25% Taxes Slows the Increasing Market

and Clobbers the Poorman’s Magic Multiplier THE TAXED POORMAN’S MODEL

There is still a multiplicative affect, but it is muted by the interceding tax. 25% of the original wage (before taxes) is recouped in goods and services above the original $1 return. Replacement goods and overhead more than triple from the 30% beginning and there is still 120% additional savings (.12 over the initial .10 transaction savings). In this system, 4 workers might stimulate the market enough to sustain 1 of them at their same pay as 4 X 1.25 = 5 G&S for every 4 of wage (effectively one job). So considering taxes of 25% the first worker spends his $1 take home, gets $1 in goods and services, while an additional $.67 is created in goods and services within the market . That’s like saying $1.33 before taxes buys $1.67 of goods and services after covering taxes on his income and the income and income taxes created by his expenditure. That’s like the first case where no taxes are paid and 1 dollar wages buys 1 dollar in goods and services and stimulates the market to produce another $.25 of tax free income, as 1.33 buys 1.67or 1.25 times itself. Thus for each pretax dollar, all taxes are paid and the buyer gets his one dollar in goods and services plus creates $.25 in tax free income and goods and services for others. But that is still not enough to sustain a job.

Note that taxes behave like propensity to spend. The market doesn’t know whether the buyer is saving 60% of his income and only spending 40% on the initial purchase or the buyer is heavily taxed. The tax rate does show up in the created wages in the market but the original buyer helps to determine the overall efficiency of his transaction through his tax rate and propensity to spend. The top 10% of income people might spend 39% of their total income, which is 39 cents out of every 100. A tax break (returned moneys that used to be taxes) will only stimulate the market by their spending rate 39%. An equal tax decrease on the poor will be totally spent. Because of the higher propensity to spend it is wiser in an economy to fuel the low end. If the taxes were not reduced and just given to the poor, then the market would grow faster than it does when the same money is given to the rich (who don’t tend to buy as much percent-wise). So a tax decrease for the rich is less efficient than welfare to the poor, using the same money taxed from the rich (that would have been saved in a tax decrease) as the welfare. But neither side likes this way of doing business. I contend that using “other income” money to raise wages is the best way to help the economy recover. Bypass the government in welfare relief and put more of the poor to work and raise their pay, because none of us needs the overhead of a government bureaucracy nor the stigma of forcing and taking hand outs.

One could iterate longer, but the point is made that for every dollar spent, there will be additional business generated throughout the market. My model is not absolutely correct but it does convey my point correctly. The consumer’s dollar drives the market. Each little box that follows is a separate business that pays overhead, wages, has goods or services, and saves.

A bank would not have exactly this as an automatic process. The wages would be there. The overhead would be there, and the savings would be there. But they don’t get stock replaced at a fraction of the value they’re going to sell it for. They lend principal dollars and collect interest and pay part of that interest to the investor while operating and saving with the other part of the interest they collect on the loan. The construction business is run through a bank. The client borrows money that is paid out of his building account at the bank to a builder to have his house built. The developer makes money by bumping the cost of both goods and labor in his business. If his workers make $15/hr he may charge $25/hr for each labor hour spent on the job. The developer submits a monthly report to the bank, the customer reviews it and approves it for payment, and the bank pays the money out of the borrowers building account.

