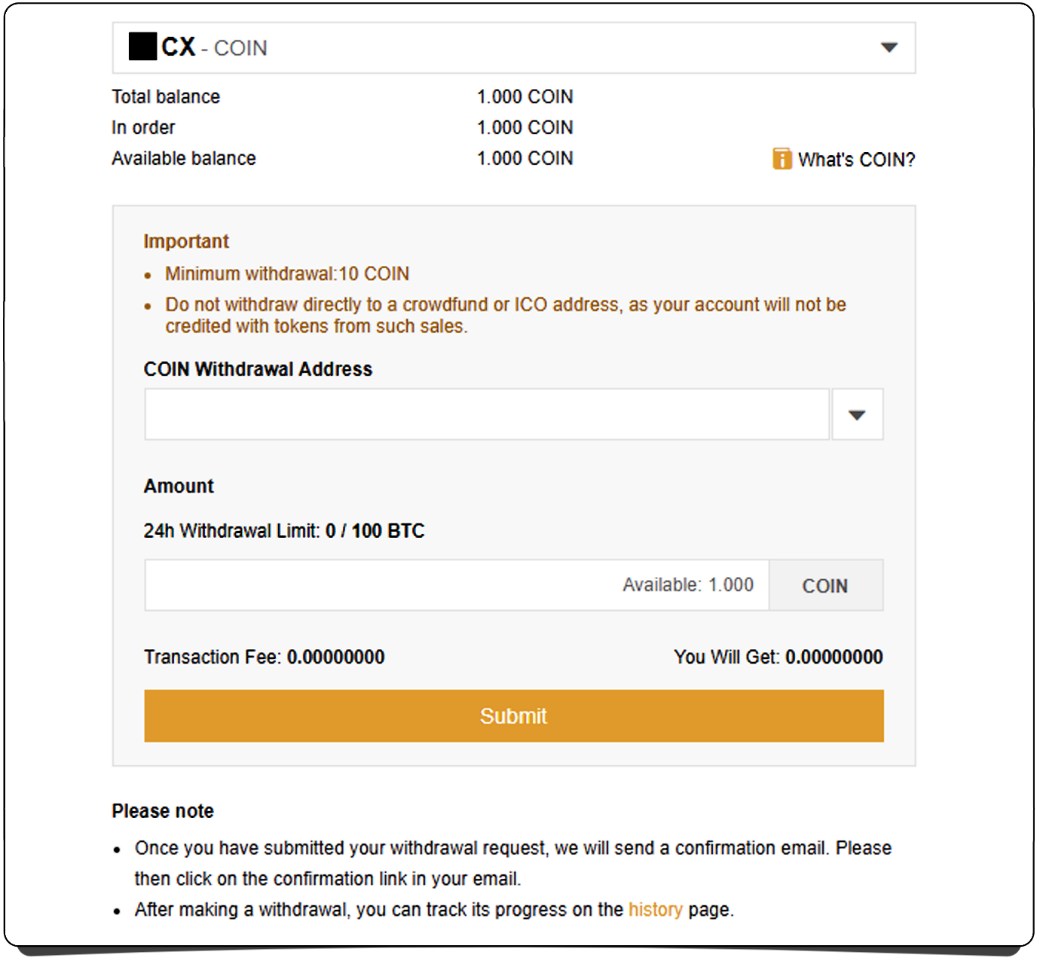

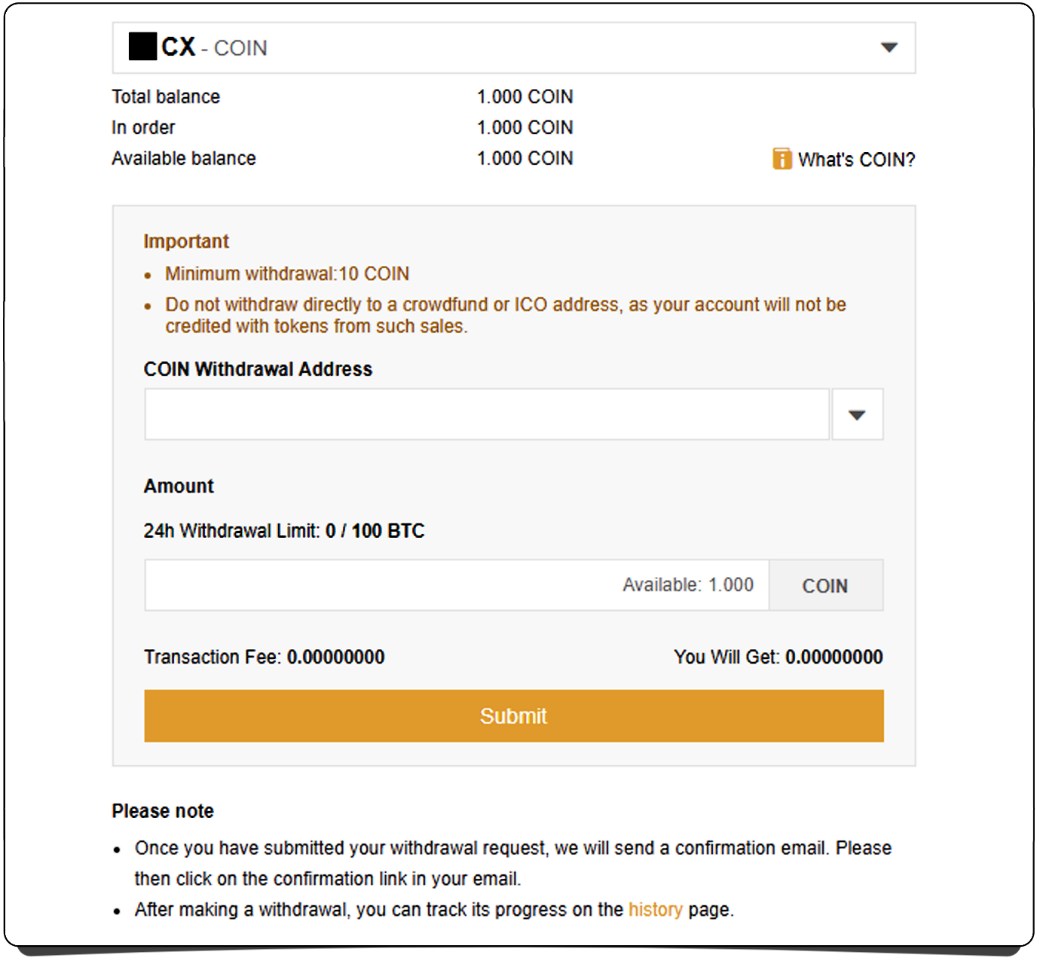

Read all the information presented to you about your coin —it may be important.

Once you’re ready, enter your personal wallet address into the ‘Withdrawal Address’ box.

Now type the number of coins you want to withdraw in the box labeled ‘Amount’.

Note: It’s smart to do a small test transaction of just a few coins when using a new wallet so you can be sure everything is working correctly before moving the bulk of your coins.

