on “Quick Sale Value”, meaning the discounted price so you can sell the asset in 90 days or less. They typically calculate this quick sale value based on 80% of the fair market value.

IRM 5.15.1.33: Accounts Receivable

Let us talk about accounts receivable. This is a major area that the IRS wants to see and review, but the value of accounts receivable can be hard to value. For example, the value of a $10,000 receivable that is 9 months past due is not worth $10,000. Even within the subcontractor industries I work with, the value of receivables can vary. Be prepared to talk through your reasoning here.

IRM 5.15.1.34: Inventory

Inventory is all types of property that is held for sale. Raw materials, work in process, supplies that ultimately become part of an item intended to sale are all consider inventory. Just like accounts receivable, some inventory groups can be hard to value. Again, be ready to make a case as to why you should value certain inventory groups less than what the IRS thinks it is worth.

IRM 5.15.1.35: Machinery & Equipment

Consider the following for valuing business assets such as machinery or expensive tools and equipment’s:

- Blue Books/auto dealers/trade association guides to value automobiles and trucks

- Trade association guide/dealers/manufacturer to value specialized machinery and equipment

- For valuing property, contact a property appraisal and liquidation specialist (PALS)

IRM 5.15.1.37: Loans to Shareholders

Loans to Shareholders are really account receivables due to the corporation from the Shareholders. The IRS will heavily review these loans, as sometimes a corporation will grant a loan to a Shareholder or relative of a Shareholder with no intention of repayment to get around paying taxes. The IRS will expect this to be treated like any other accounts receivable.

They will want to verify if the loan is legitimate or a way to avoid taxes. Specifically, they will look for:

- A written note

- If periodic payments have been made to the corporation so far

- Is the rate of interest reasonable? Has it been received or paid?

- Has the loan been forgiven after the most recent return?

Again, this is somewhat a factor of commingling of assets. Be careful here and you better be able to back up loans that have been issued.

IRM 5.15.1.38: Intangible Assets

The IRS views intangible assets as the potential for future benefit. These are valued assets that the IRM will identify and value. Assets such as patents, trademarks, franchises, licenses, goodwill, a domain name of a website, etc. are what the IRS will be looking for here.

IRM 5.15.1.16: Making the Collection Decision

We have gone through a lot of specific information already, but at the end of the day, understanding how the Revenue Officer is going to evaluate different expenses and assets is incredibly important.

When considering how to make the collection decision, the Revenue Office is going to look at other things, like:

- Compliance history

- Reasons for non-compliance (are they justified)

- How many returns are filed or not filed?

- Are they current and compliant?

- Would it be better for the company to be shut down and liquidated?

- Will the CSED expire before liabilities can be paid?

- Will there be any impact on third parties if the IRS takes certain collection actions?

- Are there any fraud issues here?

- Who is a potential Trust Fund Recovery Penalty candidate?

All of this is good to know because if you know how they are thinking, remember it is their playbook, then you can combat that playbook through prudent financial analysis.

Once they have gone through this entire analysis exercise, they are going to review your case and determine what resolution option will be allowed: paying all of it now, paying over a specific amount based on specific assets, filing a tax lien, installment agreements, offer in compromise, etc.

Form 433-B

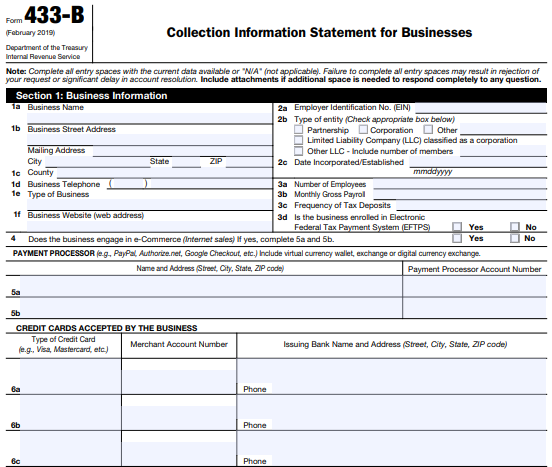

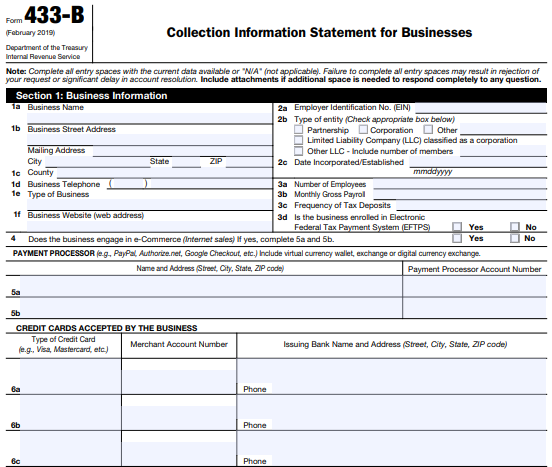

Now we are going to go through Form 433-B together, section by section to talk through some specific areas of focus. As with Form 941 in Chapter 3, I am using the most recent form that is available. This one was updated in February 2019. If the format changes, the concept should be the same.

Section 1 – Business Information

This section is used to provide the necessary contact information for the business, as well as essential information regarding the company, type of business, how many employees are employed, the type of entity, date of incorporation, the amount of monthly gross payroll, etc.

They are also looking for payment processors that you use to conduct business.

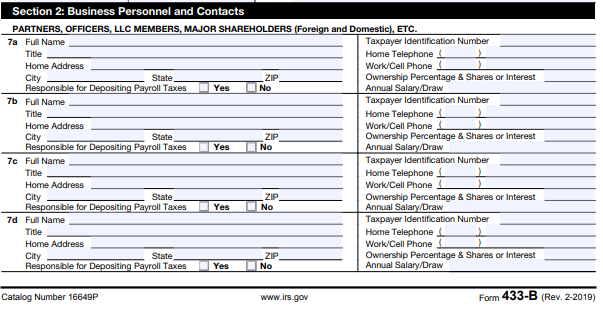

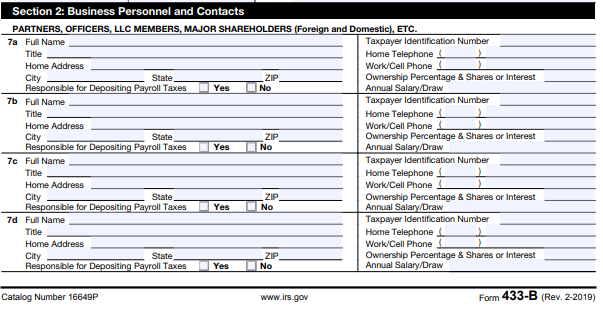

Section 2 – Business Personnel and Contacts

Section two asks you to list out specific groups of people. Partners, officers, major shareholders should all be used. If you cannot tell, you will be providing personal information here. Know what that means? They are looking for potential Trust Fund Recovery Penalty people here.

My advice is to be transparent, but do not add people just for the sake of adding people. Each person on this list will ultimately get an interview regarding the Trust Fund Recovery Penalty. If someone really does not need to be on here, do not add them.