CHAPTER THIRTEEN

WHO PAYS THE PIPER

Colin sipped thoughtfully on his glass of ‘Unbelievable’ and then began to speak ‘Bryan, you follow these things. With all of this mismanagement, corruption, lack of accountability and looting, where is South Africa headed. I am perfectly happy here in the Umhlanga Village and would not like to see the colonial bonhomie discontinued but, given the demographics of the country, I guess this must all change. I can of course retreat to my properties in the Seychelles but I naturally would prefer to stay here’.

‘Colin, the effects of almost fifty years of Apartheid has had a devastating effect on the African population of South Africa. Although in the majority, they were suppressed – intellectually, educationally and economically. The advent of democracy thrust a suppressed third world people into the first world mainstream that white South Africans had created. Despite its long history, the ANC in exile, who incidentally already had their own Constitution, were understandably not in a position to ascend to power in 1994.

Since that date they have struggled with the complexities of being part of a world order and being a leader on the African Continent.

The advent of democracy dangled never considered privileges in front of individuals for the first time. There were those who were proud of the admirable principles of the African National Party which had ultimately gained for them their political freedom. They celebrated their collective bravery, persistence and morality.

However, there were also those who realized that they had not won their economic freedom. South Africa was still governed by white capitalists.

When those capitalists attempted to level the economic playing field, through BEE policies, opportunists saw a rare opportunity to enrich, not their communities, but themselves.

And thus began the looting. It should have been a surprise as fifty odd decolonized countries North of us had followed a similar path. After twenty two years of ANC rule we see that formerly noble movement split in two: between the traditionalists and the looters.

Colin, in answer to your question, the status quo of the bohemian paradise, in which we take such pleasure, is about to implode. Make reservations to leave for the Seychelles.

The disparity which existed in our society prior to 1994 has not been adequately addressed by the ANC. As with the rest of Africa a new black elite class has evolved which attacks rather than repairs the economic equality divide. Black on Black elitism is the order of the day with little or no attempt by the haves to share with the have nots.

Until Zuma is either hastened to prison or allowed to contemplate his legacy in retirement at Nkandla, the looting will continue. The Black Elitists that remain will forever be greedy for the next buck, bribe or bottle of Blue Label.

The French Revolution comes to mind.

‘Bryan thanks for your advice. Although your view is a little extreme, I shall nevertheless consider what you have had to say.

‘On a more important subject old man, can I get you another glass of ‘Unbelievable?

Taxation

Uttered first in Daniel Dafoe’s ‘The Political History of the Devil’ in 1726, the fatalistic and sardonic proverb ‘things as certain as death and taxes, can be more firmly believed’ has evolved to ‘nothing is more certain than death and taxes’. It relays the actual inevitability of avoiding both death and the burden of taxation.

‘An Inquiry into the Nature and Causes of the Wealth of Nations’, generally referred to by its shortened title ‘The Wealth of Nations’, is the magnum opus of the Scottish economist and moral philosopher Adam Smith. First published in 1776, the book offers one of the world's first collected descriptions of what builds nations' wealth, and is today a fundamental work in classical economics. By reflecting upon the economics at the beginning of the Industrial Revolution, the book touches upon such broad topics as the division of labour, productivity, and free markets.

On the topic of taxes Adam Smith's goal was to create a tax system that had four basic requirements:

Equality

How much can the person afford to pay?

Certainty

Taxes must be clear and unambiguous

Convenience

Must be payable when convenient to the taxpayer

Economy

Taxes must be economic to collect

Tax has many associations. It has long been viewed with fatal resignation, likened to a natural but inevitable force. It has also underpinned our civilisation’s history. Whether we embrace positive or negative views of tax it has a deeply embedded role within society and our concept of citizenship. There is a fundamental relationship between tax and citizenship.

Tax represents our social contract with government. We believe the taxpayer’s obligation of citizenship, and the government’s honouring of that, to be one of the most important considerations in the tax debate. We need to position tax as a public good. Taxation provides valuable economic and social returns, which can empower both the individual and wider society.

With seventeen million South African on welfare and thirty plus percent of the economically active population unemployed the burden of taxation on those employed is enormous.

South Africa has a very small tax base. Looking forward it is critical that South Africa’s expand its tax base through increased employment and not higher taxes in order to meet the increasing demands of the country.

