CHAPTER 17

Solidarity: Government finances, economy at crossroads – market reforms needed

‘Government’s dire financial position and the consequent damage to the local economy can be overturned if market friendly reforms are implemented’. This is according to a new report by the Solidarity Research Institute. The report, which considers the current trajectory of government finances in light of the October 2015 mini budget documents, was released today.

This follows after the extent of the government’s poor financial position has once again been confirmed by revisions to South Africa’s sovereign credit ratings. The ratings agency Standard & Poor’s on Friday revised its outlook on South Africa’s BBB minus rating from stable to negative. Concurrently, Fitch Ratings has downgraded its rating from BBB with a negative outlook to BBB minus with a stable outlook. Fitch specifically based this downgrade on the South African government’s policies that are not conducive to economic growth.

Gerhard van Onselen, researcher at the Solidarity Research Institute, says the lower credit ratings come as no surprise. ‘Government debt has been growing steadily for the past several years while the sustainability of government finances keeps on weakening. Since the economic recession of the late 2000s, the government’s budget has been underpinned by fiscal deficits, attempted countercyclical policy, substantial social welfare transfers and some highly questionable large scale state-driven capital projects. This state of affairs is set to continue’ Van Onselen said.

‘Over the last number of years an increasing number of damaging policies and pieces of legislation, aspiring to enlarge Government’s role in the economy, while increasingly undermining the private sector, were introduced. It is our contention that such structural impediments to economic growth, brought on by government’s encroachments into the economy, are mounting. These could expand further, overturning any likelihood of benefits from a, now unlikely, short- to medium-term cyclical recovery’ Van Onselen warned.

Van Onselen added that the present adverse situation holds the opportunity to consider reforms to encourage business activity and investment. ‘This could set in motion the creativity and energy of free human interaction and collaboration. This is what underlies true economic progress. Our hope is that this option will be considered and implemented’ Van Onselen said.

State-owned corporations take centre stage despite internal troubles

PRETORIA – The prominence of state-owned enterprises in the economy continues to grow. Their assets have been growing steadily since 2011 as they invest in infrastructure and development finance institutions expand their lending operations.

About four years ago, the Presidency commissioned a review of state-owned entities. The report of the panel, which was led by Riah Phiyega, served at Cabinet’s Lekgotla in 2015. The report contains various recommendations. Government is called on to identify truly strategic state-owned companies and to consider disposing those are not deemed to be so.

The report also suggests that the ‘developmental mandates’ of state-owned entities should be costed.

Options for private investment, such as the approach taken in the renewable Energy Independent Power Producers Procurement Process, should be explored.

Eskom, Sanral and Transnet have some of the largest infrastructure development budgets. Eskom’s capital expenditure will come in at R62-billion in this fiscal year, Transnet will spend R36-billion and Sanral R15.6-billion.

The proportion of foreign borrowing at state-owned corporations is quite high, at 42 percent in the 2015 fiscal year, expected to fall to 34 percent in the 2017/18 fiscal year.

When it comes to government guarantees, Eskom is a clear leader with a R350-billion commitment from government. It has borrowed R145-billion against this guarantee.

A guarantee is a commitment by the state to assume responsibility for a loan in the event that entity in question is not able to repay it.

Sanral has borrowed R30.2-billion against a R38.9-billion guarantee; the Trans-Caledon Tunnel Authority R20.7-billion against R25.7-billion.

South African Airways’s guarantee comes in at only R8.3 billion borrowed against a R14.4 billion guarantee.

The budget contained little that was new about SOC’s turnaround strategies.

Once again, government confirmed that it will inject R23-billion funding into Eskom which will be raised from the sale of nonstrategic assets.

No details on assets to be sold to raise this money were forthcoming, but Nene said that the first announcement should be expected in June 2015.

South African Airways, the technically insolvent national carrier, which recorded a R2.6 billion loss in 2014/15 financial year was brought under National Treasury’s authority in December 2014.

It has cancelled loss-making routes to Beijing and Mumbai and concluded an agreement with Etihad Airways. Other turnaround measures include the extension of three aircraft leases at lower rents.

Similarly, the South African Post Office is undergoing turnaround strategy, which will help it to meet its obligation to roll out new postal services across the country at lower cost.

The Post Office enjoys a guarantee of R1.7-billion.

Development finance institutions (DFIs) have been urged to increase their lending to emerging businesses.

