Section 1: Mortgage Basics

Even if you already have a mortgage, it may be worthwhile to read this section to ensure you have a full understanding of the mortgage basics.

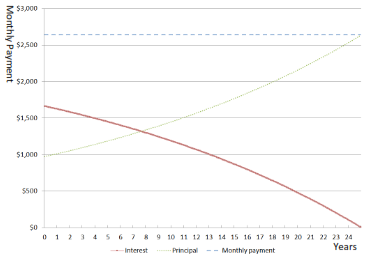

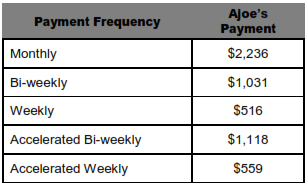

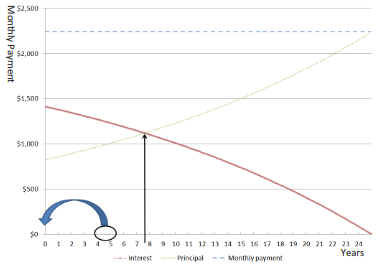

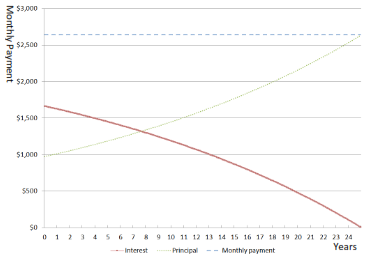

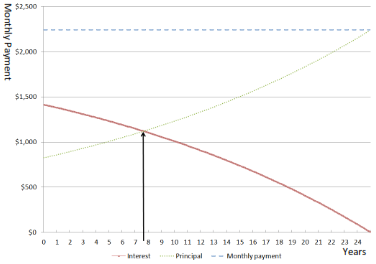

Let’s say you are buying a house at $475k and you are putting a down payment of $50k. You’ll therefore need to get a mortgage for $425k; this figure is also called the principal. When you have a mortgage, each month you must make payments to the bank, otherwise known as the lender. This mortgage payment (dashed line) will include a principal portion (solid line) pay down along with an interest payment (dotted line). This is normally paid as one payment, the combination of your principal amount plus your interest amount. This is how it looks on a chart (Chart 1).

Chart 1: Typical Mortgage Graph

The bank will give you a predetermined amount of time (usually 25 years) to pay off this mortgage. The way the banks make their money is by charging you interest (i.e., 4%) on the amount that they lend you. The more money you pay upfront to your mortgage, the less interest you’ll have to pay overall. Therefore, the trick about paying off your mortgage faster is to pay against your principal as early as possible.

What would a finance entertainment book be if there weren’t any charts or tables? We tried our best to keep charts and tables out of this book but as the saying goes: ‘A picture is worth a thousand words’. If you are confused by the charts and tables even after reading the whole book, do not hesitate to contact your mortgage agent, bank or us (at www.cashproperty.ca).

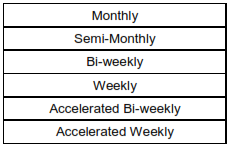

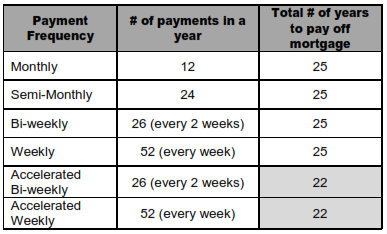

Every month, you can make one payment, or you can pay semi -monthly, which means you make payments on the 1st and 15th of every month. Alternatively, you could make bi-weekly (every two weeks) or weekly payments. You can also make what is known as accelerated bi-weekly or accelerated-weekly. This is shown in Table 1. We are showing a basic table now, as we will be building and expending this table out in the following sections.

You can only choose one of these payment options, but you may change the payment frequency at any time. Usually changing your payment option does not incur a penalty. A penalty is a fee that you must pay to the bank for changing certain features of your mortgage. In order to avoid any potential penalties, however, you should always check with your bank to see what the potential penalties are with any change.

Table 1: Payment Frequency Options

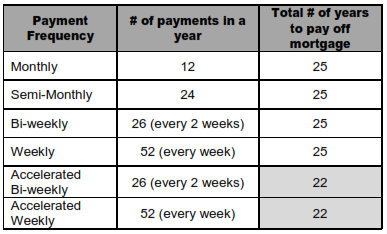

The difference between these options is the amount you pay each time, how many times you pay and the duration of your mortgage (Table 1a). The more money you pay each month, the faster your mortgage will decrease.