Once you’re sure all your withdrawal information is correct (double check everything!), press ‘Submit’.

If you’ve set up two-factor authentication, you will be asked for a code from your Authy app. Enter it and press ‘Submit’.

You will be sent an email to confirm the withdrawal.

Go to your email and click the link that has been sent to you.

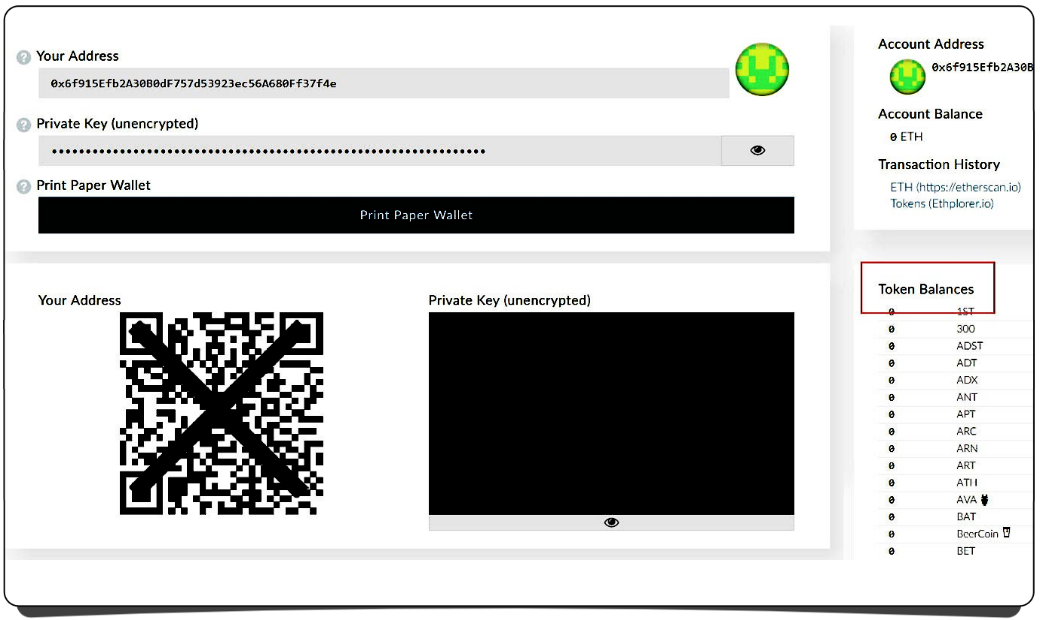

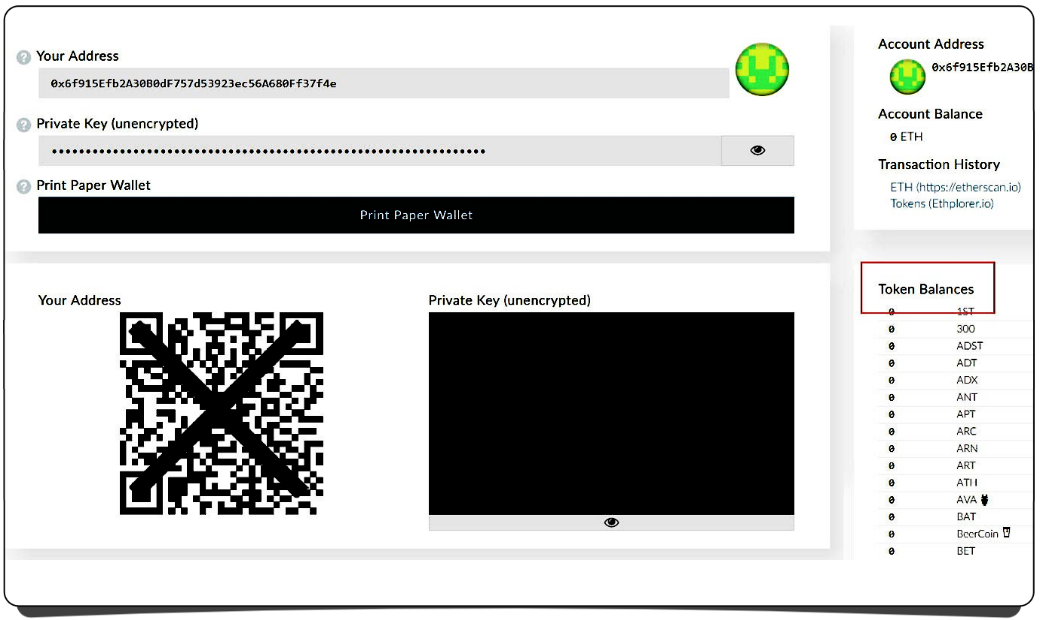

In this example, we’re moving Ethereum tokens, so in MyEtherWallet the coins would soon appear under ‘Token Balances’, listed under their trading abbreviation.