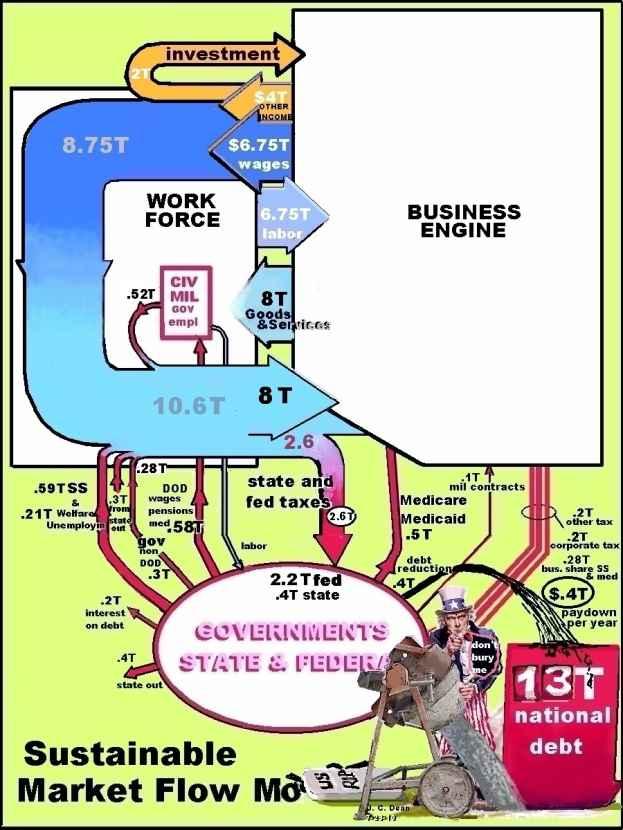

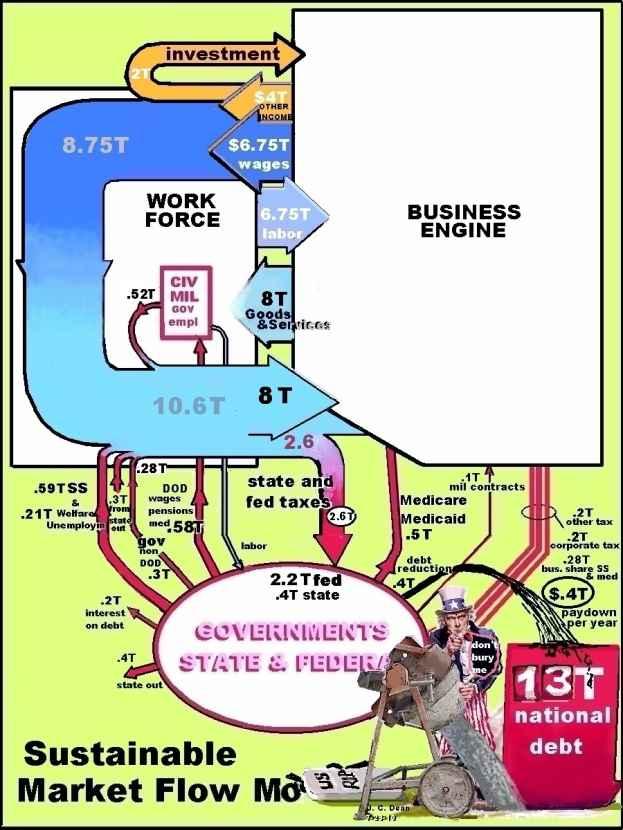

The 6.4T used to stimulate the current economy shown in the basic flow diagram in this chapter (a few pages back) together with the taxed poorman’s model produces 6.4X4.04 = 26T of business including: 6.4X1.67 = 10.7T G&S due to wages, 6.4X1.04 = 6.7T stock replacement, 6.4X1.04 = 6.7T overhead, and 6.4X.29 = 1.9T savings. Now 6.7T stock replacement is about three times that needed by the first retail business to replenish stock and 10.7T G&S with 1.9T savings, plus 6.7T overhead provides great stimulation. The overhead of rents, mortgages, power consumption, transportation, fuel, trash pick-up, etc is money earned by the companies providing these services, who in turn pay salaries. The overage in G&S is reflective of the (10.7-6.4) = 4.3T extra wages generated doing the 6.4T worth of business, and the 1.9T savings rounds out the receipts for all businesses. If .7T of this created savings is used to add to the 4.3T of extra wages created, then the original 5T of wages in the flow diagram is created to keep it going, as long as .2T of other income is also created to add to the remaining 1.2T of savings (created) to produce the minimum 1.4T of other income needed to raise the driving force in our market flow diagram to 6.4T after taxes. In other words, we need .2T of interest, and/or capital gains and/or rents and/or dividends on our 43T+3.6T = 46T+ financial wealth of America to keep this thing going. Of course, other income, excluding business profits, of 3.8T would be expected, so that the system sustains itself with increasing net worth of 3T /yr. Unfortunately that’s not good enough. We need to fill up Sam’s grave . I‘ve proposed budget reductions. The 6.4T drive and 3 T investment levels above are probably in error. It could be closer to 8T and 1.5 invested with 1.5T inflation in net worth, and less drive in the market, but it’s a starting point to show the effect of change. Now I’d like to show

Sustainable Capitalism in the US.