Table 1a: Number of Payments

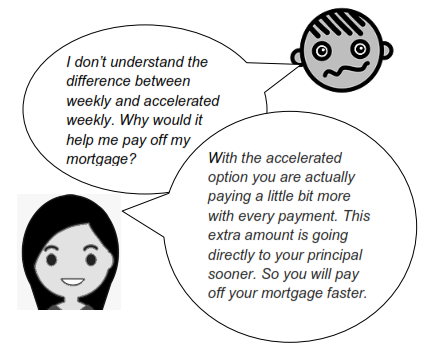

As you can see from the table above, increasing the number of payments during the course of the year does nothing to help you pay off your mortgage faster.

It’s only when you use the last two options that you’ll see an improvement.

The above table is based on a mortgage of $425k, 4% interest rate and amortized over 25 years. The 25 years is what is known as the amortization period. The amortization period represents the time that it takes to pay off your principal plus any interest that the bank is charging you to lend you the principal amount (your mortgage). We’ll review this in detail in the next section.

In addition to the payment frequency options mentioned above, you can also choose the specific day of the month that you’d like the payments to be withdrawn. For example, you can choose the second Tuesday of each month or 23rd of the month. This is something you would arrange with your bank. You can speak to a mortgage agent or your bank about which option will give you the shortest mortgage years, and what the corresponding payment would be.

There are many other components of a mortgage: CMHC insurance, down payment, GDS, TDS, variable vs fixed, open vs closed, collateral vs single, bridging, porting, blending, discount, DSR, APR, just to name a few. All of which we are not covering in this book. These components of a mortgage are a ‘nice to know’ but not critical to getting mortgage-free, let alone in 10 years.

Getting a mortgage is one of the biggest loans you can get. But it’s also the best way to leverage. Leveraging is when you use someone else’s money. This is the concept that many people talk about: “OPM” or Other People’s Money. If you want to become a real estate investor, the concept of leverage becomes really important.

Now let’s review the various aspects of mortgages.

Mortgage Duration and Term

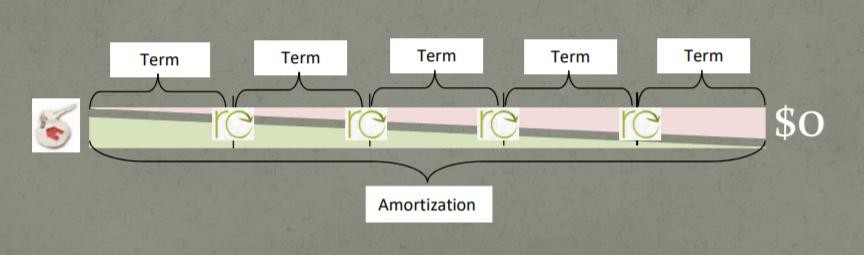

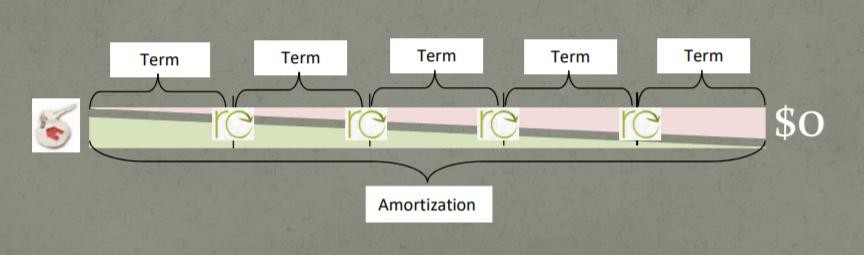

Mortgage duration is the number of years it will take you to pay your mortgage down to zero (that’s right - being mortgage-free!). This process normally takes 20, 25 or 30 years. At one point, banks were actually granting 40-year mortgages. This is called the amortization. What this means is your mortgage is amortized over 20, 25, 30 or 40 years.

As you pay off your mortgage, you do this over a chunk of time. These chunks are called terms. Most people choose a 5-year term, which means you’ll pay a set mortgage payment for a period of five years, regardless of any changes in the interest rate environment. Your interest rate is thus locked in for that term. There are other term options available as well, such as 1-year, 3-year and even 10-year terms, etc.