Outstanding loans granted by development finance institutions increased from R40.5-billion in the 2008/9 fiscal year to R108.7-billion in the 2013/14 fiscal year.

The most significant DFIs are the Industrial Development Corporation (IDC), Land Bank and the Development Bank of Southern Africa.

The IDC represents over half of the asset base of these public interest financiers, and is in the process of merging with the major smaller National Empowerment Fund.

The loan books of the big three DFIs are set to grow by a third over the next two years, to reach R178-billion in 2016/17.

The Road Accident Fund, which will benefit from a 50 cents per litre fuel levy, remains in dire straits.

On the positive side, it has improved its efficiency and is steadily reducing its claims backlog from 253,111 open claims in 2012 to 198,407 in 2014.

But its long-term liabilities are estimated at R98.5-billion. New legislation will be tabled this year to change the structure of the RAF.

The corporate entities that this department is responsible for are:

-

Alexkor – Mining sector (diamond mining)

-

Broadband Infraco – ICT sector (national backbone and international connectivity)

-

Denel – Aerospace and Defence sector (armaments manufacturer)

-

Eskom – Energy sector (national electricity utility)

-

PBMR – Energy sector (development of Pebble Bed Modular Reactor nuclear energy technology)

-

South African Airways – Transport sector (international airline)

-

SA Express – Transport sector (regional and feeder airline)

-

SAFCOL – Forestry sector (manages forestry on state owned land)

-

Transnet – Transport and related infrastructure sector (railways, harbours, oil/fuel pipelines and terminals)

-

Telkom SA – Telecommunications sector (national fixed line telephone network (PSTN))

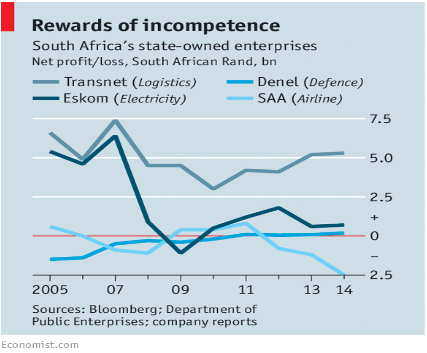

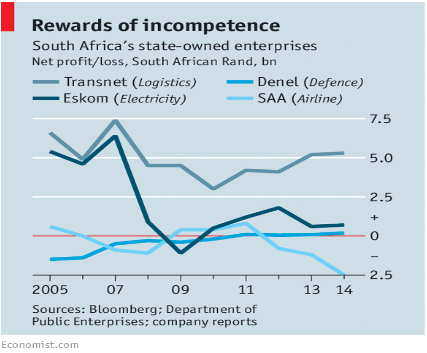

JOHANNESBURG - The state-run corporations that have shaped South Africa's economy and been part of its everyday life for nearly a century are mostly in a state of collapse, threatening to crush already weak growth.

Economists estimate that underperformance and inefficiency in state-owned firms ranging from power utility Eskom to South African Airways (SAA) to the postal service is lopping 2-3 percentage points off annual growth.

‘If we do all the calculations, most probably a lot of the missing growth in the economy is because state companies are not working’ said William Gumede, a professor at the University of the Witwatersrand School of Governance.

Johannesburg resident Gertrude Nduna would agree.

Her fledgling online perfume shop is facing ruin due to late deliveries by the South African Post Office, whose slogan is "We Deliver, Whatever It Takes", but which is tipping into financial failure.

‘It is ruining my business and my reputation but I cannot afford to use private couriers’ Nduna said, lamenting her reliance on a postal service that ran out of money for fuel for its delivery vans this month.

Telecommunications Minister Siyabonga Cwele has called it "an aircraft in urgent need of a pilot". It is losing R100-million a month due to poor financial management, despite a R1-billion ($77.34 million) loan guarantee from the state.

State-owned companies, which currently account for about 20 percent of all capital investment, have arguably always been a drain on state resources.

They have underpinned the economy since the 1920s when enterprises such as Eskom and the South African Iron and Steel Corporation were set up to provide infrastructure, basic materials and services after the First World War.

By the late 1980s the government directly or indirectly owned almost 40 percent of the industrial sector, greater than that in any country outside the communist bloc.

Many so-called parastatals were viewed as unprofitable, dependent on state funds, and their strong association with the apartheid government allowed cronyism to flourish; jobs were reserved for whites, mainly Afrikaans men.