The sustainable market flow model above is based upon the following budget and government revenues.

Fed Government Expenditures DOD reduced ops/med

Social Security

Welfare .21T Non- DOD

Medicare/Medicaid/CHIPS

Debt Interest

Debt pay down .4T

total 2.87T Discussion

The Defense budget that I proposed earlier is implemented, .35T. I allowed for . 23T medical for fed employee, military, VA, and Indian populations. After 10% reduction for savings I show .52T returning to the economy from these sources. The reduced Social Security (SS) .59T comes with the trickle down of the benefit for recipients above $132K income up to $225K, and removal of benefit (max $22K) above $225K, saving 118B, as these recipients do not need SS to live comfortably. I cut down welfare to pursue the inexpensive sleeper units approach toward subsistence at the lowest level and encourage job participation with the influx of $1.75T in new wages from the business side $1.325T + .425T to support the increase in wages plus the transfer of jobs from the government and industry of about 8-10million 40-50K (home buying) jobs per the sustainable capitalism approach presented in a curve earlier. I’ve shown constraint of non-DOD work to .3T. For Medicare, Medicaid, and CHIPS I implement the reductions mentioned in the text: anti fraud, no overcharging, no unneeded procedures, and initiation of a co-pay for the wealthy (that saves 75B) to keep them from abusing the privilege of free medicine. I pay the debt interest and double that up, one more time, in debt principal pay-off (of twice the interest) to strengthen the US government and get it out of debt, filling in Uncle Sam’s grave with concrete. Savings in business SS and Medicare of .12T, and industry backed health policies (now averaging $10.3K/yr for a family plan and covering 7.2 M more workers transferred from government employment) and still saving .11T with respect to the 67M covered by $13K policies (67MX13K – 74.2MX10.3K = 107B), creates a favorable environment for business, some 230B less taxes/health care premiums to pay. The savings in the worker’s share of the health premium is about $73B. If this is kept by the company and put into the wages side, plus 1.4T transfer of other income (that went for investment the previous year) then it is my contention that the transfer will be made up in the economy with better than job sustaining income in the business

Government Receipts Corporate tax .2T Other tax .2T Business share SS

Business share Medicare .08T Worker Medicare tax .17T Worker’s share SS

Income tax (st & fed) 2.03 T total 2.87 fed + .4 st = 3.27T

engine. In other words, the new workers in the private sector plus the increase in wages for those poorer ones already there, more than pays for themselves in an increase of true goods and services in the market. It is my supposition that the market is revved up in a sustainable way to produce more product. An essential part of this model is the strong reduction of government spending that allows, not only a strong market, but a pay down of the national debt in big chunks $400B/yr, turning a non-sustainable government into a sustainable thrifty government by comparison. Let’s run it through the multipliers and see how it works.

The model shows the availability of $8T to drive the business engine (after taxes are paid and the benefit of the taxes is received). From the sustainable capitalism curve at the beginning of this chapter, we might re-select incomes above 35K as the starting point for any kind of Federal taxation. We might look at the top $6.4T as being governed by the taxed poorman’s model that we have already looked at. This model, as shown above produces 26T of business including: 6.4X1.67 = 10.7T G&S due to wages, 6.4X1.04 = 6.7T stock replacement, 6.4X1.04 = 6.7T overhead, and 6.4X.29 = 1.9T savings. The lower $1.6T (to come up to our total of 8T) may be modeled in the tax free “Poorman’s MAGIC Multiplier Model, the super revved best of the market models, already presented. This produced 2.11 times the G & S bought by wages for every dollar spent, with the creation of 1.11 in wages. It also provided 1.11T in each of overhead and replacement inventory, plus .28T in savings for a total multiplier of 4.61. So $1.6T into this kind of market would produce a total of $7.4T in business including $1.78T wages with $3.4T wage driven G&S, $1.78T replacement goods, $1.78T in overhead, and $.45T in savings. Adding these numbers to the top 26T using the other model, we get a total market of $33.4T including $14.1T G&S in wages, $8.5T in overhead, $8.5T in replacement goods, and $2.35T in savings.