Once you’re sure the coins or tokens are showing correctly in your chosen wallet, you can return to Binance and move the rest of your coins using the same process.

Note: Make sure your means of access to your wallet is backed up somewhere private and safe.

Don’t regret losing your investment because you were too preoccupied to spend a few minutes backing everything up.

11

Monitoring your investment.

How to keep tabs on the development and price of a coin.

Now that you own cryptocurrency, I’d expect that you’d want to stay up to date on developments in your chosen coins, as well as their price movements.

There are a bunch of ways to stay informed about events concerning your coins:

Go the official site of the coin and subscribe to its newsletter.

Follow the development team of the coin, and most vocal fan groups, on Twitter, Facebook and Instagram.

Subscribe to the Reddit community of the coin.

If the coin has an official Telegram or Slack account, sign up and join the conversations.

If the coin has an active GitHub account, consider bookmarking

it and checking periodically to keep an eye on how work is progressing on the project’s code.

Sign up to a general crypto news Reddit community, such as https://www.reddit.com/r/CryptoCurrency

Visit crypto news sites such as:

https://www.coindesk.com https://www.ccn.com https://www.investing.com/crypto

... but remember they may have their own agendas in how and what they report.

Monitoring the price of a coin

It doesn’t make sense to keep opening your wallet to check the current value of your coins, as it’s time consuming and a security risk. You should be accessing your wallet only when you’re sending coins.

You can visit a website such as CoinMarketCap.com to check the price of a coin and the whole market, or visit an exchange such as Binance to see in real-time what the coin is trading for.

You can also use an app on your phone, such as:

CoinCap

BitWorth

Delta Portfolio Tracker

Using these, you can input the number of coins you have and track their price changes over a time period —a quick and easy way to check the price of your portfolio with one tap.

12

Selling your coins.

Trading to other coins or cashing out.

Note: There are potential tax implications when it comes to selling cryptocurrencies. See chapter 13.

Naturally a time may come when you’re ready to exchange some of your altcoins for other altcoins, or you may even want to sell some of your crypto back to fiat money.

Fiat money | Legal tender issued by a government , for example dollars, pounds or euros, etc. |

Trading one altcoin for another altcoin

At this time most altcoins can’t be

traded for one another directly —they must be traded for either Bitcoin or Ethereum, and from there traded to whichever new coin you wish to purchase.

To send your altcoin back to an exchange, you need to get a wallet address to send it to.

The following example shows you how to do that using Binance, and the process is very similar on other exchanges.

