[8] Day Trading on a Forex platform

(example, using the Easy-Forex™ platform)

Step (1): Deciding to perform a Forex deal

You have an intention to trade Forex, and you have your own reasoning for doing so – e.g. you feel that the USD will increase compared with the EUR. The EUR/USD exchange rate is, at the time, around 1.2000 (the common presentation of the Euro-US$ pair is EUR/USD, meaning 1.2000 US dollars for 1 Euro). Your feeling can be based on your experience, or on technical analysis, or fundamental analysis, etc. For whatever reason, you believe that the USD will rise to around 1.1850 (EUR will be down, which means USD will go up). You want to profit if your forecast is correct, and so choose to make a trade.

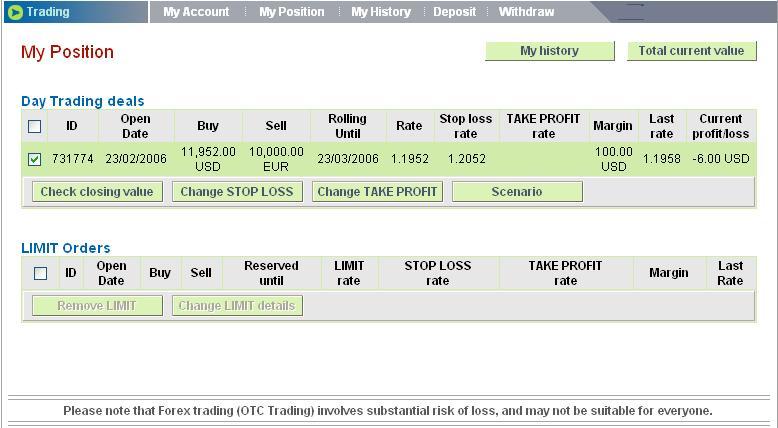

Step (2): Determining the deal Below is a screen-shot of a Day-Trading deal in the making and an explanation of each step required to put the trade into effect:

Select currencies: Select the currencies in the Forex pair. There is no connection between your “base working currency” (or “account base currency”, the currency in which you handle your Forex account and make deposits and withdrawals) and the currencies in the pair you select. In this example you selected “BUY USD” because you feel it is low in terms of Euro, and it will increase in the near future. Once it increases to the level you anticipate, you will close the deal, and get more EUR for the USD you previously “bought” - hence, you make profit.

Select the amount: Since Forex trading is “non-delivery” trading (i.e. – no physical currencies are transacted), the Forex deal (contract) has a “volume”, or “size”, meaning the amount of the currencies in this contract. You determine the volume of the contract, but you do not have to purchase the whole amount. In general, you work in the most common leverage (see below), 1:100: therefore a deal of 10,000 Euro will require much less money to facilitate it.

Select the amount to risk: This is your investment. This is the amount you risk, meaning the MAXIMUM amount you can lose. On a 1:100 leverage, EUR 10,000 against USD thus requires only USD 100 (in fact, the actual leverage you are offered in this case is 1:120, since you “buy” EUR10,000 with USD 12,000 guaranteed using only USD 100 of your own money).

Stop-Loss rate: This is the currency exchange rate at which your deal would automatically close in the event the market ran counter to your forecast. In this event, you would lose your USD 100 investment. You can define another Stop-Loss rate, however, the “amount to risk” will change accordingly. There is a direct relationship between the Stop-Loss rate and the “Margin” (i.e the amount risked) required for the deal.

Freeze Rate: This feature is unique to the Easy-Forex™ Trading Platform. You see the rate for the deal and you are almost ready to accept it, but before you do, you need a few seconds to think. With the freeze rate feature you are allowed a few seconds more to either decline or accept the deal.

Accept: When you’re ready, click “Accept” and your deal is activated. You have enough money in your Forex account to make the deal, so it’s in play. You are holding now an “Open Position” in Forex.

Please note, “Renewal until…”: The Day-Trading deal resembles a “SPOT” transaction (but is not identical). The rates in the deal are the updated current rates (“spot”), and the deal may be closed anytime during the trading day. However, the trader can extend the deal to the following day (paying a small renewal fee). Most platforms offer an automatic renewal of the deal, for a few days period. The trader may close the position at any time. If the trader closes the deal before the indicated closing time (usually it is 22:00 GMT), no renewal fee will be charged.

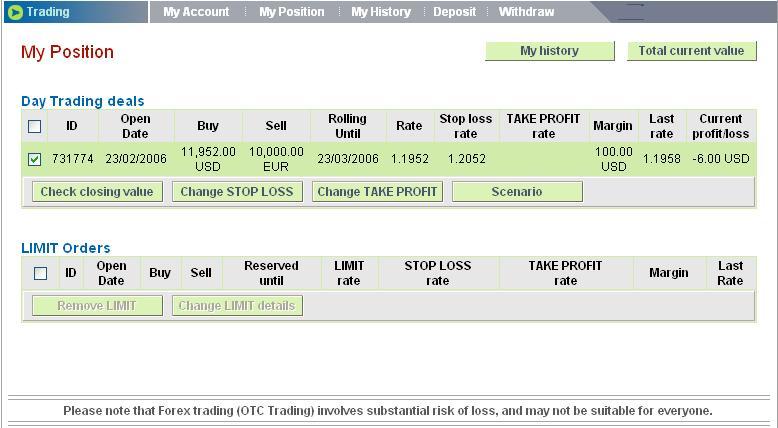

Step (3): Checking account status Below is a screen-shot of a typical “My Position” report:

With online platforms, traders have 24x7 access in order to monitor open positions, to close positions, or change parameters (definitions) in the deal.