$14.1- $8= $6.1T in wages created to cover all but .65 T in our flow model. Taking that from the savings gives us our $6.75T wages plus 1.7T business profit and $8T goods and services. Our financial wealth of 43T should produce 3-4T of capital gains, interest, rents, and dividends in a market like this. The other income would be the remaining business profit of 1.7T giving us 4.7-5.7T (which is above the 4 T shown in the flow diagram, so we should be good to go.)If we actually got 6.75T in wages plus (4.7-5.7T) in other income then our flow diagram would be giving us 11.5-12.5T (wage plus other income) 1.5T-2.5T better than the current

economy.Appendix 1 section 12 shows the results that with less income than the rich, the lower 90% group more than doubles the drive on the marketplace as the top 10% group does. So paying higher wages to the

lowest paid in the economy is the best way to push on the throttle of the market. This introduces an increased demand for home purchases with better wages for the lower half of Americans. With the 1.5-2.5T increase in the market we might have 3.5-4.5T for reinvestment after taxes.

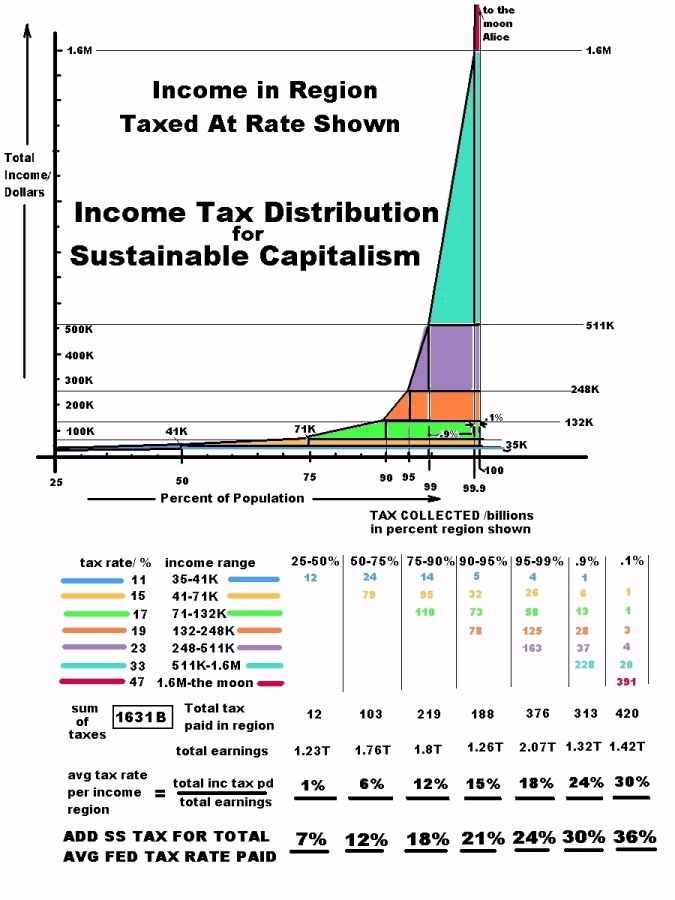

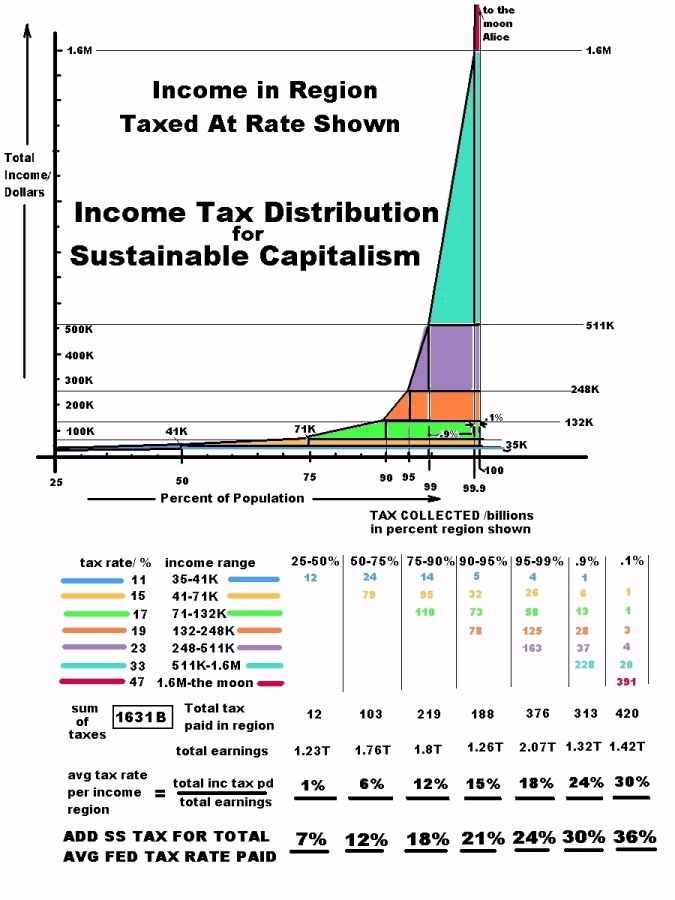

I’m only going to look at federal taxes, as each individual can deal with tax issues in his own state. Since I’ve already mentioned the savings for businesses in my new split for SS and Medicare we need only concern ourselves with personal federal income taxes and taxpayers share of SS and Medicare. From the above sustainable model on pg 116, the taxes are: $1.63T federal income tax, $.17T Medicare tax, and $.39T SS tax. From the sustainable capitalism curve at the beginning of this chapter, $550B is identified as the deficit to be made up to raise the lower 25% of income to 35K at the high end. The income integrated across the lower 25% of the filers with an average income currently of 6.9K, shows the development of 6.9K X .25 X 141M = 243B in total income before being raised. So in our system we raise the lower 25% to make a combined total of 550 + 243 = $793B. With a 10.75T total income assumed, the upper 75% would make 10.75