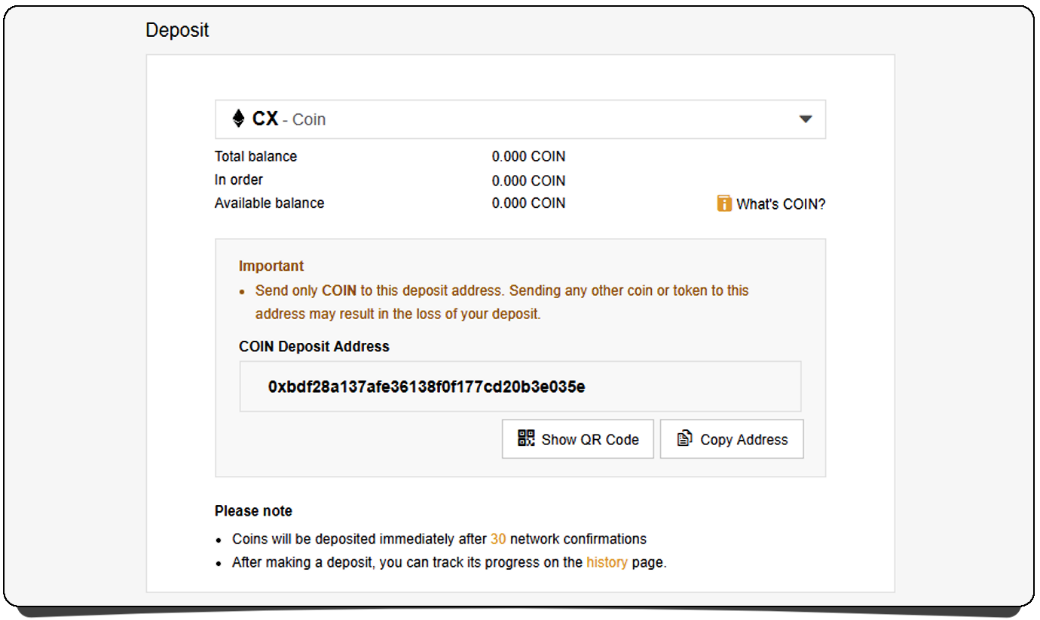

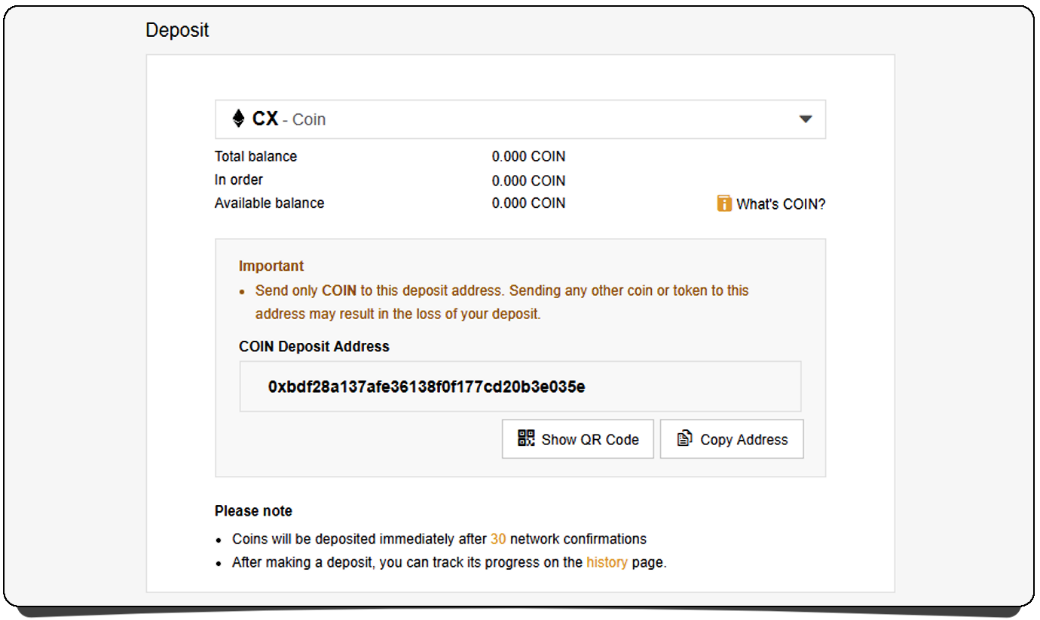

Depositing coins to Binance

On Binance, under the ‘Funds’ menu, click ‘Deposits’.

In the input box for ‘Select coin/token to deposit’, type the name of the coin you’re going to send to Binance. In the list that appears, click the coin.

This will load the deposit instructions for this coin. Read the warnings : be sure you don’t need to follow any special steps to deposit your coins. Some coins, often privacy oriented ones, require you to attach extra information to a transaction to make sure it arrives correctly.

Once you’re sure your deposit is good to go, copy the deposit address given to you by Binance.

Return to whichever personal wallet you’re using to store your coins and use the ‘Send’ option. Use the wallet address you just copied from Binance as the recipient address, and input how many coins you want to send.

At the risk of repeating myself, it’s not a bad idea to do a small test transaction to be sure everything is working smoothly before you send any large amounts.

As soon as Binance registers your deposit, the transaction will appear in the right-hand column labeled ‘History’. Be patient, as it takes multiple confirmations on a blockchain for Binance to confirm that your deposit was successful.

Once the coins appear on your ‘Balance’ screen, they’re available for trade.

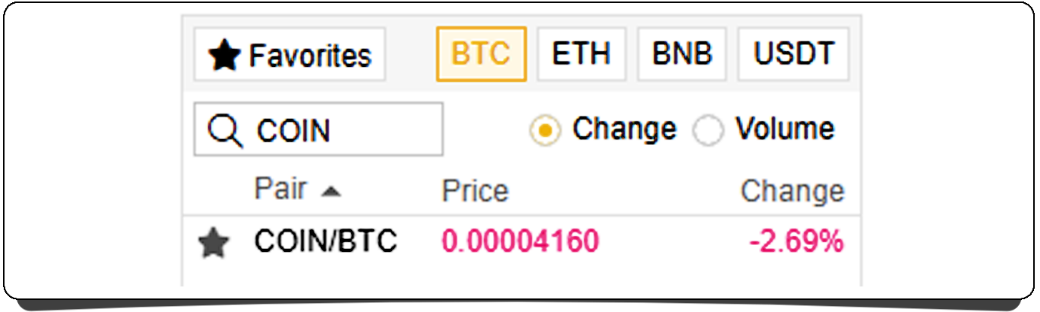

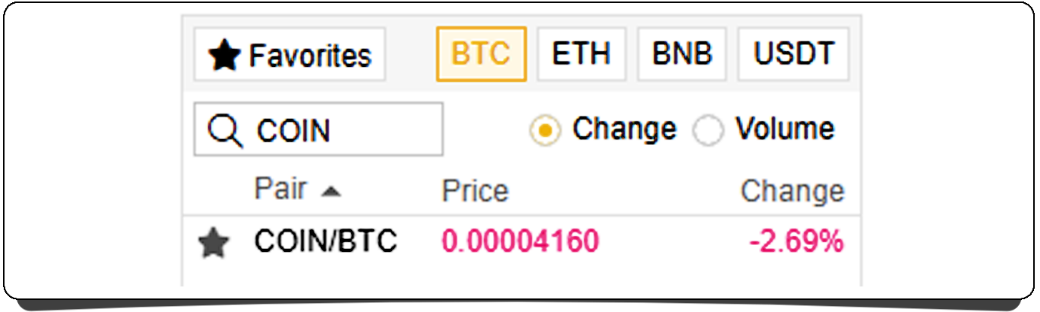

Hover over ‘Exchange’ and click ‘Basic’.

Depending on whether you’re selling your coins for Bitcoin or Ethereum, click either the BTC or the ETH box.

In the ‘Search’ input box, type your trading abbreviation of the coin and then select it from the list.

This will take you to the trading screen for your coin.

But instead of using the Limit/Market buy options, you’re going to use the Limit/Market sell options.

These options work exactly the same as the buy option, except of course you’re now selling your coins for Bitcoin or Ethereum.