With online platforms, traders have 24x7 access in order to monitor open positions, to close positions, or change parameters (definitions) in the deal. ID: The reference number of the deal, as recorded in the platform. Open date: The day the deal was opened by the trader.

Buy: The volume of the currency “bought”.

Sell: The volume of the currency “sold”.

Rolling until: The last day to which the deal will be automatically renewed. Rate: The exchange rate of the currency pair in the deal.

Stop-Loss rate: The rate defined for automatic “stop-loss” of the deal. The deal will close if this rate occurs in the market during the time the deal is active.

Take-Profit rate: (Not defined in this example). This is the rate at which the deal will close automatically assuming the market moves in the direction forecast by the trader. When defined, this rate allows a trader to take profit automatically when a set rate is achieved, thus allowing the trader to focus on other tasks rather than watching the market closely.

Margin: The amount invested by the trader for the deal. This is the maximum amount the trader can lose.

Last rate: The last known rate (it is the current rate at the time the trader is viewing the screen).

Current Profit/Loss: The status of the trader’s position. This will be the profit (or the loss) from this deal, if it was closed at this very second.

Check closing value: Pressing this key will calculate and present the status of all of the trader’s open Day-Trading deals (total profit or loss). This is the place for the trader to manually close a position, before it reaches Stop-Loss or Take-Profit.

Change Stop-Loss: The trader is allowed to change his Stop-Loss, at any time while the deal is still active. As previously mentioned, doing so would affect the amount of margin needed for the deal. If the trader changes the Stop-Loss downward (in a case where the position is losing, and is now near the automatic closing), then additional funds will be required for margin. If the trader changes the Stop-Loss upward (in a case where the deal will already see a profit, and the trader wishes to define a higher Stop-Loss to decrease the original risk), then the difference will be credited.

Change Take-Profit: Similarly, the trader is allowed to define, or change, a Take-Profit rate. Note that unlike a Stop-Loss rate, the trader does not have to define any Take-Profit rate; it simply allows the trader to focus on tasks other than rate-watching.

Scenario: The trader can key in various hypothetical exchange rates to see their impact on their overall position (amount of profit or loss), if and when such rates occur in the market.

Step (4): Closing the deal manually

Using the deal defined in the screen shot above, the deal definitions are: Buy USD; sell EUR; EUR10,000; Deal rate 1.1952; Stop-Loss 1.2052; no Take-Profit defined; margin USD 100.

The table below shows what would occur under various scenarios:

Closing Rate Profit / Loss Comments Change in Rate of Exchange return on Rate investment

1.2200 Loss USD 100.

00

1.2150 Loss USD 100.

00

1.2100 Loss USD 100.

00

-2.0% -100%

-1.6% -100% Maximum loss; the deal was automatically closed already on 1.2052

Maximum loss; the deal was automatically closed already on 1.2052

Maximum loss; the deal

was automatically closed -1.2% -100%

Closing Rate Profit / Loss Comments Change in Rate of Exchange return on

Rate investment already on 1.2052 1.2050 Loss USD 98.00

1.2000 Loss USD 48.00

1.1950 Profit USD 2.00

1.1900 Profit USD 52.00

1.1850 Profit USD 102.00

1.1800 Profit USD 152.00

1.1750 Profit USD 202.00

1.1700 Profit USD 252.00

-0.8% -98%

-0.4% -48% 0.0% 2% 0.4% 52% 0.9% 102% 1.4% 152% 1.9% 202% 2.4% 252%

The table shows the effect of “leveraged” trading: the trader invests USD 100, for a EUR 10,000 contract. Therefore, a small change in the currency exchange rate reflects a much higher change in value.

The Trader may lose up to 100% of the investment (USD 100), but can gain an unlimited profit.

The table also illustrates the value of PIPs. In this deal, every PIP (the fourth decimal digit) results in a profit or loss of USD 1.00 to the trader. So long as the trader gains on this deal, each PIP is worth $1 on a $100 margin leveraged at 1:100 .

Limit Orders (reserving a Day-Trading deal)

Some dealing rooms and platforms offer the trader the ability to set a "reserved" rate for a deal, that would "capture", if and when such a rate occurs in the market, resulting in a Day-Trading deal.

The trader can define the rate he/she wishes, letting the platform do the watching, until (if and when), it appears in the market. Easy-Forex™ does not charge additional fees for Limit Orders. Setting up a Limit Order is very similar to the process described above for Day-Trading. Should the reserved deal not be realized, the funds which were allocated for it will be returned to the trader's account.

You don’t have to miss a trading opportunity when you go on vacation! Make a Limit-Order with your preferred currency rate, and Easy-Forex™ will automatically open the deal for you (if indeed it occurs in the market), at no costs!