- .793 = 9.96T. A flat tax of .56/9.96 = 5.6% on all income will raise all the SS and Medicare needed from the taxpayers. The 1.63T income tax should be a graduated tax to help the lives of those at the lower end. The table below suggests a tax scheme for the top 75% of workers.

Income total upper income tax rate income average Inc & SS Group earnings breakpoint w/in group taxes pd % tax % tax 25-50% 1.23T 7% 50-75% 1.76T 12% 75-90% 18%

90-95% 1.26T 21%

95-99% 2.07T 24%

99-99.9% 1.32T

top .1% 1.42T to the moon, Alice 47% 420B 30%

total $ 10.9T Total $ 1631B 15% 21%

The plot below repeats the results graphically. Business tax is less and separate.

Tax Schedule for sustainable Capitalism

Going back to the family budget for all Americans and using the tax structure above, we see the possibility of 75-80% of them having their own homes, and less assistance needed by the poor.

% population .1% avg .9%avg 90% 75% 50% 25% 0% Income/wages $174K $174K $98.2K 63.5K 41K 35K $10K extra income $9.93M $670K $34.2K 8 K 0 0 0 Fed income tax -$2.98M -$200K -$16K -5.5K -.7K 0 0 Credit card Int. -$2.4K -$2.4K -$2.2K -1.7K -.57K 0 0 SS/Medicare tax -$.57M -$47K -$7.4K -4K -.3K 0 0 Net Income $6.55M $590K $106K $60K $39.4K $35K $10K House value $4M own $2M own $.7M $.2M $.2M $.2M 0 Housing$/yr $25K $15K $40K $15K $15K $15K $10K Prop. tax 1.3% $52K $26K $9.1K $2.6K $2.6K $2.6K 0 Food/yr $30K $20K $13K $8K $5K $5K $4K Utilities $5K $4K $3.5K $2.5K $2K $2K $2K Transportation $40K $30K $8K $5K $4K $3K $2K Intrnet/phone/TV $4K $4K $3K $1.6K $1K $1K $1K Clothing/misc $100K $6K $5K $3K $1K $1K $1K Medical $50K $20K $4K $6K $2K $2K 0 Total budget $306K $125K $85.6K $43.7K $32.6K $31.6K $20K $ left over