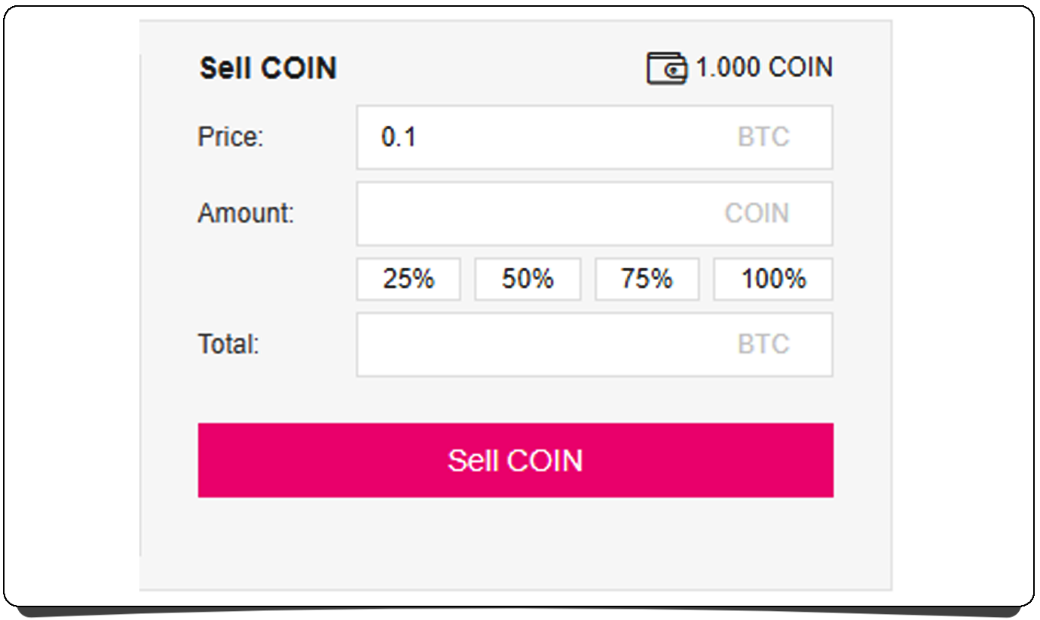

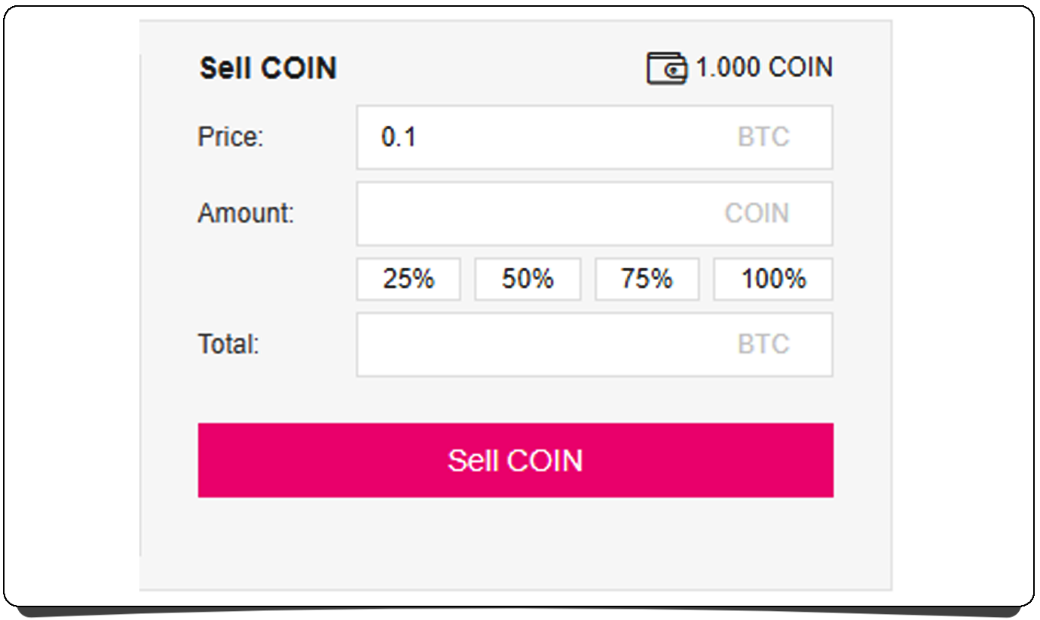

Selling using a limit order

If using a limit order, you can state the price you want to sell your coins at in Bitcoin or Ethereum, and how many coins you want to sell.

The order will sit on the order book until someone buys it. If the price of the coin goes down, your coins might not sell —and you may have to cancel your order and place it again at a lower price.

Selling using a market order

If using a market order, you enter the number of coins you want to sell and as soon as the order is placed it will be filled.

Your coins will be sold to the highest buy order, then the next highest, then the next, until it’s completely sold. Note that this may mean you get a lower overall price for your coins than you would using a limit order.

Trading an altcoin for fiat currency

At some point you might want to cash out some of your crypto.

Some exchanges do allow you to sell some altcoins for fiat currency without converting it to Bitcoin or Ethereum first.

For example, Coinbase currently allows you to buy and sell the altcoins Bitcoin Cash, Litecoin and Ethereum Classic for fiat currency without having to exchange them for Bitcoin or Ethereum first.

However, most altcoins are not yet available to trade straight to fiat currency. If that’s the case for yours, you’ll want to follow the previous guide for selling an altcoin to Bitcoin or Ethereum, and then send that Bitcoin or Ethereum to your chosen ‘crypto to fiat’ exchange, where you can then sell it for fiat currency.

As I’ve used Coinbase so far in the examples, I’ll do the same now.

In Coinbase, click ‘Accounts’. On either your Bitcoin or your Ethereum wallet, click ‘Receive’.

You will be presented with a wallet address which is where you send your Bitcoin or Ethereum to. You already know how to withdraw coins from an exchange from reading chapter 10.