If that does not occur the government’s debt level will rise dramatically, foreign direct invest will fall, divestment will be rife, tax rates will increase sharply and public sector service delivery will continue to disappoint.

All of the failures will increase the risk of a credit rating downgrade making interest more onerous with a knock-on effect throughout the economy.

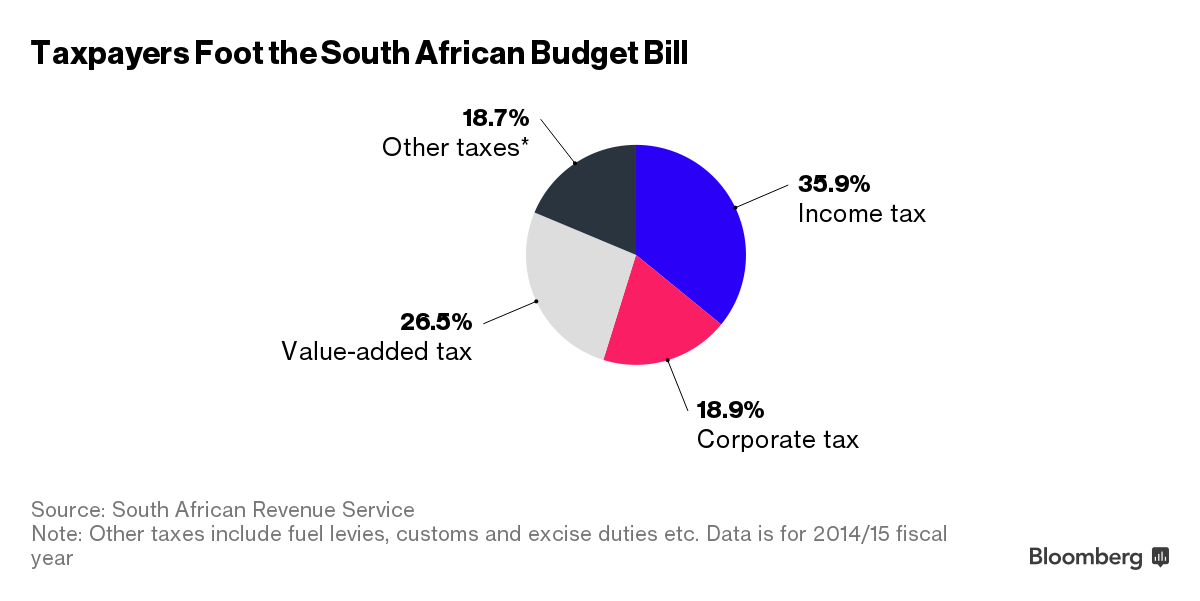