$6.24M $465K $20K $16.3K $6.8K $3.4K help Taxes/income 36% 33% 26% 19.3% 10.2% 7.4% 0

In fact, if the $210B identified for welfare, if distributed to the lower 25%, with zero to the 25 percentile worker (who is self sufficient) and maximum to the 0% worker the poorest would get another $12K while the 10 percentile worker would get about $7K, and the 20 percentile worker, $2.4K, all calculated on a straight line decrease from 0 to 25 %. This would make the budget for all Americans. Of course, I’m not thinking that the lowest should be given this money. They should be lovingly provided the basics of life in goods and services, and here’s where my sleeper units and small cabin-like homes and vouchers for rooming in the community and transportation, with food stamps, vouchers for clothing, and medical and job finding and training assistance, comes in. That’s where the low end money would go, not in the pocket of the low end to choose whatever they want, but for the goods & services they need to be sustained in life. If they want to buy cigarettes or liquor, or a car, or some other personal item not considered essential, then they must go to work to buy these things for themselves and be proud of their job well done in getting more than the essentials. And I would encourage group living environments out in the communities for this support. I tend to shy away from cash gifts for working age sedentary people, given by the working, tax paying people of the country without any accounting. I’d have more remote camps with larger numbers of sleeper units, with all the same services but fences would confine people there who had been begging on the streets or were drunk in public, and moved there not to bother the public. And I’d release them again soon thereafter but keep them longer if they were brought back, and so on and so forth. We might even provide alcohol and marijuana inside for those who want to stay confined, but take away alcohol for any trouble makers (but still let them smoke dope). This would probably attract low bottom drunks and dope addicts and drop outs who could now drink and smoke without being hassled and would not litter the streets as begging addicts. Violent people could be jailed. Just a thought. Rather than jail or other institutions as a routine.

I’m thinking that the upper 75% are regular family people or people with skills to get the jobs available at that level of pay. While raising the minimum wage for most businesses to provide a house buying wage with full time employment 40hrs/week at the 25 percentile; I believe that teenagers and other part time workers could fill jobs at the current minimum wage as is needed for some businesses to thrive. I do not have any data to support calculations for this breakdown, but I feel that there should be a segment of workers who are part time and partially supported by family that do not need a house buying wage. Maybe they’re teenagers or young adults in high school or college who want to earn some spending money, or seniors who want to work a few hours to get out of the house and earn some spending money. I would think that the restaurant industry would hire these types for better economy, and be allowed to operate this way. __________________________________________________________________

Let’s summarize the new market strategy that saves America from the brink and gives hope to more that a hundred million low economic advantage people.

We get out of the business of war and military occupation as a way of doing business. We cut our defenses, and transfer the men and women into a more fruitful economic life in the private sector with continued partial pay during the transition. We do the same but with a much greater percent reduction of our intelligence forces as a whole. From 200K to 20K people, again cradling their transition with partial pay. We ramp up solar cell manufacturing like crazy, and plug-in hybrid electric cars like crazy, and battery technology like crazy, to help us replace the energy we need to be self sufficient in America. Gas production and coal burning is trickled down as quickly as the solar, wind, and other green sources come on line, but still a vital part of energy use for America. We ramp up passive solar heating for homes. We ramp up sleeper units backed by kitchen, restroom, and shower services for every 100 units or so. We build small family homes to house the poor families and cover their essentials of food, rent, transportation, job search and training, & clothing, while they are in transition.

We establish principles of business that enable all to participate in our capitalistic system without being thwarted by people of money, and as discussed in Chapter 2 (no holding onto patents, use or lose), one time remuneration for critical discoveries, sharing economies of the big retailers, good ethical behavior, etc.