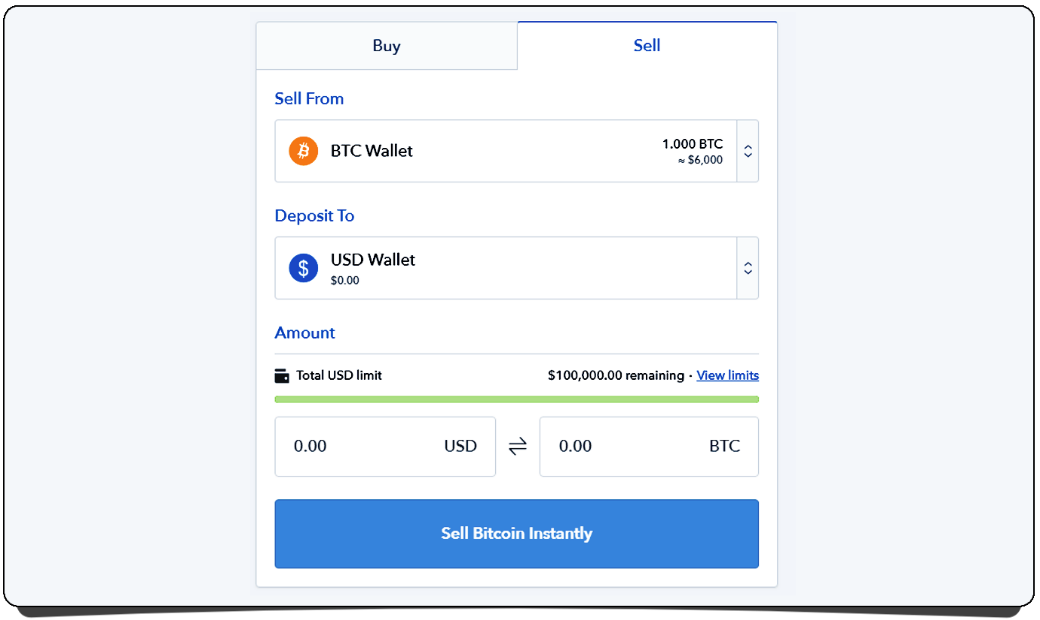

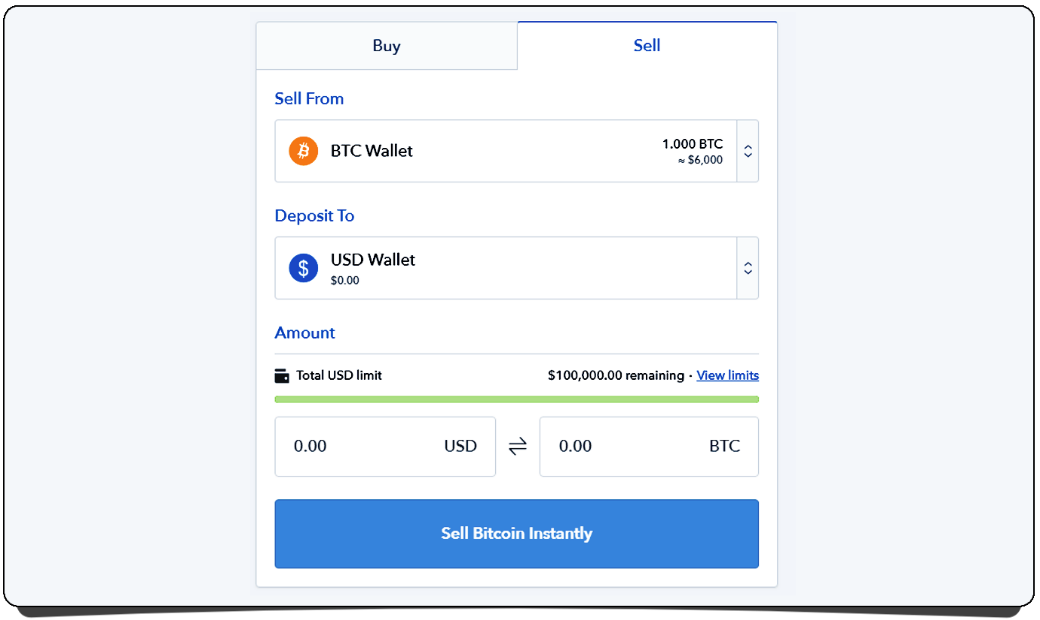

Once your coins have been deposited into your Coinbase wallet (this can take up to an hour), click ‘Buy/Sell’ along the top menu.

In the menu that appears, click ‘Sell’, then select your Bitcoin or Ethereum wallet from the drop-down menu.

In the ‘Deposit To’ option box, you can select which fiat currency you want to sell your Bitcoin or Ethereum for.

On the right of the screen you’ll be given a summary of your sell order: the price you’re selling Bitcoin or Ethereum at, the amount you’re selling, the Coinbase fee, etc.

Once you’re happy with what you see there, press the ‘Sell’ button.