The term on a mortgage is different from the amortization. Many people confuse amortization and term, but they’re not the same thing. At the end of your term, whether it’s a 1-year, 3-year, 5-year or 10-year, you’ll still have a balance owing on your mortgage. Remember that the term is only a portion of your mortgage amortization (Figure 1). If, for example you have a 25-year amortization and you wanted to do a 5- year term, when the five years are over, you’ll still have 20 years left on your mortgage. However, when you renew your mortgage, you can change your term; you’re not locked into a 5-year term.

Figure 1: Terminology

Let’s say you’ve completed your first 5-year term, in which case you’ll have 20 years left on your mortgage. At this time, you can ask your bank to increase your amortization to 25 years. (Some banks will allow you to do this.) The benefit of doing this is that your regular payments will decrease. Let’s say you had a new baby and have extra monthly expenses. This may be a good option for you, although not recommended.

However, you won’t become mortgage-free in 20 years by choosing this option. You now have another 25- year mortgage. This is one of the reasons why families never become mortgage-free. They’re constantly extending their amortization period. During the first few years of home ownership, the majority of the mortgage payments go toward interest, with very little of your payment going toward the principal.

Remember Ajoe? He got a mortgage approval in November 2017 and he’s now looking to close on his new condo in March 2018. Let’s break down Ajoe’s mortgage.

Mortgage Principal and Interest

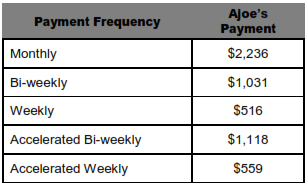

Ajoe just bought his condo for $475k and got approved for a $425k mortgage. Ajoe chose a 5-year term with a 25-year amortization at 4% interest rate to be paid monthly. Ajoe’s monthly payment works out to $2,236.

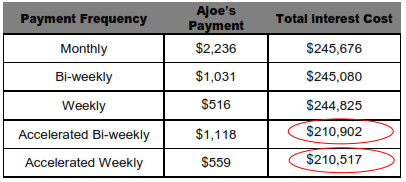

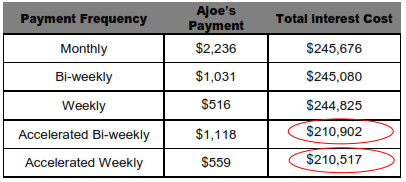

For comparison purposes, let’s see what Ajoe’s payments would be if he were to chose a different payment frequency (Table 2).

Table 2: Ajoe’s Payment Options

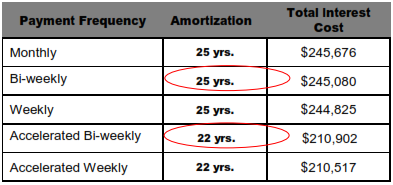

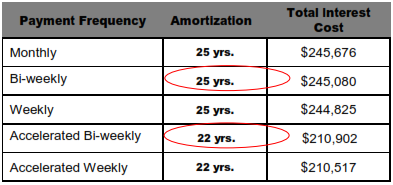

Now let’s add in total interest payments to the table (Table 3) and the effect that the payment frequency has on the amortization (Table 4).

Table 3: Ajoe Saves $34K in Interest Costs

WOW! Take a look at Table 3. What a huge difference there is between paying your mortgage on a bi-weekly basis versus accelerated bi-weekly basis.

Alternatively, weekly frequency versus accelerated weekly. You would save almost $34k in interest costs and pay it off faster. Ajoe would therefore be able to pay off his mortgage in 22 years instead of 25 years.

Table 4: Ajoe Saves 3 Years Off His Mortgage

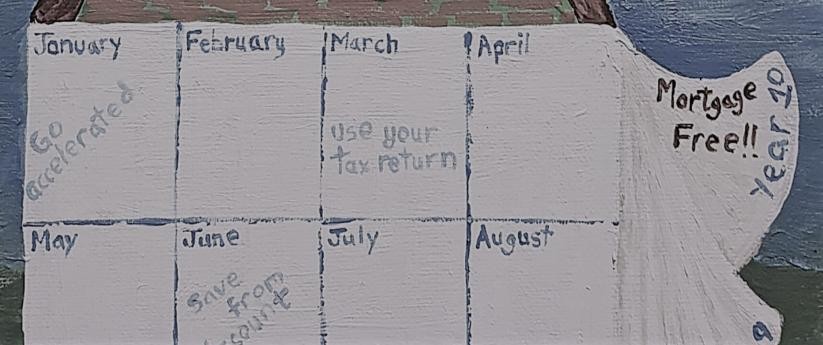

In order for Ajoe to pay off his mortgage faster, he needs to tackle the principal as quickly as possible. The sooner he pays more money directly to the principal amount; this will reduce the interest he would have to pay to the bank. By choosing the accelerated weekly or accelerated bi-weekly payment frequency option, Ajoe is making additional payments directly to his principal without having to think about it, saving almost $34k and being mortgage-free three years sooner.