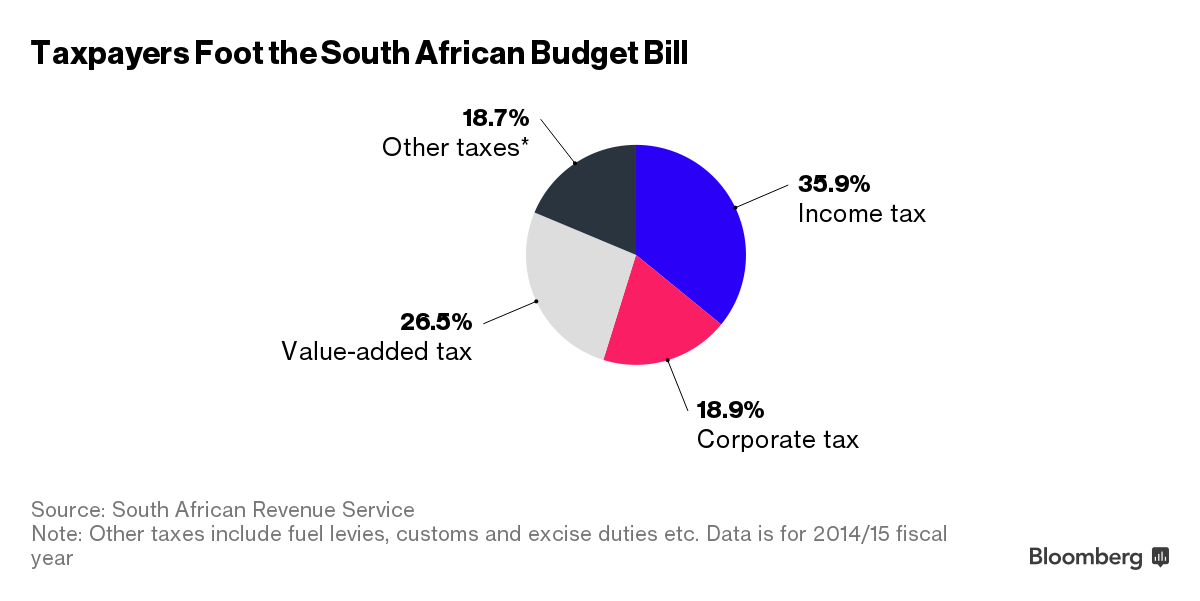

The graphic below depicts the type of tax collected by the South African Revenue Service for the 2015 Tax Year.

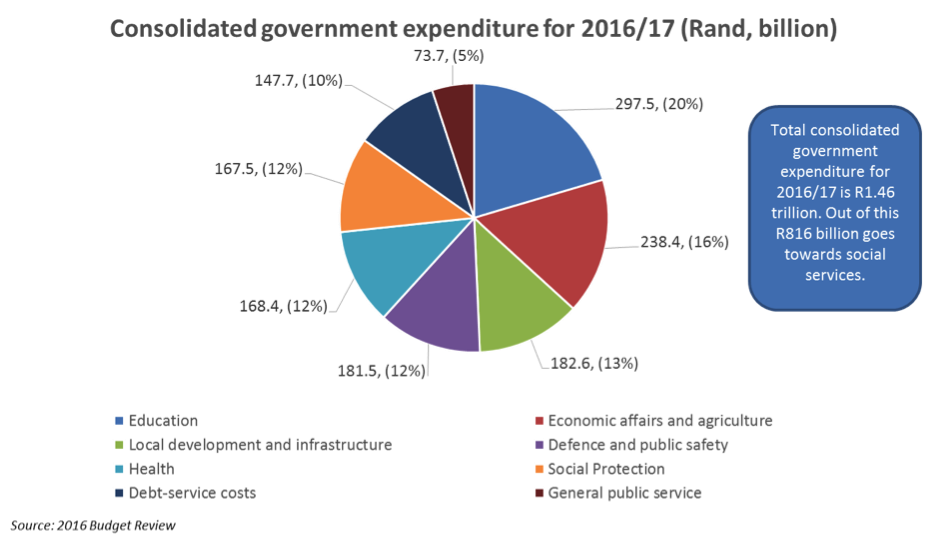

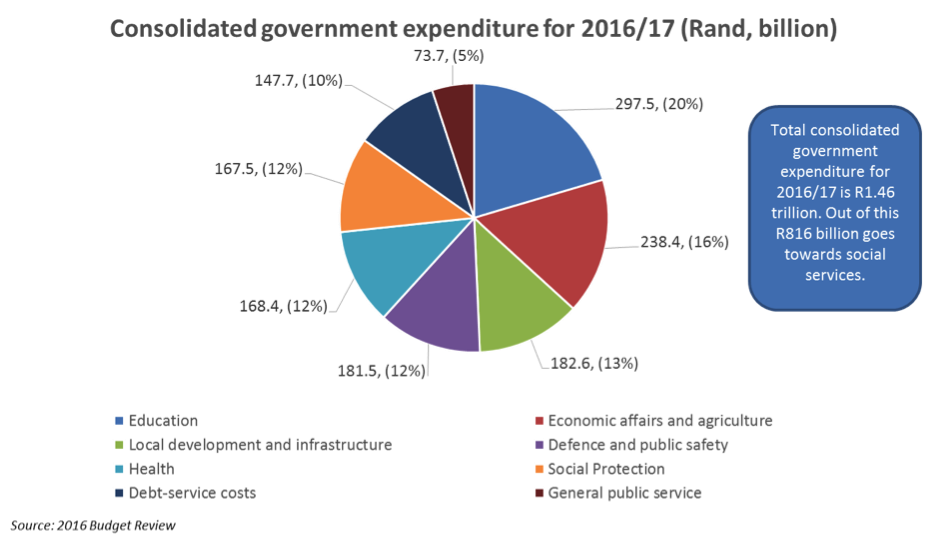

And this is where it goes

EDUCATION

The minister has allocated R297.5 billion for the education sector, an increase from last year's R265.7 billion.