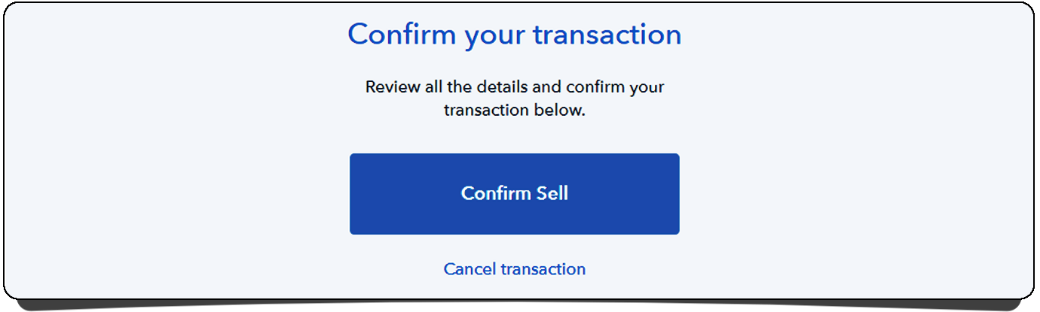

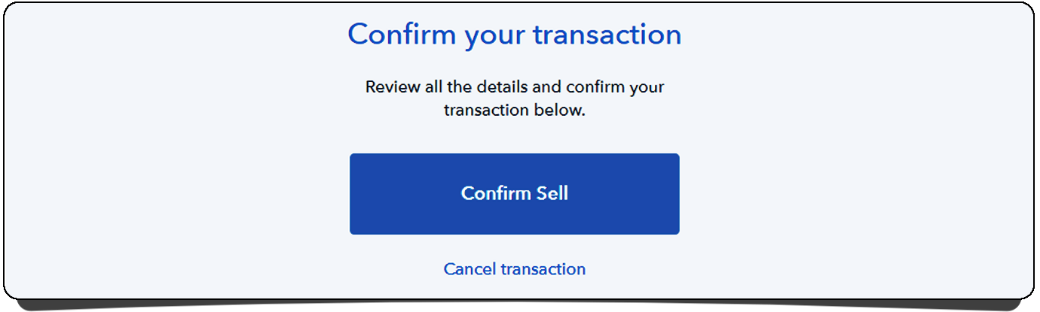

You will be asked to confirm the sell order. Check it over once again to be sure it’s correct, then click ‘Confirm Sell’.