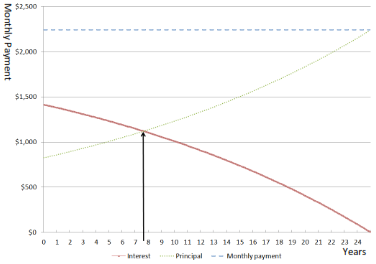

This is what Ajoe's mortgage graph would look like.

Chart 2: Ajoe’s Mortgage

Remember Chart 1. As Ajoe pays $2,236 each month towards his mortgage (dash line), the majority of it (starting at $1,408) would go towards the interest payment (solid line), with $828 going to the principal (dotted line). It is only after year seven that the majority of Ajoe's mortgage payments go towards the principal (this is the crossing of the 2 lines shown by the arrow in Chart 2). During Ajoe’s first 5-year term, he will see very little pay down of his mortgage.

The balance at the end of the 5-year term would be about $370k (meaning that Ajoe still owes $370k to the bank). During this 5-year term, Ajoe would have paid more than $54k to the principal and almost $80k in interest.

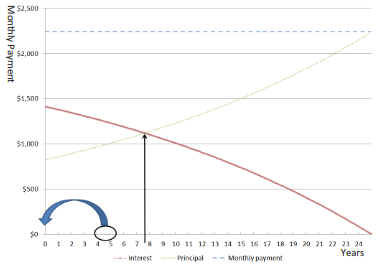

This is why many families do not pay off their mortgage. Before the 5-year term is up, the bank will ask you to renew with the option to extend. This ‘extension’ will increase the amortization back to 25 years (see Chart 3). This means the mortgage will start back at year-0, when the majority of the payments go towards the interest.

Chart 3: Risky Renewal Option

This also explains why families who move every few years may have difficulty paying off their mortgage. In other words, every time you buy a new house, the amortization period resets.

It’s Your Interest

Here are a few things you will want to know about your interest.

1. How much interest is your house really costing you?

2. How much can you really save?

Let’s look at the first question. How much interest is your house really costing you? Another way to ask this is, “How much am I really paying for this house?”

Ajoe just bought his condo for $475k and got approved for a $425k mortgage with a rate of 4%. By the time he pays off his mortgage in 25 years, Ajoe actually would have paid almost $672k. This amount doesn’t even include the legal fees, closing costs, property taxes and utilities he paid over the 25 years.

That is almost $250k in interest. Here’s another way to look at this: Ajoe just paid in full for his condo and half of a condo again with the interest he paid.

Now, let’s look at the second question: How much can you really save?

This scenario is different for everyone, as it depends on your mortgage, the interest rate and the amortization. In Ajoe’s case, if he takes the last five years off his mortgage, he could save about $15k in interest. If he can reduce his amortization to 15 years, he could save about $46k in interest.

Of course, you have to balance this with the opportunity cost. In short, what else can you invest your money in other than paying off your mortgage that will enable you to make more than the mortgage interest rate? It is worth spending a bit of time figuring out if you can invest your money another way where you will make more money than paying off your mortgage. The return on your investment can then be put into paying off your mortgage faster. Talk to your financial adviser, bank or contact us at info@cashproperty.ca to see what options work be best for you.

Meet Mr. Equity

Mr. Equity lives with you; he lives right in your house. Mr. Equity is the value of your house less what you owe on it. If your property is worth $1.0M and you have a mortgage of $700k, you have $300k in equity. The $300k equals Mr. Equity. As you pay off your mortgage, Mr. Equity becomes part of your net worth. The great thing about Mr. Equity is that you can borrow against him.

When you want to borrow against Mr. Equity, you simply go to your bank to arrange this. In some cases, you can borrow up to 80% of your property appraisal value.