'Monster'

When Nelson Mandela took office in 1994, state entities became the engine of efforts to correct racial and economic imbalances, sucking up vast resources to roll out electricity and other essential services to the black majority.

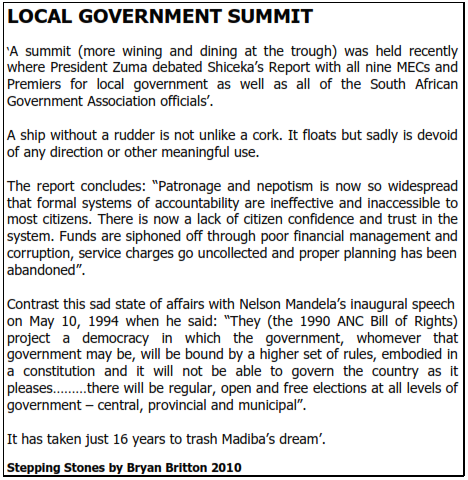

But affirmative action under President Jacob Zuma has bloomed into cronyism, analysts say, with competent candidates often overlooked in favour of political appointees. There are as many as 700 parastatals employing hundreds of thousands of people.

‘We inherited a monster and we didn't make it any better. With a few exceptions, I don't believe overall we have quality leadership in the state-owned enterprises to drive economic growth’ said political analyst Gary van Staden of NKC African Economics.

‘They're not productive and they're not making money. As things stand right now, they're a drain’.

Finance Minister Nhlanhla Nene singled out electricity shortages - partly blamed on mismanagement at Eskom - as a "binding constraint" on GDP growth, forecast at less than an anaemic 2 percent this year.

Eskom, which halved its net profit in the financial year to March and needs to borrow more than R20 billion ($1.6 billion) to refurbish its ageing infrastructure, has implemented rolling blackouts to avoid overwhelming the national grid.

It has been a revolving door for executives since a former boss, Jacob Maroga, was forced out in 2009, months after the national grid came close to collapse, forcing mines and smelters to shut down.

Since April, it has been led by respected former Treasury official Brian Molefe after his predecessor quit amid a probe into the running of the firm, as it suffered its worst power crisis since 2008. Its chairman also resigned.

SAA, which reported a R2.6 billion loss in 2013/14, has ploughed through six CEOs in as many years. The Treasury, which has assumed administrative powers over the airline, has issued more than 14 billion rand in loan guarantees.

'Favours'

‘It's fair to say that many of the appointments are payback for favours, ways in which people are kept loyal, which can be extremely damaging’ said independent political analyst Nic Borain.

Nomura economist Peter Attard-Montalto suggests a possible solution is to strip the government of the power to make senior appointments and force it to reassess empowerment.

‘South Africa needs to ask which is more important - the degree of empowerment within parastatals or the proper and cost effective functioning to prompt wider growth and job creation in the economy’ he said.

Trying to contain a budget deficit of 4 percent of GDP and keep its credit rating above junk, Pretoria has vowed to curb bailouts but has refused to consider privatisation, a thorny issue in a country with a high unemployment rate.

Shortly after the African National Congress came to power, plans to seek equity partners in telephone company Telkom and SAA triggered protests from labour unions - a crucial ANC support base - over the threat of job losses.

Telkom was eventually partially privatised, but critics say it was bungled as it was not accompanied by necessary regulation of the sector, stifling competition.

A rare bright spot among parastatals is freight and logistics group Transnet. It owes a financial turnaround to Molefe and fellow former Treasury official Maria Ramos, and is on track with a 312 billion rand plan to expand its railways, ports and pipelines by 2019.

Analysts hope Molefe can weave the same magic at Eskom, but say state firms have little prospect of effectively turning themselves around without allowing some participation from the private sector.

‘The argument often propagated against privatisation is that the poor would not afford the services of those companies’ Borain said.

‘But maybe what is needed is that state companies should not be monopolies. There should in all cases be provision for the private sector to be able to compete in that space, or for public-private partnerships to be encouraged’.