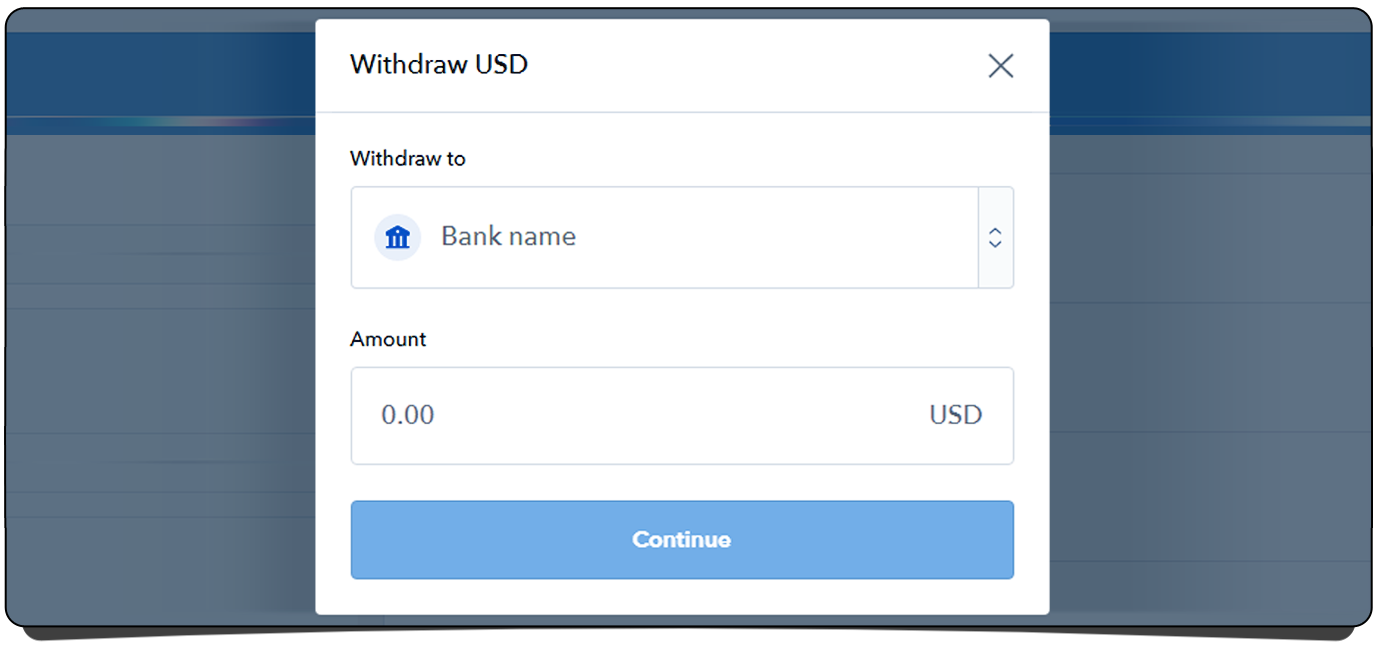

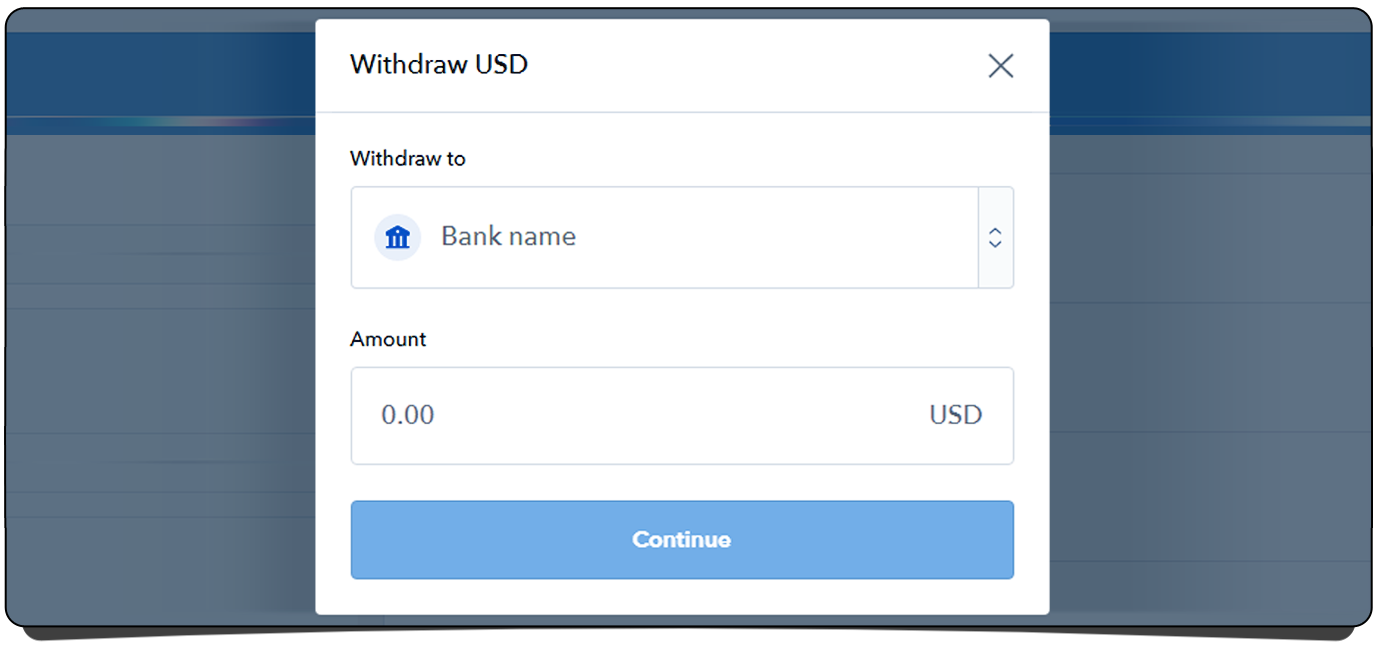

Now click ‘Accounts’ and find the correct currency wallet. Press ‘Withdraw’.

Select which bank account you wish to withdraw to, then input how much currency you want to withdraw.

Once you’re happy, click ‘Continue’. You will be presented with a summary of your withdrawal, including any fees you may have to pay. If it all looks fine, click ‘Confirm’.

The withdrawal will confirm and the funds will be sent to your bank account. How long it takes to receive them often depends on your bank’s own procedures.

13

Tax implications.

A rough guide to how trading and selling cryptocurrencies is taxed.

Tax implications for trading and selling cryptocurrencies differ from country to country, and it’s in your best interest to do thorough research before you trade or sell cryptocurrencies.

Different countries apply different rules to cryptocurrency. Some class it as property, some as an investment, some as a foreign currency. It’s up to you to find out how your country classes it, and what that means in regards to what tax you need to pay on profits you make from exchanging and selling it.

This is some general advice about the tax implications of:

Trading one cryptocurrency for another

Even though exchanging one cryptocurrency for another—for example, exchanging Bitcoin to Chainlink— doesn’t actually see any fiat money changing hands, it still counts as a ‘taxable event’.

What this means is that if you made a ‘profit’ at the time of the exchange, you may be liable to pay tax on it.

An example:

1 Bitcoin is purchased for $6,000.

That Bitcoin is exchanged for 10,000 Chainlink tokens, valued at $0.60 each in fiat currency.

Chainlink’s price goes up 10%. Each coin is now worth $0.66, valuing the 10,000 Chainlink at $6,600.

The Chainlink tokens are then exchanged for 1.1 Bitcoin.

The above example sees the trader making 0.1 Bitcoin in profit, valued at $600 in fiat at the time of the trade.

That exchange can be seen as a taxable event, and that $600 is taxable profit , even if the Bitcoin is not sold for fiat currency. This is commonly known as a ‘capital gain’.

What if I make a trade, make a taxable gain, but then the price of my new coin goes down and wipes out the gain?

Unfortunately you’ll still have to pay the tax on the capital gain you made when the profitable transaction took place.

The future rise of fall of the coin price makes no difference on the tax owed on a past trade.

Of course, it can also work the other way. If you exchange coins and make a loss, you might be able to claim a capital gains loss on your tax return.

However, some countries allow you to only post a limited amount of capital losses each year, though you may be able to carry some losses forward into the next tax year.

Selling a cryptocurrency for fiat currency

When you sell a cryptocurrency for fiat currency, you are crystallizing either a gain or a loss, and again this typically falls under capital gains tax laws.

An example:

1 Bitcoin is bought for $6,000.

The Bitcoin price goes up by 10%. That 1 Bitcoin is now worth $6,600.

The Bitcoin is sold for $6,600.

A profit of $600 is realized.

The $600 profit in the above example would typically be taxed as a capital gain.

The state of cryptocurrency tax laws

Worldwide, tax authorities have been reluctant to give concrete advice on how cryptocurrencies are to be taxed . They’re adopting a ‘wait and see’ approach to this new technology.

However, their obtuseness doesn’t mean you can ignore your tax obligations.

Remember that most blockchains have public ledgers , so anyone can view transactions, and in the future it may become easy to trace transactions back to the original buyers and sellers.

With so much money sloshing around cryptocurrency markets, you can bet that tax authorities are working out how they can get their slice of the pie , and you don’t want the tax-man knocking on your door a few years from now asking why you haven’t paid.

Following is some simple advice on keeping your crypto tax affairs straight.

Get an accountant

It’s not the easiest thing to find accountants who are well-versed in the current state of cryptocurrency tax laws, but they are out there, and well worth finding if you want to be confident you’re staying on the right side of your tax implications.

Record your trades

It’s essential to keep records of your cryptocurrency buys, sells and trading transactions.

Most exchanges , including Coinbase and Binance, offer the ability to download your trading activity, so you can see all of your buys and sells in one document.

These can then be passed to your accountant, and he can do the brain-teasing work of calculating the tax owed.