CHAPTER 16

I had discovered the existence of venture capital in New York in the late eighties. On an evening when I had declined an invitation from my travelling companions, to cause mischief and frivolity in the big apple, I had sought a magazine from the bookstore in the foyer of our hotel on Central Pak West. To my amazement I found scores of magazines on the subject of venture capital. I immediately purchased several of these and spent the evening devouring the contents.

South Africa was at that time incurring the wrath of the world for it’s untenable separate development policies and abhorrent racism. Embargoes, retraction of foreign direct investment and diplomatic scorn were the order of the day and we had, at that time, to reach New York via Ila Da Sol in the Cape Verde Islands so as not to overfly any other African countries whose airspace had been closed to South African Airways.

The magazines informed me that monolithic US Corporations were downsizing in favour of smaller, more nimble entities capable of adapting to economic changes more easily. Also that modern industrialisation and advancement in machinery and computers was less labour intensive resulting in major corporations being forced to shed jobs. The era of womb to tomb employment was over. Venture Capital was expected to come up with innovative ideas in the new world to employ the jettisoned masses.

I saw an opportunity for the introduction of venture capital into South Africa where isolation from world trade forced the country to become more independent and more self reliant. It is ironic that South Africa today, some thirty years later, is in need of a vibrant venture capital market for entirely different reasons.

World economic slow down, an out of touch central government, a shambolic education system, a risk averse banking sector, exodus of foreign direct investment and a kleptocratic leadership in South Africa has seen youth unemployment soar to fifty percent.

Unless someone takes some risks there is going to be a bloody revolt. Another Arab Spring looms. Lives are at stake. Venture capital (VC) is financial capital provided to earlystage, high-potential, high risk, growth startup companies. The venture capital fund makes money by owning equity in the companies it invests in, which usually have a novel technology or business model in high technology industries, such as biotechnology, IT and software. The typical venture capital investment occurs after the seed funding round as growth funding round (also referred to as Series A round) in the interest of generating a return through an eventual realization event, such as an IPO or trade sale of the company. Venture capital is a subset of private equity. Therefore, all venture capital is private equity, but not all private equity is venture capital.

In addition to angel investing and other seed funding options, venture capital is attractive for new companies with limited operating history that are too small to raise capital in the public markets and have not reached the point where they are able to secure a bank loan or complete a debt offering. In exchange for the high risk that venture capitalists assume by investing in smaller and less mature companies, venture capitalists usually get significant control over company decisions, in addition to a significant portion of the company's ownership (and consequently value).

Venture capital is also associated with job creation (accounting for 2% of US GDP), the knowledge economy, and used as a proxy measure of innovation within an economic sector or geography. Every year, there are nearly 2 million businesses created in the USA, and 600-800 get venture capital funding. According to the National Venture Capital Association, 11% of private sector jobs come from venture backed companies and venture backed revenue accounts for 21% of US GDP.

It is also a way in which public and private sectors can construct an institution that systematically creates networks for the new firms and industries, so that they can progress. This institution helps in identifying and combining pieces of companies, like finance, technical expertise, know-hows of marketing and business models. Once integrated, these enterprises succeed by becoming nodes in the search networks for designing and building products in their domain.

Obtaining venture capital is substantially different from raising debt or a loan from a lender. Lenders have a legal right to interest on a loan and repayment of the capital, irrespective of the success or failure of a business. Venture capital is invested in exchange for an equity stake in the business. As a shareholder, the venture capitalist's return is dependent on the growth and profitability of the business. This return is generally earned when the venture capitalist exits by selling its shareholdings when the business is sold to another owner.

Venture capitalists are typically very selective in deciding what to invest in; as a rule of thumb, a fund may invest in one in four hundred opportunities presented to it, looking for the extremely rare, yet sought after, qualities, such as:

-

Innovative technology

-

Potential for rapid growth

-

A well-developed business model

-

An impressive management team

Of these qualities, funds are most interested in ventures with exceptionally high growth potential, as only such opportunities are likely capable of providing the financial returns and successful exit event within the required timeframe (typically 3-7 years) that venture capitalists expect.

Because investments are illiquid and require the extended timeframe to harvest, venture capitalists are expected to carry out detailed due diligence prior to investment. Venture capitalists also are expected to nurture the companies in which they invest, in order to increase the likelihood of reaching an IPO stage when valuations are favourable. Venture capitalists typically assist at four stages in the company's development:

-

Idea generation

-

Start-up

-

Ramp up

-

Exit

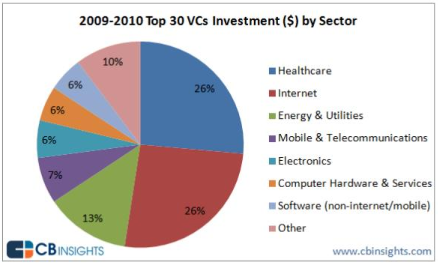

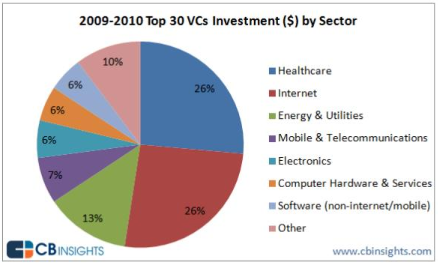

The top ten sectors in which US venture capitalists made investments in 2010 were:

Because there are no public exchanges listing their securities, private companies meet venture capital firms and other private equity investors in several ways, including warm referrals from the investors' trusted sources and other business contacts; investor conferences and symposia; and summits where companies pitch directly to investor groups in face-to-face meetings, including a variant known as "Speed Venturing", which is akin to speed-dating for capital, where the investor decides within 10 minutes whether he wants a follow-up meeting. In addition, there are some new private online networks that are emerging to provide additional opportunities to meet investors.