We redo the health system to achieve economies at least as good as I’ve designed.

We cut the federal budget to smithereens and move millions of public workers into the private sector to improve the market economy. With these cuts we balance our budgets, and set up a tax structure that respects human life and does not tax moneys needed for human subsistence. So the poor end pays no taxes up to $35K annual income per family. We drive the market to give the rich more income against their more taxes to minimize any possible increases.

We convert the Social Security system over to a flat tax on all income, and we take those of sufficient means off the receiving end.

We economize with Medicare in a similar fashion, getting a co-pay from those that over-use it, cutting providers back for un-needed procedures and bad sequencing, cutting down administration, cutting out fraud, and cutting off malpractice.

With these economies we still need to significantly tax our earners to create a surplus to pay off the national debt in decent size chunks. But I believe that we can do all of these things if we want to. The tax impact on the top 75% of Americans (from the budget table above) still gives them a nice surplus over their budgets while we are paying down the country’s debt. This is a fair and productive market plan that brings smiles and hope to all Americans who believe in our way of life and want to be a part of it. Those who want to drop out or die hard addicts and alcoholics can live in sleeper units with free dining/sanitation in or out of confined camps (which allow alcohol and marijuana use only as needed). A simple rule might be: clean and sober and well behaved, out and encouraged to transition up; using/begging, in a confined camp; bad behavior in jail. Basic medical would be for all except using die hard alcoholics and drug users. They could get hospice.

Chapter 5

RELIGION

Da Vinci’s Last Supper with modifications by me

Da Vinci’s Last Supper with modifications by me

I shared a bit about religion in Chapter 1, and I know I sounded a bit bitter. It’s not that I am a-spiritual, it’s just that I don’t support organized religion messing with my life. I wonder how many feel that way because of the Taliban in Afghanistan, who execute people for the sins they judge them to have committed. In America we keep church and state separate. But there still are some extremists who kill in the name of God in America: Scott Roeder, the anti-abortion zealot who killed Dr. George Tiller. There is also the collaboration of the Mormons with the Catholics that led to passage of discriminatory legislation against gays in California (Proposition 8). I have a lesbian daughter who cried when this legislation was passed. It’s totally about religion messing with the lives of others outside their communities. There was no need to rule on others. This is ungodlike.

My faith has given me courage to face the fears and difficulties of life while feeling the love and support of my higher power, Whom I call God, or Father, or Papa, or Good God, or Heavenly Father or Loving Father. I believe in God’s unconditional love for me as the perfect version of the similar love I have for my children. I believe that I am not anymore special than any other of God’s human creations. So I believe that God loves mankind unconditionally, and that we all have it made with God. That makes us just as lovable as each other and makes us brothers and sisters under God. My friend is my brother; my enemy is my brother. There is no distinction. I can do anything, and my Heavenly Father will love me the same. That is my belief. I choose to not hurt other humans as they are other precious children of God. I am very much attracted to this God of my understanding and not afraid of Him. I want to be like my God, steadfastly loving and supportive of human life and welfare. What I do in my life is my gift to me and to my God. And I want to bring Him treasure, treasure earned and treasure created by my hands. I want to be self supporting and not a drag on others as long as I can in this life, and I want to amass treasure for my God (deeds and gifts to others that God sees as gifts to Him). I want to be comfortable doing these things, and rest when I can’t do well until I recapture love in my heart. I need to rest at times and recapture my energies and my love and drive to work. And because I am retired now, my work is a love, fun to do. It’s ok to be stripped of the energies needed for self support. Other peoples’ energies will carry me with love. There is no need for me to stress. I do what I can do and leave the rest to the world I live in and to my God. And I am blessed.

This belief has evolved over time and was cemented in my mind and heart about 17yrs ago. In that time frame, I was working as a self employed jeweler mostly, and I was clumsy and got stressed over my work. I’d drop little gems on the floor when I was trying to set them and then crawl around looking for them. I’d bump my head coming back up off the floor under the table. My hands were cracked and sore. I used a mask but still breathed in the powdered buffing compounds when I polished the jewelry. I worked under bright lights with 2.5 power flip down binocular glasses, and I concentrated my strength into my hands to be strong, careful, and accurate.