Basic education will get R205.8 billion, while university subsidies will be allocated a total of R28.0 billion.

Gordhan said, "An additional allocation of R813 million for early childhood development is proposed to increase the number of children in ECD centres by 104 000 over the MTEF period."

The National Student Financial Aid Scheme will also get an assistance of R14.3 billion - a much-needed injection following the Fees Must Fall protests by students over tuition fees.

HEALTH

The health sector has been allocated R168.4 billion, an increase of R11.1 million from last year's R157.3 billion.

The district health services will receive R75 billion while provincial hospital services have been allocated R29.4 billion.

The minister said, "Health financing is complex, because the demands unavoidably exceed available funds. This is the case even in advanced rich countries."

He added that, "An additional R740 million has been allocated to strengthen TB programs to encourage early detection and treatment, and R1 billion for expansion of the antiretroviral treatment programme."

SOCIAL PROTECTION

The social protection, which includes old-age grants and child-support grants, has been allocated a total of R167.5 billion.

Last year, the social protection sector had been allocated R155.3 billion.

The old-age grant will receive an injection of R58.9 billion while the child-support grant will receive R52 billion.

He said, "The old age, disability and care dependency grants will rise by R80 to R1,500 in April 2016, and by a further R10 to R1,510 in October. At the same time, the child support grant will rise by R20 to R350 in April and the foster care grant by R30 to R890."

Meanwhile, the disability grant is allocated R20.4 billion.

PUBLIC DEFENCE AND SAFETY

With the recent police killings and police brutality case, this sector is one of the few that draws the most attention from Gordhan's speech, as South Africa await to see how the money allocated to it will be used to make the country a safer place.

The finance minister has put aside a total of R181.5 billion for public defence and safety. This money will be split between police services at R87.5 billion, defence and state security at R52.3 billion and

Law courts and prisons spend is at R 41.7 billion.

ECONOMIC AFFAIRS AND AGRICULTURE

The economic affairs have been allocated a total of R238.4 billion, an increase from last year's R206.2.

The science, technology, innovation and the environment will take R19.9 billion from that portion while employment, labour affairs and social security funds will get R73.1 billion.

Agriculture, rural development and land reform will then be handed R26.4 billion.

What does the future hold?

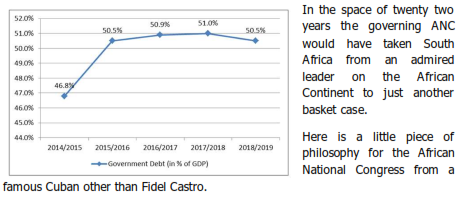

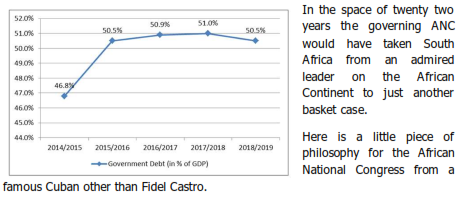

There is little wriggle-room in these statistics and Finance Minister Gordhan and his team at Treasury have performed a minor miracle in balancing the Budget in a stagnated economy. With Government expenditure out of control, corruption rife and the State’s unfriendly face in the International Arena, balancing future budgets will be nigh impossible. And sadly there is no release valve. Even if downgraded by the ratings agencies, making borrowing more expensive, the country is nevertheless borrowed to the hilt at 50% of GDP through to 2019. Foreign Direct Investment under these circumstances will dry up and South Africa will be on the slippery slope to Mr Zuma’s beloved ‘African Way’.

‘When we blindly adopt a religion, a political system, a literary dogma, we become automatons. We cease to grow’ - Anais Nin

These are the Top 10 Risks to the World in 2017

Ian Bremmer

Jan. 3, 2017

Number Ten: A Struggling South Africa

The deeply unpopular President Jacob Zuma, beset by corruption allegations, is afraid to pass power to someone he doesn’t trust. The resulting infighting over succession stalls any momentum toward crucial economic reform in the country and limits South Africa’s ability to offer leadership needed to stabilize conflicts inside neighbouring countries.