This need for high returns makes venture funding an expensive capital source for companies, and most suitable for businesses having large up-front capital requirements, which cannot be financed by cheaper alternatives such as debt. That is most commonly the case for intangible assets such as software, and other intellectual property, whose value is unproven. In turn, this explains why venture capital is most prevalent in the fastgrowing technology and life sciences or biotechnology fields

The 2008 South African National Budget Review identified access to equity finance by small and medium-sized businesses as one of the main challenges to the growth of this sector of the economy. Although South Africa has a well-developed private equity industry, its appetite for start-up, early stage and seed capital type transactions is low. To meet the challenge of access to venture capital for small and medium-sized enterprises, government introduced the section 12J of the Income Tax Act (‘the Act’) tax incentive for individual investors, corporate investors and venture capital funds in qualifying small enterprises and start-ups. The tax incentive took effect from 1 July 2009.

Since its inception and despite amendments in 2011 to enhance its attractiveness, the uptake for this tax incentive has been very limited. In the 2014 National Budget Review, Government announced that it will propose one or more of the following amendments to the venture capital company regime:

-

making tax deductions permanent if investments in the VCC are held for a certain period of time;

-

allowing transferability of tax benefits when investors dispose of their VCC holdings;

-

increasing the total asset limit for qualifying investee companies (i.e. companies in which the VCC may invest) from R20 million to R50 million, and from R300 million to R500 million in the case of junior mining companies; and

-

waiving capital gains tax on the disposal of assets by the VCC, and expanding the permitted business forms.

The purpose of this series of articles is to examine the impact of the VCC tax incentives on the investors, the VCC itself and the qualifying investee companies. This article will give a general overview of the VCC scheme while subsequent articles will deal with each of the role players in increasing levels of detail.

What is a VCC?

A section 12J approved VCC is a company designed to provide individual and corporate investors with access to a range of trading companies which have the potential for growth. The VCC aims to make money by investing in these smaller trading companies. The VCC raises funds by issuing equity shares to investors and the money is then allocated to those businesses that the managers judge to have the best prospects.

What are the risks of VCC investments?

There are significant risks associated with investing in venture capital backed companies. These risks fall in two categories: investment risk and liquidity risk.

Investment risk

They will generally be at an earlier stage than more developed quoted companies and will often carry a higher risk of failing than their blue chip counterparts. Although VCCs are long-term investments there is no minimum holding period to take advantage of the upfront income tax relief (which is discussed below). However, a minimum holding period has been proposed to qualify for the permanent tax deduction.

Liquidity risk

At present an investor may recapture the upfront income tax relief if the VCC shares are sold at a gain. Accordingly, it is proposed that investors must hold VCC shares for a minimum time in order for investors to retain the income tax relief. Even after the holding period, VCC shares may not be easy to sell at full value. Purchasers of “second-hand” VCC shares will not benefit from upfront income tax relief unless the proposal to transfer tax benefits is implemented and even then it is not clear whether the upfront income tax relief will be one of the transferable tax benefits.

Venture capital companies – the investment process

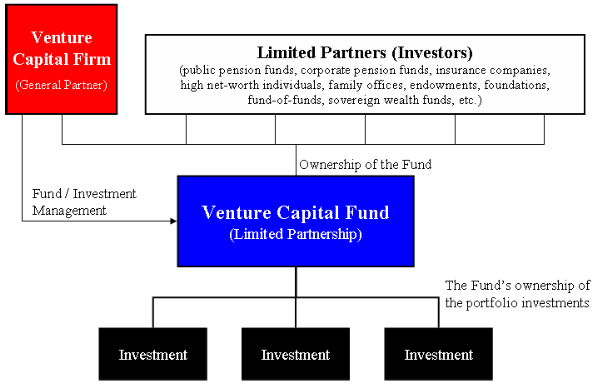

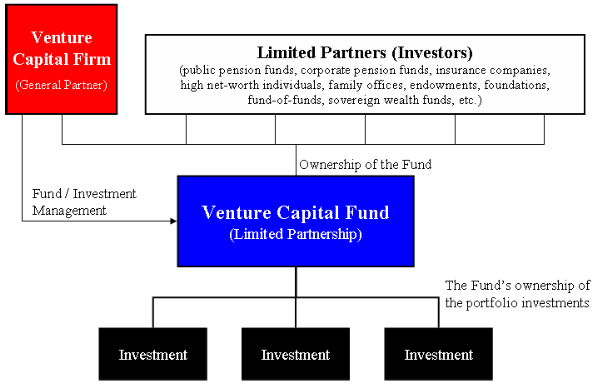

The diagram above depicts the various role players. The following articles in this series will examine the roles of the following entities:

-

The tax treatment of the individual and corporate investors in VCCs;

-

The VCC itself – the requirements, conditions and limiting factors to be taken into account when structuring the VCC; and

-

The investee companies – the profile the underlying investee companies in which the VCC is permitted to invest its funds.