In this case, let’s say your property is appraised at $1M, but you still have $700k owing on a mortgage, you have $300k in equity. You could potentially borrow up to $100k (80% x $1M - $700k). Of course, you have to demonstrate to the bank that you can pay back Mr. Equity.

As the value of your property increases, Mr. Equity will also increase. Of course, this also means that if the value of your property decreases then Mr. Equity will also decrease.

If you had access to this equity, you could take this out and do other things with it, such as make other investments or buy a rental property. Whatever you decide to do, it could definitely help you to grow your net worth (unless you spend it on travel or booze). The subject of net worth is a completely separate topic and warrants an entire book (great idea!).

Note: During the final editing of this book, the LTV ratio allowed by the banks was reduced from 80% to around 65%. Of course, this depends on the lender. The reduction in the LTV means that families will have less access to Mr. Equity. This is one of the ways in which the lenders are reducing their risk so as to avoid a housing crash crisis similar to the US does not happen in Canada.

What Can You Afford?

When you first buy a home, you want to look at your annual income and figure out your monthly expenses such as food, entertainment, transportation, utilities, etc. The amount remaining at the end of the month is what you can realistically afford to pay for a mortgage.

Don’t include bonuses, tips or any other variable income that is not stable or steady or anything that you cannot count on as part of your income. Look at these items as “gravy” money. If you have it fantastic! You can use the gravy money to make double-up payments or deposit lump sums to your mortgage annually or __________ (fill in the blank based on your knowledge of the last few pages). However, don’t consider gravy money as you could potentially end up with a monthly principal and interest payments higher than you can actually afford, especially if you don’t have gravy money in a given month.

You can download our budget and mortgage calculator at www.cashproperty.ca/tools to figure out what mortgage amount you would qualify for (within the monthly amount that you are comfortable paying).

Let’s say that each month you make $5k after taxes. After you pay your expenses, food, car, and entertain costs, you have $2k left over. Based on this, you want to get a mortgage where the principal and interest payments will be less than $2k a month.

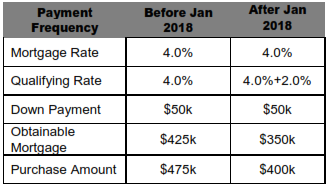

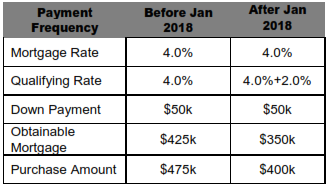

With such low interest rates banks were approving people to borrow more money, thus these families were taking out larger mortgages. As a result, in 2016, the Office of the Superintendent of Financial Institutions (OSFI) passed regulations to enforce a stress test on people applying for mortgage. Since then, the stress test has become even more stringent with the most recent changes taken introduced in January 2018. Let’s take a look at how Ajoe’s mortgage would be affected by the new stress test that took effect in January 2018 (Table 5).

Table 5: Stress Testing Ajoe’s Mortgage

Based on 25 years amortization, Ajoe’s annual income of $70k, ratios of 39%/40% for GDS/TDS (Gross Debt Service Ratio and Total Debt Service Ratio), excludes credit card debt, alimony payments, any other ordinary expenses (daily and household) and loan insurance.

As you can see, it’s a good thing that Ajoe applied for his mortgage and got it approved before January 2018 given that he was able to qualify for an extra $75k.

A few years ago, in response to the real estate meltdown in the U.S., the Canadian government and CMHC implemented new regulations around lending practices to protect Canadians from a similar crash. Individuals were able to borrow up to 80% of the value of the property without CMHC insurance. As well, individuals could refinance at the end of their term up to 80% LTV. This means that if Mr. Equity were $1.0M dollars, they would be able to access up to $800k.

In addition, the interest rates were so low that lenders allowed individuals to obtain lines of credits of up to 80% of the value of their home. As a result, many individuals were borrowing more money than they could comfortably afford to pay back.

Consider this: if interest rates rose by 1%, would you still be able to pay your mortgage? A study conducted by TransUnion (Pete Evans, 2016) indicated that almost a million Canadians would not be able to absorb a 1% interest rate increase.

A simple way to reduce your mortgage obligations and pay off your mortgage faster is to ensure that you only borrow what you can realistically afford. If you’re struggling to pay your mortgage every month, it may be time for you to consider selling the property and buying something with a lower principal and interest payment. This might require you to relocate to a different area, or potentially downsize. However, you should sit down with your bank, financial advisor or contact us at huong@cashproperty.ca to discuss at your options.