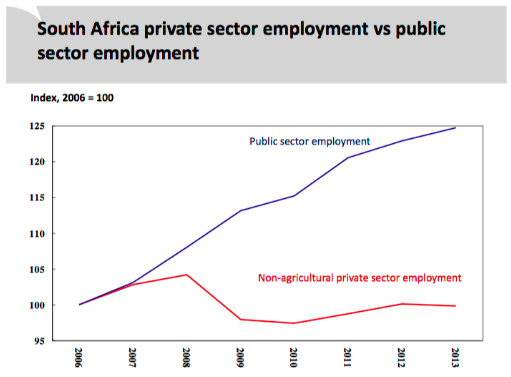

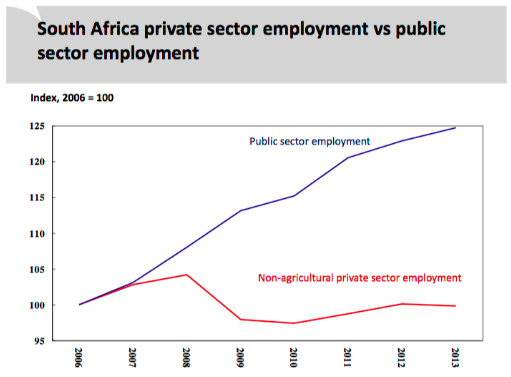

A total of 2,161 million SA civil servants

Statistics South Africa (StatsSA) tracks employment in South Africa in both private and public sectors.

According to its June 2014 Quarterly Employment Statistics (QES) survey there were 455,701 national government employees, a further 1,118,748 people working for provincial authorities, 311,361 people employed by local authorities and 275,851 employees working for “other government institutions” like libraries, parks, zoos and education and training authorities. This adds up to a grand total of 2.161-million civil servants.

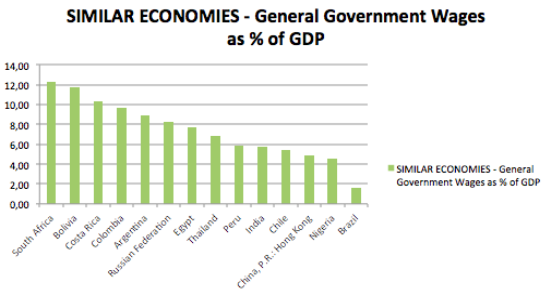

…according to economist Mike Schüssler, the average salary in government is now R241 000 per annum versus R196 000 per annum in the private sector. The bloated government salary bill lies at the heart of much of our financial problem at the moment. And what are we getting in exchange? Surly, sloppy service with attitude and if you can’t do your job, you employ a consultant.

There was a tim in history that a South African government employee would accept a lesser salary (relative to the private sector), in exchange for job security, medical aid, housing allowance and a generous pension fund. It was in the private sector where you would make the big bucks but where you could also lose your job and/or business if things went pearshaped.

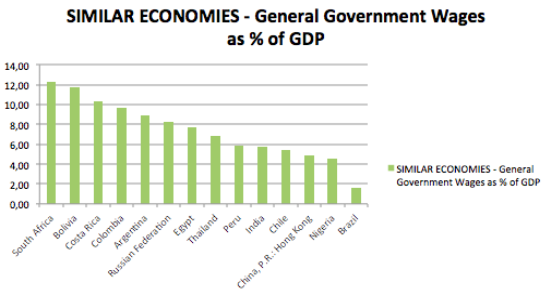

In the current financial year SA will spend R550 billion on the salaries of all civil servants from local to national government, more than half of the four major taxes central government

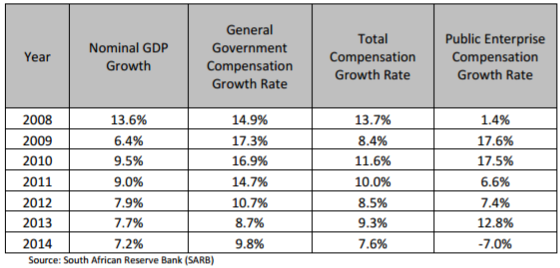

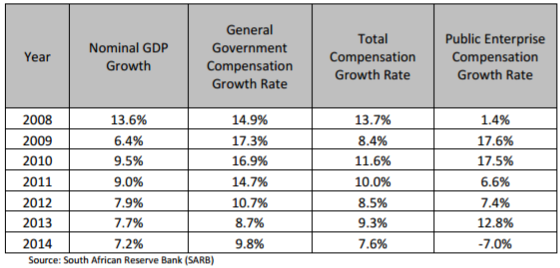

Since then, according to Stanlib Public Sector remuneration has

steepled out of control compared to the profit conscious Private Sector: Awkwardly, the general government wage bill has eclipsed the GDP growth rate every year, as well as the Total Compensation growth rate every year (with the exception of 2013):