Using finer and finer needle files, then 320 grit wet n dry sand paper, then hard buff (with white diamond buffing compound), clean-up, and then final buff with jewelers’ rouge and clean-up, I brought the piece to life. Often I’d slip with the files and poke myself with the end of a needle file. I’d bleed a bit, clean myself up, put on a band-aid if needed, and go back to work. When I finished filing and sandpapering, I’d use little wheel brushes in a hand piece to transfer the buffing compound to the gold and then I’d press down a bit with the brush and it would shine the gold as the bristles spun around, reaching back to the block of white diamond while the brush was still whirling to pick up some more compound for more buffing. The work was demanding and tedious. Accuracy was achieved at a small scale determined by control of my hands, and my ability to see what I was doing under magnification. I used the reflected light off the item to guide my work.

One Friday after a tough week, I bumped my head and injured my hands one too many times, and I lost it. All alone in my fully insulated (6inch walls) two story cabin, I broke out in a fury. I cussed God out for putting me through this pain and stress, as I believed, at that time, that God was responsible for all good and evil that would come upon me. I railed at Him saying that He already knew every hair on my head and every weakness and didn’t need to test me. What was the point of the test. He knew the outcome all the time. So why test? Why put me through pain and suffering. I saw myself as a wiggly bug under the poker of a big sadistic God who just wanted to mess with me, and I was pissed. I ranted for hours.

The next day was the same. I had more work to do and I experienced the same clumsiness and impatience and blew up again. I cussed as I worked, like a madman stuck in hellish requirements for the day. On Sunday morning I strangely awoke refreshed, calm, relaxed and as I was coming down the stairwell (where I had painted “Jesus Welcomes All Visitors” on the wall as a convocation of my house), and in the quiet of a sunlit morning, a gentle voice said in my head

What if I was just Love?”

I had heard the voice of God reply to my 2 day rant: not in a booming voice, but in a very quiet gentle voice, connoting the love and tenderness of His nature. I was not in a stupor; my mind was not hazy, I wasn’t “hearing things”. It wasn’t my voice in my head and it came out of nowhere as far as I was concerned. “just” was said like “only”.

I relished the moment and pondered the implications to an affirmative on His question.

I continue to screen everything through a filter of Love as I believe that God is Love and incapable of evil. God does all Good. It was not God testing me. I conclude the existence of an evil higher power. I call him the devil. It’s simple. God is the source of all good, and the devil is the source of all bad. We live with a mixture of both in our environment on Earth and within ourselves. The problem is of the devil, the solution is of God. Since that time I have not been angry with God. I can lay my head on the pillow each night in peace with myself and my God.

This is the basis of my personal faith. I interpret scripture through this set of glasses and if it doesn’t pass the Love test; then, for me, it is not of God, period. I interpret Jesus’ life as proof of God’s Love. He and Jesus agreed to suffer a cruel death, without raising a finger in retribution, to prove His Love, not as some ritual of cleansing. He did not die to forgive sins. He can forgive sins without suffering any pain. He died because evil men killed Him and He knew it would happen and still came. If God is just Love, then there is no hell, as any physical punishment is painful and evil as such. Amends obviates punishment and truly “makes up for”. Eternal suffering comes only from the sick mind of the priests that wrote the bible and controlled the selected copies of books. There is no mortal sin. There is no original sin except in the fantasy story of Adam and Eve.

Here’s a satire I wrote to point out faults in scripture.

John’s Bible Babble

John C. Dean

8-11-08

Today you shall be with me in paradise, as for the rest of mankind, I will choose from them sparingly, for it is written: many are called, but few are chosen. But you, my friend, just happened to be the winner of the big spin in heaven this day, and providence has smiled upon you!

As for the traitor who betrayed me with a kiss; it woul

The sustainable market flow model above is based upon the following budget and government revenues.

The sustainable market flow model above is based upon the following budget and government revenues.