Section 2

The Bearish Reversal System

Making quick profits from falling stocks

A Bearish Reversal is a change against the prevailing upward trend. Technical analysts watch for these patterns because they can indicate the need for a different trading strategy. Early detection of a bearish reversal patterns can be very profitable for a Put Option purchase often resulting in more than a hundred percentages in gains. Mastering the ability to identify major Chart Patterns and Japanese Candlesticks formation are going to be of high benefits to you.

AMGEN INC. Bearish Reversal Signals

The art of contrary thinking

Sometimes it pays to be contrary. That is thinking differently from the investing crowd. When the crowd thinks the stock is bullish usually not many will pay attention to the Put Options and therefore it is usually cheap at least before everyone starts to buy Puts to hedge against their stock. Identifying the bearish reversal signal early is of utmost importance as stocks go down faster. “The Bull climbs the stairs but the Bear usually jumps off the window”.

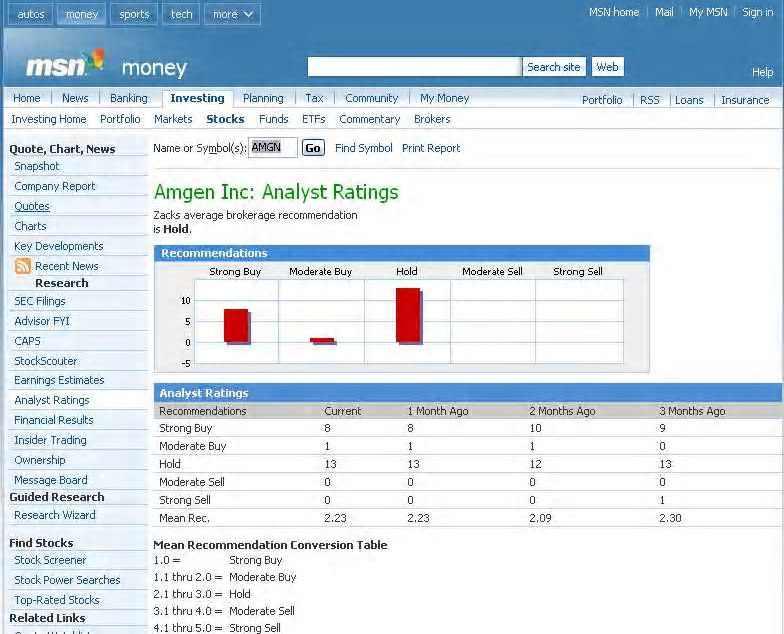

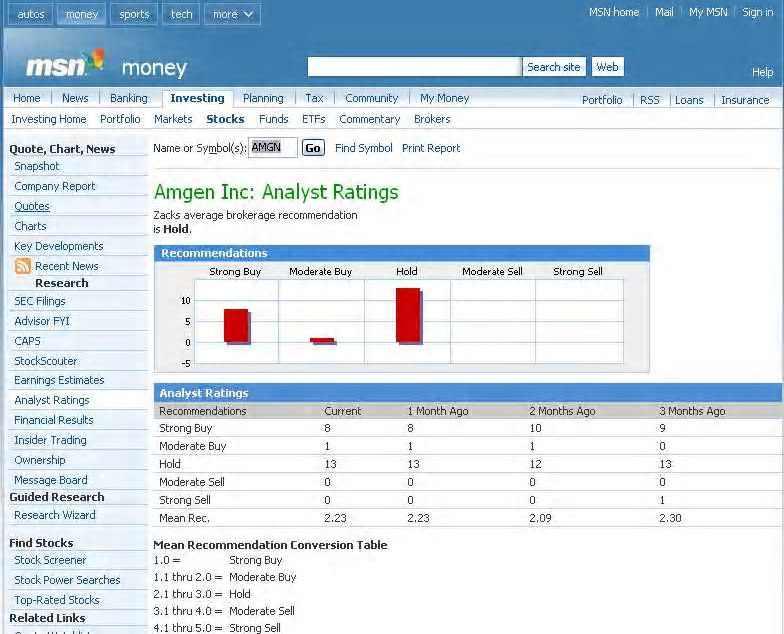

Amgen Inc. high stock ratings

Amgen Inc. high analyst ratings

Going against the crowd

When riding a trend, you are asked to follow the crowd. Now you are to go against them. By looking at Amgen Inc, you can analyze the logic for going against them. Understanding the mechanics before placing your money on the table is going to prepare you from making unnecessary mistakes and be observant as which stock you should choose to trade.

High Stock Ratings and High Analyst Rating

Investors will naturally have high expatiations on the particular stock or company. The stock price will start to tumble down under the following conditions:

1. When the stock underperforms.

2. When the company or the management underperforms.

3. Any negative news related to the company or management or products or even the same related industry itself.

4. Analyst Downgrade, you only need one analyst to make that statement.

Short listing of reversal stocks

The selection of stocks is important step and must fulfill certain criteria before we even consider trading the stock. Strict rules of enforcement must be of top priority in achieving a high probability trade.

1. There must be a significant decrease in the stock’s price during the last trading day – this will form a bearish candlestick in the chart.

2. The Market Capitalization of the stock should be above 50,000,000 – this indicates the liquidity of the stock.

3. The Last Volume traded should be above 1,000,000 – this indicates the demand of the stock.

4. The Rating of the stock should be high – this indicates the high Analysts expectation of the stock.

5. Last closing price must be above US$20.00 – sufficient amount for it to drop.

6. Mean Recommendation - Moderate Buy to Strong Buy.

Setting up for the play

Once a reversal candlestick is being spotted and the conditions are also fulfilled, you will need to do is to wait for the entry signal. It may be the next day or two to three days later, the moment you see the price is below the low of the reversal candlestick bar. It is your entry signal for this reversal system play.

Below is the illustration for qualifying and the entry to buy.

AMGEN INC, reversal candlestick chart.

Wait for the entry signal

When the price is 0.10 below the low of the reversal candlestick bar, it is your entry signal. Remember, you are not making the entry decision, the stock is making it for you and all you need to do is to act on it. If the price does not drop but goes up instead, it will be a “no go”. This is supposed to be mechanical and no emotions are involved. Use a conditional order to automate the trigger to purchase so you don’t have to wait all night. (Malaysia and Singapore trading hours, 12 to 13 hrs difference)

The Put option strategy

AMGEN INC. has been spotted a reversal candlestick bar formation and has fulfilled all the conditions as stated earlier. The stock price is 0.10 below the low of the reversal candlestick bar and you are ready to enter.

Buying a straight Put Option is the best strategy as the Implied Volatility is usually relatively low and since it is very short term, time decay is not going to affect much. As this is going to be a short play and the maximum holding period is two weeks and the target is about 50% to 100% profit on the put options.

Bearish Reversal candlesticks are found almost every time when you look at a chart. Remember what goes up must come down, even the most bullish in the world. They can also be seen repeating quite frequently in the same chart. All you have to do is to be observant enough to spot them early. Trading them with Put options can be very profitable. Remember not to be greedy, get out at the first exit signal. Money in your pocket is always better than in the markets. It Pays To Be Contrary.

“As a general rule, it is foolish to do just what other people are doing, because there are almost sure to be too many people doing the same thing” - William Stanley Jeons

AMGEN INC. Bearish Reversal Signals

AMGEN INC. Bearish Reversal Signals  Amgen Inc. high stock ratings

Amgen Inc. high stock ratings Amgen Inc. high analyst ratings

Amgen Inc. high analyst ratings  AMGEN INC, reversal candlestick chart.

AMGEN INC, reversal candlestick chart.